How does Bitcoin fight against negative interest rates?

Author / LongHash Kyle Torpey

Source / LongHash

The main claim of Bitcoin is to remove third parties from the entire digital currency system. Bitcoin users have full control over their own funds, which means that the central bank cannot expand the money supply and cause inflation; law enforcement cannot easily seize the currency; or it can't review who sends or receives certain types of money payments.

- Blockchain DAO vs. Joint Stock System: Reasons and Significance of Production Relations Revolution

- Fight against Coinbase! Investment management giant Fidelity announces full launch of hosted services

- Nobel Laureate talks about Libra: You should not pin your hopes on private companies

Under the current global economic situation, the main topic related to Bitcoin is the Negative Interest Rate Policy (NIRP). Although experts often discuss negative interest rates in financial media, not every bitcoin user understands it.

So what is negative interest rate? How do they work? How does Bitcoin fight against negative interest rates? Let's take a closer look.

What is NIRP?

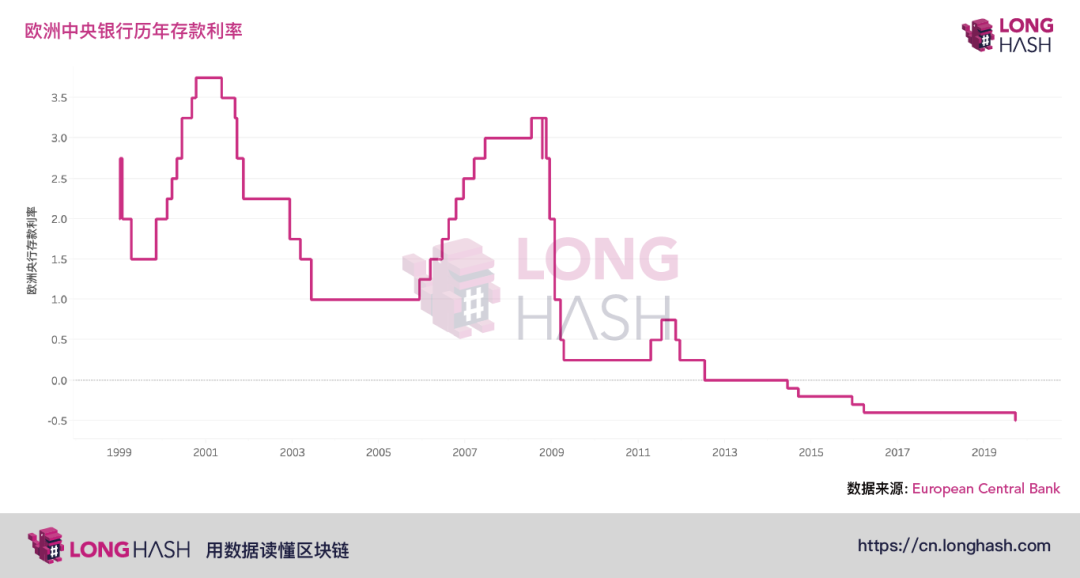

Since the Great Depression of 2008, the central bank has been using an unprecedented unconventional monetary policy. Quantitative easing (QE) has become widely known over the past decade. Recently, however, negative interest rates have become another major tool used by the Central Bank of the European Central Bank, the Bank of Japan and other major central banks to increase economic activity and achieve inflation targets. The Negative Interest Rate Policy (NIRP) is a tool for the central bank to set the target rate below zero. This means that central banks, even private banks, will charge depositors a fee instead of depositors earning interest. The basic goal of the Negative Interest Rate Policy (NIRP) is to allow money to circulate in the economy as much as possible to avoid deflation (referred to as deflation) (some mainstream economists believe that deflation is a big demon). They believe that falling prices will not increase consumption or investment, but will lead to accumulation of savings, which will further cause the economy to slow down, increase unemployment, and eventually fall into a spiral of deflation. The basis of this ideology is the work of the economist John Maynard Keynes, so it is called Keynesian economics.

Although the World Bank stated in its 2015 report that the spread of negative interest rates across Europe was “unprecedented” during the non-financial crisis, five of the world's top ten economies are adopting negative interest rate policies (NIRP) through their respective central banks. .

Bank problems

Jean-Pierre Mustie, CEO of UniCredit, believes that bankers should be encouraged by negative interest rates, because without negative interest rates, the economic situation will be even worse. But it is conceivable that increasing bank spending is not good for business. A recent CoinShares report explains:

“At present, the bank is in trouble and has to make a bold decision: either risk the customer’s departure and charge the customer a deposit fee; or first pay the excess reserve to further squeeze profitability.”

According to Bloomberg News, Danish bank profits have fallen sharply due to the introduction of the Negative Interest Rate Policy (NIRP). The Danish Negative Interest Rate Policy (NIRP) is the result of the Danish Krone's peg to the euro, as the European Central Bank (ECB) implemented negative interest rates as early as 2014.

Barron's said: The CEOs of the two largest banks in Germany said that the European Central Bank's (ECB) negative interest rate policy (NIRP) is unsustainable and that this will have a serious negative impact on the banking system and the overall economy. The former two CEOs of Credit Suisse and UBS, the two largest banks in Switzerland, have recently pointed out that the Negative Interest Rate Policy (NIRP) is “very crazy,” which further fuels the development of the situation. As stated in the Austrian economic cycle theory, the impact of the Negative Interest Rate Policy (NIRP) on ordinary Americans is mainly related to three aspects: (1) banks charge extra fees to save losses; (2) if used for a long time Negative interest rate policy (NIRP) will cause further losses to savings; (3) Overall, economic volatility has intensified.

Bitcoin solves this problem

The currency policy associated with Bitcoin is set up in a consensus rule that runs on any node of the network. From a technical point of view, it is possible to implement measures similar to the Negative Interest Rate Policy (NIRP) in the cryptocurrency system (which Freicoin has done), but such changes are basically unable to achieve consensus among network nodes. Just as the block size has been debated for years, it is not easy to change the bitcoin consensus rules. Changing the bitcoin monetary policy or effectively charging taxes and fees to bitcoin holders will be a controversial change. Since the main purpose of miners is to protect cybersecurity, this change can only happen in one situation: it turns out that transaction fees cannot replace block subsidies for a long time.

In a recent research article, there are still other solutions. Bitcoin, like gold, is a hard currency. Although the third-party supply of money is conducive to short-term price stability, it is necessary to weigh the political pressure imposed on the central bank. This may result in policies that do not meet the best interests of legal currency users. It is worth noting that US President Donald Trump has been pushing the Fed to lower interest rates.

Bitcoin users don't have to worry about this kind of thing at all. Bitcoin is often embarrassed by its price volatility, but without removing the ability of someone to adjust the money supply, the main features of Bitcoin, such as uncontrolled monetary policy, are simply not realized. In a decentralized system like Bitcoin, no one can set the price of a currency other than a free market.

If the digital cash system becomes a widely used form of currency, it will have a deflationary effect on the global economy, and as such, bitcoin is often embarrassed by mainstream economists such as Paul Krugman. Bitcoin borrowing costs will also fluctuate on a free market basis as the central bank does not artificially lower interest rates; and because of the inherent deflationary issuance time of Bitcoin, bitcoin borrowing costs are likely to exceed today's levels. Deflation and high savings rates are basically nightmares for mainstream economists. Economists debate whether "the deflationary economy has only a negative impact on today's society," but the adoption of bitcoin depends on the market rather than the bureaucracy. If the Bitcoin incentives drive people to use cryptocurrencies further, those who think deflation is bad will be powerless. Many financial experts believe that the “digital gold” meme is the reason for the increase in bitcoin prices in 2019, on the premise that negative interest rates and other policies are widely used on a global scale. Bitcoin prices may soar in 2020, as monetary and economic policies that are unfavourable to depositors are combined with Bitcoin's next “half” event. If the user who is optimistic about Bitcoin is correct, then by the end of 2021, the price of Bitcoin will eventually reach $100,000.

Of course, bitcoin may be just an extra kind of competition, which is necessary for the government to increase the value of its local currency. This is the theory put forward by Saifedean Ammous, the author of the Bitcoin Standard, and Peter Todd, an application cryptography consultant.

When the central bank has to compete with the real bitcoin free market currency, the idea of penalizing depositors through the negative interest rate policy (NIRP) does not seem feasible.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain technology company KEY GROUP announced the completion of tens of millions of A round of financing

- Gu Yanxi: Libra is a subversive of the existing financial market structure

- Fidelity is fully introducing digital asset custody and transaction services

- The 18 millionth BTC has been dug up, and the "empty anxiety" is the true eternal story of Bitcoin.

- Poloniex is stripped from Circle, Sun Yuchen is behind the new takeover agency

- German Finance Minister strongly opposes Facebook's Libra

- Babbitt unveiled the Wuzhen World Internet Conference, which is a "dialogue" between the blockchain and the Internet community.