Hong Kong digital currency exchange license analysis

Overview Overview

According to the digital currency regulatory regulations and guidelines issued by the Hong Kong Securities and Futures Commission, if you need to build a digital currency trading platform, the organization needs Hong Kong Securities No. 1 and No. 7 cards.

According to the definition of the Hong Kong Securities Law, the main role of the No. 7 card is to provide an automated trading service operation and an electronic trading platform that matches customer orders.

If you want to open a digital currency exchange in Hong Kong, you need to apply to the regulatory authorities for sandbox testing in addition to the 1st and 7th cards, and only for qualified investors.

- ChainNode live room, starting from Avalon's strongest mining machine A1166, is this a mining machine or a printing machine?

- Why do you say Bitcoin prices never look back?

- Wuzhen Newsletter | Chainlink CEO confirmed to attend the World Blockchain Conference, he is an old gunner in the smart contracting industry

Mainland companies can start the digital currency exchange business by acquiring Hong Kong 7 and 1 cards. According to our statistics, there are currently 136 institutions holding 7 cards in Hong Kong and nearly 30,000 cards.

Report report

1. Hong Kong Digital Currency Regulations

Since the end of 2018, the Hong Kong Securities and Futures Commission has issued three heavyweight guidance documents in the field of digital currency and securities-based token issuance:

- Statement on the Regulatory Framework for Management Companies, Fund Distributors and Trading Platform Operators for Virtual Asset Portfolios

- "Conceptual Framework for Regulating Operators of Virtual Asset Trading Platforms"

- "Statement on the issuance of securities-type tokens"

For the digital currency and securities-based token issuance related business, there are clear regulations, but overall, it is still in the early stage of exploration. Although it is still immature, it is already an important step in the development of digital currency regulation.

In the case of STO (STO, Security Token Offering), the Hong Kong Securities Regulatory Commission's SFC issued a statement on the issuance of securities-type tokens on the official website on March 28, 2019 (hereinafter referred to as the "Statement "). Applicable applicable laws and regulations for companies or individuals engaged in STO-related business. According to the "Declaration": "In Hong Kong, securities-based tokens may be subject to the 'securities' under the Securities and Futures Ordinance and are therefore subject to the laws of Hong Kong. Anyone wishing to promote and distribute securities-type tokens (regardless of It is a criminal offence for a Type 1 regulated activity (dealing in securities) under the Securities and Futures Ordinance, unless it is in Hong Kong or in Hong Kong. And stipulate that intermediaries who promote and distribute securities tokens must ensure compliance:

In the case of STO (STO, Security Token Offering), the Hong Kong Securities Regulatory Commission's SFC issued a statement on the issuance of securities-type tokens on the official website on March 28, 2019 (hereinafter referred to as the "Statement "). Applicable applicable laws and regulations for companies or individuals engaged in STO-related business. According to the "Declaration": "In Hong Kong, securities-based tokens may be subject to the 'securities' under the Securities and Futures Ordinance and are therefore subject to the laws of Hong Kong. Anyone wishing to promote and distribute securities-type tokens (regardless of It is a criminal offence for a Type 1 regulated activity (dealing in securities) under the Securities and Futures Ordinance, unless it is in Hong Kong or in Hong Kong. And stipulate that intermediaries who promote and distribute securities tokens must ensure compliance:

- A Class 1 license must be registered or applied, and the securities token should be sold only to professional investors;

- Intermediaries that distribute securities tokens should conduct proper due diligence and provide STO information to customers in a clear and understandable manner, and ensure that all information provided to customers is accurate and not misleading;

- Intermediaries should discuss their plans with the SFC before engaging in any activities related to STO.

However, the "Declaration" does not clearly explain the qualifications of the securities-based token exchange.

We hope that by studying the relevant requirements of the digital currency exchange license qualifications, we can clearly understand the current Hong Kong regulatory scheme for digital currency transactions, and also potential potential license qualifications for future securities-based token issuing exchanges. reference.

2. Hong Kong virtual currency exchange license requirements

What license and compliance requirements are required for virtual currency exchanges?

If a digital currency exchange is to be established in Hong Kong, according to the December 2017 Hong Kong SFC's Circular to Licensed Corporations and Registries: About Bitcoin Futures Contracts and Investment Products Related to Cryptographic Currency, the Circular indicates : Hong Kong investors can buy and sell Bitcoin futures contracts through intermediaries, but the provision of trading services and related services (including the transmission or transmission of trading orders) for Hong Kong investors constitutes a regulated service, and regardless of whether the business is located in Hong Kong, The SFC applies for a license.

Under the Securities and Futures Ordinance (Cap. 571) (the Ordinance), the SFC is empowered to grant licences to the relevant parties for the implementation of the "regulated activities" as defined in the Ordinance. Upon licensing, it shall operate an online trading platform in Hong Kong and provide trading services on one or more of its virtual assets in accordance with the definition of "securities". The operators of the platform will be placed under the jurisdiction of the Securities and Futures Commission. Scope and a licence to carry out Type 1 (dealing in securities) and Type 7 (providing automated trading services) regulated activities.

In short, the establishment of virtual currency exchanges requires at least the No. 1 and No. 7 licenses. At the same time, exchanges that operate futures contracts and structured products are not allowed to be licensed. In addition, Hong Kong regulations have five main requirements for virtual currency exchanges, as follows:

- Virtual asset trading activities are all carried out under a single legal entity, ie all trading activities must be carried out under the legal entity of the licensed company

- All virtual trading businesses are subject to applicable regulations, mainly for compliance with license conditions.

- Point to professional investors to provide services, that is, service users have assets of more than 8 million Hong Kong dollars, rather than retail investors

- The token issued for the first token is subject to trading restrictions in the first 12 months.

- Do not provide leverage or buy or sell futures contracts or other derivatives related to virtual assets

Terms and conditions

- The exchange has sufficient financial soundness to deal with risks such as theft or hacking; this requires 100% online virtual assets (hot wallets) in the platform and 95% offline virtual assets (cold wallets) to be insured. This will be a huge premium.

- Invest in insurance for risks associated with the preservation of virtual assets (such as theft or hacking) and assess the customer's knowledge of virtual assets, including those related to virtual assets.

- With KYC/AML (identity and anti-money laundering) process.

However, for cryptocurrency trading platforms, if the transaction is not a securities token, there is no need to enter the sandbox.

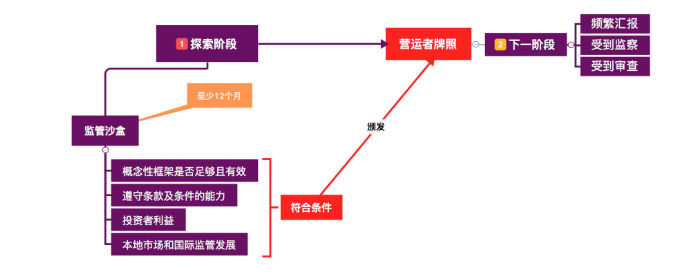

- The regulatory sandbox is voluntary and its purpose is to provide a compliance path for virtual asset exchanges that are capable and willing to do business according to law, and to distinguish between holding licenses and virtual asset exchanges that do not intend to apply for a license. That is to say, if the "virtual exchange is licensed" in the future, those without a license will be treated differently.

- Emphasize the relationship between the supervision of sandboxing and the virtual asset exchanges. The two sides discussed whether they need to be licensed, how much supervision should be achieved, and the conditions for licensing. This is in line with the aforementioned principle of voluntary participation.

- In the regulatory sandbox phase, in order to avoid confusion about the regulatory status of the platform operators, the identity of the sandbox applicants and the details of the discussions will be kept confidential.

- Only the SFC believes that the virtual asset trading platform operator can prove that it is committed to comply with the strict standards that should be met, and it is likely that it will eventually be included in the regulatory sandbox.

3. Introduction of Hong Kong No. 1 Card

The No. 1 license corresponding to the Hong Kong Securities Regulatory Commission is a securities transaction, which mainly provides the following services:

- Provide clients with trading/brokerage services for stocks and stock options;

- Buying and selling bonds for clients;

- Buying/selling mutual funds and unit trusts for placing and underwriting securities for clients.

From the statistics, the average daily turnover of the Hong Kong stock market in 2017 was HK$88.2 billion, up 32% from 2016's HK$66.9 billion. In 2017, there were 21224 new listed structural products in Hong Kong (Derivative Warrants and CBBCs). It is a record high and is up 54% from the 2016 figure of 13771. In 2017, the average daily turnover of exchange-traded funds in Hong Kong was HK$4.3 billion, up 5% from 2016's HK$4.1 billion.

According to the information released by the Hong Kong Securities and Futures Commission, among the 10 types of licences, the number of licensed corporations is 15.49%, which is the third among the 10 types of licences. The growth rate at the end of 2017 is 6.76% compared with the beginning of the year. Ranked 5th in the middle. In the gradual recovery of the Hong Kong stock market, the acquisition of No. 1 license may face higher acquisition costs than before. However, the IPO new policy that HKEx may launch this year may again be a flashpoint in the Hong Kong stock market, and No. 1 The acquisition of licenses will also provide support for securities consulting and asset management. From the perspective of acquisition cost, the currently available case for the acquisition of No. 1 license is: On September 27, 2017, Yinke Investment Holdings Co., Ltd. acquired US$2.1 million to acquire 100% of the shares of Fangde Securities Co., Ltd. with No. 1 license. The central parity of the RMB against the US dollar was 6.6192, which means that the acquisition cost of the No. 1 license was approximately RMB 1,390,300, which was calculated to be HK$16,407,300 according to the Hong Kong dollar exchange rate at that time.

4. Hong Kong No. 7 Card Introduction

The role of the 7th card

An electronic trading platform that provides automated trading service operations and matches customer orders. A dark trading system can be provided to provide investors with a dark trading service (the dark trading does not pass through the exchange system, but through the internal system established by some large brokers).

No. 7 card application funding requirements

No. 7 card application qualification

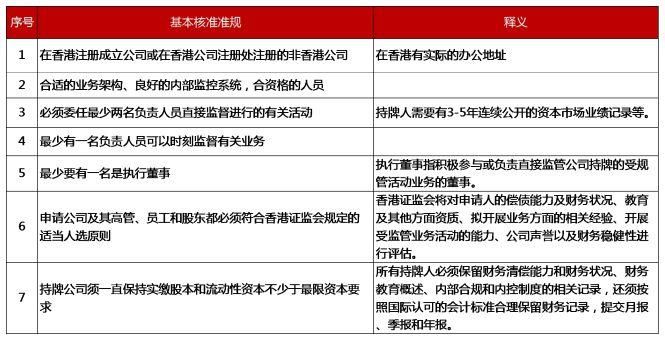

According to the Hong Kong Securities Law, if an institution wants to apply for a No. 7 card, it must meet the following requirements:

Licensed corporation and licensee requirements

About "corporate" (legal person)

First of all, it is necessary to explain that for Hong Kong companies, the concept of "corporate corporate" (the "corporate body") is used instead of the term "legal person" used in the Mainland.

- Under the Companies Ordinance 2(1) of the Laws of Hong Kong, Cap. 622, corporate bodies: including companies; and companies incorporated outside Hong Kong; but not single corporations.

- The Companies Ordinance clearly stipulates that companies that are legally required to be legally established (including: (a) public companies; (b) private companies; (c) public limited companies with equity; a private unlimited company with equity; (e) an insurance company without an equity), and an incorporation of company.

- After becoming a body corporate, any other person who is a founding member and who becomes a member of the company from time to time is a body corporate. The body corporate has the ability to perform all functions of a company with a corporate status and to continue it forever. At the same time, members of the corporation have corresponding responsibilities for the company's liquidation.

- In short, a company becomes a corps, that is, it has the independent legal personality of the mainland, and can and should bear the corresponding legal responsibilities.

About "licensee"

- “Licensor” is a more advanced concept than “Corporate”. It means that in certain areas, with the approval of the competent authority in the field, certain types of licenses can be obtained, and certain types or categories of specific businesses can be engaged. An active corporation or individual. (Note that the “licensee” generally includes both the concepts of “licensed corporation” and “licensed representative”, both corporate and individual, and has a crossover with the concept of “corporate”.

- Take the securities sector as an example to illustrate how the “licensee” is specifically regulated (after all, the securities and futures industry is also considered one of the most concentrated industries): Under the Securities and Futures Ordinance, Chapter 571 of the Laws of Hong Kong, “licensed” Lisenced person refers to a corporation or individual approved by the Securities and Futures Commission of Hong Kong (the Hong Kong Securities and Futures Commission) to engage in and be subject to “regulated activities”.

- In particular, the "licensee" first relates to the concept of a "license". According to the definition in the First Schedule to the Securities and Futures Ordinance, a licence/licence means that it is under section 116 of the Securities and Futures Ordinance. 117, 120 or 121 grants. In paragraphs 116, 117, 120 or 121, the Hong Kong Securities and Futures Commission may apply for a licence (including a formal licence and a short-term licence) to the applicant upon application by the applicant (including the corporation and the individual). Class or multi-category "regulated activities." An unlicensed corporation or individual cannot engage in so-called "regulated activities" (Section 114 of the Securities and Futures Ordinance).

No. 7 license application procedure

All personally relevant applications should be submitted through the SFC Electronic Services website ( https://portal.sfc.hk ).

Website: https://portal.sfc.hk/sfcportal/signin?locale=enCorporate applications can be submitted on the paper form of the SFC website or through the SFC Electronic Services website. If the application of the individual shareholder or responsible officer is a necessary part of the application for the corporation, the application may be submitted together with the application of the corporation in paper form.

Application fee

To become a licensed corporation, each licence requires an annual fee of HK$4,740. The application fee is also HK$4,740.

Time required for application:

Seven business days (applicable to applications for temporary licensed representatives);

Eight weeks (applicable to applications from ordinary licensed representatives);

Ten weeks (applicable to the application of responsible personnel);

Fifteen weeks (applicable to applications for licensed corporations).

Application agency management requirements

The main requirement is that at least one "Responsible Person RO" management company should be required by the law. However, when applying for a licence or after obtaining a licence, the Hong Kong Securities and Futures Commission will require at least two "Responsible Officers RO". .

Among them, the RO person in charge is divided into small and small cards. The big-name RO is the experience of the person in charge of the relevant license that has been used before. The small-name RO is a person who has passed relevant HKSI-related exams and has relevant industry experience. Take the data of RO-2017 No. 9 as an example. If you do not participate in company management and operation, the monthly salary of purely listed is about 50,000-60,000 Hong Kong dollars, which depends on experience and bargaining power. If you need to participate in company operations and management, the monthly salary will be as high as 100,000 Hong Kong dollars.

Mainland companies acquire the No. 7 card related issues held by non-listed companies in Hong Kong

The general mainland private acquisition of non-listed licensed companies in Hong Kong mainly touches the Securities and Futures Ordinance at the legal level in Hong Kong. If the licensed company is a listed company, it will also touch on the Listing Rules and the Takeovers Code. The acquisition of a licensed company in Hong Kong is essentially a “change of the major shareholder of a licensed company”. The specific process is as follows:

- The licensed company issues an application to the Hong Kong Securities and Futures Commission to apply for a change or increase the major shareholder. The key to the application is the SFC's review of the identity of the major shareholder of the licensed company. Companies and individuals who are recognized as major shareholders at each level and directors of the company must complete the application form for filing with the CSRC.

- The main body of the acquisition must issue the corresponding asset certificate, which is generally the asset certificate or financial statement issued by the bank. The acquisition entity needs to ensure that there is sufficient funds to fulfill the acquisition contract and can guarantee the subsequent development of the license company.

- The CSRC will focus on reviewing whether the acquiring company has the qualification to become a major shareholder of a licensed company.

The focus of the Hong Kong Securities Regulatory Commission review:

- Whether the acquisition of the enterprise is a company in the same industry. If the acquiring company is the same as the financial industry, it is relatively suitable. If the acquiring company is in other industries, it is necessary to provide a complete and reasonable business plan.

- After the change in the shareholding structure, whether the business model of the licensed company will undergo major changes.

- Is there a conflict of interest? For example, if the acquiring company is a private equity fund management company in the Mainland, then it is a completely similar business with the acquired company. The CSRC will consider whether there will be a possibility of cross-trading between the two, and whether there will be market manipulation. Whether it will harm the interests of one investor and benefit the other. Therefore, it is necessary to establish a sound risk control system and isolation measures, and staffing should be reasonable and sufficient.

Conclusion

Hong Kong's regulation as a whole is open to the development of digital currency, and its three heavy guidance documents have important inspiration for domestic regulation:

- Statement on the Regulatory Framework for Management Companies, Fund Distributors and Trading Platform Operators for Virtual Asset Portfolios

- "Conceptual Framework for Regulating Operators of Virtual Asset Trading Platforms"

- "Statement on the issuance of securities-type tokens"

We have reason to believe that the issue of securities-based tokens will eventually grow with the popularity of digital currency exchanges and become a new financing trend.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain games out of bugs, hard forks to protect user rights?

- Cobra Cøbra roared "Call a single V": said bitcoin must have risen mentally

- When the industrial financing reform is going on, how does encryption finance bring a new style to Hollywood movies?

- Babbitt Column | From Central Bank to Digital Currency Exchange: A Typical Case of Banking Sinking

- Chainalysis Asia Pacific cryptocurrency trend development report (October 2019)

- Privacy Backtracking and Investment: Oligarchs are significant and future value can be expected

- Libra responds to G7 full text: Improving opportunities for cross-border payments