With 8 years of experience and managing over 540 million dollars, how does CoinFund, a cryptocurrency fund, choose its track and invest in projects?

How does CoinFund, a cryptocurrency fund with 8 years of experience and over $540 million managed, select and invest in projects?Author: Gu Yu, Biscuit, RootData

As one of the most comprehensive investment and financing databases in the encryption industry, RootData has collected over 5,000 Web3 industry investors and over 5,700 investment and financing records, providing a comprehensive presentation of the investment and financing trends in the encryption industry.

Based on this data, RootData will analyze a series of well-known venture capital funds, including their development history and investment preferences. The subject of this study is CoinFund.

1. Overview

CoinFund is an investment and research institution dedicated to cryptocurrencies. It was founded in 2015 and is headquartered in Brooklyn, New York. Its latest established mission is to advocate leaders of the new internet. In early 2016, the fund gained fame for its active Slack community and insightful comments on cryptocurrency projects through participating in podcasts. It participated in discussions on topics such as “fat protocol hypothesis,” capturing the value of cryptocurrencies, and enterprise blockchain.

- Investment institution Rug? Nima Capital sells tokens to sell luxury homes, previously invested in these 16 projects

- APR Winter? A comprehensive analysis of high-yield DeFi projects in the market

- 20 Worth-Watching Unreleased Coin Projects

According to RootData’s data, CoinFund’s first public investment occurred in August 2017, participating in District0x’s ICO fundraising. Since then, CoinFund has gradually increased its investment frequency and established a significant reputation in the industry.

In 2018, CoinFund collaborated with Venrock, a venture capital firm owned by the Rockefeller family, which was seen as a pioneer in bringing traditional capital into the crypto field. David LianGuaikman, a partner at Venrock, stated that he saw more and more experienced founders and traditional tech companies entering the blockchain field, and he hoped to collaborate with CoinFund and participate in the design of various cryptocurrency economies and token projects. Years later, David LianGuaikman also joined CoinFund as a managing partner.

Currently, CoinFund has a team of approximately 30 people. Jake Brukhman is the founder and CEO of CoinFund, having previously worked at hedge fund Triton Research and companies such as Amazon. In most cases, the CoinFund team directly participates in the design process of investment projects and provides networking services, team time, and other resources to its portfolio companies.

In terms of fund size, CoinFund has been disclosing the launch of new funds every year since 2021, with fund sizes of $83 million, $300 million, and $158 million, respectively.

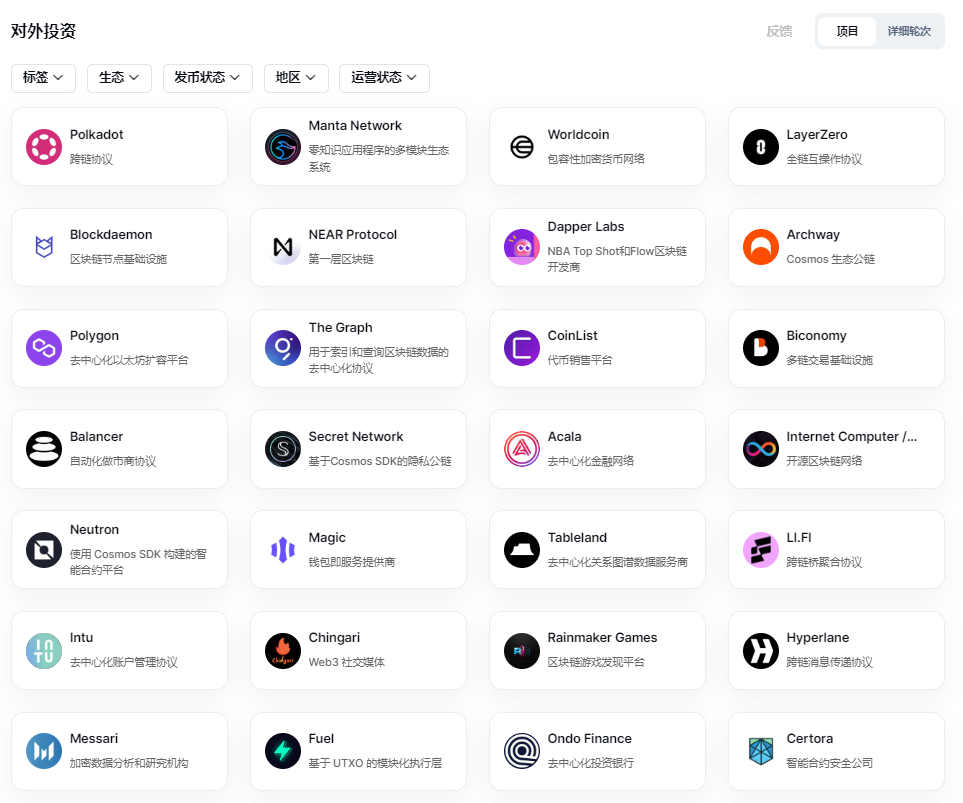

According to data compiled by RootData, CoinFund has publicly disclosed 101 investment portfolios. Typical investment cases include Polkadot, Manta Network, Worldcoin, LayerZero, NEAR Protocol, Dapper Labs, Polygon, CoinList, Balancer, Archway, Secret Network, Acala, etc. CoinFund’s earliest projects include Worldcoin, Internet Computer, CoinList, The Graph, etc. In the past year, they have made 18 transactions, including Gensyn, Neutron, Manta Network, Hyperlane, etc.

2. Portfolio Analysis

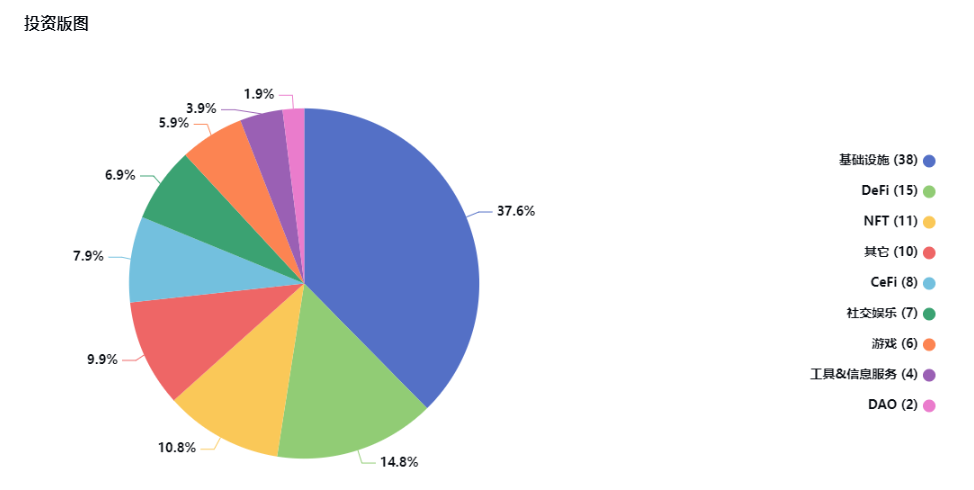

From the 101 investment portfolios recorded by RootData, CoinFund has mainly invested in sub-sectors such as infrastructure, DeFi, CeFi, and NFT. Among them, the infrastructure sector accounts for 37.6%, while DeFi and NFT account for 14.8% and 10.8%, respectively.

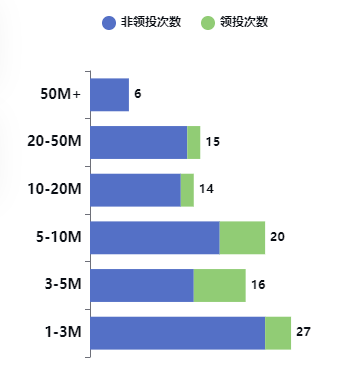

Based on the division of investment scale, CoinFund has the most investments in the range of 1-3 million USD, reaching 27 transactions. However, overall, CoinFund’s investment quantity is evenly distributed in different amount ranges, with most of them being over 15 transactions.

In terms of the number of lead investments, out of the 106 investment rounds in the statistics, CoinFund has led a total of 24 times, with a lead rate of 22%, which can rank among the top ten among all crypto venture capital institutions. At the same time, this also reflects CoinFund’s firm belief in the projects it invests in.

In an interview in 2020, Jake Brukhman revealed that CoinFund’s investment logic is to invest in products that have core values in the crypto network and are highly competitive compared to traditional products. Operating for 9 years, CoinFund’s investment logic is not static and can be divided into three stages.

1. Bear Market Construction Period

In the bear market after the ICO craze in 2017, CoinFund realized that it should focus on emerging fields, while market regulation was highly uncertain. Therefore, its investment strategy was adjusted to focus on Web3 protocols and avoid CeFi services. In addition, its investment characteristics are highly selective projects but following multiple rounds.

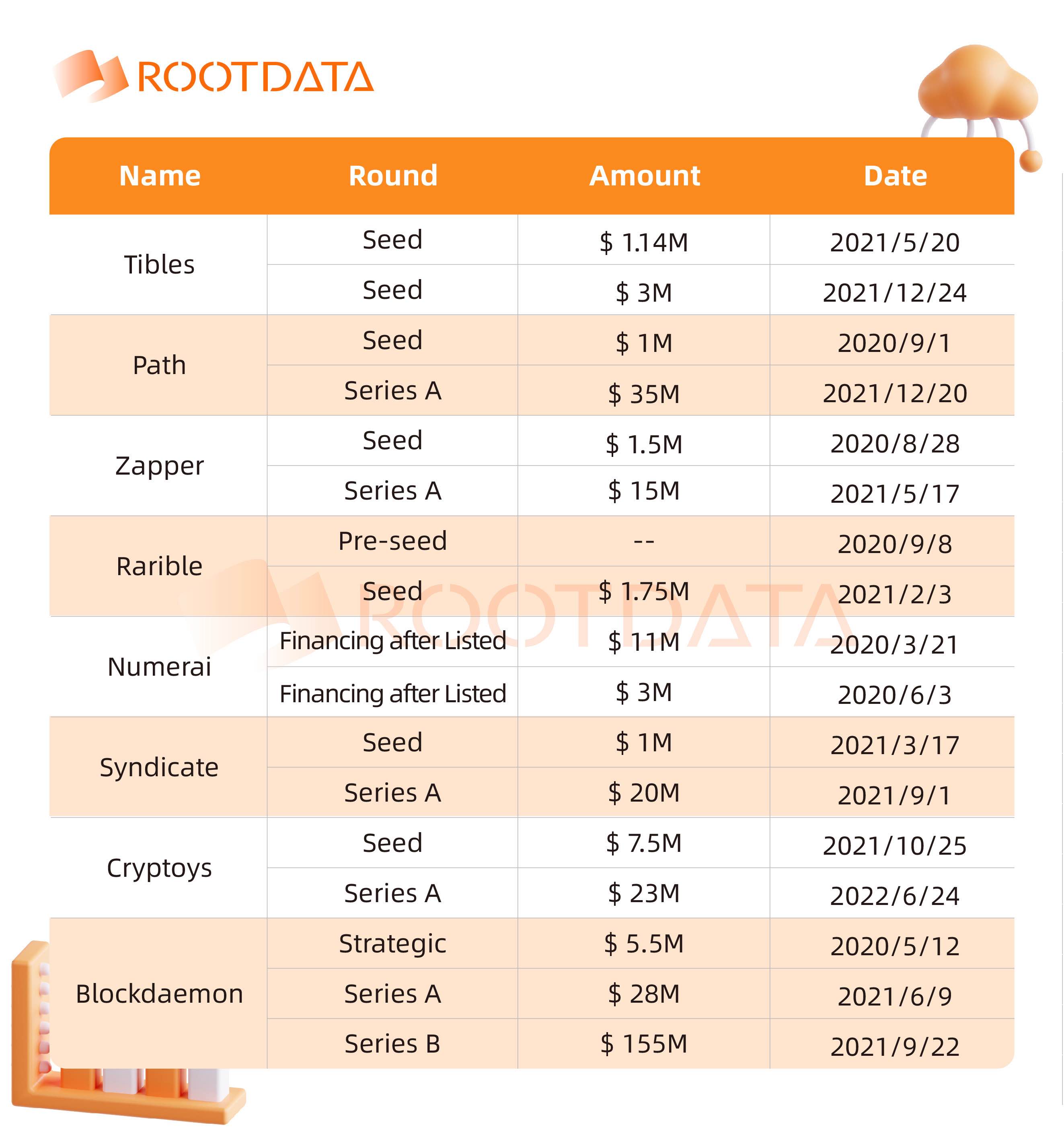

In the nearly 3 years after the end of 2017, CoinFund only invested in 11 crypto projects, among which Internet Computer, NFT Lab Dapper Labs, and crypto data analysis and research institution Messari all received two investments from CoinFund.

In addition, CoinFund also invested in token sales platform CoinList, decentralized data network Ceramic, blockchain data indexing protocol The Graph, privacy infrastructure NuCypher, etc.

2. Focus on the Growth of DeFi and NFT

During the period from 2020 to 2022, CoinFund noticed the growing adoption and interest of consumers in DeFi and NFT, which led them to shift their focus to these areas, as well as products and demands centered around developer-centric infrastructure and middleware.

This period was also the peak period for CoinFund’s investments. According to RootData’s statistics, from 2020 to 2022, CoinFund invested a total of 82 rounds, including 19 lead investments. Some well-known projects include:

- Infrastructure: Blockdaemon, Polygon, Manta Network, LayerZero, Gensyn…

- DeFi: Balancer, Opyn, Ondo Finance, LianGuairaSwap…

- NFT: Rarible, Cryptoys, NFTfi

During this period, 8 crypto projects received multiple investments from CoinFund. In addition, CoinFund’s funding rounds have also moved to later stages, from early seed rounds to Series A or even Series B.

3. The Way Forward After the Collapse of FTX

In November 2022, the collapse of the FTX empire dealt an unprecedented blow to the cryptocurrency field. CoinFund, an early investor in FTX, did not hold any FTT tokens at the time, but a small amount of equity has been written off to zero as a result of the collapse.

David LianGuaikman, Managing Partner and Head of Venture Capital at CoinFund, believes that blockchain has not failed. Smart contracts have not been hacked. The collapse of centralized exchanges has also brought more attention to the DeFi field, including Layer1 and Layer2, NFTs, games, and more.

Therefore, after November 2022, CoinFund only invested in 11 rounds and leaned more towards decentralized protocols, including multi-module ecosystem Manta Network, smart contract platform Neutron, cross-chain aggregation protocol LI.FI, and more.

III. Introduction to CoinFund Portfolio (Partial)

Intu

Intu is a decentralized protocol that enables the sharing of ownership of digital assets through local encryption sharing and any EVM-compatible chain. This means that users can easily share, recover, or even change ownership of assets while maintaining the security and integrity of their accounts. Through Intu’s efficient integration, the user experience of any dApp or wallet can be enhanced.

Tableland

Tableland Network is a decentralized Web3 protocol for structuring relational data, supporting Ethereum and EVM-compatible L2. Tableland aims to build Web3-native relational tables.

Gensyn

Gensyn is a distributed computing network for training AI models. The network uses blockchain to verify whether deep learning tasks have been executed correctly and triggers payment through commands.

Neutron

Neutron is an permissionless smart contract platform built using Cosmos SDK, enabling smart contracts to leverage cutting-edge Interchain technology with minimal overhead.

Giza

Giza is building a trustless protocol that decentralizes the process of machine learning inference computation and provides incentives for the open economy of open source AI. Giza enables AI developers to easily generate zero-knowledge proofs for AI models.

Sherlock

Sherlock protects DeFi users from protocol hacks through internal security analysis and platform-level coverage, and is the first smart contract audit insurance service provider to offer up to $10 million in coverage for audit clients.

Comm

Comm is an encryption-native messaging application based on federated key servers, aiming to be a privacy-focused, decentralized alternative to Discord. Comm allows community members to host their own backend servers and only they have access to their data.

Fuel

Fuel is a modular execution layer based on UTXO that brings global accessible scale to Ethereum. As a modular execution layer, Fuel can achieve global throughput in a way that a single-chain cannot, while inheriting the security of Ethereum.

Archway

Archway is a public chain based on the Cosmos architecture that provides fast and low-cost transactions, while incorporating developer incentives into the protocol itself. These protocol-level incentives provide a more inclusive design by providing value-added mechanisms for validators, token holders, and developers.

Primex Finance

Primex Finance is a cross-chain bulk brokerage liquidity protocol for cross-DEX margin trading, with a trader rating mechanism. Lenders will flexibly manage their risks and returns by providing liquidity to various risk buckets, which are subsets of the liquidity pool that governs traders’ risk strategies.

Ceramic

Ceramic is a decentralized network for managing and processing mutable information on the open web. By combining IPFS, libp2p, blockchain, DID, and standards for authenticated data, Ceramic enables developers to build fully serverless applications using dynamic, verifiable, and decentralized data.

DIMO

DIMO is a decentralized software and hardware Internet of Things (IoT) platform that allows users to create verified streams of vehicle data to privately share with applications, enabling users to negotiate better services such as car financing and insurance.

Ondo Finance

Ondo Finance is building a decentralized investment bank that focuses on connecting stakeholders in the emerging DeFi ecosystem, including decentralized autonomous organizations (DAOs), institutions, and retail investors.

Syndicate

Syndicate is a decentralized investment protocol and social network that will enable communities to raise, coordinate, and invest capital. It will provide a fair competitive environment for communities of builders, creators, influencers, and friends to invest in new ideas and world-changing technologies, introducing a new investment model to society.

Magic

Magic is a wallet-as-a-service provider that helps businesses onboard users into web3 with instant non-custodial wallets. It uses email or social logins while eliminating the need for seed phrases and browser extensions.

IV. Summary and Outlook

Overall, CoinFund has become one of the most influential cryptocurrency venture capital institutions in the industry, thanks to its excellent investment performance and emphasis on research, lead investment, and post-investment services. Influenced by the market, CoinFund has significantly reduced its investment frequency after April 2022, participating in an average of only two financing rounds per month.

In July of this year, CoinFund released a retrospective article on its 8th anniversary, discussing its past investment strategies and future outlook. CoinFund stated that due to a smaller client base and limited proprietary advantage in the open-source field, it had overly emphasized certain sub-industries such as data and analytics, thus missing out on the tremendous demand from non-cryptocurrency participants for fundamental security and compliance services. Additionally, CoinFund mentioned three important adjustments made in the past year, including a greater focus on lead or co-lead roles, increased capital reserves, and a reemphasis on on-site due diligence.

2023 is the year that CoinFund re-focuses on DeFi and infrastructure, emphasizing the importance of scalability, interoperability, and developer tools. They are also looking towards more real-world applications and use cases. In addition, CoinFund will continue to advance the exciting emerging field of AI x Web3 and provide further funding for Gensyn and new investments in the Giza smart contract AI model inference.

References:

“Episode 256 CoinFund – Crypto-Investing by Community Building”

“CoinFund Turns 8: Building and Managing a Web3 Investment Firm”

“Crypto VC David LianGuaikman on FTX: An ‘entirely avoidable tragedy'”

“The richest Rockefeller family in American history: may enter the cryptocurrency field”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What does the SEC action mean by treating NFT projects as unregistered securities for the first time, and what does the related legislation say?

- Understanding the Cross-Chain Leveraged Trading Aggregator MUX in One Article

- Two-tier reversal, friend.tech still agreed for you to be friends with the imitation platform.

- TRB, the oracle mining coin project, has experienced a skyrocketing price against the trend. Is it due to improved fundamentals or speculative capital?

- EigenLayer Official Inventory of 12 Early-stage Projects in the Ecosystem

- Product Expansion and Mechanism Update of Lybra V2

- An Analysis of the ‘Nintendo’ Treasure DAO in the Cryptocurrency World