How to identify the Ponzi scheme in the blockchain?

In order to promote the public's awareness of blockchain technology and promote the research and application of blockchain service technology, the Blockchain and Intelligent Finance Research Center of Sun Yat-sen University launched the I nPlusLab blockchain blackboard newspaper column . This section will introduce blockchain related technologies and knowledge in the form of a series of tweets. This issue mainly introduces the Ponzi scheme identification in the blockchain .

When a new technology was first born, it was easily used by criminals. Just as email has just become popular, there are a lot of spam, and blockchain technology has become a gathering place for various illegal applications. The Ponzi scheme is a classic scam. In the blockchain era, we found that this classic scam began to be covered with a smart contract, which is full of technology.

Below we mainly introduce the history of the Ponzi scheme, the concept, influence, type, and identification of the intelligent Ponzi scheme.

Ponzi scheme source

- The three elements and three meanings of Jianan Technology's successful IPO

- Bitcoin has been falling, and investment has taught you how to cross the bulls

- Babbitt column | Thinking about blockchain from the perspective of database

The “Ponzi scheme” originated from a man named Charles Ponzi (1882-1949), an Italian who immigrated to the United States in 1903. I have done all kinds of work in the United States, including painters, and I want to make a fortune. He had been in prison in Canada for forgery and went to prison in Atlanta because of his private strait. After more than a decade of American-style dreams, Pounds found that the fastest way to make money is finance. So, since 1919, Ponzi has concealed his history and came to Boston to design an investment plan to sell to the American public. .

This investment plan is simple to say, investing in something and then getting a high return. However, Pounds deliberately made this plan very complicated, so that ordinary people could not figure out. In 1919, when the First World War was just over and the world economic system was in chaos, Ponzi used this confusion. He claimed that by purchasing some sort of postal bill in Europe and selling it to the United States, he could make money. Due to factors such as policies and exchange rates, many economic actors are generally not easy to figure out. In fact, anyone who knows a little about financial knowledge will point out that it is impossible to make money in this way. However, on the one hand, Ponzi made a sneak peek on the financial side, on the other hand set a huge bait, he claimed that all investments can get a 40% return within 90 days. Moreover, he also gave people the evidence of “seeing is believing”: the original batch of “investors” did get the promises promised by Pounds within the specified time. As a result, the latter "investors" followed up a lot.

In a year or so, almost 40,000 Boston citizens became investors in the Ponzi Money-making Program, and most of them were poor people with a dream of making money. Ponzi received a small investment of about 15 million US dollars. The average person "invests" a few hundred dollars. At that time, Ponzi was called by some ignorant Americans as one of the three greatest Italians of the same name as Columbus and Marconi (one of the inventors of the radio) because he "discovered money" like Columbus discovered the New World. Ponzi lived in a 20-room villa, bought more than 100 expensive suits, paired with special leather shoes, had dozens of gold-plated canes, and bought countless expensive jewelry for his wife. His pipes are inlaid with diamonds. When a financial expert revealed Ponzi's investment scam, Pounds also published an article in the newspaper to refute financial experts, saying that financial experts know nothing.

In August 1920, Ponzi went bankrupt. The money he received, according to his promise, can buy hundreds of millions of European postal notes, in fact, he only bought two. Since then, the "Ponzi scheme" has become a term that means using the money of the later "investors" to reward the former "investors" and not creating any value in itself.

Smart Ponzi scheme

In the blockchain era, many Ponzi schemes are disguised under the veil of smart contracts. We refer to these Ponzi schemes as smart Ponzi schemes and refer to the corresponding smart contracts as smart Ponzi schemes. Because smart contracts have auto-executable, non-tamperable features, smart contracts are a powerful tool for Ponzi schemes to attract victims. More importantly, the sponsor is anonymous. The picture below is a typical smart Ponzi scheme. The core content is to convince investors that the contract will pay a random return between 1.2x and 3x after receiving the investment, and the return seems to come soon. .

However, the actual payment situation is far from this. By manually checking the contract transaction, we found that 112 people participated in the contract, but only 22 participants received a return from the contract. Two of the luckiest participants have scored more than 40% of the return, and the contract creator is one of them. Obviously, this contract hurts the interests of most other participants.

Typical intelligent Ponzi scheme

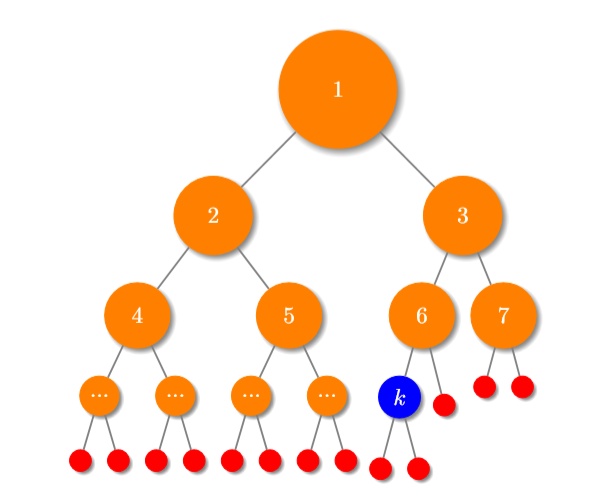

Intelligent Ponzi schemes generally have a tree type, a sequence type, a waterfall type, a game type, and the like. Tree scams use a tree-like data structure to store sorts between users, similar to a pyramid scheme scam. When a user joins the contract, he must designate another user as the inviter, who will become his parent. If the inviter is not indicated, the parent will be the root, the owner of the scam, the participant's The relationship structure as shown below is formed. When a new user joins, their investment will be distributed between her ancestors according to certain rules.

Therefore, if he wants to get a return, he must constantly develop "downline." Since there is no limit to the number of child nodes of a node, the more child nodes (and descendant nodes) of the node, the more money is earned. Generally, the sooner users join the contract, the most benefit, the later users get less benefit, and most of the contract participants are losing money.

A "weakness" of the Ponzi scheme is that late investors are no longer willing to participate because they do not see returns. A game-based smart Ponzi scheme Fomo3D introduces a special mechanism to solve this problem. Simply put, Fomo3D is a decentralized funding game based on smart contracts.

Players use Ethereum to buy keys (equivalent to shares) to join the game. Each game counts down to 24 hours. Players can get continuous dividends from later players before buying the Key to the end of the round. The more Keys you have, the more you get. The more dividends there will be; whenever a person buys a key, the countdown to the game increases by 30 seconds and the time increases up to 24 hours.

In this way, the game cannot end as long as there is constant participation; if no player buys the key for more than 24 hours, the last participant will receive 48% of the Ethereum in the prize pool. Such a rule setting allows crazy gamblers to compete for the final participants and solve the problem of unattended participation in the general Ponzi scheme. Because of the decentralization of blockchain technology, no one can manipulate the game to stop, and the greed of humanity makes this game a "Ponzi game" that does not end.

Intelligent Ponzi scheme identification

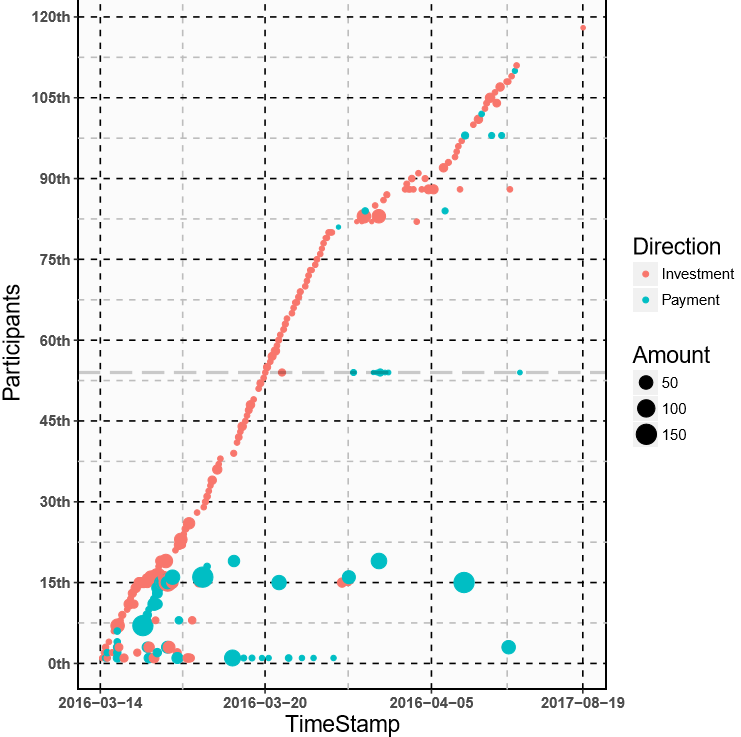

Just like in life, we must deal with "MLM". In the blockchain ecology, we also need to crack down on such contracts. This requires us to first identify such intelligent Ponzi schemes. So how do you identify such scams? Since the blockchain data is open and transparent, the easiest way to think about it is to analyze the flow of funds in the contract account and determine whether it is useful for the latecomer's funds to subsidize the characteristics of previous investors. The picture below shows the fund flow of the intelligent Ponzi scheme that was advertised.

Among them, the ordinate indicates the participant, the abscissa is the time axis, the red point is the participant invests in the contract, and the green dot indicates the return of the contract. As can be seen from the figure, a large number of participants in the latter stage have no return.

It is relatively easy to analyze whether a contract is a smart Ponzi scheme from the perspective of capital flow, but the problem is that so many people have been deceived, and later participants will understand that the return may be in the foreseeable future, so the scam may Can't continue, so the recognition will not be significant.

In order to solve this problem, we extracted the features directly from the bytecode of the contract and established the recognition model of the Ponzi scheme. Bytecode is something that is deployed on the blockchain after the source code is compiled. Any contract should run on the chain. There can be no source code, but no bytecode. Since the recognition model is built by bytecode, we can determine whether it is a Ponzi scheme when the contract is deployed, that is, when the contract has not caused any impact.

For more details on smart Ponzi schemes and their identification, please refer to our paper [1] and check out the xblock website for more information at http://xblock.pro/ .

[1] Chen W, Zheng Z, Cui J, et al. Detecting ponzi schemes on ethereum: Towards healthier blockchain technology[C]//Proceedings of the 2018 World Wide Web Conference. International World Wide Web Conferences Steering Committee, 2018: 1409 -1418.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The industry is hotly discussing "blockchain + real economy" and is optimistic about the future of the blockchain industry.

- Half-moon talk: blockchain is favored at the same time, be wary of the "leek reaper" come back

- Li Dongrong, China Mutual Gold Association: The development of digital currency cannot violate the essence of monetary activity

- Market Analysis: BTC is still in the stage of technical adjustment, and the mainstream currency market has better BCH performance.

- Xinhua News Agency comment: Do not want to put the blockchain in this chanting

- After a year of silence, what changes have happened to the Netease blockchain? | Interview with Babbitt

- Most people only know that Nakamoto has created Bitcoin, but his posts are little known.