The regulatory high pressure continues and the market needs to return to rationality

The central bank's Shanghai headquarters said that in recent years, speculations related to virtual currency (such as ICO, IFO, IEO, IMO, and STO) have been refurbished and speculative, prices have skyrocketed, and risks have gathered rapidly. Relevant financing entities through the illegal sale, circulation of tokens, raising funds to investors or bitcoin, Ethereum and other virtual currency, which is essentially unauthorised illegal public financing, suspected of illegal sale of tokens, illegal issuance of securities and Illegal fund-raising, financial fraud, pyramid schemes and other illegal crimes have seriously disrupted the economic and financial order .

This is to define the virtual currency-related hype, including the IEO (issuing digital currency issued by the exchange), IMO (issuing digital currency with mining machine as the core) and STO (securities-based issuance), which are popular this year . This move is a deterrent for digital currency exchanges and various mining machine manufacturers (different from POW mining), which can purify the market atmosphere and reduce the use of blockchain innovation and application scenarios to defraud investors. act.

Judging from the intensity of the virtual currency speculation in various places, the regulatory high pressure situation will continue. We must have a clear understanding of this, consciously resist all kinds of CX coins and air currency scams, and do not have illusions about it. Under pressure, these tokens that have no practical use and pure deception will gradually lose market liquidity and go back to zero. Investment needs to be vigilant.

The cryptocurrency market was affected by this, and the recent trend was sluggish. After the delivery of the futures contract yesterday, the market plunged again, falling from 7,400 US dollars to 7,000 US dollars, and oversold to 6,790 US dollars in the evening, currently maintaining above 7,000 US dollars. Although the short-term has stopped falling, the market has not stabilized. We look at indicators such as contract big data.

- Cai Liang of Zhejiang University: China's relevant regulatory framework has been initially completed, China blockchain must be manageable

- Baidu intelligent cloud blockchain debut: What is the platform of "Tian Chain"?

- Bright sword virtual currency! Multi-local supervision of the hand-coin security, the wave field official micro-enclosed digital coins collectively fled

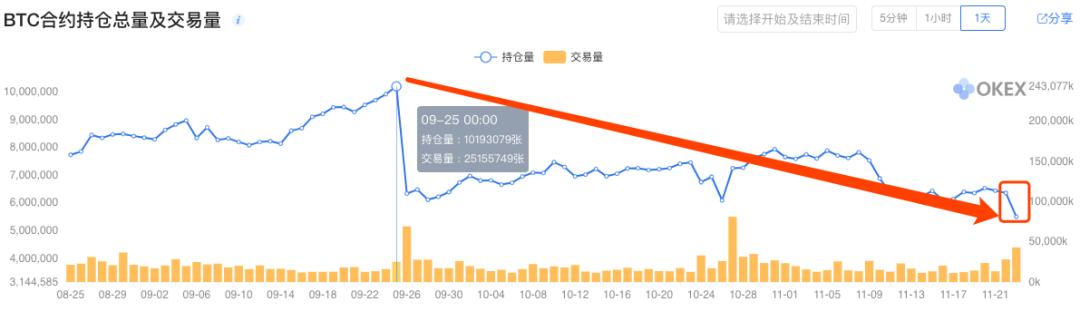

From September 25th to now, the total number of BTC contract positions has decreased by 50%, from $1 billion to the current $500 million. At the same time, from the evening of the 21st to today, the position has been reduced by 20%. In addition to being fired, and because of the need to open the position to open the position, it can be seen that the high-level hedging, short-selling amount can be actively closed in the near future, especially the BTC was exploded from 7000 points yesterday. At the time of 6790 dollars, a long shadow line can be seen on the hourly K line, and it is a continuous amount of positive line energy. It is caused by the intentional squatting of the main force and the active closing of the position. It does not represent the strength of the bullish potential in the market .

From the long-short ratio, in the past three days, from the high point of 1.88 to the current less than 1, the bulls have plummeted, almost eliminated, and now there are not many people will enter the market to do more, the market panic is reached Peak, extremely pessimistic.

There is a saying in the financial market that “the bulls are not dead, the bears are not limited”, which means that in the downward trend, as long as the active buying still exists, there will be active selling, and it is not easy to bargain. Until the bulls are desperate, there is no more active selling. At this time, the shorts can only be turned into longs without the opponents, thus pushing the market to rise. This is the so-called multi-market.

Now we can infer from the some data the short-selling move, but these are not enough, because the market is at a relatively embarrassing point of 7,000 US dollars, the hourly line level has signs of stabilizing, but the daily level is still short. MACD's decline has further expanded. It can only be said that near the 7,000 US dollars, the MA360 line has received short-term support nearby, and the market is difficult to be optimistic .

The sign of stabilizing and stabilizing is that the daily line level continues to receive Yang, standing at $7,400. It is safe to recover the position of 8,000 US dollars before the sharp plunge , this chip-intensive area, and build the bottom platform in this area, waiting The savings of long power.

Overall, the two-day weekend, the BTC's trend is extremely critical, can the daily line level receive a continuous positive line, and stand on the $ 7,400? If it can, the market has a higher probability to stop and stabilize, and build a bottom zone with a low of $7,400. At this time, we can maintain an optimistic attitude for the disk, a small amount of open positions, and enter the market after the market once again stabilized 8,000 dollars. If you can't, then the trend of oscillating around 7,000 US dollars will become extremely dangerous. It is not possible to rule out the possibility of further falling to the range of 6000-7000 US dollars. It should be treated with caution.

The overall trend of the mainstream currency and the BTC kept in sync, the decline was relatively large, and the rebound was still very weak. The price of the currency was close to the position before the second round of the beginning of the year. This range is from the medium to long term, it is the low chip area, but it has not stabilized in the broader market. Before, still be cautious, don't blindly copy the bottom of the stud.

The platform currency is most directly affected by policy supervision. Compared with the high-light moment when the IEO concept is advancing at a high level, the platform currency has lost its aura at this time, facing the continued selling pressure of the holders, market rectification, and shrinking trading volume. Waiting for many difficulties, it is difficult to have a market in the short and medium term, and it is not recommended to buy.

The domestic public chain currency, after a short period of currency price experienced a wave of roller coaster market, returned to the starting point, short-term trading is extremely inactive, the subsequent development will face the double dilemma of business transformation and technology research and development. What is even worse is the altcoin, the collective is in a state of silence. Under the high pressure of the policy, the price of the currency is difficult to perform, and many currencies will even withdraw from the market. The pain is inevitable and rational.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Coinbase announces the transition to global Staking service, Staking becomes the most critical investment strategy in the blockchain ecosystem

- Blockchain is not the next P2P: learn lessons, supervise first

- Strictly fight virtual currency transactions, Beijing arrests many people, read policies and grasp the wind direction

- Lottery lottery "winding", electronic deposit card cover "poke", blockchain boosts Zhejiang social credit governance

- BTC accelerates down to $6,800, staged bottom molding?

- Babbitt Column | Gu Yanxi: The Impact of Blockchain Technology on Film Distribution Channels

- Urban blockchain competition: Beishang Guangshen Hang ranked first echelon