Why has RWA suddenly become popular this year? What are the players?

Why is RWA popular this year? Who are the participants?Author: RWA Finance Translation: Shan Ou Ba, Lian Guai

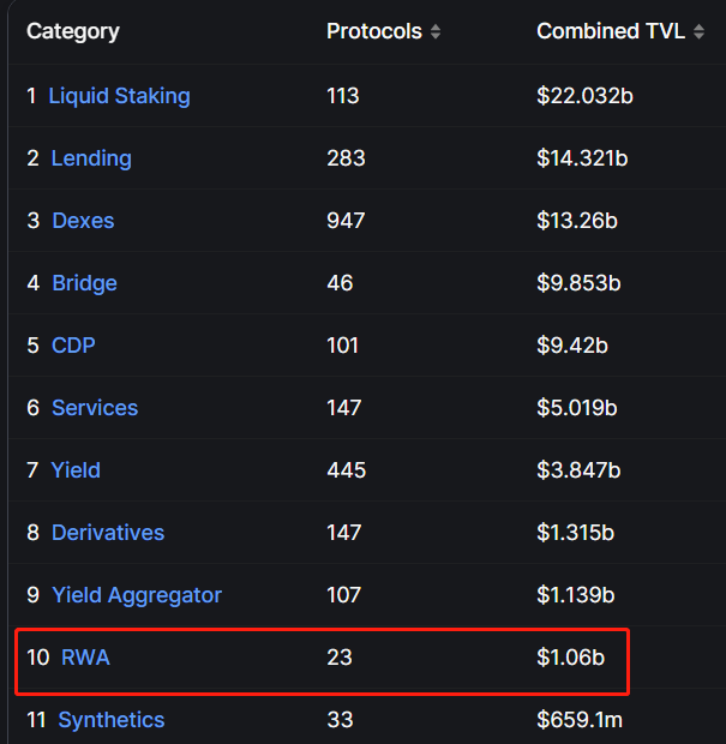

RWA is currently the hottest topic in the Web3 and cryptocurrency market and is considered to be the engine driving the new bull market. According to defillama data, there are more than 20 Rwa track projects with a TVL of over $1 billion, ranking 10th in the DeFi market.

Data source: https://defillama.com/categories

- The first Bitcoin Sovereign Rollup project Rollkit.

- The New Narrative of Cryptocurrency Investment in a Bear Market Unibot Project Analysis

- Cosmos ecosystem’s living water Entangle and Tenet, the dual heroes of the whole chain LSD.

Why is RWA suddenly popular?

Around April, RWA began to attract attention in the Web3 and cryptocurrency market, and it has become well-known in July and August.

In fact, RWA is not new. If you are an old player, you must have heard of the term “asset chain”. During the public chain boom in 2017-2018, many entrepreneurs have realized that real estate, artworks, or securities are being mapped onto the chain. Unfortunately, as the market entered a bear market and these teams were immature themselves, the track did not have much impact. By 2018-2019, compliance began to attract attention, and the concept of STO and many projects that claimed to have “chain transformation” also came to an end.

Why did “on-chain assets” become popular again this year with a new term?

Firstly, Web3 needs a new narrative. We have seen a series of events such as the fake Luna storm, FTX closure, GameFi track, DeFi and NFT stagnation, and the hot BRC20 extinguishing in the first half of the year. Naturally, we wonder: what is the next direction? The market?

Secondly, the cryptocurrency market cycle is closely related to macroeconomic liquidity. Looking back at the DeFi summer of 2020, it was essentially the unprecedented drainage and interest rate cuts by the Federal Reserve, which caused an overflow of liquidity from traditional markets to the market, resulting in a brief prosperity.

Coingecko data shows that from February 2020 to February 2022, the stablecoin market, including USDT, USDC, DAI, etc., grew from less than $5 billion to over $160 billion. During the DeFi protocol period, TVL increased from less than $1 billion to $300 billion.

Data source: https://defillama.com/

With the Federal Reserve starting to raise interest rates in March 2022, bond yields have continued to rise. The one-year Treasury yield has now exceeded 5%, far higher than the DeFi yield in the cryptocurrency market and the LSD yield of Ethereum. Researchers predict that the EtherPlace staking yield will drop to 3% by the end of the year and may fall below 1% after that.

Data Source: https://cn.investing.com/rates-bonds/us-1-year-bond-yield-streaming-chart

Data Source: https://lido.fi/ethereum

Compared to traditional world interest rates, cryptocurrency market rates are lower, prompting entrepreneurs to regain control of asset chain narratives.

Who are the RWA players?

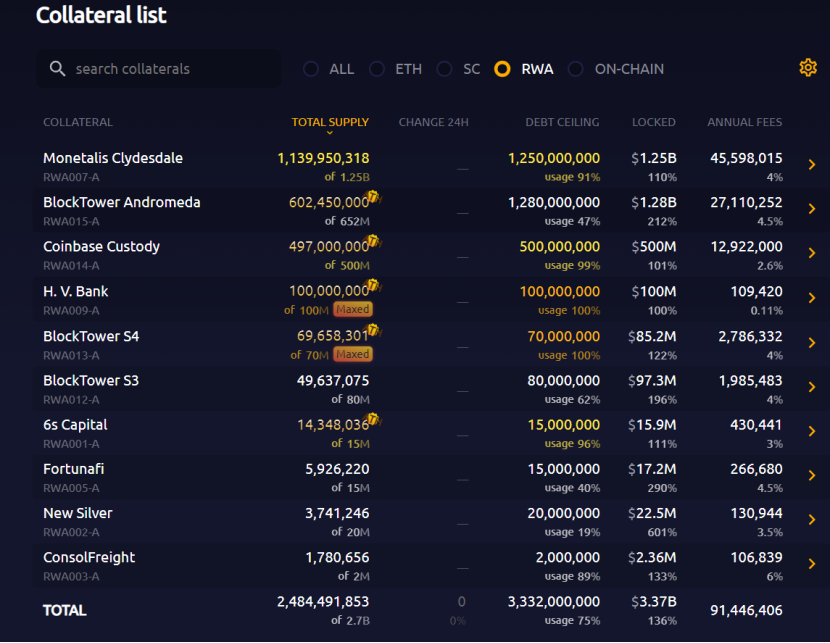

These players were known earlier than MakerDAO and have been working earlier. As early as 2020, they attempted to tokenize physical assets such as real estate and solar power plants, but the scale has always been small, mostly tens of millions of dollars. Rwa quickly realized this before MakerDAO realized US debt. According to makerburn data, MakerDao’s RWA scale has exceeded $2.4 billion, creating more than $90 million in revenue.

Data Source: https://makerburn.com/#/rundown

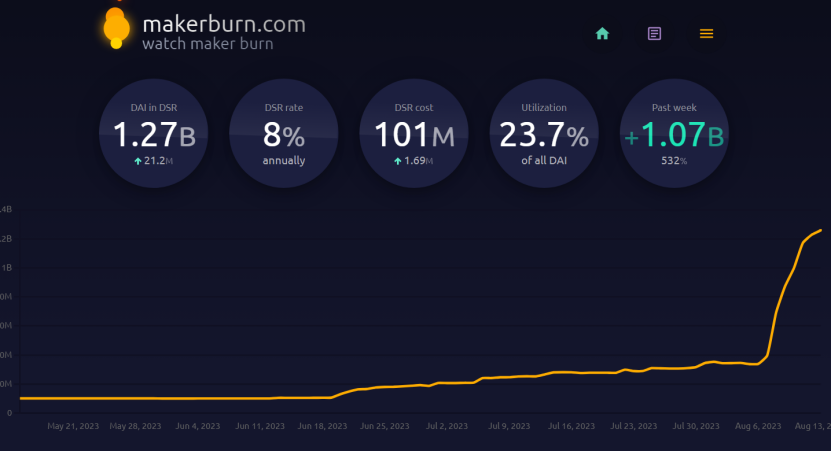

The benefits are significant and also beneficial to DAI holders. MakerDAO has raised the DSR (DAI Savings Rate) multiple times this year, from 1% to 3.49%, and recently directly raised it to 8%, which is much higher than the US Treasury bond yield. With the promotion of high deposit rates, MakerDAO’s deposit scale has increased significantly.

In addition to MakerDAO, there are many players in the Rwa track, such as Maple Finance, Opentrade, Ondo Finance, and RWA Finance.

Among them, RWA Finance is an innovative investment platform that provides a DeFi investment protocol backed by real-world gold assets. Users can deposit USDT, enjoy weekly investment returns, redeem the principal in USDT at maturity, or recover it. Unlike previous DeFi transactions that were mainly subsidized by project parties or financed by other users and had difficulty maintaining APY, all income of RWA Finance comes from stable and more sustainable real-world assets.

RWA Finance breaks the Ponzi scheme of the cryptocurrency game, and real-world assets can be digitized and tokenized through blockchain technology. This provides investors and users with a more transparent, convenient, and efficient way to participate in asset investment and transactions. Investors are no longer restricted by the opening hours and regions of traditional financial markets and can conduct asset transactions anytime, anywhere, providing new possibilities for global capital flows.

However, RWA Finance may also face some challenges and obstacles. The tokenization of real-world assets requires solving many legal, regulatory, and technical issues to ensure the authenticity and compliance of the tokens. In addition, there are risks in the decentralized finance field, such as security issues, smart contract vulnerabilities, and ongoing technical and security improvements. In terms of compliance, RWA Finance has the corresponding compliance licenses and cooperates with professional compliance institutions to connect investment and financing channels. In terms of security, the RWA Finance team members have been deeply involved in blockchain and DeFi for many years, and the code has been audited by security auditors. At the same time, users’ assets are transparent and visible on the chain.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Reddit Avatar One-Year Anniversary Layout and Insights Behind the NFT Project with the Largest User Scale

- Worldcoin in the Polkadot ecosystem? Another money-spreading project Encointer analysis

- Quick Overview of Recent Popular DeFi Narratives and Innovative Projects

- Inventory of the 8 old projects of the transformation LSD

- Crossing the Bull and Bear The LSD Battle of the Project Party

- Crossing the Bull and Bear The LSD Battle of Project Parties

- A summary of 10 projects worth paying attention to recently DeFi, DEX, games, and on-chain tools