Is the recent court ruling an intentional attempt by the judicial department to balance the scales of SEC regulation?

Is the court ruling an attempt to balance SEC regulation?Author: Matthew Lee

On September 27th, SEC Chairman Gary Gensler attended a hearing of the U.S. House Committee on Financial Services. The hearing reviewed regulatory developments, rulemaking, and activities of the SEC since October 5, 2021, including the SEC’s proposed amendments to the definition of “exchange” and the expansion of the SEC’s authority over digital asset trading platforms. Although Gary Gensler still maintains a strict scrutiny attitude towards virtual assets, the SEC no longer presents a united front, and internal staff members have become exhausted. Bloomberg’s senior ETF analyst also stated that employees hope to be freed from such work before the government shutdown.

Although U.S. regulations have always suppressed the development of the industry, the advantage lies in its development of a legitimate procedural legal system. When things may get out of control, it ensures the correct corrective measures (as seen in the comparison between the losses of U.S. investors and Asian investors caused by FTX’s bankruptcy).

- Friend.tech without innovation has brought a product lesson to the cryptocurrency circle.

- Namada in Detail A Modular Privacy Solution for Multi-chain Ecosystems

- How do lawyers use AIGC to write articles? Taking Microsoft Copilot as an example.

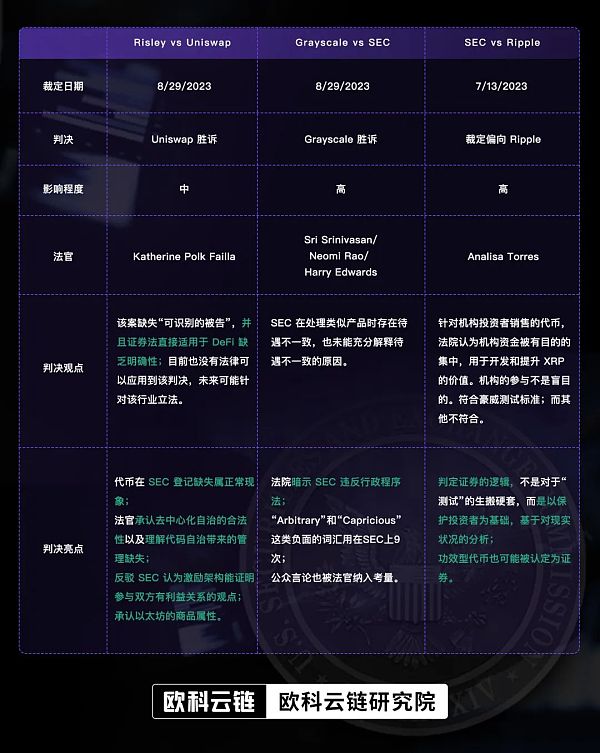

In the past three months, the courts have ruled on three industry-related cases: Risley vs Uniswap, SEC vs Ripple, and SEC vs Grayscale. The rulings in these cases have been relatively favorable for the industry. Combined with a series of rulings by the Department of Justice against the SEC, it is hard not to speculate whether the SEC’s “long arm” behavior towards virtual assets will be restricted.

The details highlighted in the judgments are worth discussing as they demonstrate positive factors in the U.S. regulatory environment. Below, we will observe the attitude of the judicial system towards virtual assets and SEC regulation, as well as explore the regulatory trends of virtual assets.

TL;DR

Key Points of the Risley vs Uniswap Judgment

The judgment of the court on Uniswap and Risley received the least attention from the public, but it also had the most detailed rulings, with some very clear and directional viewpoints that illustrate the court’s attitude towards the industry.

Accusations

Risley’s accusations against Uniswap Labs and its venture capital companies, including LianGuairadigm, Andreessen Horowitz, and USV, mainly include:

i) Uniswap platform selling unregistered securities;

ii) Uniswap operating as an unregistered broker-dealer;

iii) Uniswap Labs profiting from false advertising.

Court’s Response

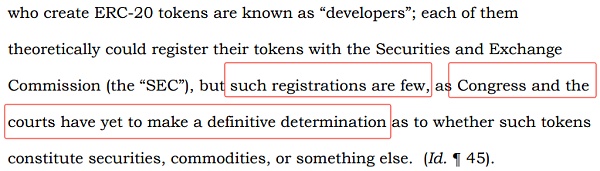

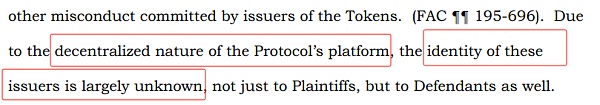

The decentralized architecture of Uniswap makes it unable to identify fraudulent token issuers, resulting in a lack of “identifiable defendants” in this case. And securities laws directly apply to DeFi without clarity, and there is no federal law that allows the court to hold Uniswap Labs and its venture capital companies accountable. Therefore, merely charging Uniswap Labs with transaction fees and other aspects of authority is not sufficient to establish liability for Uniswap Labs or the venture capital companies.

Highlights of the Judgment

This paragraph is very important. The judge believes that law should not be separated from reality, and combining the current situation and the law, it is considered normal for tokens to lack registration with the SEC. Therefore, many of the SEC’s accusations, such as “failure to register with the SEC or issue prospectuses or annual reports in violation of securities laws,” are not valid.

Due to the characteristics of decentralized autonomy, the judge understands the lack of management for “Scam Tokens”. However, with the gradual improvement of the law, decentralized organizations should also adopt on-chain tools such as OKLink’s on-chain labeling system to remind users of the risks of certain tokens, in order to avoid legal disputes. Institutions should also consider using on-chain tools to avoid risky interactions when conducting large transactions on decentralized autonomous platforms.

The judge revealed two pieces of information: i). Recognizing the legitimacy of smart contracts in operation; ii). Recognizing the attributes of Ethereum as a commodity (SEC claimed that ETH is a security rather than a commodity when suing Coinbase).

Due to the lack of laws, decentralized trading platforms have not been punished, but there will be stricter regulations on decentralized organizations, especially trading platforms. Taking Hong Kong and Singapore as examples, both have established strict legal requirements for trading platforms to conduct strict reviews of tokens traded on the platforms, and many platforms have purchased data labeling services from data service providers in order to comply with anti-money laundering regulations. In the future, decentralized trading platforms will not have many privileges.

However, the judge’s current conclusion clearly differs from the previous view of the SEC chairman that “most DeFi trading platforms are actually no different from traditional exchanges”.

The court also dismissed the plaintiff’s reference to the SEC’s viewpoint, believing that the presence of incentive structures does not prove a relationship of interest between the defendant and the project party. This view can bring relief to many projects with incentive measures.

Summary

The judgment contains two very important pieces of information: i). The judge has a deep understanding of the operational logic and characteristics of decentralized projects; ii). The judge is tolerant of the operation of decentralized project code and recognizes the legality of smart contract execution.

However, the most important thing is that the decentralized operating model and the lack of a legal framework make it impossible for the court to make an objective judgment. There are already several senators proposing new legal frameworks for virtual assets, KYC, and even decentralized protocols, aiming to clarify the regulatory framework and responsible parties. In the future, decentralized operations also need to find ways to comply with regulations, and more data service providers like OKLink are needed to help identify potential “Rug-Pull” or “Pump and Dump”.

Key Points of the Grayscale vs SEC Judgment

Allegations

Grayscale accused the SEC of arbitrarily and repeatedly rejecting the listing of Grayscale’s Bitcoin ETP, while approving a substantially similar Bitcoin futures ETP.

Court Response

The court found that the SEC did not object to Grayscale’s evidence that the spot market for Bitcoin and the futures market have a 99.9% correlation, nor did it imply that market inefficiency or other factors would undermine this correlation. The judge believed that the SEC had shown inconsistent treatment when dealing with similar products.

Therefore, the judge approved Grayscale’s request and revoked the SEC’s order.

Highlights of the Judgment

It is rare for a court to state in a judgment that an institution has violated the law (Administrative Procedure Law), and the court used very harsh words to imply that the defendant’s decision was hasty and capricious, even an “abuse of discretion.”

In the judgment, words with very negative connotations such as “Arbitrary” and “Capricious” appear 9 times.

Public opinion was also taken into consideration by the judge, and it can be said that the SEC was almost universally disliked in this judgment.

Summary

In this overwhelming 3:0 judgment, the judge questioned how Grayscale’s ETP and other approved ETPs are fundamentally different, allowing the SEC to be “distinguishable.” The SEC did not provide a successful answer to this question.

Regarding the judgment against Grayscale, the policy director of LianGuairadigm also provided some additional information: two judges appointed by Presidents Obama and Carter were very critical of the SEC’s arguments, so they (as Democrats who are more opposed to crypto assets) also joined the opinion of conservative judge Rao. Therefore, the probability of the SEC requesting a joint trial is very small, as it is likely to anger the court. If they were to restate the reasons for disapproval, it should be related to the internal operations of the company, rather than hidden dangers of the ETP itself.

Key Points of the SEC vs Ripple Judgment

Allegations

i). Ripple’s sale of tokens to institutions is alleged to constitute the sale of securities;

ii). Ripple’s sale of tokens to the public on digital trading platforms is alleged to constitute the sale of securities;

iii). The gifting of tokens to an outsourcing company is alleged to constitute the sale of securities;

iv). Failure to file similar prospectuses or updated annual reports with the SEC.

Due to the extensive use of the Howey test in this article to determine if something is a security, let’s start with a brief explanation of the Howey test: 1. Is there an investment of money; 2. Is there a common enterprise; 3. Is there an expectation of profit; 4. Is the profit generated primarily from the efforts of others.

*The SEC believes that most tokens meet the second and third criteria.

Court’s Response

i). Ripple’s sale of tokens to institutions through contracts constitutes the sale of securities. The court believes that institutional funds are purposefully concentrated and used to develop and enhance the value of XRP. The institution’s involvement is not blind. It meets the Howey test criteria;

ii). Ripple’s sale of XRP to the public through “programmatic interfaces” (exchanges) does not constitute the sale of securities. The public does not know the source of the tokens and does not have an expectation of profit from the efforts of the issuer (but rather from other factors such as market trends). It does not meet the third and fourth criteria;

iii). Distribution through other channels does not constitute the sale of bonds. Because no “tangible or definable thing” is paid to Ripple, paying XRP cannot be considered the sale of securities. It does not meet the first criterion.

Highlights of the Ruling

Ripple proposed the “essential elements” test – a narrow version of the Howey test, which was undoubtedly rejected by the court. The judge also demonstrated the logic of determining securities, which is definitely not a rigid application of the “test,” but rather based on protecting investors and analyzing the current situation. Compared to Ripple’s proposed test, it focuses more on form.

The court believes that institutional users clearly understand the terms of the investment contract, and they do not consider their purchase of XRP as currency or commodities, but as investment products. Therefore, the sale of XRP to institutions is considered the sale of securities.

On the other hand, ordinary users do not understand various documents from the SEC and Ripple’s market promotions and do not associate them with investment returns. Therefore, they do not meet the “expectation of profit” in the Howey test.

Ripple argues that XRP is not a security and is more like ordinary assets such as gold and silver, so it does not have a “commercial nature” as a security. The court does not recognize the logical relationship of XRP because the court believes that even commodities can be sold in the form of investment contracts.

Many projects also claim that their tokens are not securities but utility tokens. However, from the court’s perspective, although they have utility, it does not prevent them from being considered securities.

Summary

Unlike the one-sided “support” for Grayscale and Uniswap, although the judge has a more positive attitude towards the virtual market, the court still makes some rulings that are favorable to the SEC, such as not sticking to the form in the Howey test, which to some extent complies with the SEC’s definition of securities. It is difficult for projects that claim their tokens are “utility tokens” to stand in court.

The ruling puzzles me. It concludes that tokens sold to institutional investors are considered securities because these investors are aware of the investment regulations and the sources of sales, while retail investors are “unaware”. However, the “intention” of classifying securities is to protect investors, which retail investors have not received. According to this logic, if tokens are sold through exchanges, then securities laws do not apply, and retail investors who purchase tokens on trading platforms would not be protected, right?

Regulatory signals revealed by the ruling

Several rulings have shown some “unreasonable” aspects, reflecting the biased position of the judicial department towards the industry and the checks and balances within the United States. In the past few years, the SEC has taken aggressive measures to expand its “jurisdiction” on whether virtual currencies are securities. However, before the legislative department has taken formal action, the judicial department has begun to vigorously curb the administrative department’s arrogance.

Ripple, as an example intentionally used by the SEC to warn the industry, did not establish authority but instead presented the industry with a gift. As a country represented by case law, the ruling in the “Ripple vs SEC” case will provide a clearer direction for the industry, especially by pointing out that tokens sold in a “programmatic” manner do not fall within the SEC’s definition of “securities”.

Although the ruling in the Uniswap case is unrelated to the SEC, it reveals the court’s attitude: decentralized projects are different from ordinary companies, and tokens cannot be equated with company securities. Judge Katherine Failla, who presided over the SEC and Coinbase cases, is also highly regarded by the market, and it is expected that Coinbase will reject the SEC’s lawsuit.

If the Ripple and Uniswap cases are the judiciary’s goodwill towards the industry, then Grayscale’s ruling is a blow to the SEC. The overwhelming 3:0 ruling reflects disappointment with the SEC, regardless of whether it is from the progressive party or the conservative party.

The hearing held yesterday also indirectly sent a signal to the industry that the SEC’s strong regulation will be restrained, and the legislative department will promptly clarify the regulatory framework. Although regulation will not be completely relaxed, future enforcement will be more “rule-based”. Congressional members are also unlikely to miss this opportunity to promote their own views in the cryptocurrency industry and gain political capital. There will be a large number of ETF applications in October, which have already exerted strong political pressure on the SEC. Combined with the recent ups and downs and the cold reception at the Permissionless Conference, it is a criticism of the SEC. If it continues to take unreasonable measures, it will be abandoned by public opinion and political resources.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Thoughts on Friendtech Not optimistic about all Friendtech clones.

- NFT quietly integrates into the mainstream Fat Penguin settles in Walmart, Microsoft Xbox may integrate encrypted wallets.

- LianGuai Morning Post | 3 more people arrested in JPEX case, bringing the total number of arrests to 15.

- SeeDAO White Paper Digital City-State

- JPEX bankruptcy, Hong Kong SFC plans to issue a blacklist for virtual asset exchanges.

- Crypto Security Differences Between Hacker Attacks and Fraud

- Conduit Elector Introduction How to bring high availability sorter and zero downtime deployment to Superchain?