Why is Binance in such a hurry to sell its Russian business to a newly launched exchange?

Why is Binance in a rush to sell its Russian business to a new exchange?CommEX, registered in Seychelles and launched on September 26th, has been questioned as a “shell company” of Binance in the Russian region.

By: Nian Qing, ChainCatcher

On September 27th, Binance announced that it has sold all its business in Russia to the cryptocurrency exchange CommEX. To ensure the smooth withdrawal of existing Russian users, the withdrawal process will last for one year. Part of the KYC new user registrations from Russia will be immediately transferred to CommEX and gradually expanded over time. In the next few months, Binance will stop all exchange services and business lines in Russia. Binance will not receive any ongoing revenue share from this sale and will have no option to repurchase business shares.

According to the official description, the sale of all business in the Russian region is due to “the business in Russia not complying with Binance’s compliance strategy,” but the official did not provide specific explanations for the compliance strategy.

- Is the recent court ruling an intentional attempt by the judicial department to balance the scales of SEC regulation?

- Friend.tech without innovation has brought a product lesson to the cryptocurrency circle.

- Namada in Detail A Modular Privacy Solution for Multi-chain Ecosystems

What is even more strange is that CommEX, the buyer of Binance’s Russian business, is a cryptocurrency exchange that was officially launched on September 26th. Its social platform X account, Telegram community, and so on were registered around September 25th. According to the introduction on CommEX’s official website, CommEX is a centralized cryptocurrency exchange supported by “top-level crypto VCs”. The team is committed to providing convenient, secure, and innovative services to “global users”. In addition to spot trading, CommEX also provides futures and P2P services. Its futures market offers up to 200x leverage perpetual contracts and up to 500x leverage simple futures trading. Currently, its spot trading market only provides USDT trading pairs for more than 20 currencies, and P2P fiat trading only supports the Russian Ruble (RUB). According to a response from an official staff member in CommEX’s Russian community, the team is gradually improving support for more currencies, and other fiat currency services are not yet available.

Binance’s decision to sell its business in the Russian region to what appears to be a newly established exchange has raised doubts among the public, especially Binance users in Russia. Can a new exchange guarantee the security of assets? Can its trading depth accommodate Binance’s Russian users? However, more voices point to “CommEX being a front for Binance’s Russian business”.

Why is Binance eager to exit the Russian business?

Russia used to be one of Binance’s largest trading markets, and its fiat business was also an important part of its operations. However, after the Russia-Ukraine war, Binance’s business in the Russian region became awkward.

Due to extensive sanctions imposed by the United States on the Russian financial industry, many Russians were unable to wire rubles to foreign bank accounts or convert money into other currencies, and cryptocurrency became one of the ways for Russians to escape these restrictions. In April last year, Binance began to limit the cryptocurrency wallet balances of Russian users to no more than 10,000 euros, and blocked several accounts related to relatives of senior Kremlin officials due to international sanctions against Russia.

In March of this year, Binance closed the channel for Russian users to buy and sell US dollars and euros through its P2P service. In addition, it also banned EU citizens from buying and selling rubles through P2P.

However, in April of this year, there were reports that Binance lifted the restriction on Russian users depositing 10,000 euros. Binance responded that all restrictions related to sanctioning Russian citizens still apply to the platform and its legal entities in the EU.

In May, the US Department of Justice began investigating whether Binance was being illegally used to help Russia evade US sanctions and transfer funds.

In August, The Wall Street Journal reported that Binance was still processing a large number of ruble transactions, and Russian users could still transfer funds from sanctioned Russian banks to Binance accounts through intermediaries. Binance also supported P2P transactions between rubles and digital tokens, which often involved banks blacklisted by the West. A recent review of Binance’s P2P service website revealed that Binance recently provided at least five sanctioned Russian banks (including Rossbank and Tinkoff Bank) as payment options for Russian customers. Meanwhile, sources revealed that the US Department of Justice is still investigating whether Binance may have violated US sanctions against Russia. However, after this report, Binance immediately removed these five Russian borrowing institutions from its website. A Binance spokesperson stated that the system will be regularly updated to ensure compliance with local and global regulatory standards.

On August 28, Binance announced through the media that it may “completely” withdraw from the Russian market due to controversies in the region. At the same time, Binance’s Russian Telegram channel updated its rules for P2P exchange users, stating that Russian users can only trade with the Russian ruble (RUB) as the legal currency on the P2P platform, and this option is only available to Russian residents who have gone through KYC verification.

Earlier this month, Binance’s head of Eastern Europe and Russia, Gleb Kostarev, and Binance’s general manager for Russia and the CIS region, Vladimir Smerkis, both announced their resignations on Facebook.

Therefore, Binance’s decision to withdraw from the Russian market is mainly due to the ongoing investigation by the US Department of Justice. In addition to this investigation, Binance has become a key target of US regulatory authorities this year. In March, it was sued by the US Commodity Futures Trading Commission (CFTC), alleging that its founder, Changpeng Zhao, and its three operating entities of Binance, had repeatedly violated the Commodity Exchange Act (CEA) and CFTC regulations.

Subsequently, Binance Holdings Limited and its founder, Changpeng Zhao, faced multiple securities law violations filed by the US Securities and Exchange Commission (SEC) in June. This includes allegations that the overseas company operated an illegal trading platform in the United States and misused customer funds.

Therefore, in order to operate in compliance, Binance has to take countermeasures.

Deep Dive into CommEX: Its Ambitions May Not Be Limited to Binance’s Russian Business

Currently, CommEX’s Telegram community has opened Russian, English, and Korean channels. According to the administrator’s response in the Russian channel, CommEX is registered in Seychelles, not Russia. It is a global platform focused on multiple markets (including the Commonwealth of Independent States) and will also focus on business in Asian countries. Therefore, it has also opened a Korean community in the early stage.

Although the official statement says that this is an exchange supported by many “top VCs,” no relevant information has been disclosed. Users who enter the community repeatedly ask questions such as “Where can I find information about the exchange” and “Who are the founder and CEO,” but they are all ignored by the administrators, who only respond by saying, “The team will hold an AMA to answer questions collectively.”

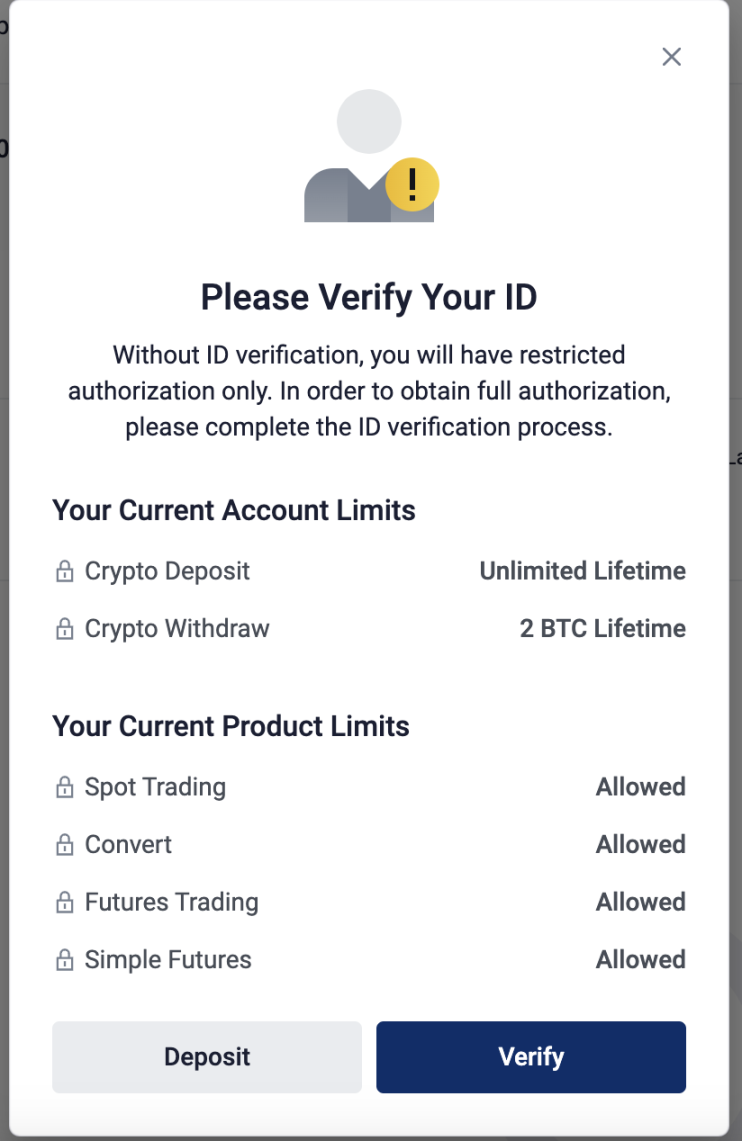

CommEX’s official website shows that it currently supports four languages: Russian, English, Japanese, and Simplified Chinese. First-time registered users can choose to register using their existing Binance accounts. The rights of newly registered users include exchange, spot trading, contract trading, and simple futures trading. Without KYC, there is a withdrawal limit of 2BTC. In addition, ChainCatcher reporters found that the exchange’s KYC is targeting multiple regions and countries, including China. Reporters used Chinese ID cards for KYC and successfully passed verification within 12 hours.

In addition, many users questioned the connection between CommEX and Binance. According to the disclosure by crypto KOL @Adam Cochran, according to the name server’s historical records of the domain name, https://www.commex.com/ was originally used by a commercial credit card company, and its server was only updated on the 21st of this month.

CommEX can use Binance login to indicate that it operates on Binance Cloud, and Binance Cloud was closed together with the Connect product in 2022. Therefore, general partners do not have permission to operate on Binance Cloud, and even Binance partner WazirX has lost the permission to use “Binance login.” Moreover, exchanges operating on Binance Cloud can share liquidity with Binance, which is why the BTC/UST trading volume on this newly launched website can reach 1 million US dollars on the first day, and the bid-ask spread in the market is good…

In my opinion, the above evidence is not very sufficient to prove “CommEX is an empty shell company of Binance.” However, it is indeed highly suspicious that Binance sold Russia to such a newly launched exchange without disclosing relevant information. We will also continue to track more developments of CommEX in the future, so please stay tuned.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How do lawyers use AIGC to write articles? Taking Microsoft Copilot as an example.

- Thoughts on Friendtech Not optimistic about all Friendtech clones.

- NFT quietly integrates into the mainstream Fat Penguin settles in Walmart, Microsoft Xbox may integrate encrypted wallets.

- LianGuai Morning Post | 3 more people arrested in JPEX case, bringing the total number of arrests to 15.

- SeeDAO White Paper Digital City-State

- JPEX bankruptcy, Hong Kong SFC plans to issue a blacklist for virtual asset exchanges.

- Crypto Security Differences Between Hacker Attacks and Fraud