Ethereum transactions decrease, Layer 2 dominating the market in-depth analysis of on-chain activities and trends

Layer 2 dominates Ethereum market as transactions decrease analysis of on-chain activities and trendsAuthor: Jiang Haibo, LianGuaiNews

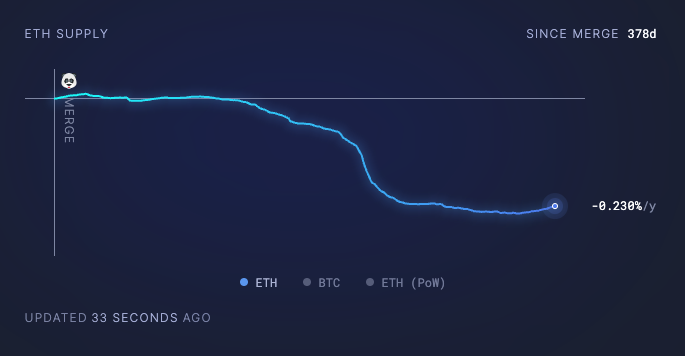

After the implementation of EIP-1559, there was an expectation of deflation for ETH, especially in the context of the overall market rebound this year. The maximum issuance of ETH has decreased by 300,000 coins compared to when EIP-1559 was implemented. However, in the past month, there has been a reversal, with Gas Prices on the Ethereum mainnet dropping to single digits (within 10 Gwei). In contrast to the deserted Ethereum mainnet, the transaction volume on Layer 2 solutions such as zkSync and Base is high. Could it be that transactions on the Ethereum mainnet have been transferred to Layer 2? LianGuaiNews compared the on-chain situation of the Ethereum mainnet with several Layer 2 solutions, including Arbitrum, Optimism, zkSync Era, StarkNet, Base, Linea, and Polygon zkEVM.

Ethereum Data

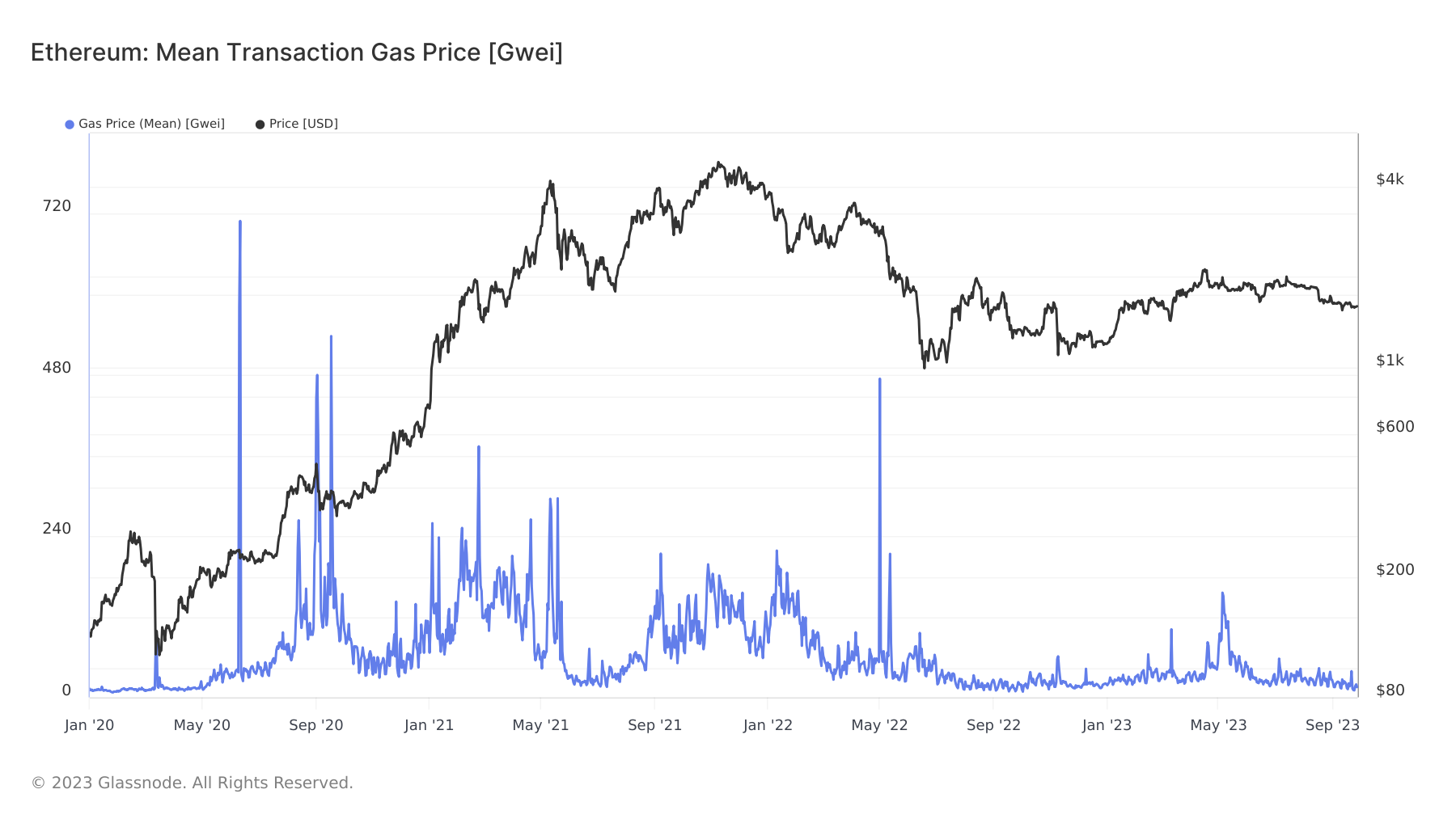

Gas Price

According to Glassnode data, as of September 28th, the average Gas Price of Ethereum in recent days has been between 10 Gwei and 20 Gwei, close to the lowest value in over three years and comparable to the data before the “DeFi Summer” in early May 2020, when the price of ETH was only around $200.

- Q3 Eight major hotspots review Ripple, L2, PYUSD

- 2024 Bitcoin Price Prediction Insights from Major Banks and Hedge Funds

- A record of the closure of a rural bank Is encryption beginning to ‘butcher’ the banking industry?

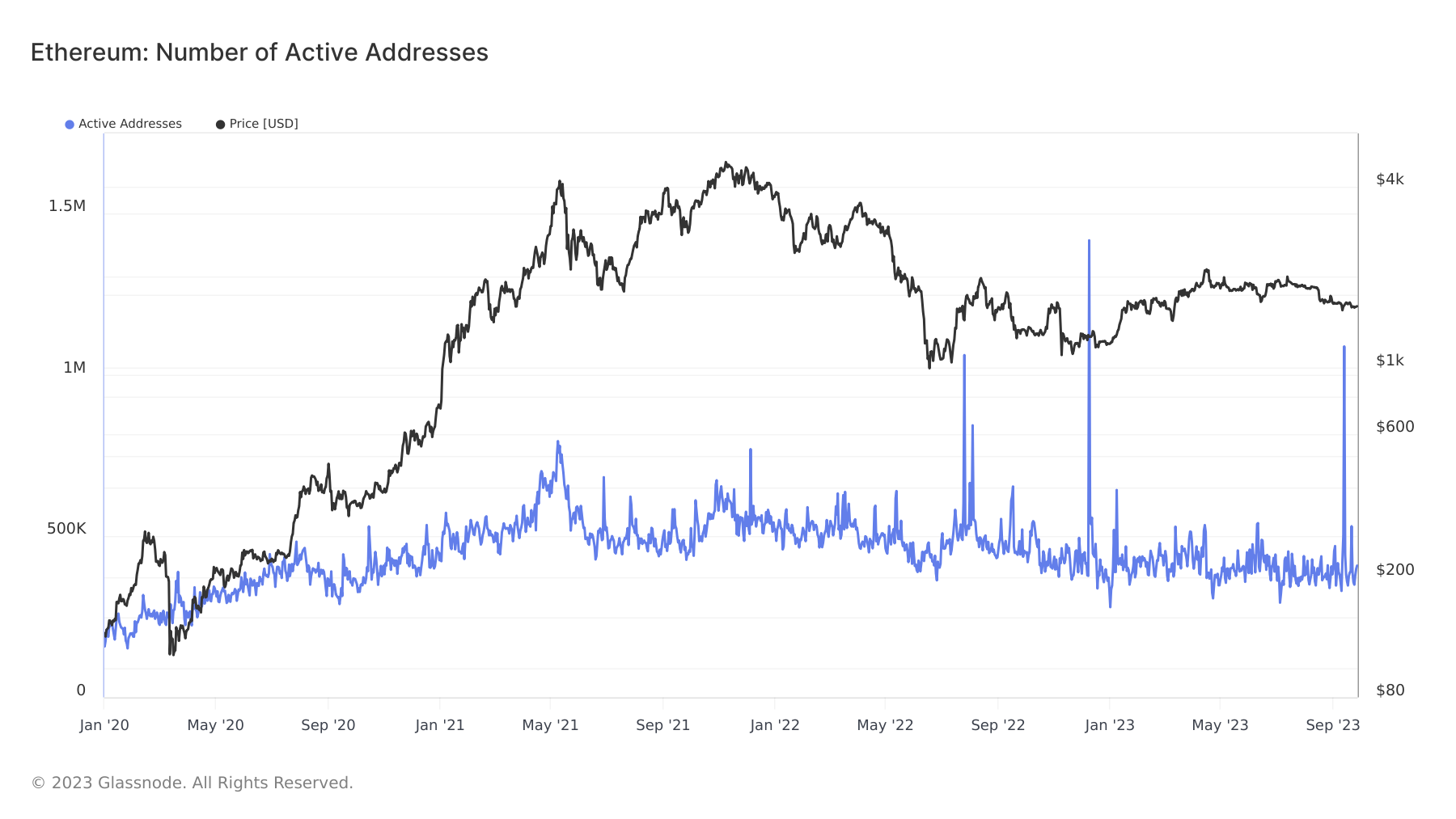

Active Addresses

The number of active addresses on Ethereum has shown a similar trend, declining since the market peaked in October 2021. Currently, there are approximately 400,000 active addresses per day, which is nearly the lowest value in over three years.

New Addresses

The performance of new addresses on Ethereum is better than the lowest level. Currently, there are approximately 77,000 new addresses per day, compared to around 50,000 at the beginning of this year.

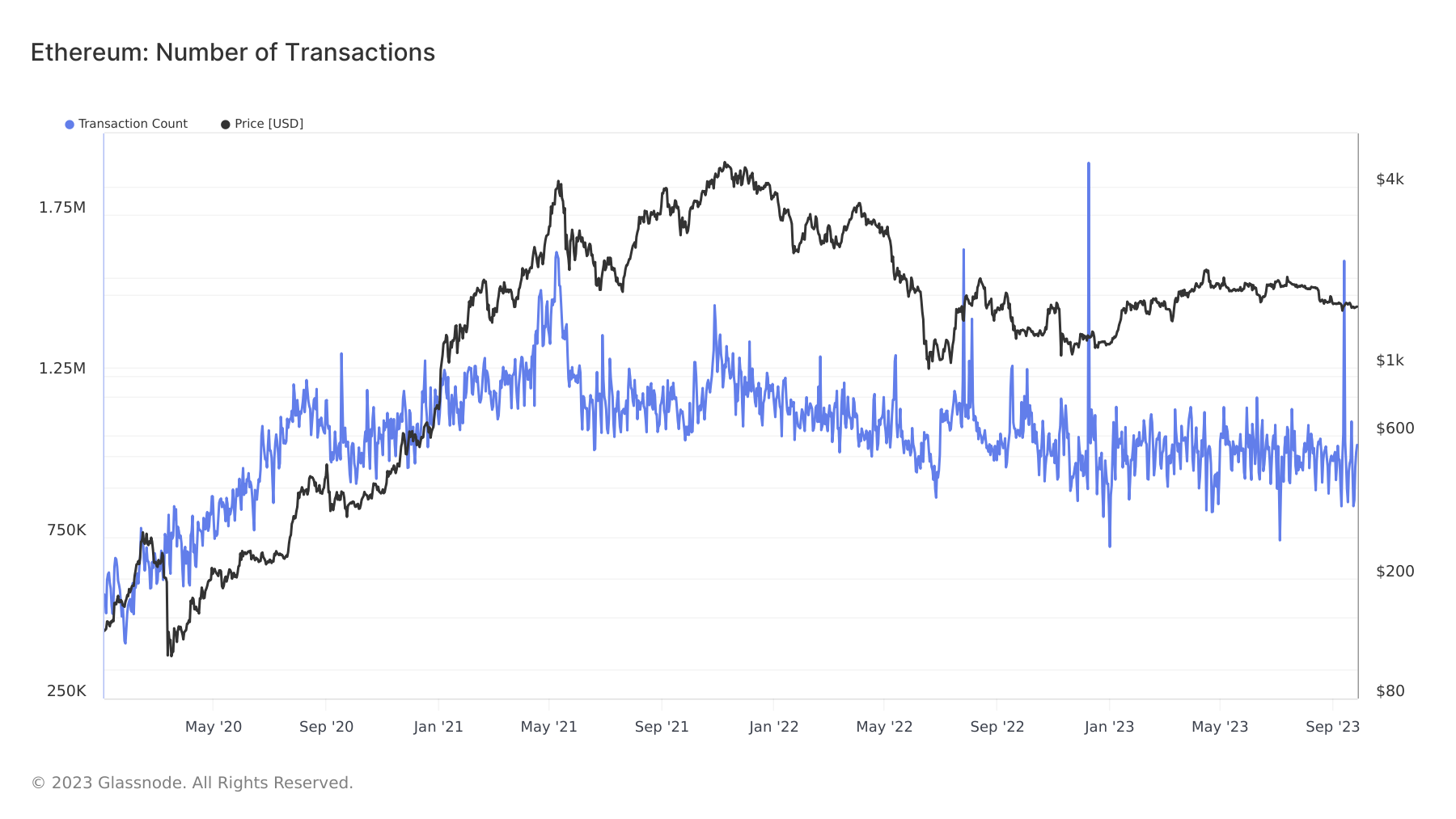

Number of Transactions

The number of transactions per day on Ethereum is also comparable to the lowest point in the past three years, averaging 1 million transactions per day.

All of the above data indicates that the transaction volume and user base on Ethereum are low, with low gas fees. Even Ethereum co-founder Vitalik has been continuously transferring ETH to exchanges. Which projects are consuming gas and how have they changed?

Sources of Gas Consumption on Ethereum

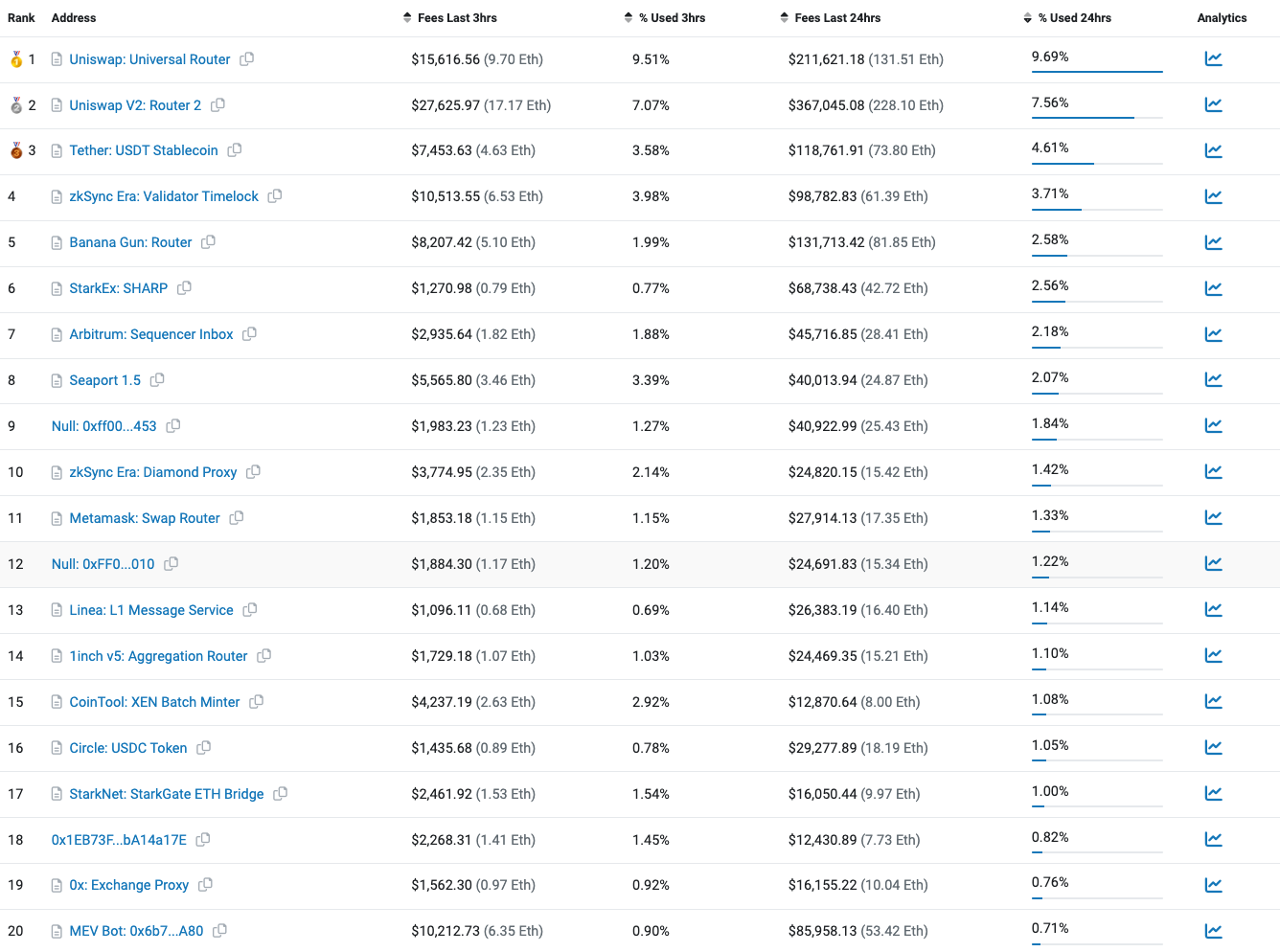

According to Etherscan data, in the past 24 hours on September 28th, the smart contracts that consumed the most gas were: Uniswap, Tether’s stablecoin USDT, zkSync Era, and the Telegram bot Banana Gun. Among the top 20 gas-consuming smart contracts are the contracts of seven Layer 2 projects: zkSync Era, StarkEx: SHARP, Arbitrum, Base, Optimism, Linea, and StarkNet.

According to Artemis data, these contracts are classified. The gas consumed by Layer 2 in the past 24 hours is about $594,000, accounting for 12.5% of all categories, second only to DeFi and wallet transfers, higher than stablecoins, NFT Apps, infrastructure, cross-chain bridges, games, and other categories.

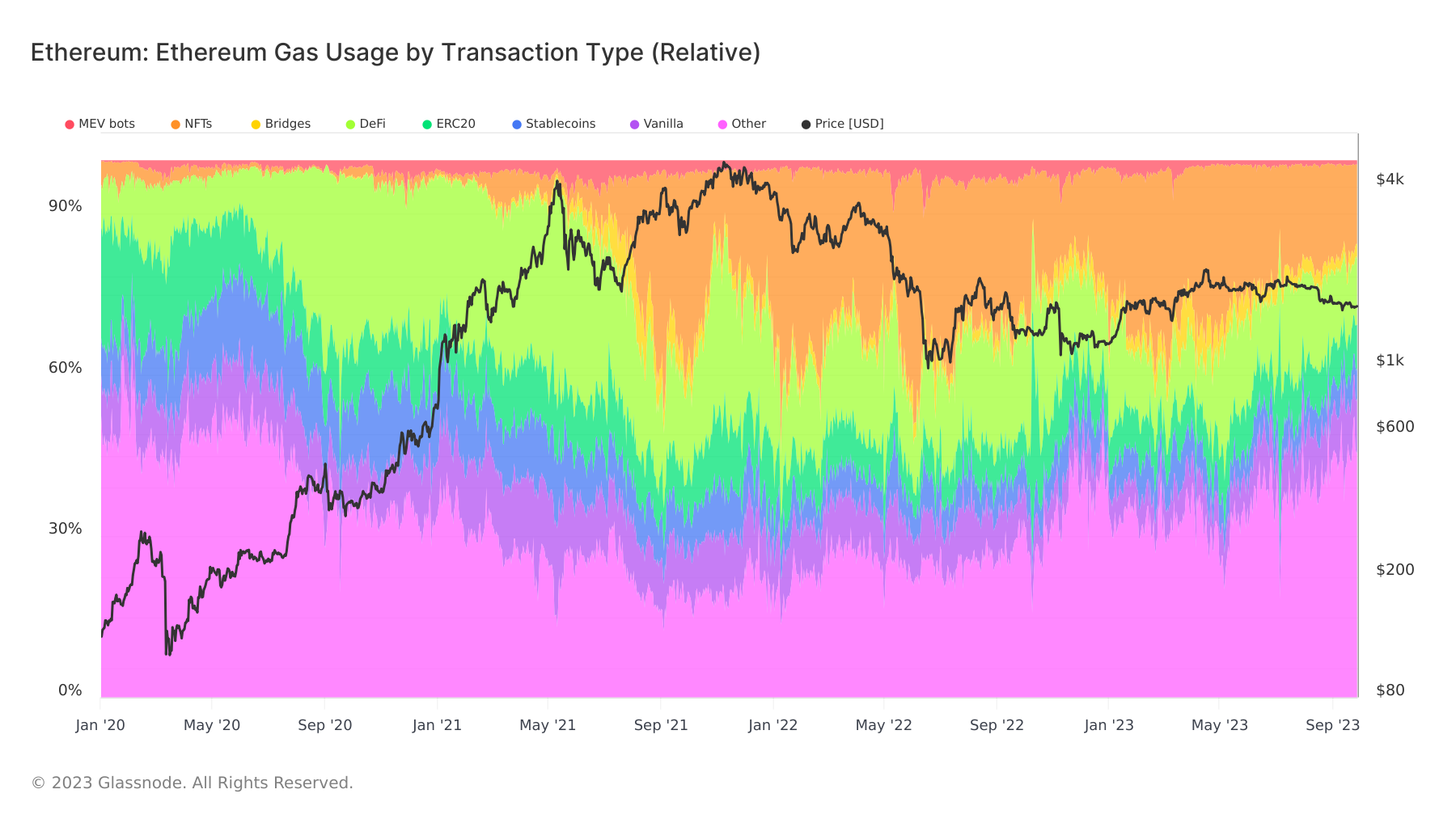

In terms of the changes in the proportion of gas consumed by various types of transactions, according to Glassnode data, the NFT market has contracted the most severely, with the proportion of gas consumed decreasing from over 30% in early March to the current 15%. The proportion of other categories correspondingly increased from 30% to 45%, and Layer 2 is also included in other categories.

Comparison of 7 Layer 2 Data

It can be seen that Layer 2-related trading pairs on Ethereum cannot be ignored. Due to lower gas fees for transactions on Layer 2, is it the reason for the decrease in gas on the Ethereum mainnet? Next, LianGuaiNews will compare the changes of Ethereum with Arbitrum, Optimism, zkSync Era, StarkNet, Base, Linea, and Polygon zkEVM.

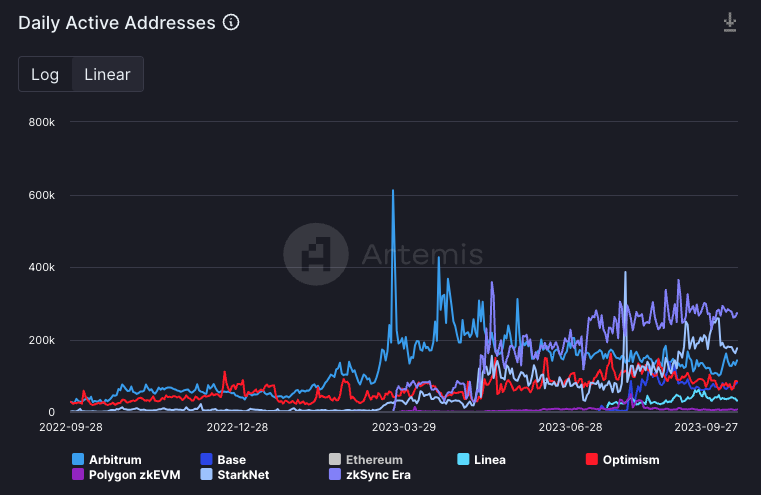

Active Addresses

As of September 27th, the active addresses of Ethereum and major Layer 2 are as follows: Ethereum 336,000, zkSync Era 273,000, StarkNet 175,000, Arbitrum 142,000, Optimism 84,000, Base 80,000, Linea 31,000, Polygon zkEVM 7,000.

After excluding Ethereum, their active addresses are shown in the following figure, and the current data is as follows:

- The number of active addresses on the Ethereum mainnet still exceeds each independent Layer 2.

- The active addresses of zkSync and StarkNet, which have not issued native tokens and have strong airdrop expectations, exceed those of Arbitrum and Optimism, which have issued tokens.

- The active addresses of Base have grown rapidly after going online and are currently comparable to Optimism. There are also many applications migrating from Optimism to Base. The governance and revenue-sharing framework previously reached by Optimism and Base may benefit Optimism.

- The active addresses of Arbitrum surged after the issuance of native tokens in March, but they entered a period of continuous decline starting in April. After Arbitrum announced the issuance of governance tokens, the active addresses of zkSync Era and StarkNet began to increase and experienced a large-scale growth in May.

- Although the co-founder of Polygon stated that “there is no rule that projects with issued tokens cannot conduct large-scale airdrops”, implying that Polygon zkEVM may have airdrops, it does not seem to attract enough users. Currently, there are only a few thousand active addresses per day; Although Linea has a background of ConsenSys, the number of active addresses is less than half of Base.

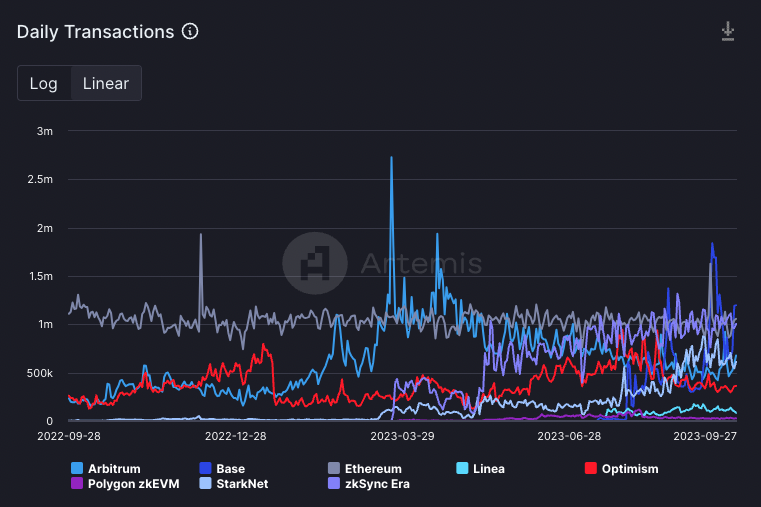

Daily Transaction Volume

In terms of daily transaction volume, Base has temporarily surpassed Ethereum, with daily transactions of Base at 1.2 million, Ethereum at 1.06 million, zkSync Era at 1 million, Arbitrum at 678,000, StarkNet at 612,000, Optimism at 363,000, Linea at 83,000, and Polygon zkEVM at 28,000.

Both zkSync and StarkNet have shown strong performance in daily transaction volume; the transaction volume of Base has consistently exceeded that of Optimism recently, and since the launch of Base in July, the transaction volume of Optimism has shown a downward trend.

Arbitrum and Optimism, which have a richer ecosystem and no airdrop expectations, may better reflect the real demand for Layer 2 at this stage. The transaction volume of both has been declining.

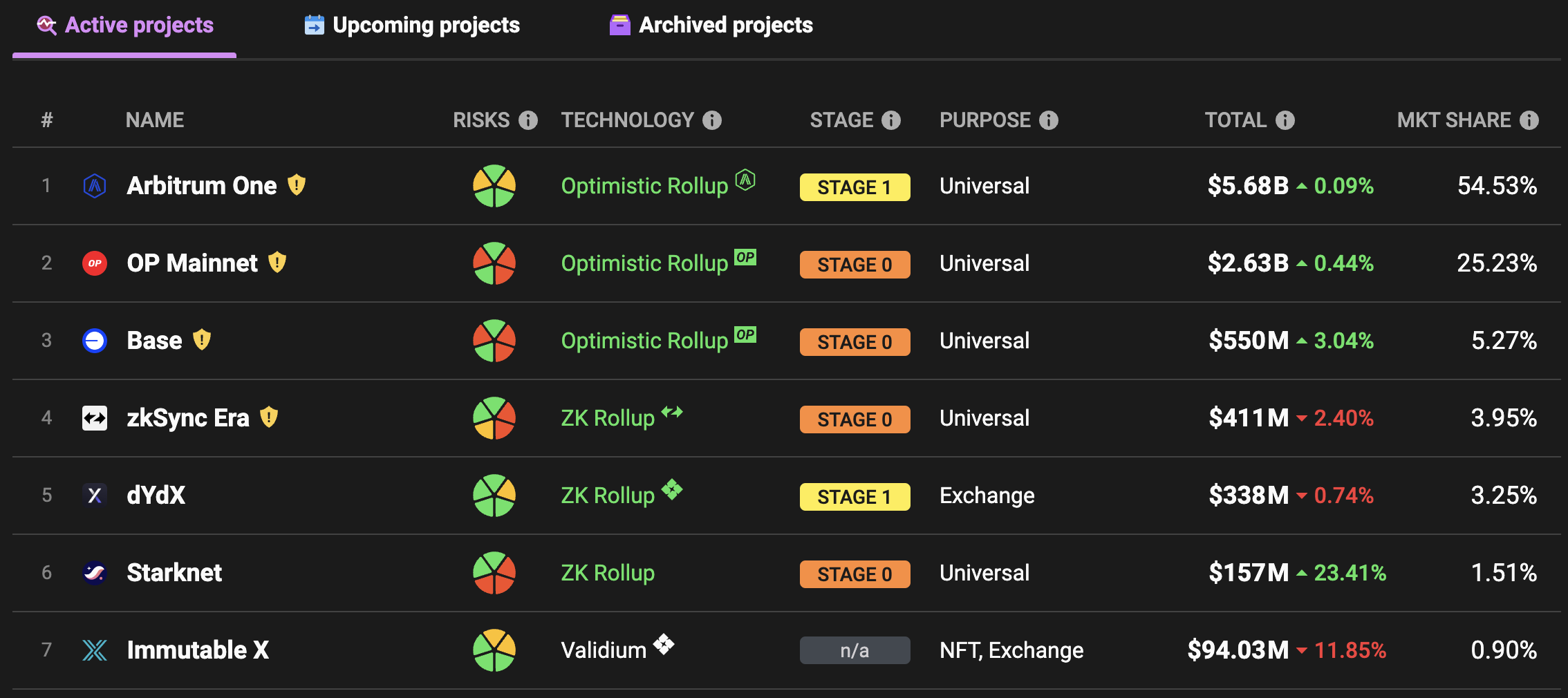

TVL

According to L2BEAT data, the TVL of these seven Layer 2 solutions are as follows: Arbitrum $5.68 billion, Optimism $2.63 billion, Base $550 million, zkSync Era $411 million, StarkNet $157 million, Linea $61 million, Polygon zkEVM $43 million.

The funds on zkSync and StarkNet are less than 10% of Arbitrum’s, and their on-chain applications are not as rich as Arbitrum and Optimism. However, they have more active addresses, indicating that there are a large number of active addresses on zkSync and StarkNet that have a high demand for non-real transactions, possibly belonging to airdrop hunters.

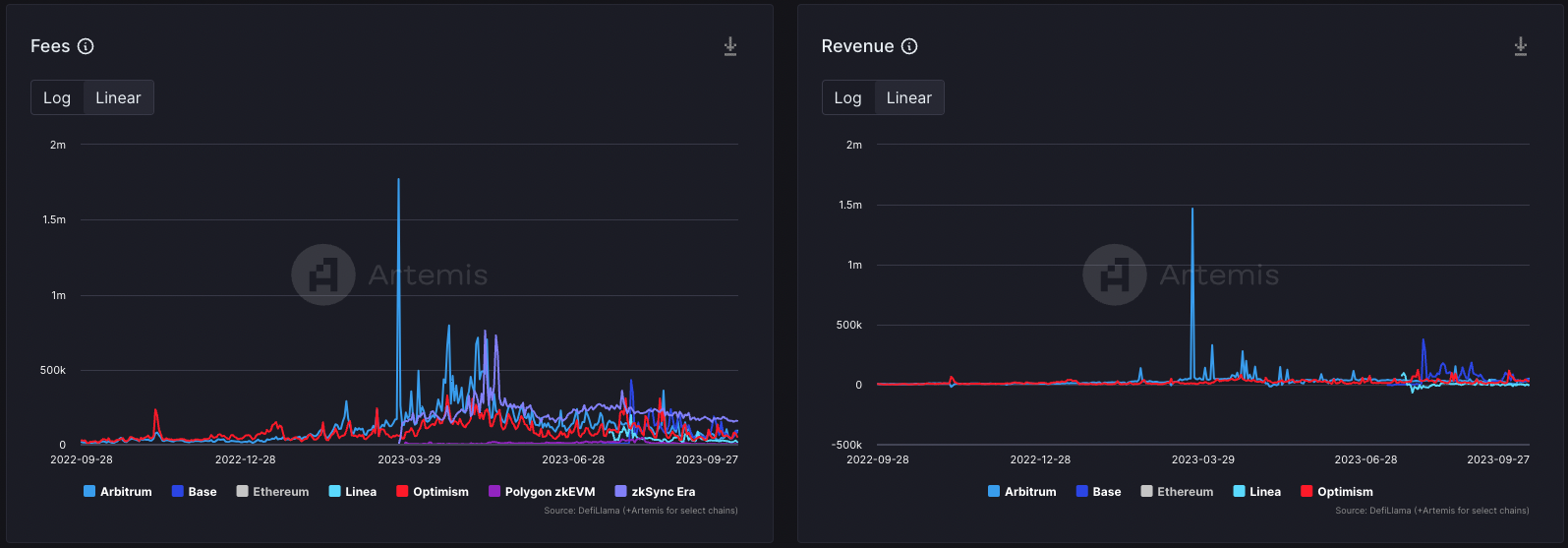

Fees and Revenue

In terms of fees and revenue, Ethereum’s fees and revenue are much higher than those of various Layer 2 solutions, and the fees of zkSync Era are still significantly higher than other Layer 2 solutions. Their daily fees are approximately Ethereum $2.69 million, zkSync $159,000, Arbitrum $94,000, Base $82,000, Optimism $52,000, Linea $18,000, Polygon zkEVM $4,000.

In terms of revenue, their daily revenue is as follows: Ethereum $2.05 million, Arbitrum $50,000, Base $42,000, Optimism $28,000.

The fees and revenue of zkSync Era have not increased with the increase in active addresses in the past few months, possibly also due to the decrease in gas price, showing a downward trend in fees. The fees of Arbitrum and Optimism have reached a low point.

Summary

In the past month, the number of active users, transaction volume, and gas price of Ethereum have all dropped to the lowest level in over three years, indicating low on-chain activity. Meanwhile, there have been many transactions on Layer 2 solutions such as zkSync and StarkNet, and the daily transaction volume of Base has even temporarily exceeded that of the Ethereum mainnet.

After comparing the data of active addresses, transaction volume, and TVL of various Layer 2 solutions, LianGuaiNews believes that Arbitrum and Optimism, which have a more complete ecosystem and larger funds, may better reflect the real on-chain demand for Layer 2. The current data is in a declining phase, and the recent growth in data for zkSync Era and StarkNet is more likely due to airdrop hunters.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interview with Lily Liu, Chair of Solana Foundation Entering the Asia-Pacific market at the right time, Solana may have new moves by the end of the year

- Account abstraction implementation, the on-chain ecosystem will shift towards the buyer’s market.

- A Review of Eight Hot Events in the Cryptocurrency Market in Q3

- Variant联创 Li Jin The main obstacle to the mainstream adoption of cryptocurrencies is the issue of product-market fit.

- BRC-20 speculation is prevalent, will the new FT protocol Rune released by Ordinals founder bring a new trend?

- LianGuai Daily | HTX hot wallet was stolen about 8 million US dollars; US SEC opposes Celsius distributing tokens to customers through Coinbase

- Analyst Bitcoin ETF may be approved in early 2024.