Q3 Eight major hotspots review Ripple, L2, PYUSD

Q3 Ripple, L2, PYUSD reviewAuthor: SUSS NiFT Researcher @Jesse_meta

Even though the financial market is sluggish, we still see exciting industry progress and new applications.

The market was relatively weak in the third quarter, experiencing a brief pullback after a period of low volatility. This was expected as the third quarter has historically performed poorly. Only through a deep cleanse can chips be concentrated in the hands of diamond hands with faith. Even though the financial market is sluggish, we still see exciting industry progress and new applications. Let’s review the eight major highlights of Q3 together.

Ripple —— A Phase Victory in the Cryptocurrency Market

On July 13th, the US Southern District Court of New York ruled on the SEC’s charges against Ripple, stating that XRP, as a digital token, does not meet the “contract, transaction, or plan” requirements of the Howey Test, meaning XRP is not a security. Using XRP for investment, funding, transfers to executives, or sales on exchange order books are not considered securities. However, securities include institutional sales, OTC, ICOs, and IEOs.

- 2024 Bitcoin Price Prediction Insights from Major Banks and Hedge Funds

- A record of the closure of a rural bank Is encryption beginning to ‘butcher’ the banking industry?

- Interview with Lily Liu, Chair of Solana Foundation Entering the Asia-Pacific market at the right time, Solana may have new moves by the end of the year

If XRP, which is more centralized, is not considered a security, then more decentralized cryptocurrencies are even less likely to be securities. Influenced by this news, XRP surged by 90%, and BTC and ETH followed suit. SOL, MATIC, and other tokens previously deemed securities by the SEC also experienced significant gains. Coinbase subsequently relisted XRP. This represents a major victory for the cryptocurrency industry in the face of the SEC’s strong regulation in recent years. It temporarily clears the haze for the cryptocurrency industry and indirectly supports the legitimacy of token trading provided by cryptocurrency exchanges (previously, the SEC sued Binance and Coinbase for providing unregistered securities trading).

The SEC later applied to appeal the ruling. The battle between the SEC and Ripple continues. The lack of clear regulatory policies has always cast a shadow over the cryptocurrency market. Clear legislation is urgently needed to better protect investors. Industry practitioners should actively engage in dialogue with regulators to help them better understand the market and achieve win-win outcomes.

Layer 2 —— Not Enough ETH Tokens in Hand!

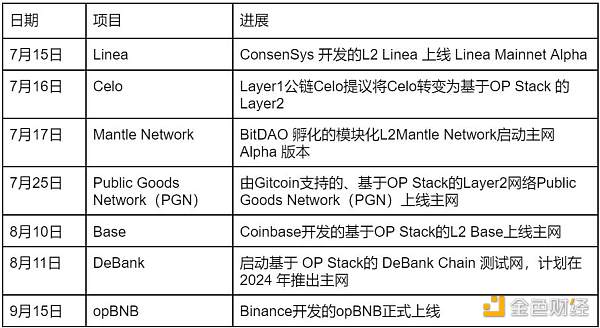

Ethereum’s Layer 2 networks are still in high demand and developing rapidly. Many L2 solutions have been launched, and even some competitors to L1, such as Celo, have joined the Ethereum L2 camp. Faced with the multitude of L2 solutions, airdrop hunters are saying that they don’t have enough ETH tokens in hand.

According to data from L2Beat, there are 31 L2 solutions listed, with 18 of them having a TVL (Total Value Locked) exceeding $10 million. Currently, Arbitrum ranks first with a TVL of $5 billion, occupying 54.31% of the market share, far ahead of Optimism with a TVL of $2.42 billion (25.31% market share). ZkSync Era, based on ZK Rollup, ranks third with a TVL of $428 million, but only captures 4.47% of the market share. This shows the obvious advantage of OP Rollup. However, this does not mean that OP Rollup will have better development prospects or will develop separately from ZK Rollup. Some projects, such as Polymer, are trying to combine the advantages of ZK and OP to provide new solutions. L2 solutions currently using OP Rollup may switch to ZK Rollup in the future.

Polygon co-founder Sandeep Nailwa said at TOKEN 2049 that today’s Ethereum is more like a chain-to-chain model for users, moving towards a chain-to-chain model. In the next 2-4 years, Ethereum will become the underlying settlement layer, providing security, settlement guarantees, and security features to these chains.

Worldcoin – The Savior of the AI Era?

On July 24th, Worldcoin released an open letter signed by co-founder Sam Altman of OpenAI, announcing the official launch of the WLD token, which was listed on major exchanges immediately.

Worldcoin is dedicated to creating a new identity system and financial network owned by everyone. It aims to increase new economic opportunities in the AI era and provide a solution to differentiate between AI and human identities. While protecting privacy, it explores a possible path to achieve a global basic income funded by AI by distributing tokens to verified unique human identities’ wallet addresses.

In the AI era, it is foreseeable that a large number of labor forces will become unemployed due to the improvement of productivity, and AI companies will gain a lot of profits. Worldcoin hopes to redistribute the profits of AI and provide a basic income to every verified unique human individual.

To achieve Worldcoin’s vision, unique identity verification for every individual must first be implemented to prevent fraud and duplicate applications. After considering government IDs, network trust, and other models, Worldcoin finally chose biometric technology based on iris scanning. Worldcoin uses a specialized device called Orb for iris scanning to detect whether the subject is a real person and ensures that only one real person can register an identity on Worldcoin. Orb uses a specially designed camera and algorithm to extract iris feature information, completes all processing on the local device, does not save user images, and only outputs signed iris codes. By decoupling zero-knowledge proofs from user wallets, user privacy leaks are avoided. As of September 15th, 2.298 million people have been verified on Worldcoin.

This is a very challenging and forward-looking project that has attracted widespread attention from the community. However, there are also criticisms. Vitalik has raised concerns about the project’s privacy, centralization, security, and accessibility. In addition, residents of economically underdeveloped countries have sold their irises at low prices, which goes against the intended results. In August, Kenya, one of the countries where Worldcoin was first launched, suspended registration in the country due to security, privacy, and financial issues.

Telegram Bots – Innovations and Speculation in Cryptocurrency Trading

Unibot is a trading bot on Telegram, and its token market value soared from around $30 million on July 7th to $2 billion on August 10th, attracting widespread attention from players in the cryptocurrency market.

Unibot allows users to interact with the bot, monitor liquidity pools, receive alerts for new token minting, trade tokens, and perform copy-trading operations. Unibot’s trading execution speed is six times faster than Uniswap. Token holders can receive 40% of the trading fees and a dividend of 1% of the total $UNIBOT trading volume. Unibot’s high-speed execution, innovative features, and robust income distribution model make it stand out among many competitors. Especially in the current phase of no new technological innovations and a sluggish mainstream market, some cryptocurrency users seek to trade altcoins or “meme” coins to make high profits, and Unibot conveniently provides services similar to centralized exchanges for these users.

These robots meet the needs of degen players, and with the success of Unibot, various types of trading robots have emerged in the market, such as LootBot, Bridge Bot, and MEVFree robot, to provide different crypto services. The security risks cannot be ignored. Importing private keys into robots can lead to asset theft.

According to CoinGecko data, Unibot’s token $UNIBOT surged 27 times at its peak, but only 27 days later, it plummeted 70.47% from its all-time high. Once again, it proves that the crypto market is filled with financial speculation while undergoing technological innovation.

Friend.tech —— Reinventing Web3 Social

Friend.tech is a new social app launched on Base on August 10th, where users can buy tokenized stocks of KOLs on Twitter to gain exclusive access to private group chats with these social celebrities.

In just the first week of its launch, the trading volume on Friend.tech exceeded 7,000 ETH, demonstrating its strong market appeal. By September 12th, more than 210,000 users have completed 3.734 million transactions on the platform. This rapid growth is not only due to its close collaboration with crypto Twitter KOLs but also thanks to its unique Progressive Web Application (PWA). Users can experience it directly in the browser without the need for downloads, making it easy for newcomers who are unfamiliar with crypto currency to use.

The innovative point of Friend Tech lies in using tokens as ownership when interacting with crypto enthusiasts. Owning tokens is equivalent to holding shares of specific companies. An increase in token holders on Friend.tech leads to token price increases. Trading tokens requires an additional 10% transaction fee, with 5% going to the protocol and 5% to the creator. In just one week, the total income of creators reached $13.25 million. On August 19th, Friend.tech announced an exclusive $100 million financing from LianGuairadigm, introducing a points system to incentivize user participation.

Although user growth has slowed down, Friend.tech is still in the beta testing phase, and the launch of new features is expected to further stimulate user growth. In addition, subscription-based content platforms have proven their commercial value by involving fans in creator economies. However, the sustainability of fan token growth requires specific case-by-case analysis.

On August 21st, it was revealed that Friend.tech’s API could directly query user wallets and Twitter information, resulting in the leakage of over 100,000 user data. Privacy issues still need improvement. In addition, tokenized stocks may attract SEC investigations.

PYUSD —— Web2 Financial Payment Company Joins Stablecoin Battle

Stablecoins are important tools for cryptocurrency investors to preserve value and are an important part of the DeFi ecosystem. In addition to Tether and Circle, which are based on fiat currencies and have a first-mover advantage, native DeFi protocols such as MakerDAO, Aave, and Curve compete for market share by minting decentralized stablecoins with over-collateralized cryptocurrencies. After giving up BUSD, Binance started supporting stablecoin FDUSD issued by a Hong Kong trust company.

The companies and protocols that issue stablecoins can enjoy interest income from underlying assets or the minting process. The current risk-free short-term US Treasury bond yield is as high as 5%, which has also attracted LianGuaiyLianGuail to announce its entry into stablecoin issuance on August 7, becoming the first major financial company in the United States to issue its own stablecoin.

LianGuaiyLianGuail uses LianGuaixos as its issuer, and the underlying assets are fully supported by US dollar deposits, short-term US Treasury bonds, and similar cash equivalents. Therefore, PYUSD can be considered a centralized USD stablecoin similar to USDT and USDC. However, unlike USDT, LianGuaiyLianGuail is available to US users.

As a veteran electronic payment company from Web2, LianGuaiyLianGuail has distribution channels that Web3 companies cannot match. Even though the on-chain use cases are initially limited, given its good reputation in the payment field, if LianGuaiyLianGuail takes measures to stimulate existing massive users to use PYUSD, or reduces merchant fees to encourage merchants to support PYUSD payments, PYUSD may quickly gain more users than the early adopters of stablecoins in the short term. On September 12, LianGuaiyLianGuail launched cryptocurrency-to-USD exchange services for US users, providing a secure cash-out option for cryptocurrency players. Therefore, we see that LianGuaiyLianGuail may promote further adoption of cryptocurrency and make stablecoins a daily payment method for people.

Considering the high pressure on DeFi policies and regulatory uncertainties surrounding stablecoins in the United States in recent years, the development of PYUSD still needs to be observed.

FTX Liquidation – Can the market withstand selling pressure?

On September 14, according to CoinDesk, a judge ruled that FTX can sell, pledge, and hedge the cryptocurrencies it holds to repay creditors. Currently, FTX has about $3.4 billion in A-class cryptocurrencies with good liquidity, including about $1.2 billion in SOL, $560 million in BTC, and $192 million in ETH. In addition, B-class assets such as SRM and MAPS are difficult to realize due to low liquidity.

In addition to cryptocurrencies, FTX also has about $4.5 billion in venture capital. Equity investments include $500 million in AI star company Anthropic and $1.1 billion in the important Bitcoin mining company Genesis. In addition to equity investments, FTX also cooperates with multiple funds for asset management and provides loans to fintech companies. Given the good fundamentals of some of FTX’s investment projects, there is a possibility of obtaining high valuation returns in the future.

According to Messari’s statistics on September 11, BTC and ETH held by FTX and Alameda account for about 1% of weekly trading volume, and are expected to have a small impact on the overall market. SOL and APT held by FTX account for 81% and 74% of weekly trading volume respectively, but these assets are currently in the unlocking period, which means there may be long-term selling pressure in the future. In addition, liquidation also has a certain degree of impact on TRX, DOGE, and MATIC, with FTX holdings accounting for 6% to 12% of weekly trading volume. It is rumored that FTX’s weekly liquidation limit is $100 million, and the possibility of liquidating a single currency in one week is small. The actual impact of liquidation on the market has already been priced in to some extent.

From the liquidation of assets on FTX, investors are once again reminded to pay attention to the liquidity of investment assets. While altcoins may have higher gains than mainstream assets such as Bitcoin during a rally, their liquidity should be closely monitored, otherwise it is just paper wealth. Decentralization is the value of Web3, and only with sufficient decentralization can it be more secure.

Snaps — MetaMask’s Self-Disruption

MetaMask wallet, which is almost essential for crypto players, undoubtedly plays a crucial role in the Ethereum ecosystem, providing users with the ability to access EVM chains through RPC. Some non-EVM chains such as Cosmos, Solana, Sui, Starknet, etc., are loved by users and developers for their unique technological advantages and ecosystem applications. However, when using these chains, users often need to use corresponding specialized wallets, which greatly affects the user experience.

To address this pain point, MetaMask has launched the Snaps API access specification, integrating wallets for non-EVM chains, allowing MetaMask users to experience non-EVM chains in their existing wallet and open up a new multi-chain world.

In addition to cross-chain interoperability, Snaps can also provide clear transaction insights, enabling users to understand potential security risks before interacting. This can greatly reduce the likelihood of phishing attacks when self-custodying. Snaps can also obtain specific information that needs to be known within the wallet, adding communication capabilities to the wallet.

Snaps is MetaMask’s self-disruption, transforming from an EVM wallet hegemon to a traffic entrance for multi-chain wallets and decentralized applications by integrating various wallets. Developers can unleash their imagination on MetaMask to extend its functionalities and create a brand new Web3 experience for users.

Although MetaMask has undergone self-audits and third-party audits, there are still inherent potential code risks in Web3. However, Snaps is currently only running in a sandbox testing environment and cannot access MetaMask account information, providing isolation for the original MetaMask assets.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Account abstraction implementation, the on-chain ecosystem will shift towards the buyer’s market.

- A Review of Eight Hot Events in the Cryptocurrency Market in Q3

- Variant联创 Li Jin The main obstacle to the mainstream adoption of cryptocurrencies is the issue of product-market fit.

- BRC-20 speculation is prevalent, will the new FT protocol Rune released by Ordinals founder bring a new trend?

- LianGuai Daily | HTX hot wallet was stolen about 8 million US dollars; US SEC opposes Celsius distributing tokens to customers through Coinbase

- Analyst Bitcoin ETF may be approved in early 2024.

- Bitcoin price faces risks? The golden cross of the US dollar strength index has been confirmed.