Analysis of Lybra Finance v2: Creating eUSD Use Cases, Attracting TVL, and Optimizing Tokenomics

Lybra Finance v2 analysis: eUSD use cases, TVL attraction, and tokenomics optimization.$LBR has been rising all the time. I sold it at around 0.1x. It has been 10 times higher than when I sold it, and it is around 1.8u when I write this. I think that it cannot rise so much without the team’s efforts in token price and product development. Regarding token price, the team did not use a high-emission model, but instead focused on long-term development, so the protocol’s TVL has been rising steadily. Regarding product development, the team has not stopped because of its achievements, and will soon launch v2 testnet in mid-June (after being audited and bug-bountied by Immunefi and code4rena).

Therefore, today I will share my personal insights into Lybra Finance v2.

There are several exciting contents in v2:

- Onion routing in the Lightning Network and how it works

- How to Participate in the zkSync Era Exploration Campaign?

- What Crypto applications are integrated into the Worldcoin App, which has 1.7 million users?

1. Full-chain expansion through LayerZero;

2. Adding more LST asset types;

3. New Tokenomics of LBR;

4. Reform of protocol revenue/fee capture;

5. DAO governance;

The first one is full-chain expansion. The first cross-chain target is Arbitrum. As far as I know, the team has started to discuss cooperation with protocols on Arbitrum. I guess Layer2 is the first choice for cross-chain, and eUSD may be cross-chained to other alt-layer1 in the future. The protocol will create a weUSD for cross-chain purposes. In fact, outside of cross-chain, weUSD scenarios will be more extensive, such as participation in other DeFi protocols, etc.

The second point is to add more LST asset types for collateral. The difficulty of this matter lies in the fact that stETH is automatically compounded, so eUSD is also automatically compounded. If other LST assets are introduced, how should the automatic compounding of eUSD be realized? I guess that if we return to unity, the automatic compounding function of eUSD will be cancelled-only by pledging eUSD can the user obtain ETH pledging APY. After pledging, users can get the weUSD version, which can be used for cross-chain or participation in other DeFi protocols. If users want to exit, they need to convert weUSD to eUSD to obtain principal + profit.

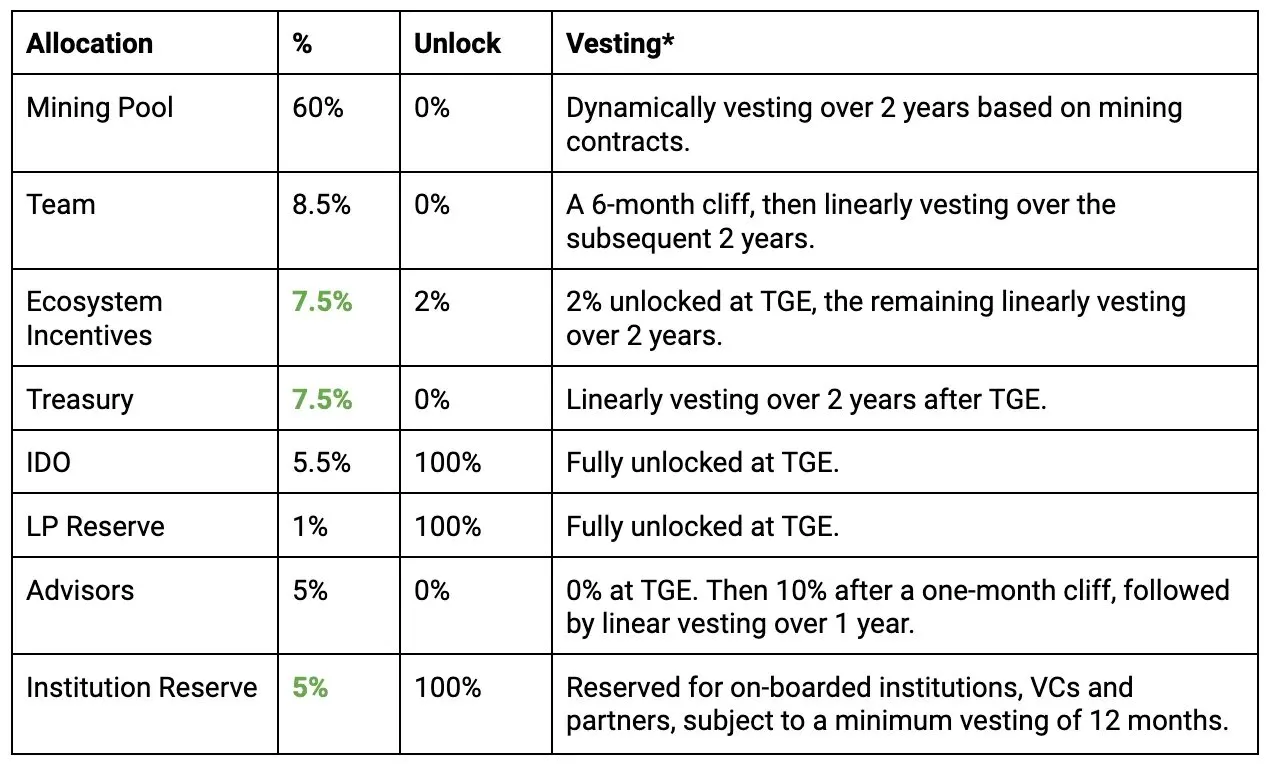

The third and fourth points, Lybra has introduced investors, and VCs have a lock-up period of at least 1 year. VCs will help Lybra develop markets and ecology. In addition, it introduces deflationary elements for $LBR and increases the ownership period of esLBR (increased to 60 days), and allows locking for longer periods of time.

To ensure the token price, protocol v2 also creates some scenarios for $LBR, such as introducing the Dynamic Liquidity Provision (DLP) mechanism. To mine $LBR from the eUSD pool, you need to provide DLP tokens with a minimum collateralized total value of 5%. Token deflation will be reflected in this scenario: if the 5% DLP is not reached, other users can buy these esLBR rewards with LBR at a 50% discount. After receiving the LBR, 10% is destroyed, and 90% is re-sent to the reward pool.

Fifth, DAO governance. After introducing esLBR into DAO governance, Lybra will allow the community to participate in the protocol’s decision-making power.

Another point worth noting is that Lybra is considering how to ensure that eUSD has sufficient liquidity and a more stable peg in the future. The main idea is to introduce eUSD into Curve. However, this needs to be done step by step, and the protocol needs to accumulate $CRV.

Overall, I am quite satisfied with the vision of Lybra v2. It is committed to solving its own protocol development problems (TVL and Tokenomics) and the problem of eUSD’s lack of application scenarios. Next, how to create sufficient liquidity and rich circulation scenarios for eUSD will be a crucial part of the protocol’s development.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Chainlink Engineer: How Oracles Connect Web2 and Web3

- What is Schnorr Signature?

- Evening Reading | Why won’t there be a bull market for 23 years?

- Proposal from Synthetix Founder: Opportunities I’ve Discovered and Synthetix’s Next Plans

- Complete Guide to On-chain Wallet Tracking: Practical Tools and Wallet Trackers

- Interpretation of Hong Kong’s “Virtual Asset Consultation Conclusion”: Can mainland retail investors enter the market?

- Discussion on ZK Mining and ZKR Performance