Comparison of NFT lending protocols: Will a price drop lead to a cascade of liquidations?

NFT Lending Protocol Comparison: Will a Price Drop Trigger Liquidations?Original Text: “Comparison of NFT lending protocol mechanisms: A drop does not equal a necessary liquidation”

Author: Loopy Lu

With the fermentation of the Azuki incident, the NFT community and industry are facing a test. Not only have major blue-chip NFT series experienced different degrees of decline, but many NFT lending platforms have also come under pressure.

The market is even more suspicious that as NFT prices continue to fall, will it trigger a chain of liquidations in lending, leading to a new round of spiraling trampling of NFT prices?

- Blur V2 is officially launched, what are the changes in the points incentive system?

- The Rise of Web3 Social

- Full text of South Korea’s first independent “Encryption Act”: Insider trading carries a maximum sentence of life imprisonment.

How prosperous is NFT lending?

With the development of NFTs, new projects in the entire NFTFi market are emerging one after another, and various protocols are constantly emerging.

How many NFT lending platforms are there? As a relatively “rigid demand” product in the NFT field, there are countless lending protocols. Alchemy alone has included 42 NFT lending products, but most of them are not popular and the data is difficult to obtain. This article does not use this list as the research object.

DeFiLlama’s data shows that 23 NFT lending protocols have been included in its statistics. As of the publication of this article, the total TVL of the 23 protocols has reached 189 million U.S. dollars.

From a data perspective alone, this number is quite impressive. If an unequal comparison using FT is used, the total TVL of 264 FT (homogeneous tokens) lending protocols is as high as 14.7 billion U.S. dollars, which is 77.7 times the TVL of NFT lending. The total market value of FT is about 1.2 trillion U.S. dollars, which is 200 times the total market value of NFT of 6 billion U.S. dollars.

Although there are numerous protocols, from the data, only a few protocols recognized by the market.

Among NFT lending products, 5 protocols have a TVL of more than 10 million U.S. dollars, and 4 protocols have a TVL between one million and ten million. The head protocol has obvious advantages, BlockingraSBlockingce and BendDAO BendDAO Bend is an NFT liquidity and lending protocol with responsive interest rates used for NFT securitization. Bend is bringing NFT pool lending into a rapidly growing market, providing a gateway for Web3 users to access DeFi. More The sum of the TVLs of the two platforms is about 91 million U.S. dollars, accounting for 48% of the total TVL of all NFT lending protocols.

Flexible, “Traditional” P2P Lending Injects Liquidity into Long-tail Assets

This May, the famous NFT trading platform Blur introduced an NFT lending protocol called Blend, which ushered in a new track in the NFT market. Similar to Blur, NFTfi and Arcade are NFT lending protocols that use a P2P model.

Take NFTfi as an example. This protocol is a P2P NFT lending protocol, which is currently the mainstream form of NFT lending.

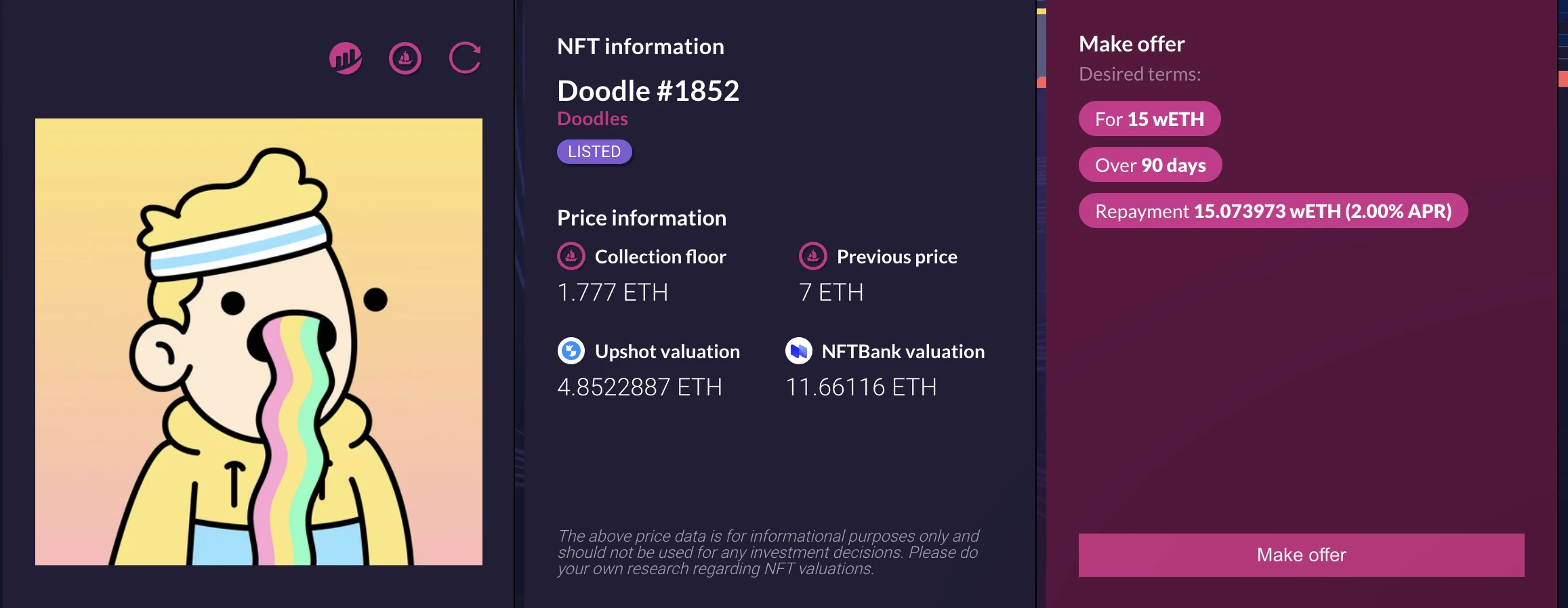

NFTfi lending page

Under this model, borrowers and lenders can be matched one-to-one on the platform, with a lender directly lending to a borrower.

The P2P model is closer to traditional collateralized loans, with the platform acting only as an intermediary.

Under the P2P model, all quotes and transactions are completed on the platform, and the collateral is held by the platform. If the borrower defaults, the platform will auction off their collateral. Since this model is closer to “one-on-one bargaining”, smooth transactions for such agreements depend on a large number of users and are more “semi-manual”. However, the advantage is that loan transactions are more diverse and more tolerant of long-tail assets.

But specifically, while they are all P2P lending, each has its own differences.

Specifically, NFTfi is closer to traditional loans. Lenders can set their own loan amounts, loan terms, interest rates, etc. If there is a default on the loan, the borrower’s NFT assets will be pledged to the lender, and the lender will have the opportunity to acquire the NFT at a price lower than its market value.

Arcade is also an old lending project. The predecessor of the project was Blockingwn.fi. Similar to NFTfi, the lender needs to initiate a loan request, set the loan category, loan amount, repayment period, and loan interest rate, and sign a binding transaction based on this. In addition, Arcade allows users to package multiple NFTs into a single NFT bundle and use the bundle as a single asset for collateral. It also has greater flexibility in lending agreements. At the end of June this year, a user lent $7,500 in debt tokenized as NFT, which was worth $31,307.81, using an NFT package as collateral.

BendDAO借贷市场

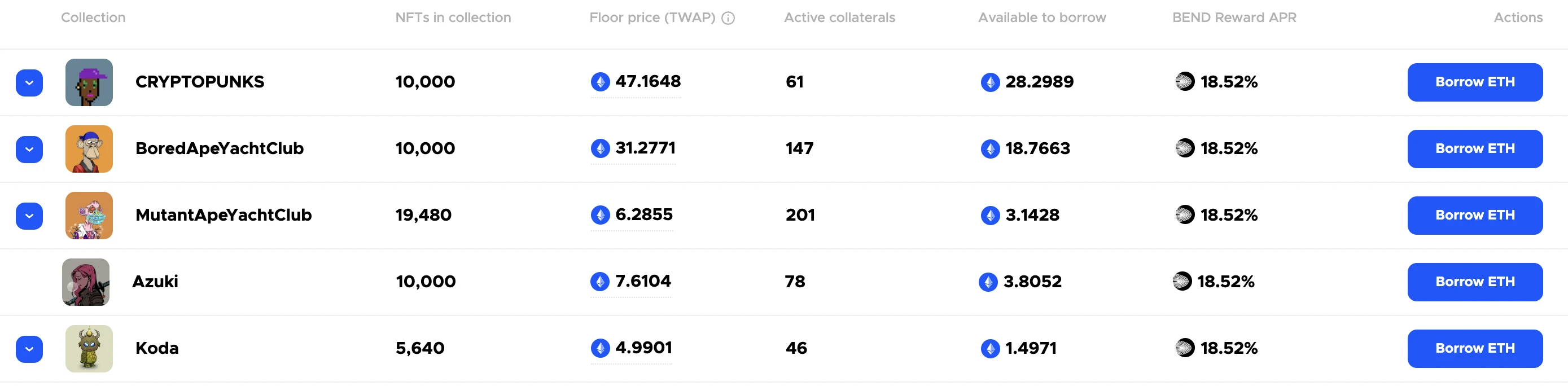

Similar to BlockingraSBlockingce, BendDAO allows users to borrow directly from the protocol, which then distributes loans to borrowers through a unified reserve pool.

One key difference between this model and P2P NFT lending is the importance of external oracles. Since these loans are not pre-arranged agreements between two parties, the debt default settlement mechanism is different from that of P2P platforms.

Additionally, after liquidation occurs, NFTs will flow to secondary markets through auctions rather than being transferred to the lending user. This difference makes this type of model more “automated,” but also poses the risk of NFT “spiraling downward.”

Both BendDAO and BlockingraSBlockingce use Chainlink oracles and OpenSea’s floor price as their price data.

JPEG’d is a unique NFT lending project among mainstream ones. The protocol does not follow the conventional model of storing NFTs and borrowing ETH. Instead, it imitates MakerDAO and allows users to deposit NFTs as collateral and borrow synthetic stablecoin PUSd. Users can provide liquidity and earn interest on the protocol using PUSd. This model is called NFDP (Non-fungible debt positions). Similar to other P2P lending platforms, JPEG’d uses Chainlink oracles for price feeds.

Liquidation triggers a spiral stampede?

Liquidation occurs when the collateral health is insufficient.

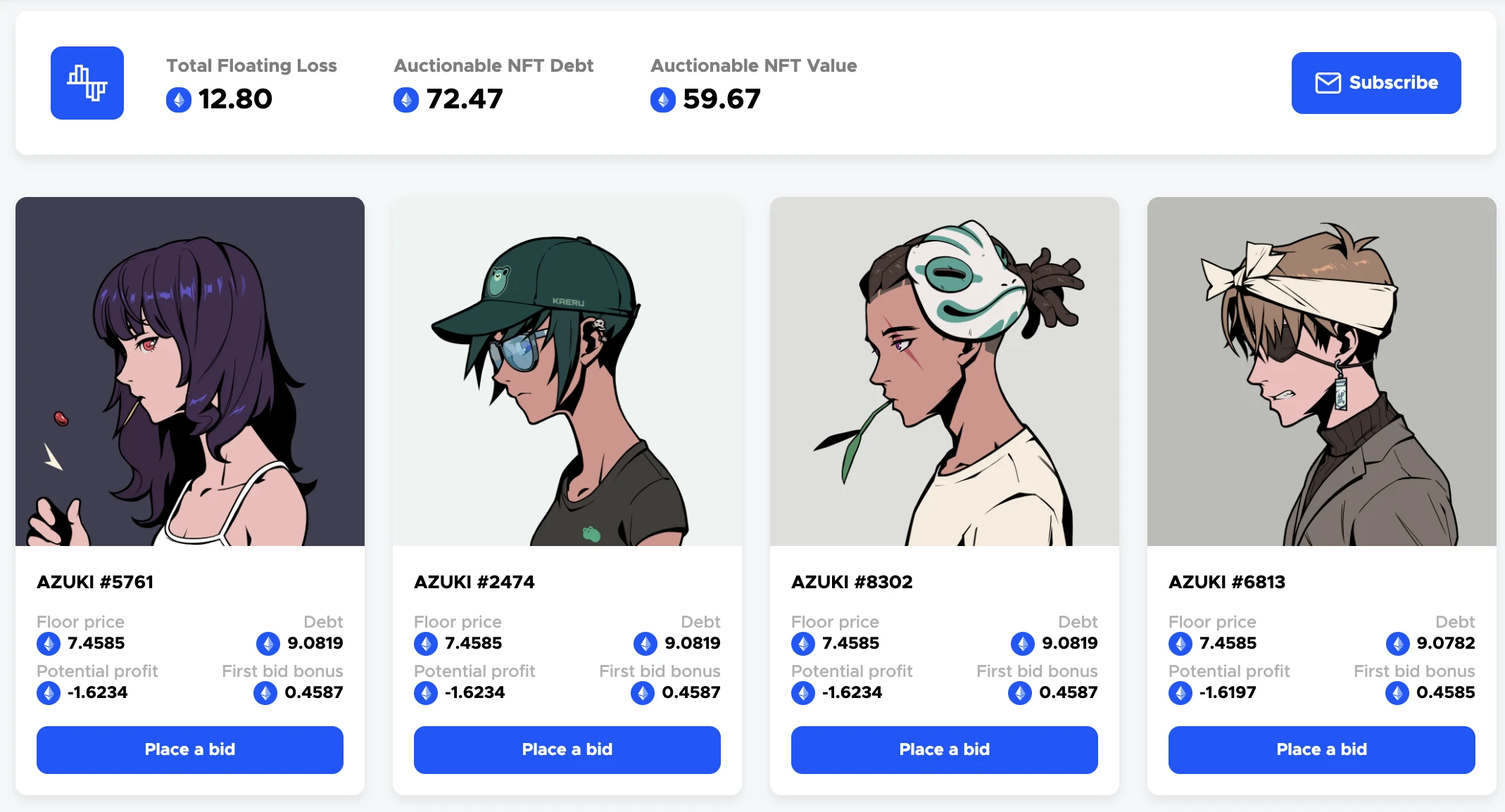

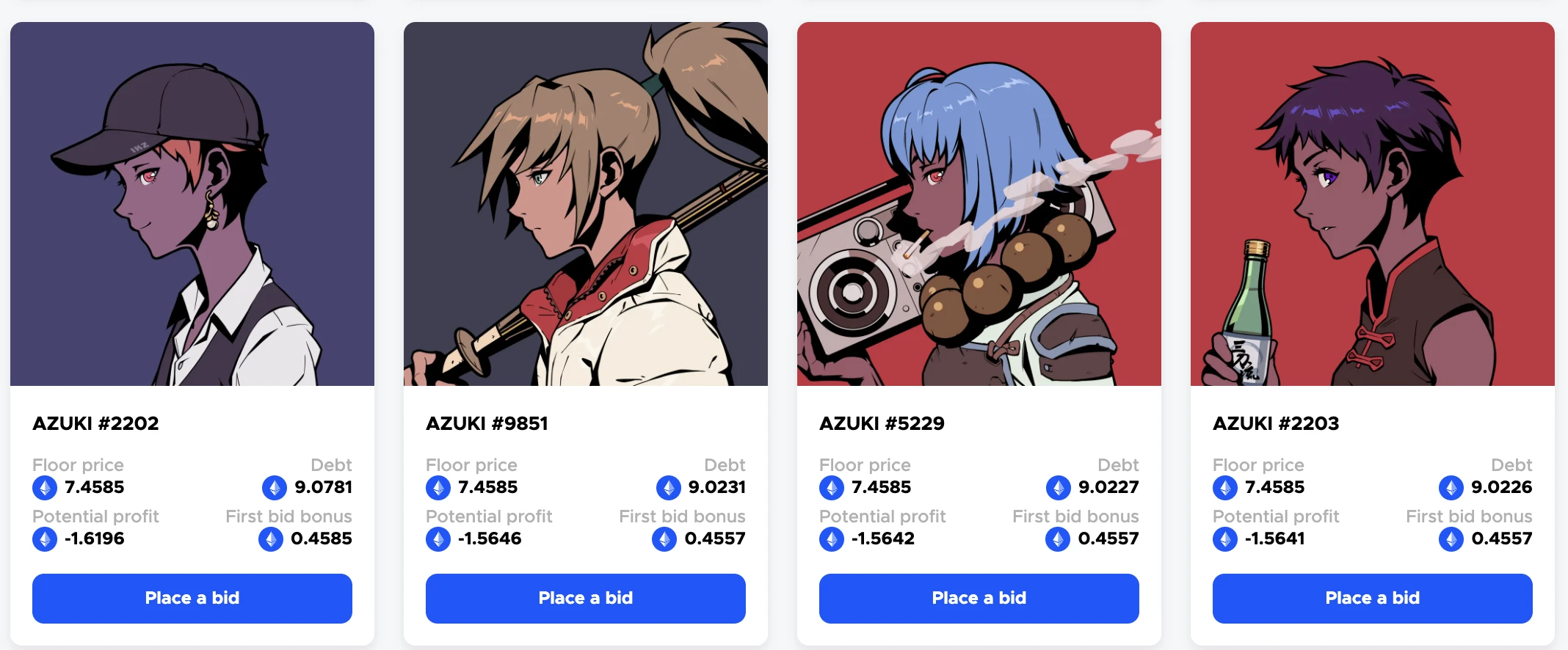

After the Azuki incident, the rapid decline in Azuki prices led to the floor prices of some NFTs falling below their debt values. For example, in BendDAO, a total of 8 Azukis have defaulted, and the collateral assets worth 59.67 ETH owe 72.47 ETH in debt.

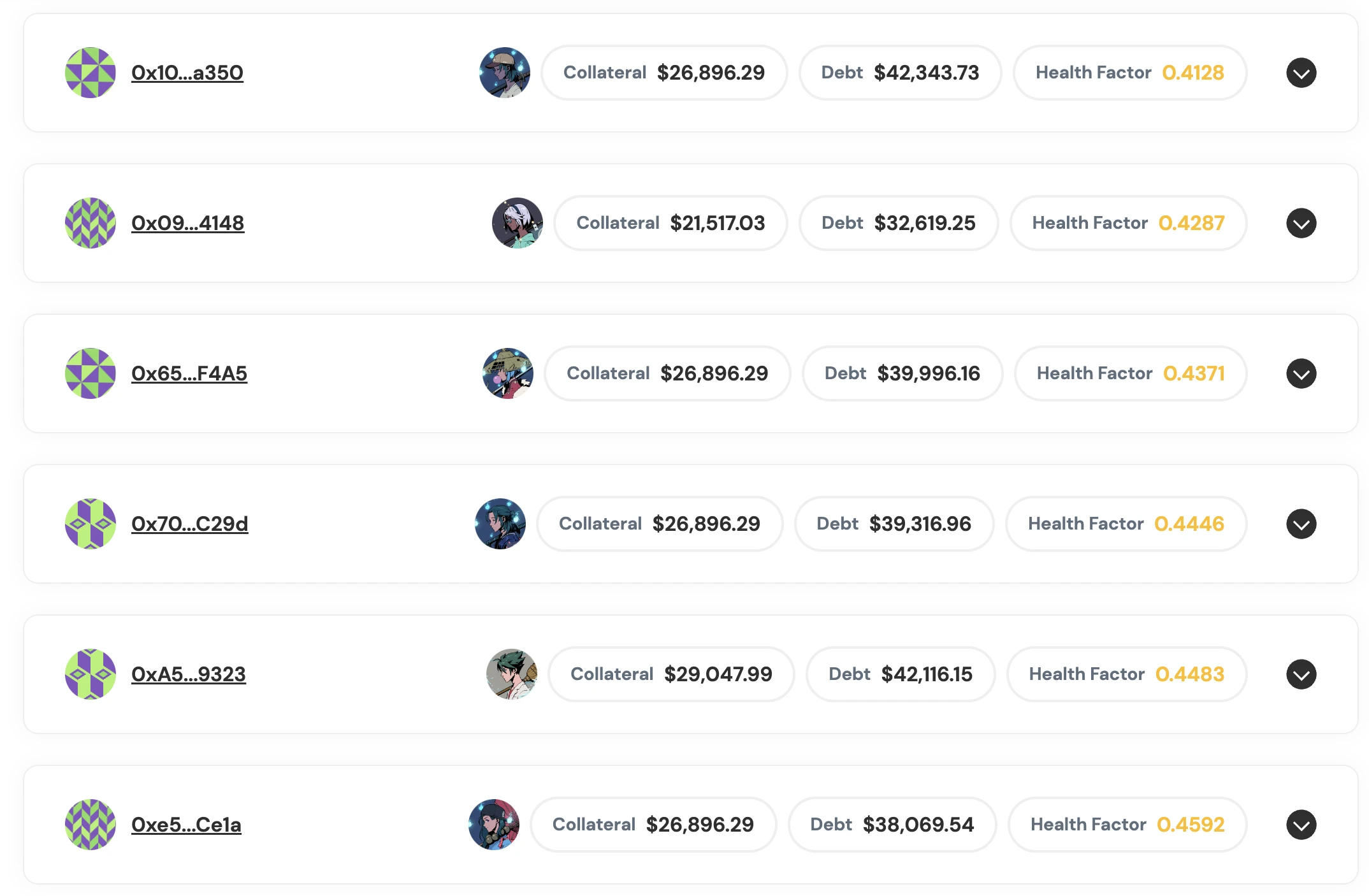

BlockingraSBlockingce has also experienced similar situations, with multiple loans on the platform having insufficient collateral to cover their debts.

Currently, 13 (out of a total of 14) Azuki loans have been suspended for liquidation, with a total collateral value of 359,900 yuan. The suspension of liquidation is intended to give users more time to supplement liquidity, repay loans, and improve health, and liquidation will resume later. Currently, these bad debts are worth about $100,000, and BlockingraSBlockingce says it has enough reserve funds to deal with unexpected situations, and its reserve funds are fully covered.

How terrifying can the downward spiral caused by liquidation be?

In April of this year, the withdrawal of BAYC whale Franklin caused much regret. Franklin Franklin FLy token is the native token of FLyECO. FLyECO includes FLy LaunchBlockingd for IDO projects, FLy transaction signals for manual and API trading, FLyDEX for traders, and solutions for FLy token holders, such as FLy Staking and FLy Farming. More BendDAO has been repeatedly used to allocate a large amount of BAYC in the case of leverage and market downturns. He once owned 61 BAYC, ranking sixth in the BAYC list. And his borrowing amount also reached an astonishing nearly 20,000 ETH. However, under a series of erroneous operations, Franklin finally moved towards a large loss and withdrew.

Currently, the NFT lending market is booming, bringing more liquidity and rich imagination space and usage scenarios to the market. However, as the financialization of NFT intensifies, various financial risks in the FT market will also be brewing in the NFT market. With the emergence of this round of significant market fluctuations, how many risks will there be in the future NFT market?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Has Web3 effectively solved the problems in Web2 marketing?

- First Impressions of Threads: Is this “Twitter Killer” any good?

- Meta launches Twitter competitor Threads:

- Review: “Twitter Killer” Threads officially launched. How does it perform?

- Dr. Lu Qi, the founder of MiraclePlus, says that AI and Web3 will create a new data-driven society.

- Interview with Justin Sun: Web3 Yu’ebao stUSDT, Tron’s Ambition to Connect DeFi and TradFi

- Custom Collateral Tokens? A Summary of GMX’s New V2 Version HighlightsGMX recently released its new V2 version