RWA Discussion: Underlying Assets, Business Structure, and Development Path

RWA Discussion: Assets, Business, and DevelopmentSource: Colin Lee

Since the beginning of the year, the discussion about real world assets (RWA) in the market has become more frequent, and some opinions believe that RWA will trigger the next bull market. Some entrepreneurs have also adjusted their direction to RWA-related tracks, hoping to accelerate business growth with the support of the gradually heating narrative.

RWA is the mapping of assets in the traditional market onto the chain in the form of tokens, which can be bought and sold by web3.0 users. RWA tokens have the right to income from assets. A few years ago, STOs mainly focused on corporate bond financing, and now the scope of RWA is broader: not limited to the primary market of traditional assets, any assets circulating in the primary and secondary markets can be mapped onto the chain through tokenization, allowing web3.0 users to participate in investment. Therefore, the narrative of RWA contains a rich variety of asset types, and the range of covered yields is also relatively wide.

RWA has gradually attracted market attention, which may be due to several reasons: first, the current crypto market lacks low-risk U-based assets, and under the trend of interest rate hikes in the traditional financial market, the risk-free interest rates of major economies have risen to 4% or even higher, which is attractive enough for investors in the native crypto market. Corresponding to this phenomenon is that during the bull market period of 2020-2021, many traditional funds also entered the crypto market and earned low-risk returns through arbitrage and other strategies. Introducing low-risk and high-yield products from the traditional market through RWA may be welcomed by some investors; secondly, the crypto market is not currently in a bull market, and even in the native crypto market, there is a lack of sufficient narratives. RWA is one of the few tracks with solid income support that may achieve explosive business growth; finally, RWA is one of the bridges connecting the traditional market and the crypto market. Through RWA, there is also an opportunity to attract incremental users from the traditional market, inject new liquidity, which is undoubtedly a positive development for the blockchain industry.

- Understanding ERC-6551: Has the composability of NFTs finally been achieved?

- How will the Pendle War unfold?

- OPNX bond trading is being questioned as a “false transaction” gimmick. Can Su Zhu fulfill his wish to open an exchange to pay off debts?

However, from some RWA projects currently seen, their business indicators such as TVL have not grown rapidly, and the market may have overestimated the short-term expectations for RWA. For an RWA project, the following issues need to be considered from several dimensions:

-

Underlying assets. This is the most core issue in the RWA track. Choosing suitable underlying assets is of great help for subsequent management.

-

Standardization of underlying assets. Due to the different “heterogeneity” of different underlying assets, the difficulty of standardizing underlying assets is also different. The stronger the heterogeneity of the assets, the higher the standardization requirements and the more complex the process.

-

Off-chain collaborative institutions and forms of collaboration. High-quality off-chain collaborative institutions can not only perform their obligations smoothly but also fully release the value of underlying assets.

-

Risk management. The maintenance of underlying assets, the on-chain of assets, the distribution of income, and other links all involve risk management. If it is a debt-type asset, it also involves risk management of asset liquidation and collection after the debtor defaults.

I. Underlying assets

Underlying assets are the most core elements.

At present, the RWA track’s underlying assets are mainly divided into the following categories:

-

Bond-type assets, mainly short-term US Treasury bonds or bond ETFs. Typical representatives include stablecoins USDT and USDC. Some lending projects, such as Aave and Maple Finance, have also joined this camp. Treasury bonds/Treasury ETFs are the largest proportion of RWA;

-

Gold, the typical representative being BlockingX Gold. Still under the narrative of “stablecoins”, but the development is slow, and market demand is weak;

-

Real estate RWA, typical representatives being RealT, LABS Group, etc. Similar to packaging real estate into REITs and then putting them on the chain. This type of project has a wide range of real estate sources, and the project team will often choose their own city as the main source of assets;

-

Loan-type assets. Typical types include USDT, Polytrade, etc. The types of assets are relatively wide-ranging, including personal housing mortgage loans, corporate loans, structured financing tools, car mortgage loans, etc.;

-

Equity-type assets, typical projects include Backed Finance, Sologenic, etc. The trading of such assets seeks to be real, but is greatly restricted by legal and other issues. An important development direction for the cryptonative “synthetic assets” is already listed and circulating stocks, which highly overlap with this field;

-

Others, including farms, artworks, and other types of assets with large scale (large individual asset amounts) but low standardization.

In summary, for risk management of underlying assets, the most basic is to ensure that the underlying assets are real and effective during the project’s existence, followed by ensuring that the value of the underlying assets will not be lost due to human factors. Third, it should also ensure that the underlying assets can be realized at a fair market price, and finally should ensure that the income and principal can be safely and smoothly delivered to investors. This type of risk has a relatively high degree of overlap with the attributes of traditional assets, and there are risk management measures that can be referred to.

2. Chain-related risk management. Because it involves data on the chain, if the off-chain institution has not received sufficient management, there may be a situation of false reporting of data. Similar negative cases often occur in the traditional finance field. For example, in the fields of commercial bills, supply quantity finance, bulk commodities, etc., there have been huge falsification behaviors. Even with real-time monitoring through sensors, fixed delivery locations and other methods, it is still impossible to avoid risks 100%.

For the RWA industry, which is still in its infancy, the author believes that similar situations will also occur, and the cost of illegal acts is too low. The risk of data fraud on the chain cannot be underestimated.

3. Cooperation risk management. This type of risk still tends to be traditional, but the problem is that there are currently no regulations for RWA supervision. For example, in the custody link, what kind of custody agency is compliant? In the audit link, can the current accounting and financial standards accurately and completely reflect the characteristics of RWA? In the process of project operation, if risk events occur, what kind of risk disposal methods and processes can better protect investors? There is still no very accurate answer to these questions. Therefore, cooperation parties still have the opportunity to do evil.

Four, current user structure and user needs

As mentioned in the previous “Outlook for the “Native Bond Market” in the Cryptographic World”, due to the extreme volatility and cyclicity of the cryptographic market, relatively low-risk and risk-averse conservative investors difficult to obtain sustained and stable returns in the market. In such a market, a large number of users also show extremely strong risk preferences:

In the survey report released by teams such as dex.blue in 2020, half of the surveyed cryptographic market users invested 50% or more of their entire savings in the cryptographic market; Pew Research and Binance In the survey report released by it, it also mentioned that young people currently account for a relatively high proportion of users in the cryptographic market. In this market structure, the risk appetite of cryptographic market investors will be higher than that of traditional market investors.

If such a situation arises, some practitioners in the traditional financial industry will be more confident in putting assets on the chain: the advantage is that the assets are local, but can absorb global liquidity. This idea has been recognized by some RWA project entrepreneurs: although they are limited by geographical factors, with blockchain, they can attract global investors. For these practitioners, the asset on-chain under regulation will bring two benefits: 1. With the touch of global liquidity, the fund side will not be affected by geographical factors, which may merge into cheaper money; 2. Because it may find investors with lower yield requirements than the local, the project’s range of choices will increase.

At the same time, regulatory measures on the user side are also advancing: KYC. Cryptographic native projects only need wallets to access, but some start-up projects financed in the primary market already require KYC assistance to determine whether users are qualified investors. Some projects that introduce RWA, such as Maple Finance, also regard KYC as an indispensable process in the process of acquiring customers. If KYC processes are gradually implemented in more new projects, then a more clear regulatory and KYC coexisting blockchain industry may bring an additional benefit: more ordinary investors can enter the market with confidence.

This type of user’s risk preference is more inclined to familiar assets, and there is also a certain interest in emerging cryptographic native assets. At this time, RWA can serve as an important investment direction for this more ordinary type of investor.

VI. Possible Development Path of RWA

In the short term, RWA brings three benefits to investors in the crypto industry:

1. Low-risk investment targets denominated in fiat currency: the risk-free interest rates of major economies, led by the United States, have reached a level of more than 3%, which is significantly higher than the borrowing rates of various U-based lending agreements in the crypto market. Without cycling leverage, it brings extremely low-risk investment opportunities to investors. Currently, projects such as Ondo Finance, Maple Finance, and MakerDAO have launched investment projects based on US Treasury bond yields, which are extremely attractive to investors denominated in fiat currency. In this track, there may be a “Yu’ebao” project in the crypto market.

Source: https://fred.stlouisfed.org/series/FEDFUNDS

Source: https://fred.stlouisfed.org/series/FEDFUNDS

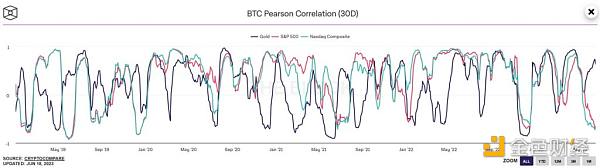

2. Asset risk diversification: Taking Bitcoin as an example, the correlation with gold and US stocks fluctuates to different degrees in different market stages.

Source: https://www.theblock.co/data/crypto-markets/prices/btc-pearson-correlation-30d

Source: https://www.theblock.co/data/crypto-markets/prices/btc-pearson-correlation-30d

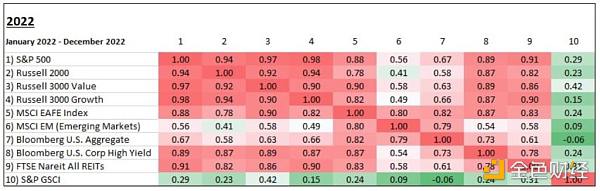

Even in the macro-factor-driven year after 2020, different asset classes still have a certain degree of diversification advantage.

Source: https://www.swanglobalinvestments.com/the-correlation-conundrum/

Source: https://www.swanglobalinvestments.com/the-correlation-conundrum/

For allocation-oriented investors, mixing native crypto assets with various types of RWA can achieve a greater degree of asset risk diversification.

3. A means for investors in developing countries to hedge against currency fluctuations: In some developing countries, such as Argentina and Turkey, inflation is at a relatively high level all year round. RWA can help investors in these regions hedge against currency fluctuations to a certain extent and achieve global asset allocation.

From the above three dimensions, in the short and medium term, RWA that can be widely accepted is more likely to be the main economic sovereign bond RWA with high returns and low risks caused by interest rate hikes.

In the long run, as the regulatory framework becomes more clear and more mainstream investors gradually enter the crypto market and the operation of the crypto industry becomes more convenient, RWA has the opportunity to replicate the boom of China’s Internet finance ten years ago:

1. Blockchain-based RWA assets provide unprecedented “accessibility” for global retail investors: RWA, as the most familiar asset to retail investors, may become the main chain investment target of non-Web3 natives. For them, the borderless property and permissionless access and operation of on-chain assets have opened the door for them to invest and use more widely global assets. Conversely, for entrepreneurs in the field, this also provides them with unprecedented user breadth, scale, and extremely low customer acquisition costs. The rapid development and widespread use of USDT and USDC as “on-chain dollars” have preliminarily verified this trend.

2. RWA assets may lead to new DeFi business models: LSD as a new underlying asset has stimulated the rapid development of LSD-Fi. Among them, in addition to the previously existing business models such as asset management, spot trading, stablecoins, etc. being revalued, there are also directions that were previously overlooked, such as fluctuations in yields. If RWA becomes an important type of underlying asset, the introduction of new and large off-chain income may give birth to new DeFi business models. In the future, RWA can also form hybrid assets with encrypted native assets and strategy portfolios, allowing more users who are willing to explore encrypted native assets to understand them through more familiar ways. From this perspective, the next high TVL RWA+DeFi project may be the “on-chain Yu’ebao”.

3. The game between the industry and regulation will eventually have an answer, and practitioners can seek methods for compliant customer acquisition: Whether in Western countries or in Hong Kong in the East, supervision is gradually being implemented. If the cryptocurrency industry grows to a size of $10 trillion in the future, regulations will not sit idly by. As regulatory policies gradually become clear, we can see that in some regions, businesses that were previously impossible to implement can now be launched. In Hong Kong, stablecoins can now be issued through compliant channels, and in the Middle East, the blockchain industry is exploring ways to integrate with traditional industries.

In the long run, one of the important factors for the thriving development of the cryptocurrency industry is sufficient liquidity. As regulations are implemented, RWA, led by fiat-backed stablecoins, is bound to grow rapidly. Especially in the next round of global liquidity stimulus, if new players entering the market can have strong support in ecology and channels, compliant fiat-backed stablecoins may be able to replicate the road of USDT’s high growth.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Founder’s Complaint: What Has Moonbirds Done This Year to Make People Disheartened?

- Global Coin Research: How to create a sustainable Web3 game economy model

- Canadian woman creates a metaverse law firm and plans to profit from renting out metaverse properties.

- Gemini co-founder angrily accuses DCG founder: “Scammer, return the money quickly, or we will officially sue DCG and individual.”

- DWeb Camp Experience and Impressions

- Binance Launchpool will list Pendle

- How to initiate the NFT era with ERC-6551?