Number of exchange liquidity: the strength of the three major domestic exchanges close to Binance's abnormal trading volume

Analyst | Carol Editor | Tong Tong

Source | PANews

As one of the few sustainable profitable businesses in the industry, the war between exchanges has never slowed down, but is extremely fierce. Exchanges want to stand out among thousands of well-known or unknown exchanges, not only need differentiated asset strategies, listing strategies, marketing strategies, but sometimes they also need bosses to fight each other "shoulderless." However, changes are inseparable, competition will eventually return to the essence, and the fundamental support for the sustainable development of an exchange is still the liquidity it can provide.

- Viewpoint: 2020 is the year of the blockchain transition. The prospects of supply chain finance and digital asset governance are promising.

- Ethereum's implementation of the hard fork on January 1 will accelerate the block time, and ETH inflation may rise by more than 20%

- Long Baitao | Digital Asset Research Institute Digital Currency Weekly (2019/12/22)

How is the liquidity of each exchange? Which exchanges have the best liquidity of investment assets? Are there any abnormal performance of the exchanges in the near future? To this end, PAData has selected 6 well-known exchanges at home and abroad, Huobi Global, OKEx, Binance, Bitfinex , Bittrex and Poloniex, by analyzing the data performance of their asset structure, number of listings, daily trading volume, market spreads, trading depth and trading volume and other dimensions, to observe the status of the exchange's liquidity.

1.Huobi has the richest list of currencies, and Binance has the most trading pairs.

The number of tradable digital currencies in the exchange, the number of trading pairs opened, inter-currency liquidity (the average number of trading pairs corresponding to each digital currency), and the composition of asset classes are macro indicators that measure the liquidity of the exchange. It is generally believed that the more types of tradable digital currencies, the greater the number of trading pairs, the higher the liquidity between currencies, the wider the asset class coverage, and the better the macro liquidity of the exchange.

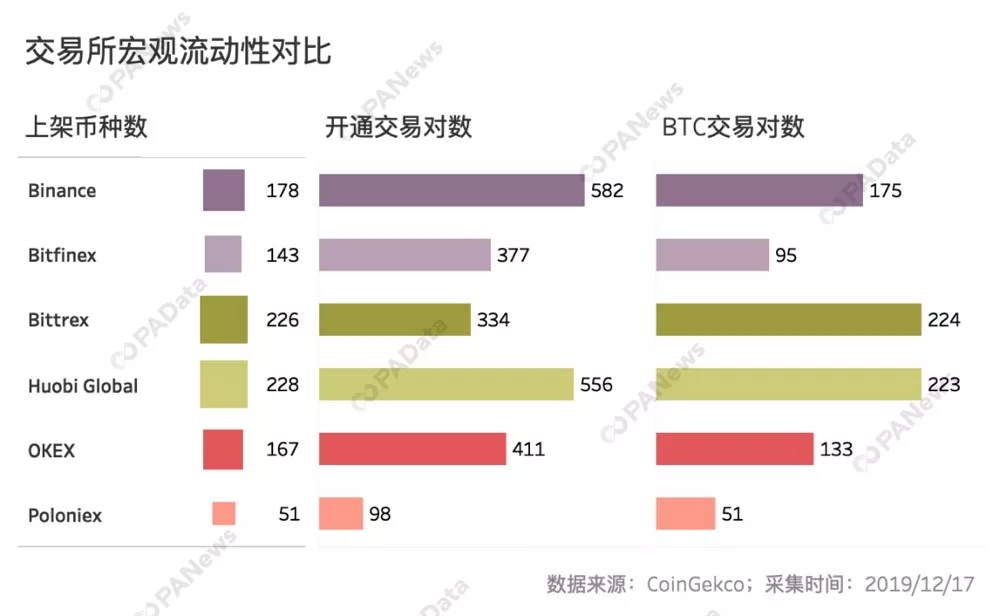

According to CoinGekco data, as of December 17, the exchange with the largest number of digital assets among the six exchanges was Huobi Global , with a total of 228 digital currencies listed, followed by Bittrex, with a total of 226 digital currencies listed, the least number of It is Poloniex, only 51 species.

Binance is the exchange with the largest number of trading pairs . A total of 582 trading pairs have been opened, of which 175 are related to BTC, accounting for 30.07%. Huobi Global is followed by a total of 556 trading pairs, of which 223 are related to BTC, accounting for 40.11%. The lowest number of trading pairs opened is Poloniex, with only 98 trading pairs, of which 51 are related to BTC, accounting for about 52.04%.

Judging from the number of listed currencies and the number of open trading pairs, Huobi Global, Binance, and OKEx, the three well-known domestic exchanges, generally perform better than Bitfinex, Bittrex, and Poloniex, which mainly serve foreign users.

The macro liquidity of Huobi Global, Binance and OKEx also showed preliminary currency differences. BTC has better macro liquidity in Huobi Global, and non-BTC assets in Binance and OKEx have better macro liquidity.

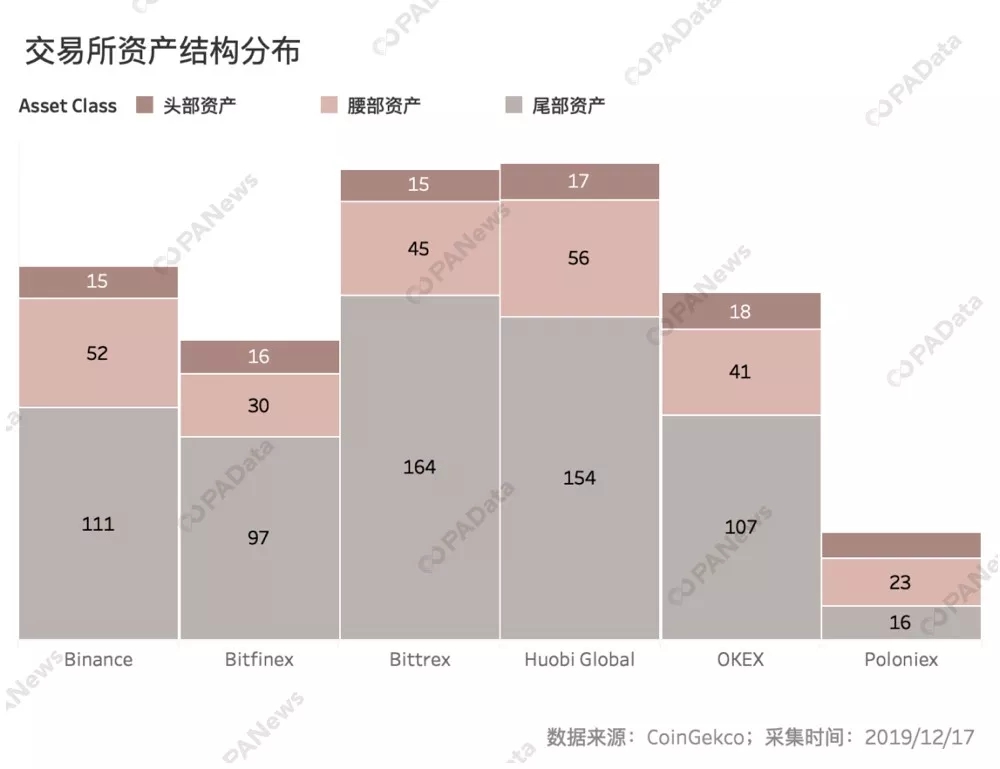

According to the "Eight and Eight Rule", PAData divides assets into head assets, waist assets and tail assets according to their market value rankings. Among them, the top 20 digital currencies with market capitalization are head assets, the digital currencies with 21 to 100 market capitalizations are waist assets, and the digital currencies with 100 or more market capitalizations are tail assets.

From the perspective of the coverage of various assets, OKEx is the exchange that covers the most head assets. A total of 18 head assets have been listed, accounting for 90% of head assets. Huobi Global followed, covering 17 head assets, accounting for 85% of head assets.

At the same time, Huobi is still the exchange with the widest range of waist assets. A total of 56 types of waist assets have been listed, accounting for 70% of waist assets, followed by Binance, which covers 52 types of waist assets, accounting for 65% of waist assets. Bittrex is the exchange that covers the most tail assets, with a total of 164 tail assets listed, followed by Huobi Global, with 154 tail assets listed. From the perspective of the coverage of various assets, Huobi Global has the broadest comprehensive coverage.

2. The trading volume of the three major domestic exchanges is very different

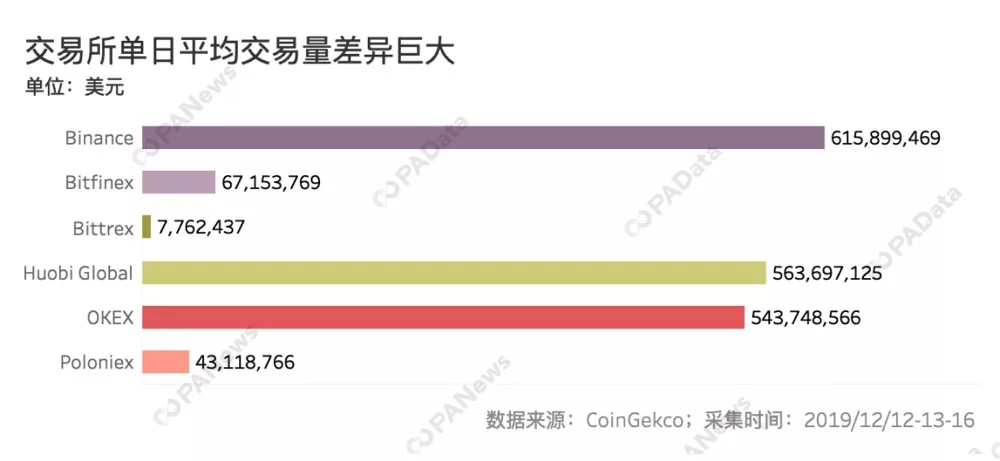

PAData tracked the transaction data on CoinGekco on December 12, December 13, and December 16 in order to more accurately observe the actual liquidity of the exchange from the daily average. But it must be stated that this can still only observe the liquidity situation of the exchange from a short-term static cross section.

According to statistics, the average daily trading volume of the six exchanges varies greatly. The average daily trading volume of the three major domestic exchanges, Binance, Huobi Global and OKEx, is much larger than Bitfinex, Bittrex and Poloniex. Among them, Binance, which has the largest average daily trading volume, reached about $ 616 million, which is more than 9 times that of Bitfinex. Secondly, the average daily trading volume of Huobi Global and OKEx are also very high, reaching approximately US $ 564 million and US $ 544 million, respectively. Bittrex, which has the lowest average daily trading volume, is only $ 7.6624 million.

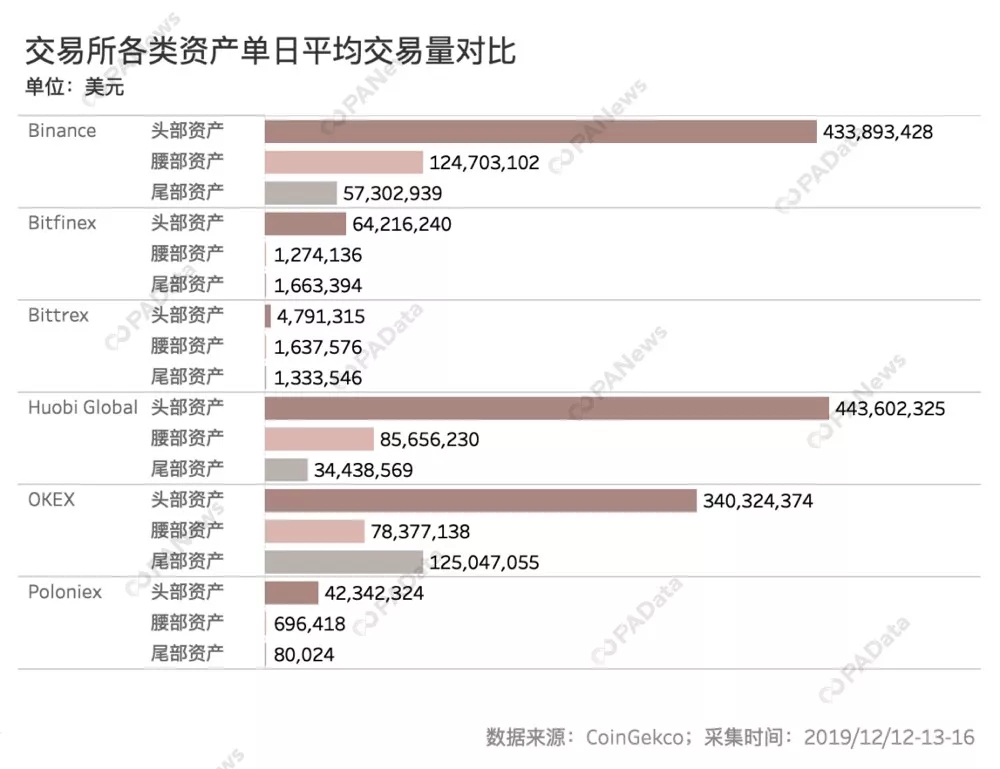

From the comparison of the daily average transaction volume of various types of assets of various exchanges, all exchanges have the highest transaction volume of head assets, and the "two-eight effect" is very obvious, and the trading performance of the three major domestic asset classes has Significant differences.

It is worth noting that although Huobi Global's daily average total transaction volume is not as high as Binance, Huobi Global's average daily transaction volume of head assets is about 10 million US dollars higher than Binance, reaching about 444 million US dollars, accounting for Huobi Global The average total transaction amount of 78.72% indicates that Huobi Global is known for its head assets.

The liquidity of the head assets is a direct sign of the liquidity of the exchange . This is because, on the one hand, with the gradual development of the industry and the gradual clarity of supervision, the survival space of small currencies has become very narrow. The head assets represented by Bitcoin are leading the market, and the 28th effect has intensified, so the liquidity of the head assets basically directly reflects the quality of the exchange's liquidity. On the other hand, due to the high market value of the head assets and the large plate, the cost of the transaction volume is relatively higher, so the transaction volume of the head assets is more real, that is, the head assets can more accurately reflect the liquidity of the exchange.

Binance's waist assets have the highest average daily trading volume of all exchanges, reaching about 125 million US dollars, accounting for 20.29% of Binance's average daily total transaction volume.

In addition, unlike other exchanges , which have the smallest proportion of tail asset trading volume, OKEx's tail asset trading volume is higher than waist assets, and the average daily transaction value of each tail asset is about 125 million US dollars, accounting for OKEx days. The average total transaction amount is 22.98%.

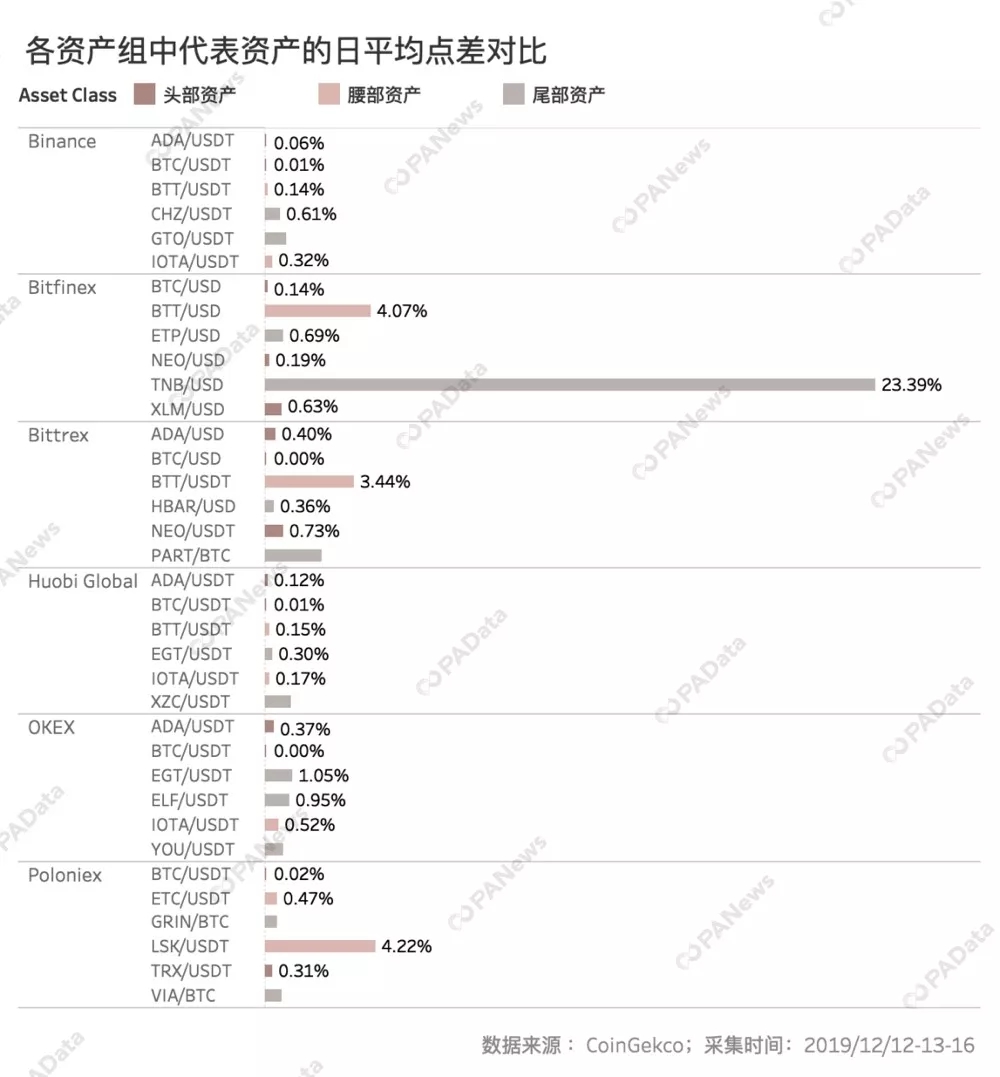

In order to further observe the performance of each asset class of each exchange, PAData sampled two types of assets in each group of asset classes [1], and selected the mainstream trading pair of the asset (the trading pair with USDT / USD / BTC) as the Perform analysis on behalf of assets.

According to statistics, the BTC trading pair in the head assets contributed the largest trading share. Among them, on Binance, the average daily transaction value of the BTC / USDT trading pair is about 234 million US dollars, and the total transaction amount in the head assets is higher. On Huobi Global, the average daily trading volume of the BTC / USDT trading pair is approximately $ 169 million. This means that BTC occupies half of the head assets on Binance, but Huobi Global's head assets are more evenly distributed, and other head assets besides BTC also have a larger trading volume.

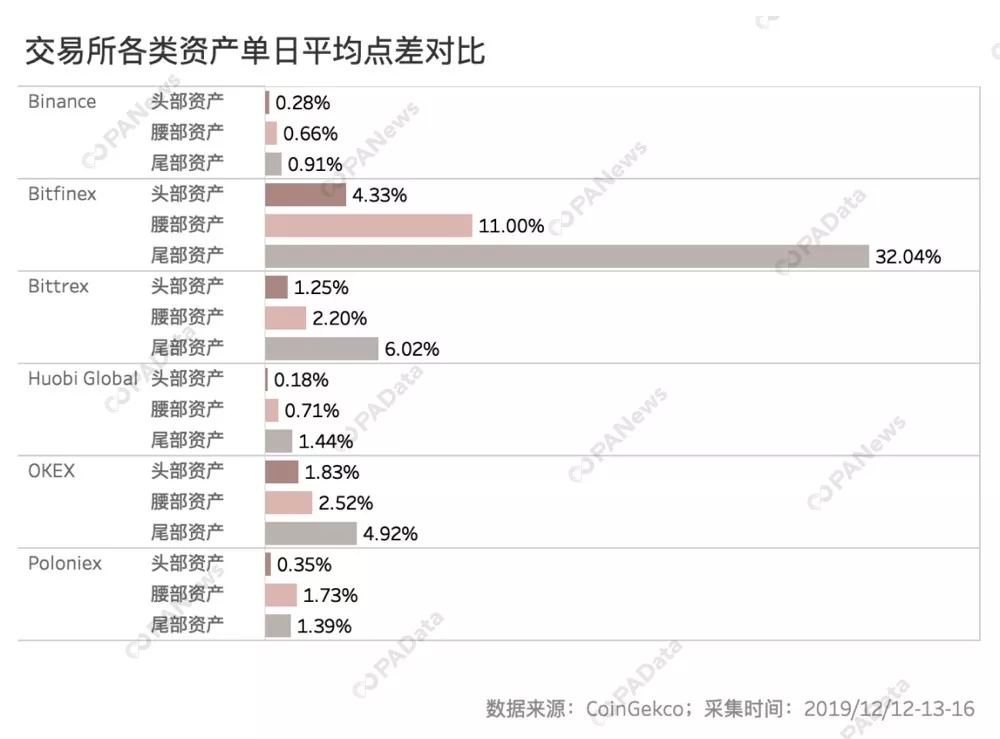

Spread is another important indicator for measuring liquidity. The smaller the spread, the higher the matching may be, the lower the transaction cost, and the better the liquidity. More importantly, spreads are harder to counterfeit than transaction volumes, so this is a reliable indicator of liquidity. According to statistics, among the head assets, the exchange with the smallest daily average spread is Huobi Global, with only 0.18%, followed by Binance and Poloniex, with 0.28% and 0.35%, respectively. These three exchanges have better liquidity of head assets.

In the two categories of waist assets and tail assets, the exchanges with the smallest daily average spreads are Binance, which are 0.66% and 0.91%, respectively. Especially for their tail assets, although the average daily transaction value is less than OKEx, the spread is far. Much smaller than other exchanges.

Further observation of the spread performance of the representative assets in each asset group of each exchange shows that the average daily spread of BTC trading pairs in all exchanges is very small, including 0% for OKEx and Bittrex, and 0.01% for Huobi Global and Binance. Bitfinex, which has the highest spread, is also only 0.14%. It can be said that BTC has good liquidity in the six exchanges in this observation range.

Except that the head assets have significantly better liquidity, the difference between the sampled waist assets and the tail assets in the spread liquidity is not very obvious. For example, on Bittrex, the average daily spread of waist assets BTT / USDT is 3.44%, while the average daily spread of tail assets PART / BTC is only 2.20%. As far as waist and tail assets are concerned, asset classes are not an effective indicator of liquidity.

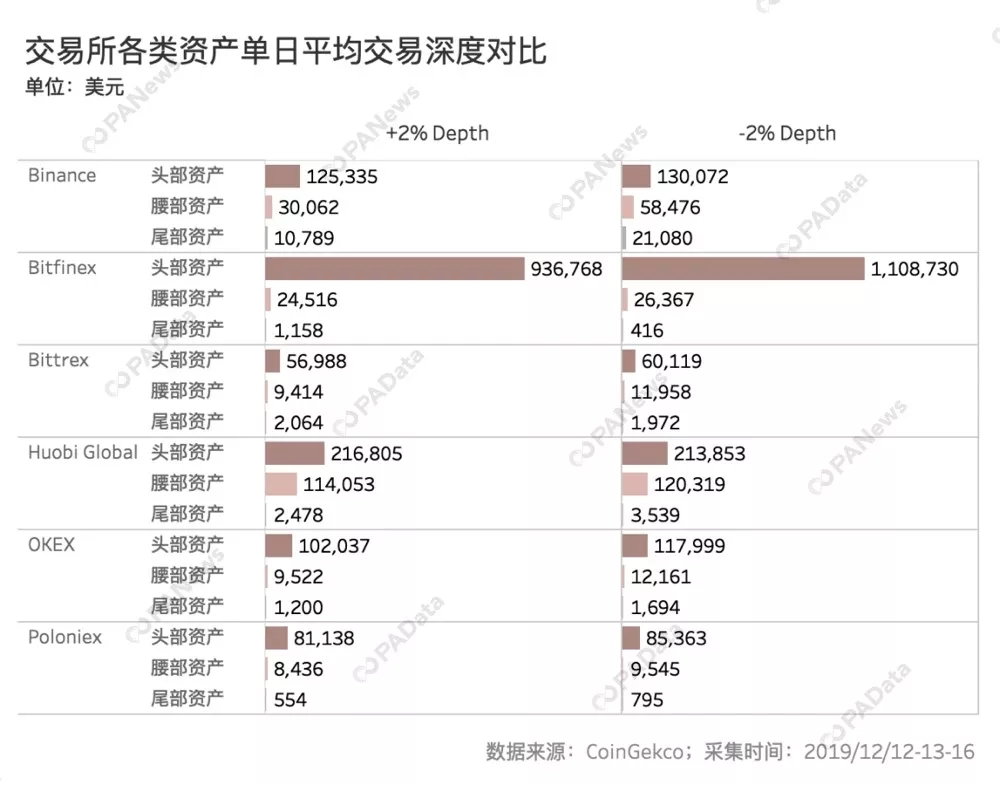

Transaction depth is another important indicator for measuring liquidity. It refers to the amount that can be traded within the range of N% above and below the equilibrium price in the order book. Within the same range, the deeper the depth, the greater the sustainable transaction volume and the better the liquidity. According to CoinGekco's ± 2% depth , Bitfinex's trading depth is the best in terms of head assets. This is because CoinGekco counts Bitfinex's USDT / USD trading pair into the head asset group. Characteristics, resulting in orders focused on a depth of ± 2%. In addition, because Bitfinex's head assets have opened trading pairs with various types of fiat currencies, which is one of the reasons for its concentrated orders, the exchange rate fluctuations of fiat currencies are much smaller than those of cryptocurrencies.

For Binance, Huobi Global and OKEx, which have closer trading environments, the trading depth of Huobi Global's head assets is better. At a depth of ± 2%, the average daily total of each trading pair is USD 218,800 and USD 213,800 respectively. .

The trading depth of Binance and OKEx is closer. At the same time, Huobi Global is also the exchange with the deepest waist asset trading, followed by Binance and Bitfinex. As far as tail assets are concerned, the best trading depth at the level of ± 2% is Binance, which reached an average daily total of $ 10,800 and $ 21,100 for each trading pair, far higher than other exchanges.

From the perspective of the representative assets of each asset group, the trading depth of the BTC / USD trading pair on Bitfinex is the best, with an average daily depth of ± 2% reaching USD 4.6 million and USD 8.7 million, followed by BTC / USDT on Binance. The average daily depth of ± 2% reached $ 2.85 million and $ 2.64 million, respectively. Both of these values are higher than the average daily average depth of the head assets of the respective exchanges, which means that the internal depth of the head assets is very different.

In general, the three major domestic locations show better liquidity in daily average trading volume, daily average spread and daily average trading depth. Among them , Huobi Global performed better overall in the head asset group. Binance's BTC / USDT transaction has better liquidity. Bitfinex relies on fiat currency trading, and its BTC's liquidity is also good. In the group of waist assets, the liquidity performance of the three major domestic firms is relatively close. In the group of tail assets, Binance's overall liquidity is better.

3. Is the abnormal transaction volume of some assets an advantaged asset or a volume?

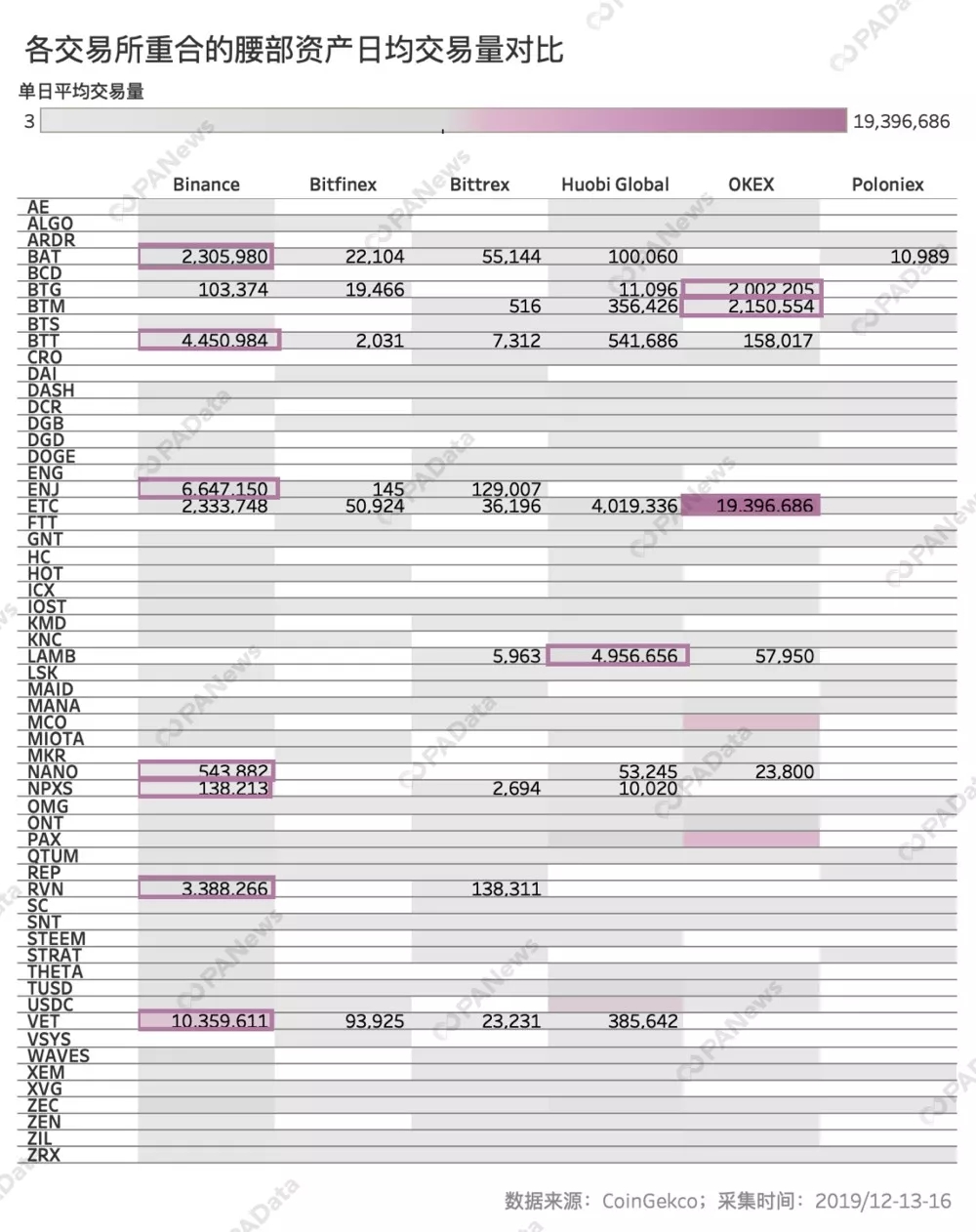

In order to analyze the performance of various types of assets of the exchange in depth, PAData counted the daily average transaction volume of the overlapping head and waist assets of each exchange [2], and found that some of the exchanges' individual assets are indeed or abnormal, that is, individual assets The average daily trading volume on one exchange is 10 times or more than all other exchanges.

According to statistics, among the overlapping head assets, the average daily trading volume of LINK on Binance is much higher than all other exchanges. The average daily transaction volume of LINK on Binance reached 15.056 million US dollars, which is 10.05 times that of Huobi Global and 14.47 times that of OKEx, or there are abnormalities.

In the overlapping waist assets, the transaction value is more abnormal. For example, the average daily transaction volume of BAT on Binance is approximately 2.30.6 million US dollars, which is 23.05 times the daily average transaction volume of Huobi Global during the same period, and 41.82 times that of Bittrex during the same period, or there are abnormalities. The transaction volume of VET on Binance is approximately US $ 1,035.96 million, which is 26.86 times the average daily transaction volume of Huobi Global during the same period, and 110.30 times that of Bitfinex during the same period, or there are abnormalities.

The average daily transaction volume of BTG on OKEx reached US $ 20.22 million, which is 19.37 times the average daily transaction volume of Binance during the same period, or there are abnormalities. In addition, OKEx's BTM, ETC, Huobi Global's LAMB, Binance's BTT, ENJ, NANO, NPXS, and RVN also have such abnormal transactions.

When analyzing the non-overlapping head assets and waist assets of the exchange, there is another suspected abnormal phenomenon. A digital asset quantification practitioner, PAData, said, "If the average daily transaction value of an asset on an exchange accounts for more than 30% of the market value of the asset, the transaction volume of the asset may be very high."

In PAData's statistics, only the average daily transaction value of MATIC and TOMO on Binance accounts for more than 30% of the market value, of which the average daily transaction value of MATIC is about 34.134 million USD, accounting for 104.46% of the total market value. The daily average transaction volume higher than the market value may be caused by the frequent change of hands by MATIC on Binance within the statistical time range. TOMO's average daily trading volume on Binance is approximately $ 1.998 million, which accounts for approximately 34.59% of the total market capitalization.

The tail asset overlap rate is low, and the single-day trading volume of a single trading pair is relatively low, which has a small impact on the liquidity of the single-day market. In addition, the market value of tail assets is small, the cost of swiping assets is much smaller than that of head assets, and the swipe volume is highly operable. These tail assets are often used by small exchanges to counterfeit trading volume. Therefore, the credibility of the tail asset transaction volume is low, and no separate statistics are made here.

PAData believes that there may be two reasons for the abnormal transaction volume of head assets and waist assets. The first is that exchanges with abnormally high transaction amounts may falsify the transaction volume of individual assets, or the project party conducts transactions on a certain exchange. Swap amount, but from the perspective of the project party, because the transaction amount needs to pay a large fee, and there is no incentive to swipe a large amount on individual exchanges, therefore, the probability of the exchange amount is higher. Second, the asset is an advantaged asset of the exchange, and this advantage is exclusive. What kind of abnormal situation needs more long-term follow-up analysis.

the data shows:

[1] Sampling method: Select the assets with the market value ranking of 1st and 50% in each group of asset classes. If the exchange does not have a sample asset listed, it will choose an asset with a similar market value ranking instead.

[2] Average daily trading volume: refers to the daily average of the total trading volume of all trading pairs of an asset on a certain exchange during a statistical period.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Shenzhen Stock Exchange official blockchain index released, six rules for stock selection, constituent stocks rose an average of over 50% during the year

- Without losing control and ownership, can you get rewards through data sharing in the blockchain?

- Multiple Youtube encrypted bloggers deleted a large number of videos without any notice

- Analysis: Why pay attention to the challenge of stable currency to sovereign currency?

- What kind of development will the crypto world usher in in 2020? Talk about three low-key product trends

- 8 Questions | Luo Mei, Tsinghua University: The most knowledgeable person in the field of accounting, the most knowledgeable person in the field of blockchain

- Against the halving market, 6500 at the end of this year is 3200 at the end of last year