Crypto psychological warfare: How does market sentiment influence Bitcoin?

Source: Medium

Translation: First Class (First.VIP)

The Silk Road founder Ross Ulbricht published a series of articles on Bitcoin price prediction, which he believes Bitcoin will rise to $ 100,000 in 2020.

Elliott Wave Theory is one of the financial principles he used to analyze the price of Bitcoin. This article is an analysis process published by Ross Ulbricht using Elliott Wave Theory.

- Number of exchange liquidity: the strength of the three major domestic exchanges close to Binance's abnormal trading volume

- Viewpoint: 2020 is the year of the blockchain transition. The prospects of supply chain finance and digital asset governance are promising.

- Ethereum's implementation of the hard fork on January 1 will accelerate the block time, and ETH inflation may rise by more than 20%

The Eliot wave theory is a concept that describes the price changes over time in a speculative market. It combines fractal geometry in popular psychology and mathematics. For those who are afraid of numbers, don't worry; apart from basic counting and arithmetic, there will be no difficult mathematical problems. It's worth taking a moment to understand, because it provides a very good framework to understand the price history of Bitcoin so far, and the future price trend.

The Eliot wave theory believes that the driving force behind speculative market price fluctuations is investor expectations for future prices. This makes sense, because investors only buy when they think the price will rise, so that they can later profitably sell, and when they buy, they will push up the market price. So, optimism drives prices up.

When other investors see the price rise, public psychology comes into play, they will become optimistic, and then buy, which pushes the price higher. As more and more investors are drawn in, a feedback loop is formed between higher prices and higher optimism. In the end, when optimism reached its peak, everyone who planned to buy had already completed the purchase, and there was no more funds to continue pushing up the price. At this time, the remaining few sellers in the market began to ship, driving down prices. When they do this, market sentiment changes from optimistic to pessimistic, and the opposite feedback loop is formed. Pessimism causes prices to fall, which creates more pessimism.

Time and again, the cycle of optimism and pessimism always overlaps with price highs and places. Therefore, buying (high price) when you (and everyone else) is the most optimistic and selling (low price) when you are the most pessimistic are the reasons for the loss.

Elliott Waves can make people reverse investors. When everyone is convinced that the future of an asset looks good, it is right to be pessimistic; when everyone is giving up negatively, it is right to be optimistic.

Many people read the news to understand the price rise and fall, and find out the reasons for future price rises or falls. This is counterproductive, because these news are in the same cycle as investors, so you will see good news and optimistic forecasts when prices peak, and bad news and pessimistic forecasts when prices bottom. This is the blind guide, because no one knows the future. This is not to say that Elliott Wave is omnipotent, but it can help you take a step back and keep you from being influenced by popular opinion.

Elliott Waves also uses fractal geometry to track these optimistic and pessimistic waves. A fractal is a shape with small features nested in large features. Small features look similar to large features. There are many such examples in nature, such as ferns with leaves nested in the leaves, or patches of clouds in the clouds. Fractal patterns often appear in chaotic systems, and speculative markets (such as Bitcoin) are a chaotic market.

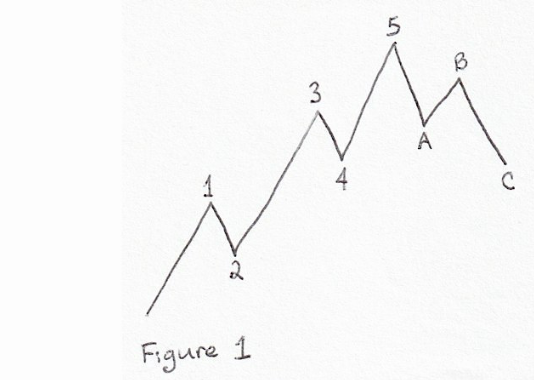

In these markets, fractals are fluctuations between optimism and pessimism, and they drive prices up and down in various ranges (from years to decades, to hours and seconds). Volatility is the continuous change (rising or falling) of prices. The basic pattern is five rising waves and three falling waves. (see picture 1)

(figure 1)

The wave's movement towards the next larger price trend is called an impulse wave. They are numbered at their endpoints and divide them into five smaller waves (1, 2, 3, 4 and 5 in Figure 1). The waves moving in the opposite direction to the next larger trend are called corrections. They are usually marked with letters and subdivided into three smaller waves (A, B, and C in Figure 1). This model is not arbitrary. This is the minimum number of waves necessary to allow periods (undulations) and trends (continuous movement) in the fractal series of prices. It can even be seen as an efficient and concise form.

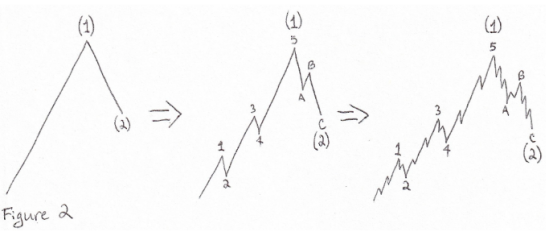

(figure 2)

As shown in Figure 2, each wave is part of a larger wave and is also made up of smaller waves. In this graph, the trend is up (the end price is higher than the start price), so wave (1) is a push wave because it goes up with a larger price trend. The wave (2) is a correction because it moves downwards against the trend. Waves (1) and (2) are the same as in Figure 1, and then these waves are further subdivided. Wave 1, Wave 3, and Wave 5 move in the same direction as Wave (1), so they are propulsion waves, and they can be subdivided into 5 smaller waves. Wave 2 and Wave 4 move downwards, in the opposite direction to Wave (1), so they are adjusted waves, and they can be subdivided into 3 smaller waves. Waves A and C are sub-waves of wave (2). They move downward in the same direction as wave (2), so they are propulsion waves, which can be subdivided into 5 smaller waves. Finally, wave B is an adjustment wave, which can be subdivided into 3 smaller waves because it is the opposite of wave (2) and moves upwards. Therefore, whether a wave is subdivided into three or five does not depend on whether it moves up or down, but on whether it moves with its mother wave or moves backward.

There are many rules and guidelines on how to correctly calculate these waves in the actual market. There are many literary works and books about Elliott Wave on the Internet, and I will not go into details here. I will only introduce what I consider the most important.

Rule 1 : In an advancing wave, the end point of wave 2 can never exceed the start point of wave 1.

Rule 2 : In an advancing wave, the end point of wave 4 can never exceed the start point of wave 2.

Rule 3 : Wave 3 is by no means the smallest wave of the propulsion wave.

Rule 1 : Adjustment waves are often undulating, overlapping and difficult to count.

Rule 2 : Propulsion waves are often clear, compelling, and easier to identify than adjustment waves.

Elliott waves have more details and subtleties than I cover in this article. As demand increases, I will delve into these details when analyzing the Bitcoin market in a future article.

Combining investor mentality (optimism or pessimism) with clear wave counts can give investors a moment's confidence in the future price direction, but this requires patience, humility (no one is right every time) and decisive Will.

This article represents the original opinion of the original author. First.VIP is always objective and neutral, presenting readers with diverse information for learning and communication, and does not constitute investment advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Long Baitao | Digital Asset Research Institute Digital Currency Weekly (2019/12/22)

- Shenzhen Stock Exchange official blockchain index released, six rules for stock selection, constituent stocks rose an average of over 50% during the year

- Without losing control and ownership, can you get rewards through data sharing in the blockchain?

- Multiple Youtube encrypted bloggers deleted a large number of videos without any notice

- Analysis: Why pay attention to the challenge of stable currency to sovereign currency?

- What kind of development will the crypto world usher in in 2020? Talk about three low-key product trends

- 8 Questions | Luo Mei, Tsinghua University: The most knowledgeable person in the field of accounting, the most knowledgeable person in the field of blockchain