Opinion: Is the bull market for bitcoin coming early?

PayPal, founder and CEO of PayPal, shared the keynote speech “The bull market will not be late and will not be absent”.

Based on the price trend of Bitcoin since 2011, he believes that “85% is already the limit of the bear market”, and analyzes the reasons for the bear market from multiple angles and why it is considered “the bull market is coming”, when the bull market will come.

The following is the full text of his speech.

So, how was the bear market formed and when will it end? Is a bear market a process or a result?

- March blockchain application monthly report: global blockchain application is accelerating, and the number of China is significantly leading

- The ultimate guide to understanding the differences between PPIO, Filecoin and Storj

- Report: Bitcoin is growing at an incredible rate and can surpass Visa in 10 years

In order to ensure the health of the economy and reduce the bubble in economic operations, many countries have implemented monetary tightening policies. Performance in China is “de-leveraging”. In the United States, it is “shrinking the table.” Given the key position of the US dollar, we will use the United States for analysis.

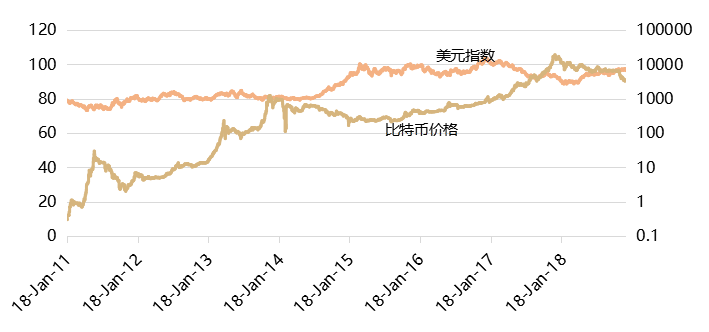

Last year, the impact of the Fed’s monetary tightening plan on the sharp fall in bitcoin prices was reflected in the Fed’s bond purchases, which triggered a wave of selling in all major and emerging markets, including US stocks, bonds and crypto assets. The reduction of liquidity in the market has also caused the prices of many commodities to fall. The “appreciation” of the US dollar has caused “depreciation” of other assets (such as Bitcoin) defined by the US dollar in the global market. Moreover, due to the implementation of monetary tightening policies and the increase of deposit and loan interest rates, the flow of funds in the market has decreased, which has also reduced the enthusiasm of public investment, which has accelerated the decline in bitcoin prices.

The US Dollar Index (USDX) is a comprehensive indicator of the exchange rate of the US dollar in the international foreign exchange market. It is used to measure the exchange rate of the US dollar against a basket of currencies. It measures the strength of the dollar by calculating the dollar and the combined rate of change in the selected basket of currencies. The rise in the US dollar index indicates that the exchange rate between the US dollar and other currencies has risen (that is, the US dollar has appreciated), so the international dollar-denominated commodity prices should fall.

Microclimate – currency fork, market confidence, policy changes, etc.

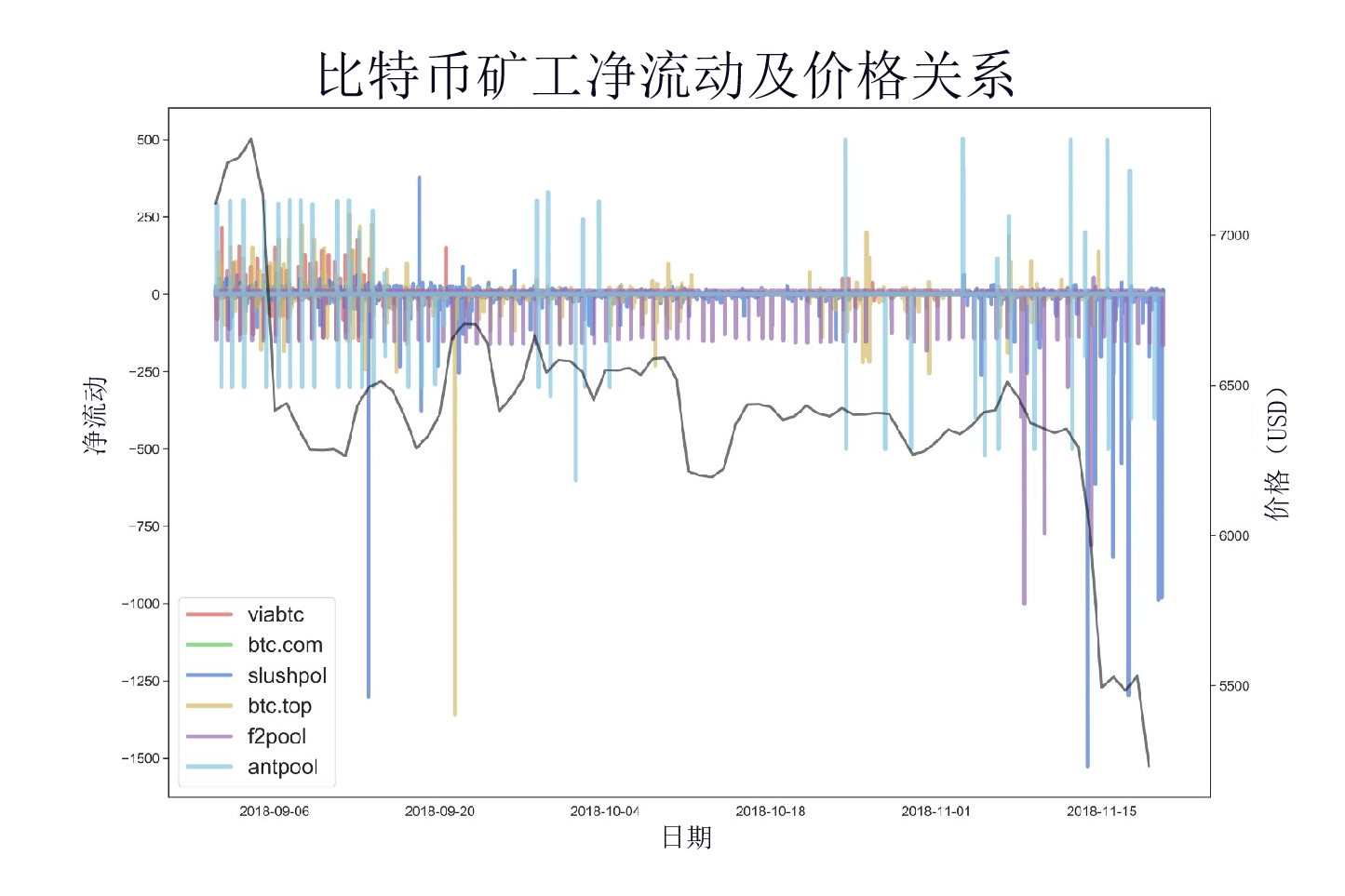

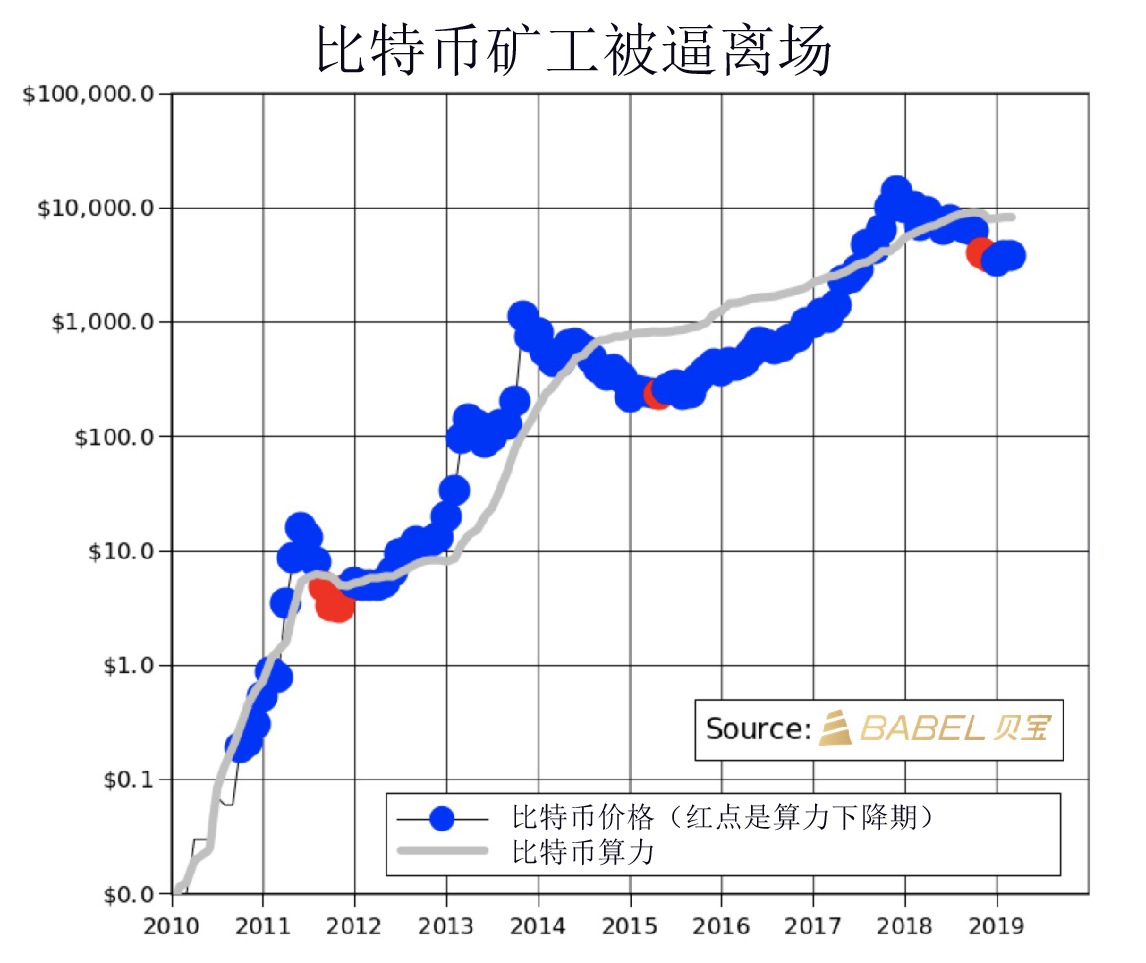

According to the situation of several bear markets in the past, by analyzing the impact of bitcoin price changes on the changes in miners' liquidity, we can see that every time the fluctuation of bitcoin prices in the market has a great impact on the mobility of miners. Whether it is the fork of a certain currency, the decline in computing power, the difficulty of mining, or other factors, these factors have a very large impact on the miners entering and leaving the field. The miners have just left the market and the price of the currency has risen. This is very common. In this regard, Yang Zhou said that only after experiencing the storm can see the rainbow, I hope everyone will firmly believe in the bull market.

Great climate – the scale of social financing and the balance of RMB loans have increased substantially, indicating inflation

Through the chart below, we can see that in China, the scale of social financing in January 2019 has increased significantly, exceeding RMB 4.5 trillion, which even exceeds the total amount of financing in the past quarter or even several quarters. In addition, the balance of RMB loans has also increased significantly. This shows that the flow of funds in the market is increasing, facing inflation and the risk of rising prices, which means that the price of bitcoin in China will “rise”.

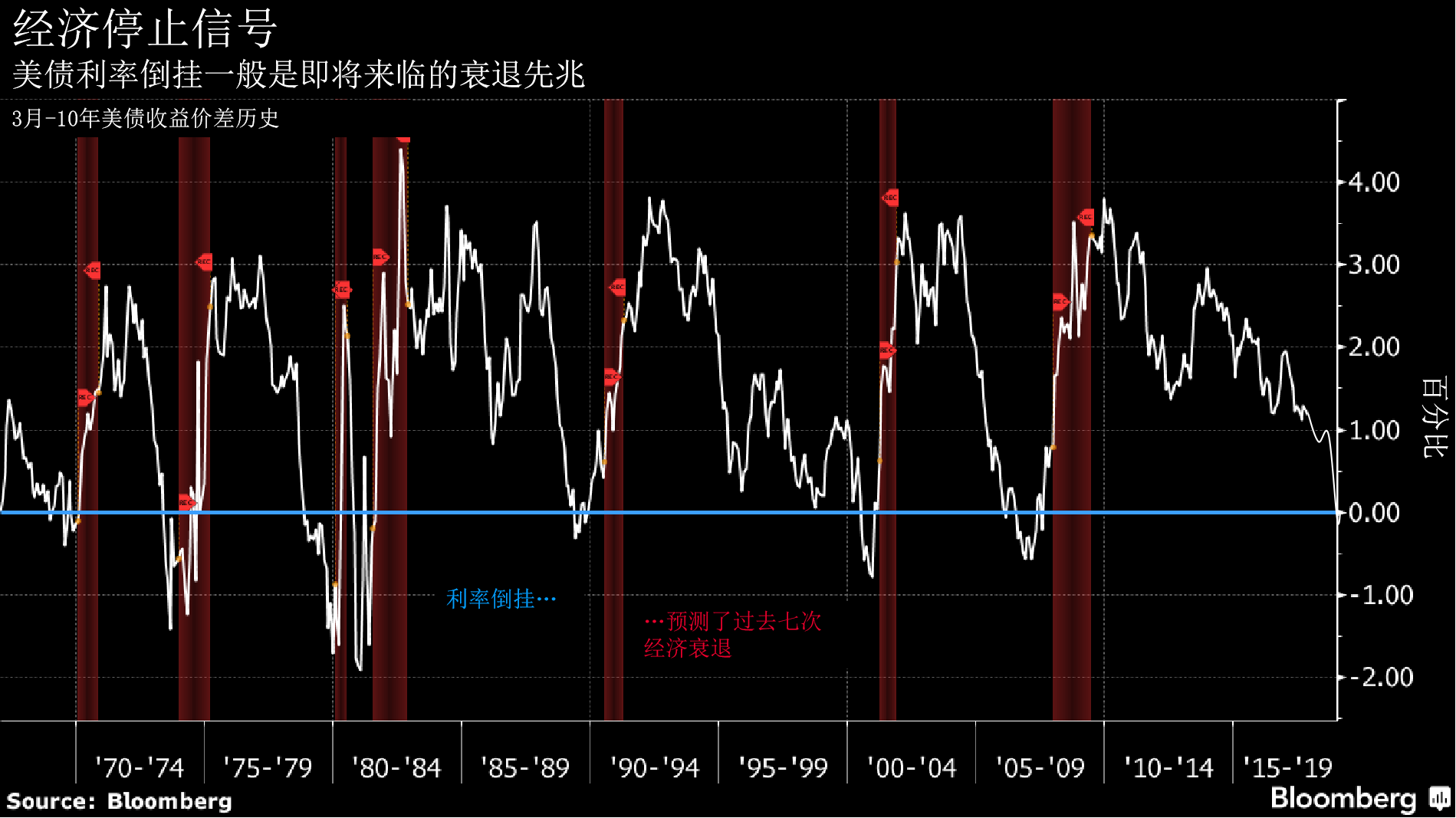

The upside down of the US debt interest rate curve is a forward-looking indicator of the US economic recession and the loosening of the Fed. With the 10-year US Treasury yields below the 1-year yield, the US Treasury yield curves have been upside down for the past nine recessions, with an average lead time of 14 months.

Last year's minutes of the Fed's FOMC meeting showed that many officials are pessimistic about the future economic development of the United States. So in December last year, the United States stopped raising interest rates. In March of this year, the Fed’s FOMC negotiated “one pigeon and another pigeon”. The dot matrix indicates that it will not raise interest rates in 2019, and announced the timetable for ending the contraction in September. — The Fed’s monetary policy shift to easing is a foregone conclusion, that is, the dollar is about to “depreciate”. From a global perspective, the price of goods priced in dollars (such as bitcoin) will rise. At the same time, after the interest rate cut, the liquidity in the market will increase, the public investment is expected to rise, and the funds flowing into the bitcoin market will also increase, which will help promote the price increase of Bitcoin.

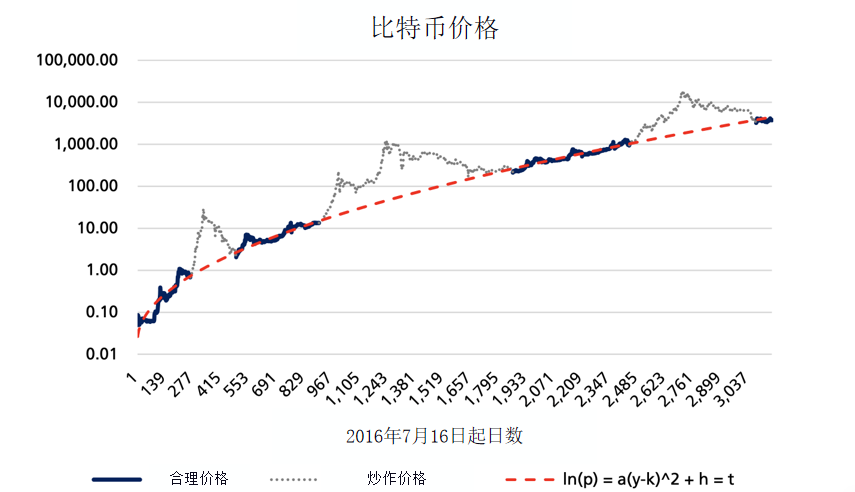

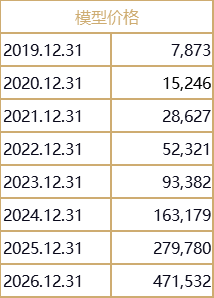

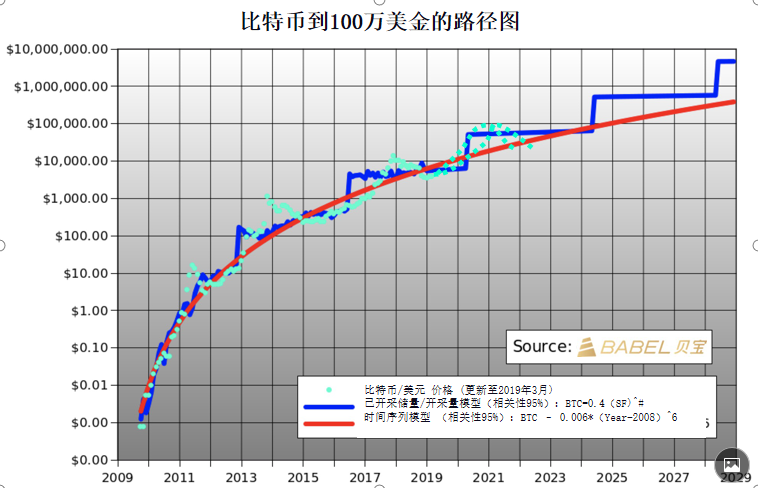

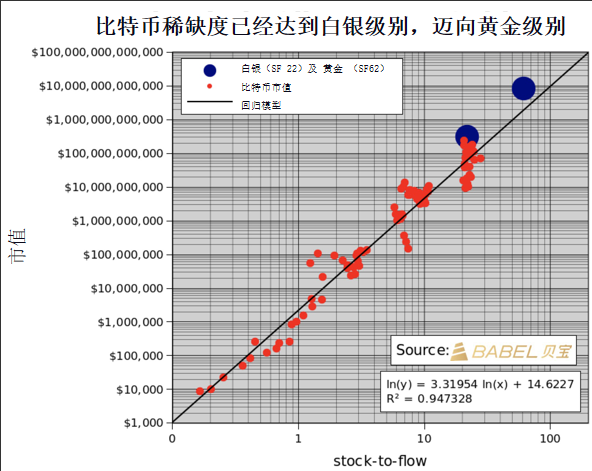

In the long run, the price of bitcoin is not random, but has mathematical laws. Excluding the noise, the bitcoin price and time are horizontally parabolic, and the logarithm relationship with the number of users (the logistic function is the S curve, the number of users is the active address active index).

Except for the exceptions of the three periods of 2011, 2013 and 2017, the logarithm of the bitcoin price and the time are horizontally parabolic, as shown in the following figure. The abscissa is the time since July 16, 2010, and the vertical axis is the logarithmic coordinate of the bitcoin price.

The growing number of Bitcoin users also means an increase in the number of people who recognize and accept Bitcoin. In other words, the "consensus" of Bitcoin has increased. To explore the value of this consensus, we return to the original question: the value of "money."

We know that whether it is the shells we used in the past, copper coins, or current banknotes, they are actually worthless, just a "value symbol." And they can be circulated, can be used for trading and trading, because most people "recognize" its value, these items can not be created and distributed at will, there is a certain scarcity, and their circulation is based on our consensus. By the same token, the consensus of Bitcoin has increased, his circulation will expand, the circulation rate will increase, and the price of Bitcoin will increase.

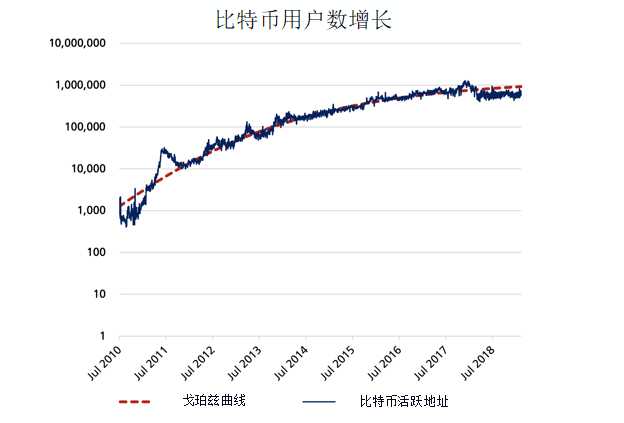

Microclimate – half cycle of bitcoin production

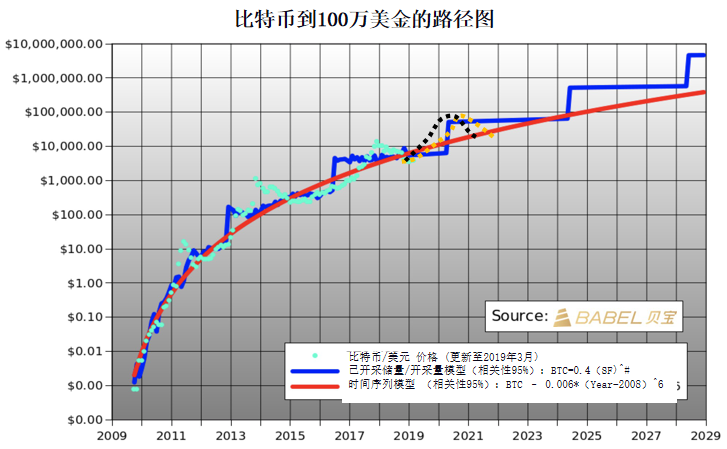

According to forecasts, Bitcoin has 14 months left in the halving cycle of May 2020.

According to past experience, Bitcoin will start to rise in the first eight months of halving, and it will start to decline in the first ten months after halving. That is to say, starting from the beginning of October this year, Bitcoin will enter a halving cycle. According to the halving model of Bitcoin, we can see that in the past, each halving is gradually reduced to half the price of the model after halving, and gradually exceeds the model price. So the first possibility of bitcoin price movement is to completely re-enact history, and then reduce the price of the model after halving (yellow line); the second possibility is due to the hype of professional institutions or For other reasons, the price after halving appears before the model price (black line).

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ethereum's profits are not enough to ensure its safety

- The blockchain concept stock boom has come again, and many companies are busy clarifying the "hot spot"

- Ethereum co-founder Vitalik Buterin: blockchain technology and cryptocurrency are inseparable

- 3.6 billion dollars! – 2019Q1 Dapp Data Report

- Why do you want to hold Bitcoin? Nakamoto wrote a letter telling you

- US SEC issues guidance document on whether or not the certificate is a security

- Why did the younger generation of content creators in Korea turn their attention to DApp?