Research Report | Central Bank Digital Currency Research Report (1)

Background introduction

On August 10, 2019, Mu Changchun, deputy director of the Payment and Settlement Department of the People's Bank of China, said at the Third China Financial Forty Forum. "The central bank's digital currency can now be said to be ready."

The People's Bank of China Digital Currency (DC/EP) has been in development since 2014 and has been in existence for five years. This explosive news can be said to be both unexpected and unexpected. The various circles of the community have discussed this extensively, but the interpretation of many media experts at the central bank's digital currency is not very complete and in-depth, so this is the original intention of our research report.

- Research Report | Central Bank Digital Currency Research Report (2)

- The second exploration of the derivative products: Who is the king of the contract?

- Blockchain games are breaking out, where is the future of investment? | Hangzhou Blockchain Game Forum

The Jinqiu Blockchain Research Institute will use a combination of blockchain & digital currency and banking and financial systems to launch a series of research reports to explore more fully what is the central bank digital currency (CBDC) and the central bank's figures. Interpretation of the currency DC/EP policy, and a series of predictions and application ideas for the financial institution's business after the introduction of the central bank's digital currency.

This article will focus on the following three questions:

1. Definition and basic information of the central bank digital currency (DC/EP);

2. The difference between the central bank's digital currency and cash, demand deposits, electronic cash (the balance in Alipay/WeChat), and stable currency;

3. The central bank's digital currency is not a pseudo-demand.

1. Definition and basic information of the central bank's digital currency (DC/EP)

The central bank's digital currency (DC/EP), English is “Digital Currency/Electronic Payment”, which is a unique English expression for internal R&D by the People's Bank of China. The International Monetary Fund (IMF) called the central bank digital currency CBDC, and the English language is “Central Bank Digital Currency”, which actually describes the same concept. The CBDC used in this article refers to the usual central bank digital currency (no country restrictions), and if used (DC/EP), it refers to China's upcoming central bank digital currency.

Going back to the concept of the central bank's digital currency, there is currently no uniform definition in the world, and the definition given by the IMF is more refined and accurate:

"CBDC is a new form of money, issued digitally by the central bank and intended to serve as legal tender."

“The central bank’s digital currency is a new form of currency that is issued by the central bank in a digital manner and has legal capacity to pay.” It is clear that the central bank digital currency (CBDC) does not have physical forms of entities, but it will be as full of cash as every citizen and organization in the country, including potential overseas individuals and businesses. At the same time, the central bank's digital currency can make it easier to pay for any amount in point-to-point payments (such as between individuals, between individuals and businesses, between companies and companies) (cash needs to be met face to face).

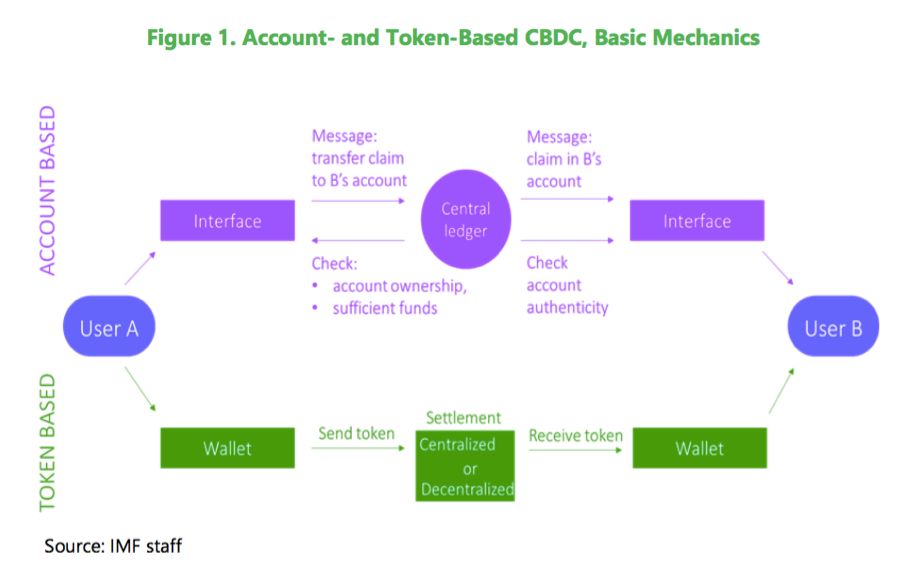

Usually the central bank digital currency can be divided into two versions, "Account Based" and "Token Based". The account version requires an account system for the financial institution, and the Token version only has a digital wallet. Mu Changchun, deputy director of the Payment and Settlement Department, mentioned in his speech that the central bank's legal digital currency is an alternative to M0. M0 refers to cash in circulation. Therefore, the Chinese central bank's digital currency is the Token version, not the account version.

(This is also a well-thought-out decision by the central bank. We will elaborate on the interpretation of the policy environment in the next article.)

Account version CBDC

The account version of CBDC is simply very close to the current commercial bank account system, but in the CBDC design system, the main difference between the two is that the central bank's digital currency requires accounts to be opened in the central bank rather than commercial banks. The specific process is: the payer needs to log in to the central bank's account – apply for payment to the payee in the central bank's account – the central bank's general ledger record settlement and transaction information – to complete the transaction.

This is also the single-layer structure that Mu Changchun mentioned as being negated by the central bank. Because the account version of CBDC will increase the financing cost of commercial banks, and the central bank's credit is better than commercial banks, it will lead to various problems such as financial disintermediation and excessive risk concentration.

Token version CBDC

The Token version of CBDC actually has more steps than the cash transaction in the transfer process, but it also brings convenience to the parties who do not have to meet each other. Compared with physical cash, the central bank digital currency CBDC will be more complicated and difficult to identify the two sides of the transaction. Therefore, the transaction often needs to introduce an external authentication mechanism to verify the authenticity, which also causes the transaction to be 100% like cash. Anonymity. The degree of anonymity depends on the disclosure of digital wallet registration information. For China's upcoming DC/EP, we will also interpret the anonymity.

The Token version of CBDC's verification and settlement is divided into two methods, centralization and decentralization, depending on which technology is used. Decentralized settlement usually uses distributed ledger technology (DLT). Because of the requirements of efficiency, scalability, and transaction completion, distributed ledger technology will verify and settle CBDC management in the licensed chain of central bank participation management.

But distributed ledger technology is not the only solution, and many centralized settlement technologies have proven to be very advantageous in terms of efficiency. The centralized system can efficiently verify the corresponding serial number on the Token, and in order to avoid the double flower problem, Token reassigns a serial number every time the digital wallet is converted.

Second, what is the difference between the central bank digital currency CBDC and bank deposits, electronic cash (Alipay/WeChat balance), and stable currency?

The difference between the central bank's digital currency and cash is already clear, but many people still have no specific concept of the difference between it and bank demand deposits, electronic cash (balance in Alipay/WeChat), and stable currency. Especially for consumers, it is difficult to perceive the difference between these legal tender forms. Coupled with the emergence of a large number of cryptocurrencies and Facebook's Libra, what is the difference between these and the central bank digital currency CBDC?

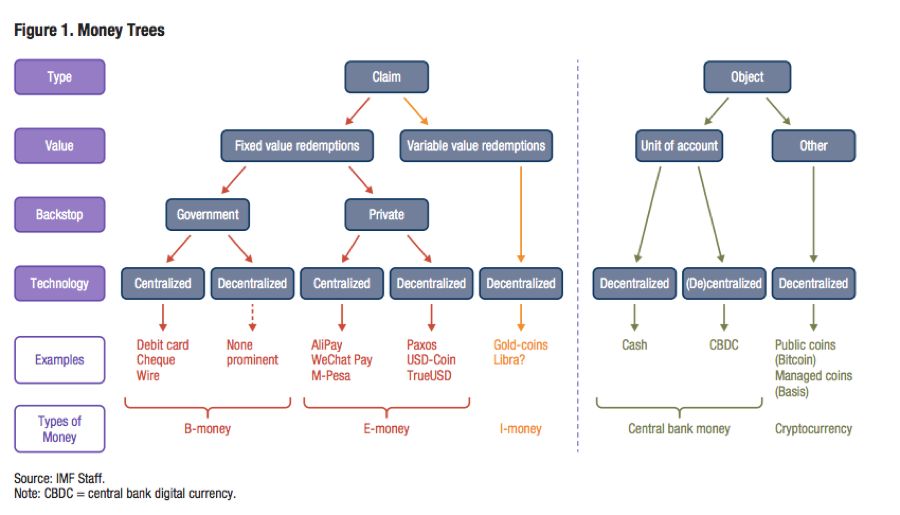

IFM made a Money Trees and made a detailed distinction on how to define different kinds of currencies:

The first level is the difference between the types of "payment forms", which are divided into two categories: "object" (Object) and "Declaration" (Claim). "Subject correspondence" is to use money to buy coffee, the transaction is completed in an instant, and there is no need for information flow interaction. “Declaration Correspondence” refers to the transfer of a “Value of Claim”, such as swiping a credit card to buy coffee, transferring the value statement in the bank to the merchant, and the transaction requires the exchange of information. The payment of the "Declaration Correspondence" class can also be completed in an instant, although it relies on a sophisticated and developed payment system, but provides users with a lot of convenience. Therefore, the most current payment in the world is the "declaration correspondence" category.

The second level is the difference in value. When the “declared correspondence” payment method, the value of the currency redemption statement is fixed (rededed) or floating, and different types of money are distinguished. Fixed redemption guarantees a pre-agreed face value to be valued. We deposit 10 euros in the bank, we can definitely take out (redeemed) 10 euros of cash, we put 100 yuan in Alipay, we can also confirm the redemption of 100 yuan, fixed value redemption is a form of similar claims Redemption statement. If the redemption of the corresponding value is a floating value of redemptions, the redemption of the currency can be converted into other currencies of different value. It is a behavior that is declared in the corresponding market value of the asset. This method is more like an equity tool. . In the payment method corresponding to the subject, there is no concept of redemption, and the value corresponds to the face value of the currency in your hands or in the local account.

The third level is the difference in support, ie what institutions provide support for fixed value redemptions. There is government credit endorsement support, and there are also collateral assets (such as margin) that rely on the company's sound operation and legal agreement to redeem endorsement.

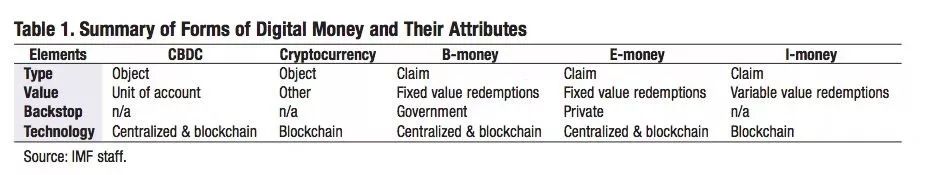

Through the differentiation of these four dimensions, we can help us distinguish between 5 different currencies/payment methods:

1. Central Bank Money , central bank currency, the main category is cash and CBDC;

2. B-money , bank cash. The most commonly used "declarative correspondence" currency, our deposits in commercial banks fall into this category;

3. E-money , electronic cash. A new form of currency that is prominent in the field of payment, also as a tool for creditor's rights, redemption of value needs to be endorsed by corporate credit, coupled with prudent operation and legally agreed collateral assets (such as margin) for redemption endorsement. The E-money of the centralized technology route includes Alipay, WeChat payment and Paytm of India. Most of the compliant Stablecoins in the decentralized technology route are, by definition, E-moneys that also use the bottom of the blockchain, including TrueUSD, USDC, Gemini, Paxos, and others.

4. Cryptocurreny , cryptocurrency (digital currency). It is issued through non-financial institutions and is valued in its own account system. Currency is issued by blockchain or mining. Bitcoin, Ethereum and other cryptocurrencies fall into this category.

5. I-money , a potential new form of money payment, the basic situation is very similar to E-money, the only difference is that the value of the statement redemption is not fixed, similar to equity instruments, corresponding to gold, a basket of currencies, Floating assets such as stock portfolios, such as Digital Swiss Gold (DSG) and Novem Gold Endorsement I-money.

Another example of I-money is Facebook's Libra. Libra corresponds to a portfolio of bank deposits and short-term government bonds (called Libar Federal Reserve), which can be converted into French currency at any time based on the value of the corresponding asset. However, it does not have any price guarantee, and the value of the redemption is not fixed, so it is classified as I-money.

Third, how to judge whether the central bank's digital currency is a pseudo-demand

The above two parts let us understand the necessity of the central bank's digital currency issuance.

Many people think that if the central bank's digital currency is used instead of M0 cash, in fact, China is now entering a cashless society. E-money electronic cash can already replace cash. Does it still need to add to the central bank's digital currency? There are also many questions about centralized management and transaction anonymity.

In fact, we can now give a conclusion. We believe that the attempt of the central bank's digital currency is a very necessary innovation!

Judging whether a currency form has value or not depends on the two dimensions of supply and demand. One is from the perspective of the user's use of money, and the other is from the perspective of the central bank's issuing institution. From the user's point of view, is CBDC able to increase the benefits of payment, reduce the cost of payment, and reduce the risk of payment and stored value, which is the value; from the perspective of the central bank, is CBDC able to maintain financial? The credit system, the stability of the monetary system and the effectiveness of the central bank's monetary policy are also the values.

In the next report, we will make a detailed comparison of the advantages and disadvantages of the central bank's digital currency CBDC, cash, B-money, and E-money, and then interpret the policy in conjunction with the central bank's digital currency (DC/EP).

Conclusion

The CBDC is likely to be the next milestone change in the evolution of the currency. From the history of currency evolution, the most basic monetary function may not change, but the form of currency existence has always evolved with the needs of users.

In a digital world, many economic behaviors have quietly changed. In the era of the Internet of Everything, the gradual blurring of the boundaries between the physical world and the digital world, the demand for money from users will also change dramatically, so the evolution of the currency form is inevitable.

The CBDC may not be the future direction, but the innovative exploration is!

Reference

Adrian, Tobias. 2019. "Stablecoins, Central Bank Digital Currencies, and Cross-Border Payments: A New Look at the International Monetary System," speech given at the IMF-Swiss National Bank Conference, Zurich, May 2019.

https://www.imf.org/en/News/Articles/2019/05/13/sp051419 -stablecoins-central-bank-digital-currencies-and-cross -border-payments

Duffie, Darrell. 2019. “Digital Currencies and Fast Payment Systems,” mimeo, Stanford University.

Yao Qian, Tang Yingxi. Some Thoughts on the Legal Digital Currency of the Central Bank[J]. Journal of Finance Research, 2017, 445(7): 78-85.

Author: Liu Mingrui

Source: Jinqiu Block Chain Research Institute

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Questioning the resurgence, XRP is wilting because Ripple accelerates sales?

- The world of encryption originated in Bitcoin, and the prosperity stems from some "small problems" in Bitcoin.

- Market analysis: BTC fluctuates slightly, weekends are still resting

- Vitalik: More pessimistic about capacity expansion through the second layer network, Zk-Snarks and sidechain solutions are more effective

- Blockchain and the future of the intelligent revolution

- Market Analysis: External factor disturbances tend to weaken the impact on the cryptocurrency market

- Winklevoss brothers talk about bitcoin: "Wall Street is absent-minded"