In-depth Analysis of Account Abstraction AA User Growth Data

Analysis of AA User Growth DataIn September 2021, ERC4337 was formally proposed as a standard for account abstraction, with the goal of improving the account experience in the Ethereum ecosystem through smart contracts.

This approach does not require modifications to the Ethereum consensus layer, making it easier to implement, and any potential increase in Gas consumption can be greatly reduced with the development of Layer 2 and the launch of subsequent upgrades.

On February 28, 2022, an important milestone for ERC4337 was reached when the entry point contract (EntryPoint) was deployed to the Ethereum mainnet, and it has since been expanded to over 20 EVM-compatible blockchains.

In the six months since its launch, an increasing number of users, infrastructure, and dApps have started building their own on-chain applications based on this entry point contract. So, how do the user metrics, infrastructure builders, and dApps perform?

- Why is Binance in such a hurry to sell its Russian business to a newly launched exchange?

- Is the recent court ruling an intentional attempt by the judicial department to balance the scales of SEC regulation?

- Friend.tech without innovation has brought a product lesson to the cryptocurrency circle.

Let’s explore the performance of ERC4337 since its launch by analyzing the data from the entry point contract.

Introduction to ERC4337

The Ethereum account system can be divided into EOA (Externally Owned Account) and CA (Contract Account). EOA is the native account of Ethereum used to trigger Ethereum transactions.

CA is essentially a smart contract, providing flexibility and programmability, which can bring a better user experience. However, it cannot directly initiate Ethereum transactions and still suffer from issues caused by EOA, such as private key risks.

In the ERC4337 account abstraction standard, users have complete control over their CA and can use any desired verification method. The task of initiating Ethereum transactions is delegated to Bundlers.

The simplified process is as follows:

1. Users use CA to initiate UserOperation (UserOp), a new transaction type proposed by ERC4337, and send it to a separate UserOp mempool.

2. Bundlers will bundle UserOps in a transaction and initiate a transaction to the entry point contract using their EOA account. Since it is a transaction initiated by Bundlers, the gas fees will be paid by them.

3. The entry point contract is responsible for standardizing transaction execution and preventing Bundlers from being targeted by malicious transactions or DoS attacks. All Bundlers need to call it to execute UserOps.

4. Users need to pre-deposit gas in the entry point contract to pay the Bundlers, or LianGuaiymaster can pay the gas fees on behalf of the users. LianGuaiymaster can be any third party willing to pay for the gas fees.

5. If users have not created a contract wallet, the wallet factory contract will automatically create a smart contract wallet for them.

User Analysis

User Growth

Currently, there have been over 680,000 account abstraction wallets created based on the ERC4337 standard, with over 2 million UserOps initiated.

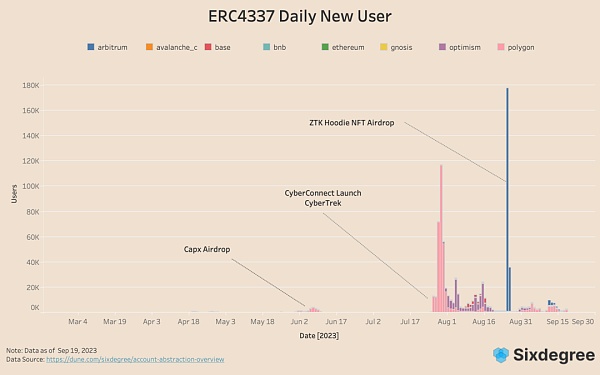

From the above chart, we can see that the number of AA users has experienced three phases of growth:

The first growth came from the project The Capx App, which is a learn-to-earn app. It uses AA’s bundling feature to facilitate token transfers. The platform has developed rapidly and has built an app chain based on zk-rollup technology using the polygon SDK.

The second growth came from CyberConnect’s Cyber Trek campaign, which incentivizes users to create Cyber Accounts based on AA.

The third growth is from the metaverse project ZepetoX (ZTX) on Arbitrum. Zepeto is a virtual fashion social platform for creating personal digital avatars launched by Naver, a South Korean internet giant and the parent company of the social app LINE, in August 2018. ZTX is their new project extending into Web3.

User Activity

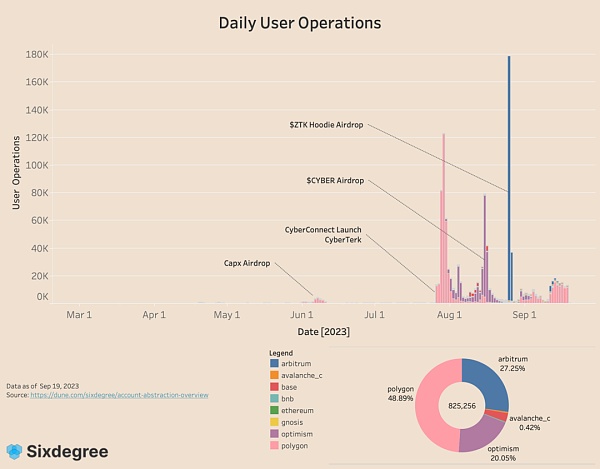

The growth of UserOp follows a similar curve as user growth, with the only difference being that UserOp has four growth phases because the CyberConnect airdrop was distributed on the Optimism mainnet and users needed to claim it using an AA wallet.

Due to the additional gas burden caused by the use of ERC4337-based account abstractions, most UserOp transactions occur on Layer2 chains with lower gas costs.

Polygon, Arbitrum, and Optimism account for the majority share, with percentages of 48.89%, 27.25%, and 20.05% respectively.

The art creation trading platform Zeroone on Avalanche launched on August 18, bringing in over 40,000 UserOp transactions, while Base Chain saw a small growth due to the recent Onchain Summer.

Overall, user activity shows a gradual upward trend.

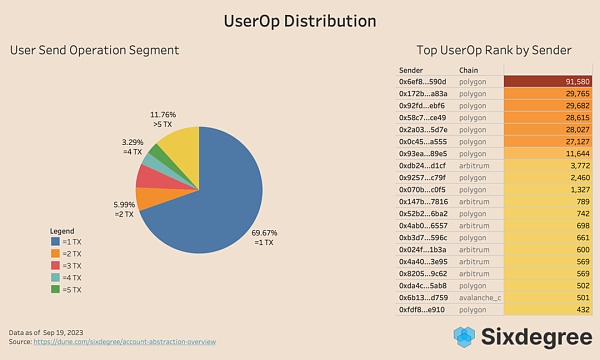

Looking at the activity of each AA wallet, 88.24% of wallets have been used five times or less. Considering the user growth and UserOp growth charts above, most AA wallet users are temporary users brought in by projects, which means that apart from the designated operations in the projects, there are not many additional use cases for these wallets.

This is mainly due to two reasons:

First, most 4337AA wallets are in-app AA wallets built by the project teams themselves;

Second, because most mainstream projects have not yet integrated AA compatibility. Therefore, situations where users use CyberWallet to claim ZTX commemorative NFTs do not exist, which means that user behavior is limited to these apps.

There are also a small number of AA wallets with particularly high usage frequency, even reaching thousands or tens of thousands of times. For example, wallet 0x93 has initiated UserOp transactions more than 11,000 times. This wallet is used by Capx for token distribution, so only a few project teams have use cases and truly leverage the advantages of AA wallets.

User Behavior

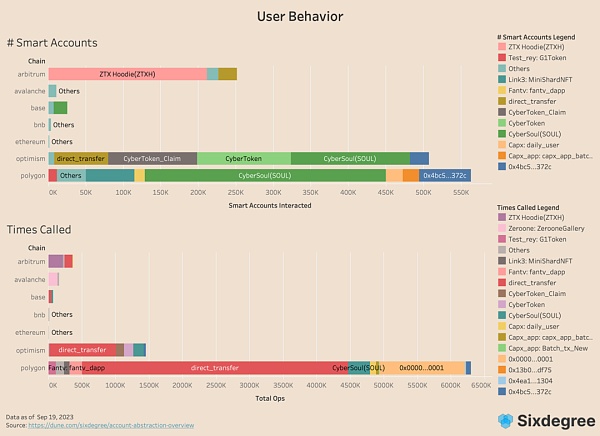

When focusing on the scenarios where users use AA wallets on-chain, Polygon has the most diverse interaction scenarios based on the richness of interactive contracts.

Among them, CyberConnect and ZTX are the main contracts that the AA wallet interacts with. From the perspective of the number of contract calls, the majority of actions are mainly direct transfers and minting NFTs, which account for 90% of all user operations.

Take Polygon as an example, it can be found that direct transfers are only a small part of user interactions, but the number of uses is the highest, which also confirms that only a small number of people have truly found suitable AA usage scenarios.

AA Infrastructure

Currently, most AA wallets using ERC4337 are built in a Lego-style manner, that is, using different third-party modules to build their own AA wallets within applications. The advantage is convenience and easy implementation, but the disadvantage is lack of universality. Later, the market situation and major participants of each module will be analyzed.

Bundler

Bundler triggers transactions using EOA, freeing users from the hassle of EOA. It has strong public goods attributes and is a module with expected wealth effects.

Bundler’s income comes from two parts: first, gas difference, which refers to the difference between the maximum priority gas fee and the actual gas cost, while spreading the fixed gas expenses among multiple users to profit from these frictions;

Second, potential MEV revenue. Bundler’s role is very similar to that of block builders. When it finds that the user’s UserOp contains MEV profits, the bundler can also join in and capture this part of the revenue.

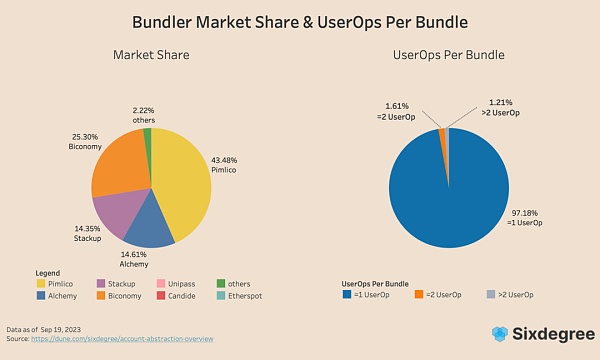

Currently, there are about 1.5k bundlers in total. Pimlico, Alchemy, Biconomy, and Stackup are the most mainstream players, accounting for more than 97% of the bundler market.

Among them, Pimlico occupies 43.48% of the market share by extensively cooperating with various dApps and packaging the most UserOps.

Bundlers can package multiple UserOps into one transaction, but in reality, 97.18% of transactions only contain one UserOp.

This means that there are currently not enough UserOps, resulting in the workload of bundlers being completely unsaturated, further leading to almost no profit space for bundlers.

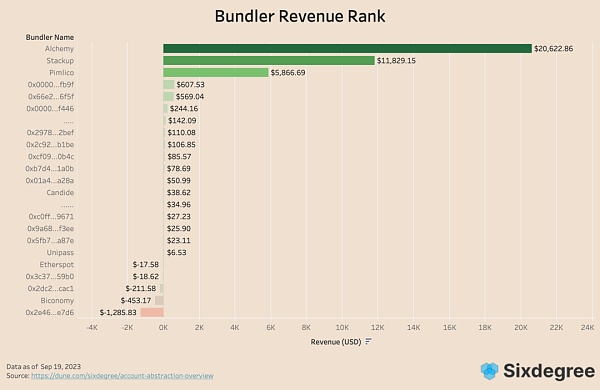

Currently, all bundlers generate a total profit of about $38k, of which 88.38% are in a break-even state. Among them, Alchemy ranks first with a profit of $20k, while Stackup and Pimlico rank second and third with profits of $11k and $5.8k respectively.

LianGuaiymaster

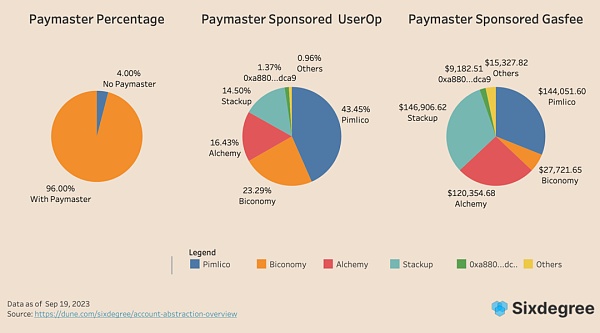

As an option in the ERC4337 standard, LianGuaiymaster actually pays for 96% of the gas for UserOps, indicating that the vast majority of users’ dApps have enabled this feature, creating a gasless experience for users.

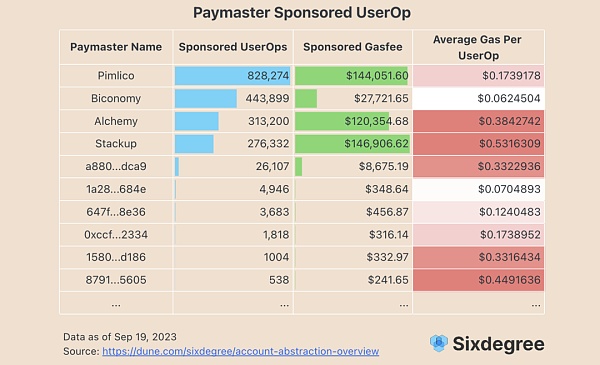

Currently, a total of 117 LianGuaiymasters have paid a total of $465k in gas fees, and Stackup, Pimlico, Alchemy, and Biconomy still occupy the majority of payers.

Among them, Pimlico pays for the most UserOps, accounting for 43.45% of the total, and has paid a total of $144k.

Secondly, Stackup accounts for 14.5%, while Alchemy and Biconomy account for about 16.43% and 23.29% respectively.

A notable point is that the average gas fee paid by LianGuaiymaster of Pimlico for each UserOp is significantly lower than that of Stackup and Alchemy, which results in Pimlico paying nearly the same total gas fee despite having twice the number of UserOps as the other two.

The possible reason for the difference is that different UserOps call different contracts. Pimlico pays for a large number of dApp applications and direct transfers, many of which have low gas consumption, resulting in the aforementioned difference in gas fees.

Wallet Factory

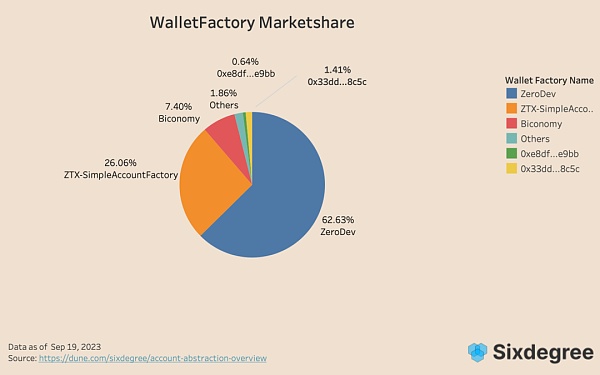

In terms of market share, currently only ZeroDev monopolizes 62.86% of the market share, thanks to its cooperation with CyberConnect. The second-ranking one is ZTX, which uses the official ERC4337 contract repository of the Ethereum Foundation, called SimpleAccountFactory. There have not yet been large-scale wallet applications, and cases like Soulwallet have not been seen on-chain.

Summary

Since the launch of ERC4337 six months ago, we can see that AA based on ERC4337 has shown a clear growth trend in both the number of users and transactions. Every time an application adopts ERC4337, it brings a surge.

However, currently users and transactions are concentrated on a few chains and a few applications, and the types of UserOps used by users are also very limited. One reason is that most AA wallets are in-dapp form and lack universality. Another reason is that 4337 is still in its early stages, and mainstream applications have not provided login interfaces.

Finding suitable application scenarios for AA is a prerequisite for the wider use of 4337. With the maturity of blockchain infrastructure, we expect to see more application products and full-chain games emerge in the next 12-24 months. As Web3 projects become more complex in terms of business logic and full-chain games naturally have complexity, AA wallets will become key to lowering user thresholds and improving user experience.

As one of the three major routes of Ethereum endorsed by Vitalik, the significance of account abstraction is enormous and it is also an important prerequisite for achieving mass adoption in the future. We are very much looking forward to and firmly believe that account abstraction will be an important part of the future of blockchain.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Namada in Detail A Modular Privacy Solution for Multi-chain Ecosystems

- How do lawyers use AIGC to write articles? Taking Microsoft Copilot as an example.

- Thoughts on Friendtech Not optimistic about all Friendtech clones.

- NFT quietly integrates into the mainstream Fat Penguin settles in Walmart, Microsoft Xbox may integrate encrypted wallets.

- LianGuai Morning Post | 3 more people arrested in JPEX case, bringing the total number of arrests to 15.

- SeeDAO White Paper Digital City-State

- JPEX bankruptcy, Hong Kong SFC plans to issue a blacklist for virtual asset exchanges.