Is it time to include Bitcoin in your investment portfolio?

Should Bitcoin be in your investment portfolio?Yesterday was another day of pounding and stamping by some investors.

On June 5, 2023, the Nikkei index hit a new high since July 1990, surpassing 32,000 points for the first time.

Take a look at the chart. It’s just a matter of stepping on the gas to get to the peak of 33 years ago, isn’t it?

- Viewing the activity curve of new concepts in the current market through the on-chain data of FERC-20.

- Binance’s response in full: All user assets are safe and protected; SEC’s allegations are aimed at unilaterally seizing control of the definition of the cryptocurrency market.

- 19 Responses from He Yi: Regarding Listing on Binance, IEO Rumors, and Market Share

According to statistics, the Nikkei 225 index has risen by 23.46% this year.

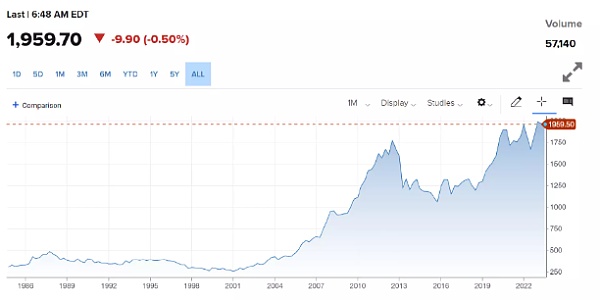

There are also some charts that seem to be preparing for a new launch, such as physical gold.

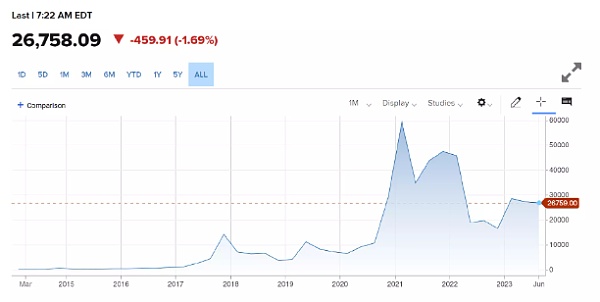

Oh, and there’s one that may have already been relegated to the cold palace – Bitcoin.

The chart may not be as exciting as the first two, but according to the calculator, as of June 5, 2023, Bitcoin has risen by 60.6% this year, making it the most impressive.

The investment community has reached a consensus in recent years: Leaving aside Bitcoin’s “political aspirations” in its early years, the role it is mentioned more often now is – digital gold.

People often say, “Confidence is more important than gold.” Gold has always been an important safe-haven asset, at least an important anchor, but whether Bitcoin is such an anchor, many people may still have doubts.

But guess what analysts say?

UBS analysts said that Bitcoin is a barrier against the adverse consequences of economic disorder and excessive monetary and fiscal intervention.

Goldman Sachs predicts that if investors accept Bitcoin as a “digital gold,” Bitcoin could eventually reach $100,000.

As for those who think that the volatility risk of Bitcoin is too high (often cutting in half), a calculation is also encouraging:

According to Morningstar Inc., investors who allocate 1% of their portfolio to Bitcoin in a traditional 60/40 investment portfolio (i.e., 60% S&P 500 stocks and 40% 10-year US Treasury bonds) saw a slightly lower return in the past year – down 8.93%, compared to a 8.77% decline in a traditional 60/40 investment portfolio.

Given that Bitcoin fell nearly 40% during that time, these numbers are not frightening.

Over a longer period of time, a 1% allocation to Bitcoin would greatly increase returns. Over the 10 years ending in March of this year, a 1% Bitcoin investment portfolio easily beat the traditional 60/40 investment portfolio – 13.3% to 7.8% per year.

A slightly larger 2% allocation performed slightly worse over the past year (down about 9%), but grew almost 18% per year over the 10-year period.

Another point worth mentioning as supplementary information is that most Bitcoin traders are young people.

For example, in South Korea, media reports once stated that the population of people aged 20-39 was about 13.421 million, while the number of people holding virtual currencies was a total of 3.08 million, accounting for 23%, that is, one out of every five young people in South Korea is trading Bitcoin.

Blockingxful, an instant Bitcoin trading software, said that its main user group is between 25 and 33 years old, accounting for 32.76% of all traffic, of which the 18-24 age group accounts for 32.21% of all traffic.

In the future, they will be important investment forces, which also means that Bitcoin’s future will not only be an option for “niche investment”.

So, is it time to include Bitcoin in your investment portfolio?

Don’t rush, let’s take a look at the opinions of some experts and scholars together.

Gold is a natural currency and wealth preservation, while Bitcoin is a virtual electronic currency. Young investors are definitely more bullish on Bitcoin, but Bitcoin is prone to large-scale market fluctuations, and most sovereign countries do not recognize the legal status of Bitcoin, so the existence of Bitcoin often has some dark sides and is prone to become a heavy disaster area for money laundering.

Personally, I think it is necessary to allocate gold, but there is no need to necessarily allocate Bitcoin.

We see that central banks around the world are buying gold frantically, and the amount is scary. In the first quarter of this year, global central bank gold reserves increased by 228 tons, setting a new record for the highest increase in reserves in the first quarter of each year since records began.

We can use “swallowing whales” to describe the state of central banks in various countries hoarding gold. Central banks of various countries continue to hoard gold to resist risks. As the saying goes, buy gold in troubled times and make antiques in prosperous times. Now antique prices have plummeted, but gold has gradually become the main type of reserves for central banks around the world, and more of them are the result of the recent Russia-Ukraine conflict.

Various foreign exchange reserves in Russia have encountered unprecedented pressure and restrictions, which has made many countries believe that gold reserves are becoming more and more important. They are afraid that foreign exchange reserves will be suppressed and are buying gold to support their national currency.

The latest news is that the acceleration of “de-dollarization” has slowly begun in many countries. I believe that under the trend of de-dollarization, countries will choose to hoard gold as a guarantee against some risks.

Actually, it is still related to the US being too overbearing, and other countries dare not speak out against the US dollar hegemony. But where there is currency oppression, there will be resistance. There is already a trend in this direction.

It should be said that the abuse of US dollar hegemony will first drive the BRICS countries to jointly create a new world currency. The Asian Clearing Union (ACU), composed of nine Asian countries including Iran, India, and Bangladesh, will launch a new cross-border financial settlement system in June this year, which will serve as a substitute for the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system.

The 51st Asian Clearing Union (ACU) Summit

Source: Asian Forward

Of course, China did not participate in this one, because China has long been secretly preparing to replace the US dollar. The main reason is that the US’s hegemonic behavior has stimulated many countries’ dissatisfaction, hindered the circulation and use of many countries’ currencies, and this is the fundamental reason why such an anti-US dollar alliance has formed.

Actually, ACU was established in 1974, but in recent years, relevant governments have not continued the past policies. However, this kind of hidden resistance has always existed, and what was missing was a spark to ignite the fire.

I believe that while the Asian Clearing Union is launched, the sprouts of “de-dollarization” are forming.

During the process of transferring debt risks to other countries, many countries like India and Japan have experienced economic setbacks of several decades. Therefore, more and more economies are putting “de-dollarization” on the agenda and making plans to avoid such situations.

The trend of Bitcoin is closely related to factors such as the global economic cycle, the cycle of the US dollar, and the attitude of major national monetary authorities towards cryptocurrencies.

Bitcoin’s highest point broke through $60,000. After the outbreak of the epidemic and the US dollar’s large-scale easing, the broad money M2 of the US dollar once increased at a rate of 25%, which is an important reason for Bitcoin’s historic high.

Later, the US dollar entered a fast interest rate hike and balance sheet shrinking cycle. The Bitcoin bubble burst and fell to around $16,000. Recently, Bitcoin rebounded to around $27,000, which is related to the end of the US dollar’s interest rate hike and the general rebound of global stock markets.

Gold and Bitcoin are similar, both are safe-haven assets, and their trend is exactly opposite to that of the US dollar.

But gold and Bitcoin compete with each other. If there is no gold, the price of Bitcoin will perform better; conversely, if there is no Bitcoin, the price of gold will be higher. The emergence of cryptocurrencies such as Bitcoin has diverted the safe-haven function of gold and also curbed the high price of gold.

Ordinary people do need to pay attention to the price trends of gold and cryptocurrencies. Physical gold and cryptocurrencies provide important ways to avoid taxes and transfer assets.

Central banks around the world buy gold because they see the trend of the end of the US dollar’s interest rate hike and the possible rebound of gold. However, in April, the amount of gold purchased by the Chinese central bank has significantly decreased, and it may gradually suspend the purchase of gold in the next two months (May or June).

The long-arm jurisdiction and financial hegemony of the United States make many countries hope to “de-dollarize”, and there have been many cases this year. But this is a long process that requires years of effort. China increased its holdings of US Treasury bonds in March, ending seven consecutive months of divestment, indicating that “de-dollarization” exists and is difficult.

For most investors, the biggest enemy in the long-term investment process is excessive volatility. I think ordinary investors should have a very core logic, called “stick to high probability events and prepare for low probability events”.

What is a high probability event? That is, the whole world is still generally on the track of peace and development, so in this direction, it is actually to follow the traditional asset allocation in the past, and options like the stock market and bond market are still worth considering, which is also the mainstream of most Chinese investment directions.

A low probability event is something like the conflict between Russia and Ukraine. To prevent such an event from having a major impact on family assets, our investment portfolios should have greater antifragility by properly allocating defensive assets.

For investors with a certain amount of capital, gold can be added to the asset allocation portfolio because gold has a relatively high non-correlation with stocks and bonds, which makes the entire family asset portfolio more stable and smooth. Within the range of risk tolerance, then consider some digital assets. A diversified portfolio can reduce volatility.

Some people call bitcoin digital gold, but it should be noted that assets like bitcoin have high volatility and many speculators. For individual investors, they must be aware of and understand the risks and not invest too much proportionally.

In the past, individual investors may have only focused on single assets, such as real estate in China, or mostly on markets like the S&P 500 for Americans.

Looking to the future, asset allocation is a very important means for ordinary people to achieve long-term wealth appreciation, and the core is to allocate your assets in different categories, with good long-term return rates.

Central banks around the world buy gold. In the short term, first of all, it is to ensure the health of the assets and liabilities of each country from the perspective of financial stability. In the long run, in the past decade, the trust in the US dollar around the world has been declining. In the past, everyone thought that the US dollar was equivalent to gold, which was a global consensus after the Bretton Woods system was dismantled.

However, this consensus is not so strong now, so people need more anchors that can hedge and stabilize the finances and currencies of various countries, and gold is currently the mainstream choice.

“De-dollarization” is an undoubtedly certain trend from a long-term perspective of ten or twenty years. Because the whole world will develop towards multipolarity, there will be multiple forms of currency competing for the global value storage status.

In the short term, in the past one or two years, the phenomenon of “de-dollarization” has not been so serious due to various forms of instability. Because in this situation, many people will trust the US dollar because they have no other choice. So I think the long-term and short-term trends of “de-dollarization” are different.

The global economic downturn is basically set in stone, and to re-emerge, I think we need to look at three things.

▶▷ First, how the Russia-Ukraine conflict develops.

▶▷ Second, whether the competition between China and the United States eases or even reconciles.

▶▷ Third, whether the new technology industry can really exist in the long term.

Overall, in the process of global economic turbulence, buying gold in troubled times can play a role in preserving value.

And now Bitcoin is called digital gold, so after binding the concept of gold, it can also be one of the ways to hedge in troubled times.

However, physical gold and Bitcoin are not currencies after all, and they have the characteristics of not being very convenient for trading and realizing value, so when investors buy gold or Bitcoin, they should fully consider the issue of liquidity.

The overprinting and overissuance of the US dollar may make the US dollar depreciate into worthless waste paper.

Various central banks that used to use the US dollar as the main reserve currency have shaken their confidence. Especially after the epidemic, the debt crisis has made bank failures go from worrying to reality, so central banks around the world use gold as a reserve and make it a safe-haven asset.

Various countries generally have a desire to “de-dollarize”, but their strength is not enough, and it will take a relatively long period of time.

We also need to “de-dollarize”, but we still can’t beat the US dollar. At this time, we need to bide our time and strengthen China’s strength.

Strategically, we need to “de-dollarize”, but tactically, we cannot mention it too much.

The entry point for wanting to “de-dollarize” is the trading of bulk commodities. The key is how to make the new trading mechanism, especially the currency mechanism, no longer anchored to the US dollar.

But it is currently difficult to find this cracking mechanism. Bitcoin can accelerate the process of “de-dollarization”, but the total amount is only 21 million, and its role is very limited.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What is the value of the Unisat domain name, given that the total transaction volume since its launch is only $40,000?

- Bitcoin developers are debating whether to adjust the code to curb Ordinals and BRC-20 token activity.

- What impact will the upcoming legalization of stablecoins in Japan have on the market?

- Bitcoin domain name BNS speculation frenzy: opportunity or risk?

- The next trillion-dollar market? Global financial giants are rushing to embrace RWA tokenization

- Pre-Musk’s call Milady: A “cyber psychopath” pushed to the extreme

- What impact will the upcoming legalization of stablecoins have on the market in Japan?