Flashbots: Restraining all parties, committed to thoroughly decentralizing MEV

Flashbots: Decentralizing MEV with restraint.Original Text: “The Road to Decentralization of MEV from FlashBots” by BadBot

MEV (Miner/Maximal Extractable Value) refers to the potential value that miners or validators can obtain in blockchain transactions. It is the profit generated by the transaction order and packaging selection method. The sources of MEV include Front Running, Back Running, Sandwich Attack and more. For more information about MEV, please see “An Analysis of the Development Status and Trends of MEV.”

Flashbots has launched a series of MEV solutions, dedicated to establishing a fair, transparent and secure transaction environment. This article will take stock of the efforts made by Flashbots to decentralize MEV.

Flashbots Auction- Decentralization of Miners

In the PoW era, the main participants in MEV include searchers and miners. Miners have the right to mine and have privileges in transaction sorting, queue jumping, and tampering, which account for the bulk of the profits. At the same time, searchers are willing to pay high gas fees to ensure that their transactions are included in the block. In some cases, searchers may pay out 90% or more of the MEV as a reward to miners.

- MEME Coin: From Internet Meme to a Market Cap of Over One Billion, What’s Behind the Power?

- When AI meets blockchain: ushering in a new era of human-machine integration

- What are the recent movements of Crypto VCs? 7 tools to help you easily track

Obviously, this privileged position poses a threat to the privacy and security of transactions, causing negative externalities such as network congestion and gas competition.

Flashbots Auction provides a private communication channel between Ethereum users and miners, negotiating the execution order and price of transactions in a transparent and fair manner.

- Auction submission: Searchers submit transactions packaged into bundles to the Flashbots auction system, specifying a minimum price to display the potential value of the transaction;

- Miner bidding: Miners bid on the bundle they are interested in in the auction system, specifying the minimum price they are willing to accept;

- Building blocks: Miners select one or more bundles with the highest bid from the auction system and include them in the block;

- Settlement and execution: Transactions and bundles included in the block will be executed according to the order and price reached in the auction.

Through Flashbots Auction, searchers no longer need to ensure that their transactions are prioritized through Gas War and do not need to pay the cost of failed transactions. This makes MEV distribution more fair and reasonable, greatly improving the security and execution efficiency of the Ethereum network.

MEV-Boost- Decentralization of Validators

In the PoS era, PoW miners are replaced by validators (who can become validators by staking 32 ETH and running an Ethereum client), and a validator is randomly selected to be a proposer to pack and submit transactions to the Ethereum mainnet in each Epoch.

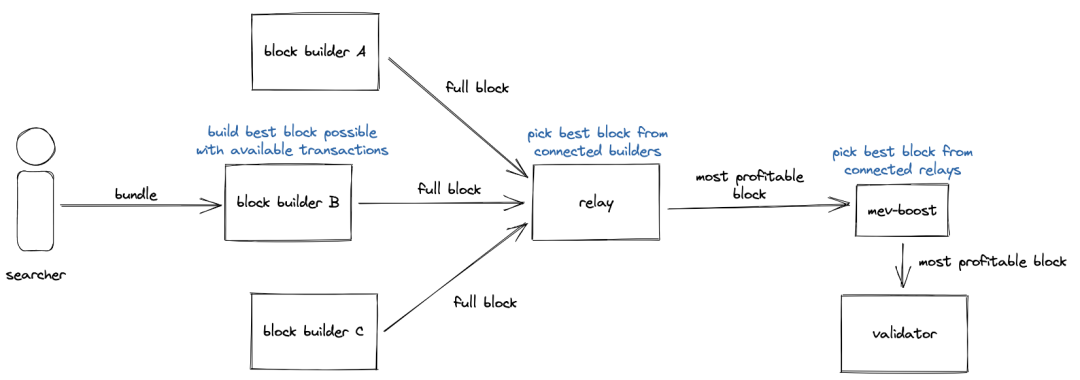

Flashbots Auction introduces MEV-Boost and a new role called Builder, who is responsible for constructing blocks. By separating proposers and builders through PBS (Proposer-Builder SeBlockingration), it promotes validator competition, decentralization, and censorship resistance. Meanwhile, validators access MEV-Boost to reduce the threshold for finding the most profitable transaction, which can significantly increase staking rewards.

Image source: Flashbots

Searchers find transactions with arbitrage opportunities through mempool and other channels, bundle them with their own transactions, and send them to block builders;

Block builders try to select the most profitable bundles to pack into blocks and send them to Relay;

Relay actually hosts the block packed by the builder for validators. Relay forwards the block header to MEV-Boost. After validators sign the block header to lock the commitment to pack the block, Relay forwards the complete block to validators;

Validators sign the commitment to become block proposers, responsible for proposing blocks to the network and adding them to the chain.

Suave – Decentralizing Builders

Although MEV-Boost brings many benefits, it also faces the problem of centralization of builders. Currently, a few builders monopolize most of the block construction.

The main reasons for the centralization of builders are:

- EOF (exclusive order flow), such as builders cooperate with wallets, Dapps, etc. to obtain exclusive order flow by modifying user default RPC;

- Cross-chain MEV, where cross-chain builders capture multi-chain transactions, leading to further centralization of the entire blockchain network.

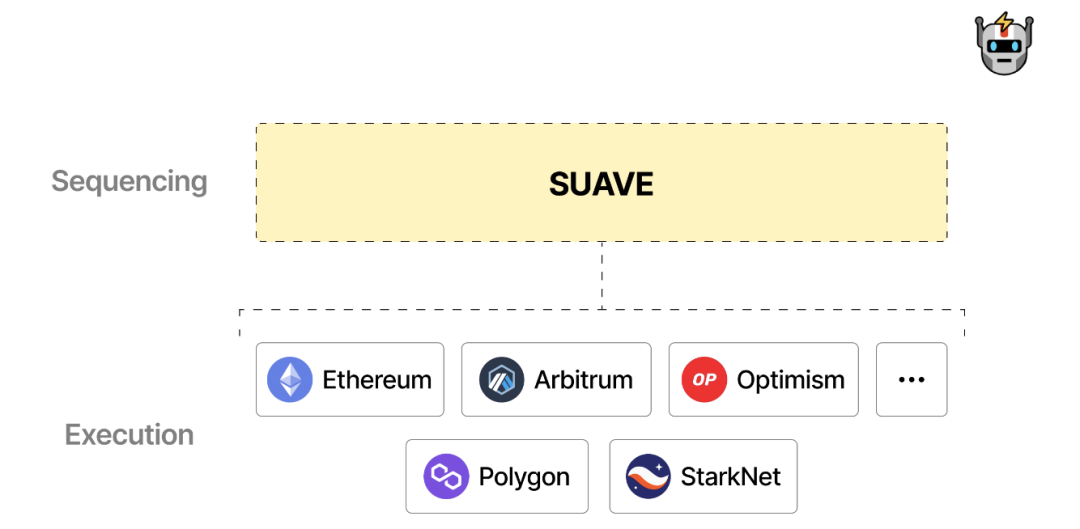

Therefore, Flashbots has launched Suave, a highly specialized, plug-and-play independent network that separates mempool and builders from the existing chain and shares the same sorting layer for multi-chain to ensure decentralization.

Image source: Flashbots

The architecture of Suave is based on user transaction preferences, consisting of expressing, executing, and settling preferences.

Universal preference expression: Suave’s mempool publicly and transparently displays all EVM chain users’ transactions. Users can express their transaction preferences when initiating transactions;

Best execution market: Executors listen to transactions in the mempool, fully compete to propose the optimal execution price, and return part of the MEV to users;

Decentralized block construction: Beyond the single-block builder, a decentralized block construction network is formed, and the network shares order flow and Bundles. Without leaking the specific content of transactions, it collaborates to complete block construction. Since builders can package MEV generated by multiple chains, this also allows builders and validators to earn higher MEV income.

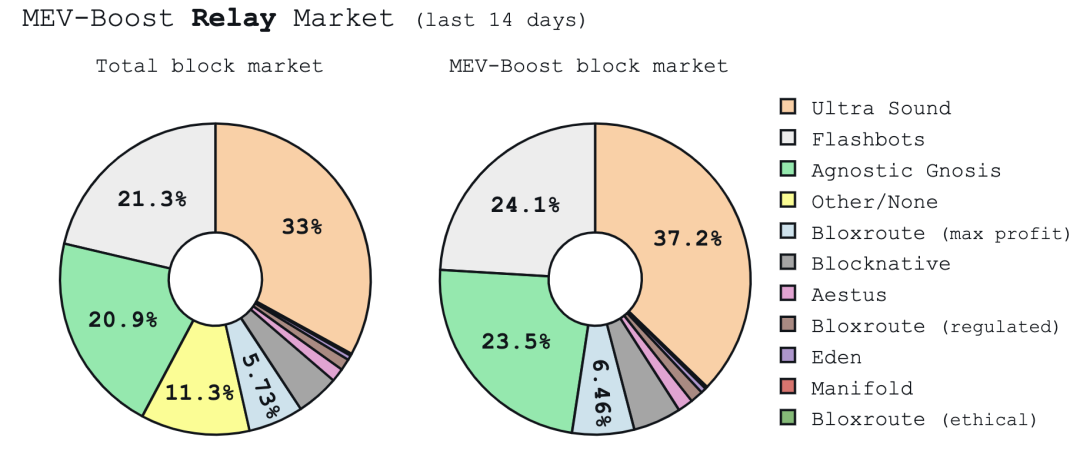

Decentralized Relay

Currently, the centralized problem of Relay in the MEV-Boost ecosystem has not been completely resolved, and Relay plays a trusted role in the entire MEV chain. As one of the largest Relay operators in the market, Flashbots provides free use to validators, which leads to a lack of motivation for new Relay operators to enter the market. Currently, high concentration of Relay may cause problems such as single-point failures and transaction review. Some Relay will collude with Builder, prioritize forwarding blocks of cooperation Builder, and refuse or delay processing some normal transactions, thus affecting the full competition of the market.

If head Relay operators such as Falshbots continue to provide subsidies, Relay will be difficult to form a market scale to promote decentralization.

It is worth noting that Flashbots is no longer the largest Relay provider. Ultra Sound is an optimistic Relay that is permissionless, neutral, and resistant to censorship. We are pleased to see the increase in Relay diversity, and of course, this is also inseparable from Flashbots’ open source support for new Relays such as Ultra Sound and Agnostic Gnosis.

IOBC has invested in the Bloxroute project’s Relay, which forwards transactions to MEV-Boost via Flashbots. The Bloxroute BDN network has Relay distributed worldwide, so using Bloxroute Relay will have higher success rate and speed. In 2022, Bloxroute reached a cooperation with the Flashbots white hat team, allowing Flashbots customers on BNB Chain to use BloXroute BDN for fast and reliable transaction experience.

Image source: mevboost.pic

Where will MEV “roll” to?

Mempool: Profitable orders are the starting point of MEV. This part of entrepreneurs mainly rolls BD, looking for more wallets, Dapps, and other RPCs to connect to their own, in order to protect transaction privacy and obtain exclusive order flow. Some projects will also return part of the MEV income to users through the protocol layer, such as Flashbots’ MEV-share.

Builders: This group of entrepreneurs mainly focuses on hardware and strategy to provide services securely and stably, which is a basic factor for a builder to be selected, and the strategy directly affects MEV profits. Some entrepreneurs also eye the cross-chain MEV cake, as the value of MEV that can be extracted from a single chain is limited.

Validators: The threshold for validators is constantly decreasing, making it one of the best ways for retail investors to participate in MEV. Entrepreneurs targeting validators mainly focus on pledging ETH liquidity, which is the LSDfi track. Currently, the LSDfi track is also quite crowded.

The future development of MEV still faces some challenges:

1. Cross-chain MEV. With the development of Layer2, more and more transactions are flowing from Layer1 to Layer2, but the block generation and sorting of Rollup are processed by Sequencer, and MEV is exclusively extracted by Sequencer, becoming an important source of profit for Rollup. The emergence of shared sequencers may solve this problem.

2. Redistribution of MEV profits. Currently, most of the MEV is extracted by validators, and the unfair distribution of interests among various parties may lead to a stronger willingness to do malicious things.

Although the head effect of the MEV track is obvious, it still continues to attract more developers to enter the dark forest. In fact, there are still many aspects of MEV that are worth exploring in-depth, such as the capture of MEV in modular blockchains, and the impact of re-staking on the MEV supply chain, etc. We also look forward to better solutions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- a16z partner jonlai: the most successful application is the packaged game

- How Blockchain Is Impacting Online Poker

- Blockchain in the annual report of listed companies: a comparative analysis of six state-owned banks

- More than 60 organizations in Europe and the United States jointly developed: Rehabilitation Certificate for New Coronavirus Patients Based on Blockchain

- Blockchain war "epidemic" action (1): big data application

- Observation | Is the open source of the blockchain the biggest flaw in the business model or the strongest defense?

- Video: Blockchain opens a new chapter in medical health (Part 1)