A Summary of a Cryptocurrency Project Attempting Hybrid Rollup

Summary of a Hybrid Rollup Cryptocurrency ProjectAuthors: 0x Facai, Jaleel, BlockBeats

On June 16th, the Frax Finance stablecoin protocol announced the launch of Fraxchain, an Ethereum Layer 2 network that enables native support for all Frax assets. Fraxchain will use a hybrid rollup scaling solution that combines OP Rollups and ZK Rollups to achieve better scalability, faster finality, and enhanced security against competitors, which has attracted a lot of attention from the crypto community.

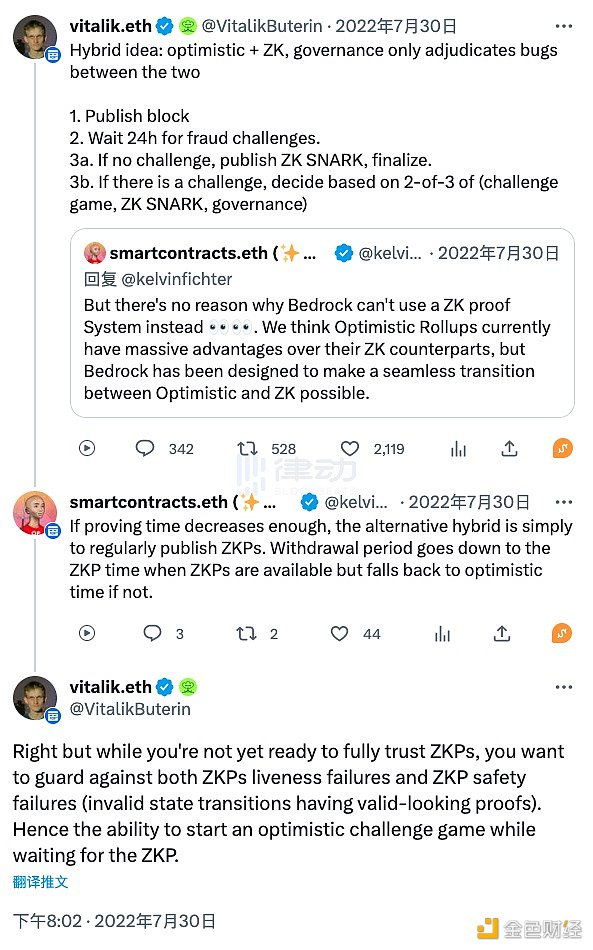

In fact, this combination of the Rollup approach is not new. As early as July 2022, Kelvin Fichter, the core developer of Optimism, developed the Optimism Bedrock architecture and proposed this hybrid approach, stating that “Optimistic Rollup currently has advantages over ZK similar products, and Bedrock aims to make a seamless transition between Optimistic and ZK possible”, and discussed it with Ethereum co-founder Vitalik Buterin.

Following Kelvin Fichter’s approach, Ethereum co-founder Vitalik Buterin also gave his opinion: combining Optimistic Rollups with ZK Rollups and using governance only to solve bugs between the two. The process is to: 1) publish a block, 2) wait for a 24-hour fraud challenge period; 3) (a) if there is no challenge, publish a ZK SNARK for final confirmation; 3) (b) if there is a challenge, make a decision based on two of the three options (challenge game, ZK SNARK, and governance).

- Blur V2 is now online, with updates including a 50% reduction in Gas fees and bidding based on Trait.

- Quickly browse 15 popular GameFi projects on the blockchain in one article

- Evening Must-Read | A Quick Look at 15 Popular GameFi Projects on the Blockchain

With more and more players joining the competition for Layer 2 scaling, this Rollup hybrid approach is becoming more and more widely applied. In addition to Optimism, multiple teams are now researching and attempting Hybrid Rollups. What are Hybrid Rollups? Why choose Hybrid Rollups? Which teams are developing in this field? BlockBeats provides an analysis and summary in this article.

What is a Hybrid Rollup?

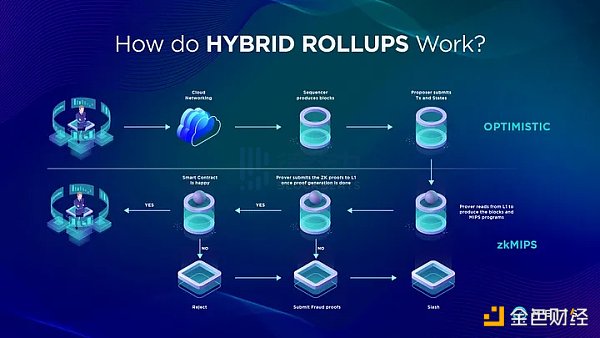

Hybrid Rollup is a Rollup approach that combines Optimistic Rollups and ZK Rollups to optimize product functionality to the greatest extent possible, find the best fit between the product and the market, and achieve Product-Market Fit.

To understand what Hybrid Rollup is, it is necessary to first understand what Optimistic Rollup and ZK Rollup are.

First, Rollup is one of the Ethereum scaling solutions that transfers the calculation and storage of transactions on the Ethereum mainnet (Layer 1) to Layer 2 for compression and then uploads the compressed data to the Ethereum mainnet to expand Ethereum performance.

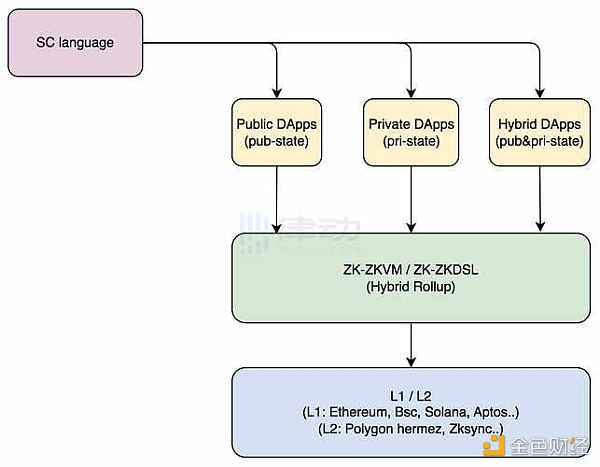

Essentially, users do not send transactions to miners on L1, but instead send them to Rollup servers to execute transactions outside of the Ethereum main chain. However, these Rollups publish transaction data to the Ethereum main chain. When transactions are published to the main chain, they inherit L1’s security attributes. Rollups are typically programmable, so they need to support smart contract (SC) languages for developers to develop DApps. However, because Privacy is incompatible with EVM (Ethereum Virtual Machine), Solidity cannot be used directly to develop privacy-type DApps. This requires a customized smart contract language to support the development of public and private contracts. Of course, because different types of state trees need to be maintained, VM module adaptation is required.

Rollups typically run on the second layer and have the flexibility to run on the third layer.

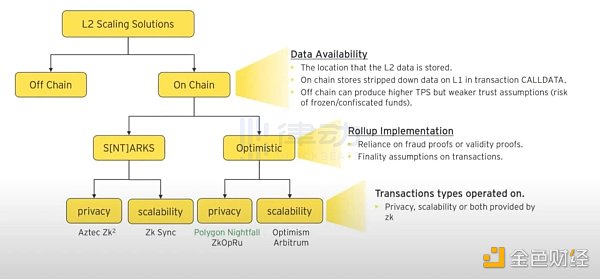

Rollups can be divided into ZK Rollup and Optimistic Rollup depending on different solutions to ensure the validity of compressed data (i.e. data correctness).

ZK Rollup is a Rollup solution that uses zero-knowledge proofs, with ZK standing for zero knowledge. The difference from other Rollups is that ZK Rollup uses zkSNARK (a zero-knowledge proof algorithm) to compress data and ensure security.

Optimistic Rollup is literally an optimistic Rollup, which optimistically assumes that the data synchronized to Layer 1 is correct. If anyone thinks that the synchronized data is incorrect (i.e. fraudulent), they can challenge it during the challenge period. Therefore, this proof method is also called fraudulent proof, which ensures that the data finally synchronized to Layer 1 is valid.

Hybrid is a solution that combines the two Rollup schemes and supports more contract types, including public, private, and mixed contract types. For developers, they can freely choose contract types based on their own needs. For users, it also has a high degree of freedom, allowing them to freely choose transaction types in mixed contracts.

The following chart briefly depicts the positioning and function of Hybrid Mixed Rollup. Currently, there are known projects dedicated to building in this direction. Although the technical details of each project may differ, they all have a common vision: to bring more possibilities, higher security performance, more real-world scenarios, and more daily users to the blockchain industry.

Which teams are trying Hybrid Rollups?

Although the OP+ZK Rollup technology may seem distant from us, many well-known cryptographic protocols and projects have already tried in this field. In addition to Frax Finance, which recently announced the L2 network Fraxchain, there are many top teams that have made their own products. BlockBeats has briefly sorted out these protocols and projects.

Frax Finance

According to The Block, on June 16, the hybrid algorithm stablecoin protocol Frax Finance announced the launch of an Ethereum Layer 2 network named Fraxchain, which will create a smart contract platform focusing on the decentralized finance field. All Frax assets will be natively supported on Fraxchain. Sam Kazemian, co-founder of Frax Finance, revealed that Fraxchain is likely to be launched at the end of this year.

In addition, Sam Kazemian, founder of Frax Finance, recently revealed in the “Flywheel DeFi” podcast that unlike most second-layer expansion solutions on the market, Fraxchain will use a Hybrid rollup expansion solution that combines OP Rollups and ZK Rollups. This means that Fraxchain will be built on the Optimistic rollup architecture and integrated with zero-knowledge proofs to achieve better scalability, faster finality, and enhanced security against competitors.

It is worth noting that the network will use Frax stablecoin and Frax Ether (Frax liquid staking derivatives) to pay transaction fees. Some of the fees generated in this second-layer network will be destroyed or redirected back to the Ethereum mainnet and allocated to holders of FXS governance tokens.

Metis

On March 3 this year, MetisDAO, which focuses on L2 construction, stated in a blog post that the Ethereum Layer 2 network Metis is developing a hybrid Rollup based on the combination of Optimistic Rollup (OPR) and zero-knowledge proofs (ZKP), combining the scalability of Optimistic Rollups with the security of ZK Rollups. At the same time, Metis stated that developing this new architecture will be one of its top priorities and that the technology will be open-sourced.

In the Metis Andromeda 2023 roadmap, Hybrid Rollup occupies a large portion, which shows Metis’ importance to it.

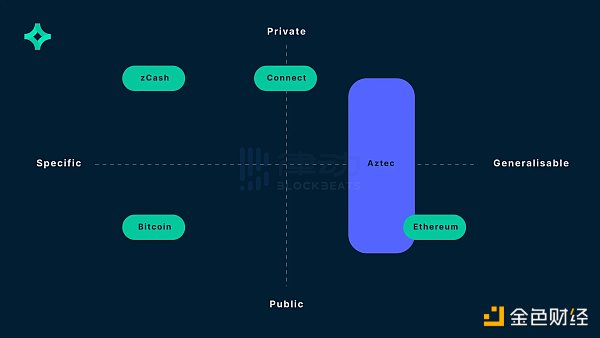

Aztec announced on May 4th that it will launch a public and private hybrid zkRollup network that will continue to use Aztec’s name. This network can execute public and private smart contracts in one environment, which will help expand the design choices for developers on the chain.

Aztec allows smart contract logic to be executed in a public and private way while still inheriting the security advantages of Ethereum. On Aztec, privacy is optional, not mandatory. Its goal is to expand Ethereum by providing functions that have privacy function calls, transaction privacy, and user anonymity while all data remains public. This allows users to protect sensitive information from leakage while still being able to share this information with relevant agencies when necessary to achieve compliance purposes. Aztec also stated that the team is currently completing the basic contract deployment and is expected to establish a local test network before the third quarter of 2023, and users are expected to access mature public test networks before the beginning of 2024.

In May last year, Polygon established a partnership with global professional services and technology company Ernst & Young (EY) and released version 3.0 of Nightfall. Polygon Nightfall is essentially an Optimistic Rollup that uses zk encryption to protect privacy. The most prominent feature is the effective combination of the backbone concept of Optimistic Rollup with the zero-knowledge (ZK) cryptography commonly used in ZK-Rollups, thereby achieving the fusion of scalability and privacy.

In fact, as early as 2019, EY released the initial version of Nightfall. The most different point from other zk solutions is that Nightfall is a rollup with privacy as the focus, and EY positioned it as “one of the most prominent privacy solutions on Ethereum.” Specifically, every transaction on Nightfall contains privacy, which means that if Alice sends an asset to Bob, others will not see what the asset is, how much value it contains, or where it is going.

The reason why more emphasis is placed on the privacy of transactions is because EY targets corporate clients. At the beginning, Nightfall tried to build the first enterprise-level blockchain directly on Ethereum, but finally found that privacy on the Ethereum mainnet was too expensive, so it turned to L2 and ultimately chose to cooperate with Polygon.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Share 3 projects that received funding during the bear market and identify potential winners.

- ZK and AI-driven new project: Noya, how to maximize liquidity mining profits?

- Decentralized Ethereum staking protocol ssv.network announces mainnet launch plan, expected to achieve permissionless full operation in Q4 of this year.

- BlockingncakeSwap V3 has been officially deployed to the Polygon zkEVM mainnet.

- SBlockingrtan Labs: Review of 5 notable projects from ETHGlobal Waterloo Hackathon

- IDO & IEO: Inventory of 8 popular projects to be launched in July

- A Summary of Projects Using OP Stack