Further observation on the staking track: What other potential projects are there besides EigenLayer?

What other projects are possible on the staking track besides EigenLayer?Author: Beehive Validator; Compiled by: DeepTechFlow

Currently, Staking is one of the largest areas in the DeFi market, with Lido’s staked total value (TVL) ranking first. It allows ETH holders to earn more profits and increases the decentralization and security of the Ethereum network.

Since Ethereum switched to PoS, the demand for Staking ETH has grown sharply, leading to the development of liquidity staking protocols. Currently, a large number of blockchain platforms, including Ethereum, Near, BNB Chain, Avalanche, Cosmos, Sui, Aptos, and others, use the PoS consensus mechanism. Therefore, we believe that the potential of the liquidity staking market is enormous.

So, why use liquidity staking?

- Understanding the five core principles and unique features of ZKStack

- Comprehensive Interpretation of the StarkNet Ecosystem: Which Projects are Worth Paying Attention to

- Proto-Danksharding may become the biggest narrative of the year, which projects will benefit?

Liquidity staking solves the main problems of simplified staking, unconstrained liquidity, and increased network decentralization. In the DeFi market, we are closely following the issue of unlocked liquidity, such as the Lido protocol, which allows users to stake ETH and receive stETH of the same value, with the ability to operate in the DeFi market by transferring it to other exchanges.

ReStaking is one of the activities involving the reuse of liquidity staking token assets (such as stETH) to stake in validators on other networks or blockchain platforms. The concept was originally introduced by EigenLayer, which maximizes the utilization of liquidity staking liquidity and paves the way for the development of many other applications.

What Is ReStaking?

ReStaking is the use of liquidity staking token assets for staking with validators on other networks and blockchain platforms to earn more returns while still contributing to the security and decentralization of the new network.

ReStaking can also be understood as using a portion or all of the rewards obtained from staking to continue depositing with that node to increase future profits. However, the main focus of this article is on the concept of staking LSD tokens on other networks.

Through ReStaking, investors can get double returns from both the original network and the ReStaking network. Although ReStaking enables stakers to earn greater returns, it also carries the risk of smart contract failures and validator staking behavior fraud.

In addition to accepting the original assets, the ReStaking network also accepts other assets such as LSD tokens, LP tokens, etc., which increases the security of the network. And while still generating actual income for the protocol and its users, it releases an infinite source of liquidity to the DeFi market.

Both the ReStaking network and the standard network generate revenue from fees generated by security leasing, validators, dApps, protocols, and layers. Stakeholders on the network will receive a portion of the network’s revenue, and may also receive inflation rewards for the network’s native tokens.

How ReStaking Works

The ReStaking network is similar to other networks, except that it accepts more low-volatility, low-risk, and security-enhancing assets. When the value of the network’s stake is high, hackers need to acquire most of the stake, which requires a lot of assets. In addition, ReStaking assists holders in increasing profits.

Each ReStaking project will have different goals and operating mechanisms, but the differences between them are small.

Advantages and Disadvantages of ReStaking

Advantages:

-

Unlocking the liquidity of LSD and LP tokens: Pledging LSD or LP tokens to validators can increase the amount of the original assets pledged on the native network and provide more liquidity asset choices for the DeFi industry.

-

Increasing revenue: By approving the asset on both networks, the pledger can earn double the income. In addition, after pledging assets in the second network, investors can continue to earn assets that can represent the asset, which can be used as collateral to mint stable coins and bring to the DeFi market to create profits.

-

Increasing the security of networks that use liquidity pledging: As more assets are pledged, the value of the network increases, making it more resistant to attacks and becoming a trusted location for other decentralized applications, protocols, and platforms.

-

Reducing sell-offs: ReStaking makes the original token more useful, avoiding sell-offs that can cause significant value loss for the project and its investors.

-

Increasing the motivation of original asset holders to participate in pledging: Increasing the security and decentralization of the network.

Disadvantages:

-

Asset loss risk: If a node engages in improper behavior, your assets are at risk of being confiscated or fined, which may result in partial or total loss of assets.

-

Smart contract risk: If the network is hacked, you run the risk of losing all of your assets. However, in theory, the networks of projects that use liquidity staking are highly resistant to attack.

-

Asset bubble: Inflation of the market value by doubling the value of new Wrap Tokens or Tokens, resulting in the market value no longer reflecting its true value. In addition to the platform, continuing to use assets that represent the value locked in validators to mint stablecoins increases risk and makes the original asset more vulnerable to liquidity.

-

Too many tokens on the market: When there are too many tokens on the market, DeFi novices are easily confused and susceptible to scams. Especially low-quality projects that mint large amounts of junk tokens will flood the cryptocurrency market.

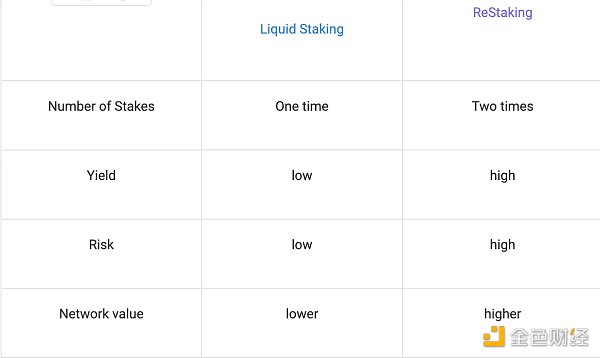

Comparison of Re-Staking and Liquidity Staking

Excellent Projects in the ReStake Field

EigenLayer

EigenLayer is developed by a highly respected and experienced team in the cryptocurrency market. The project has received up to $64.5 million in funding support from well-known supporters such as Blockchain Capital, Coinbase Ventures, Polychain Capital, and Electric Capital.

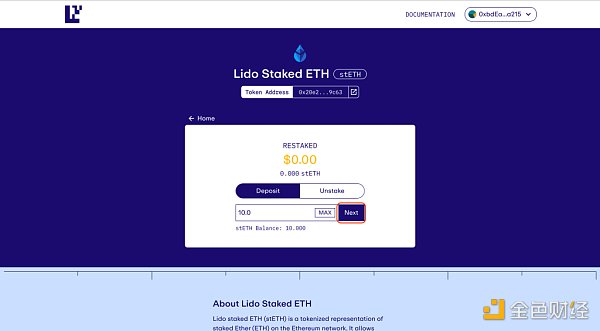

EigenLayer is the first team to develop and introduce the ReStake model to the community. The project uses LSD ETH and LP ETH for validator staking. Ethereum network nodes continue to participate in Ethereum network validation.

EigenLayer’s main business model is secure leasing and validation. Customers can be dApps, Layer 2 protocols, or cross-chain bridge protocols. They can use high-security or low-security validators, depending on their requirements. A single validator can authenticate multiple consumers.

Protocols that adopt this network will generate revenue for EigenLayer. Part of the assets will be granted to the stakers. Users do not receive a second token when staking assets on the EigenLayer network. In addition, users must choose reputable validators to ensure the security of their assets. If a validator engages in improper behavior, the network will fine them, which may result in partial or total confiscation of assets. Therefore, those who authorize validators will also lose their assets.

Advantages and Disadvantages of EigenLayer

Advantages:

-

EigenLayer is the foundation for many other dApps, protocols, Layer 2, Layer 3, and clients.

-

The structure of attaching validators to a single layer can multiply the network’s value. Minimize the risk of being hacked by punishing validators for inappropriate behavior.

-

Ethereum nodes can earn additional income by participating in the EigenLayer network. In addition, a single validator can validate multiple clients.

-

Maximize the profit of holding LSD ETH and LP ETH assets and their applicability.

-

Staking ETH has attracted many people due to the enhanced security and high yield of the Ethereum network.

Disadvantages:

-

Smart contract risks, you may lose all assets if the network is hacked. However, theoretically, the network of projects using ReStaking is extremely difficult to attack.

-

When nodes behave improperly, they may be subject to penalties, and your assets are at risk of being confiscated or fined, which may result in partial or permanent loss.

-

When branching or problems occur, the Ethereum community may be split. As Vitalik recently said, EigenLayer reused ETH assets and validators on Ethereum.

-

EigenLayer must develop a large enough ecosystem and customer base. If incentives are distributed in the form of project tokens, or if there are no incentives, profits are no longer attractive to those who choose to stake.

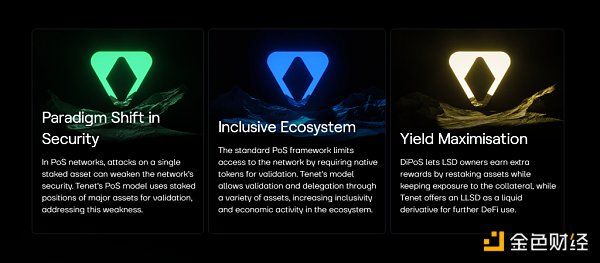

Tenet

Tenet is the L1 of the Cosmos ecosystem and was developed using the Cosmos SDK toolkit. The project was developed by the same team that developed the largest liquidity staking project ANKR in the BNB Chain ecosystem and Cosmos ecosystem.

Tenet and other blockchain platforms adopt the PoS consensus mechanism and integrate project governance Stake Tokens into validators to ensure network security. Compared to networks that accept LSD Token assets such as Ethereum, BNB Chain, Cosmos, Cardano, Polygon, Avalanche, and Polkadot, Tenet is more advanced.

Investors who participate in asset pledging will be accepted and issued tLSDToken tokens. This asset can be used as collateral for the Mint Stablecoin LSDC to continue to profit from the DeFi market.

Tenet’s business model includes charging fees to the network and compensating validators. In addition, the network provides TENET governance tokens as a reward for each generated block. The reward will be proportional to the staked shares. The weight of TENET is always 1, and DAO will determine how much weight other assets should have, which will all be less than 1.

When borrowing LSDC, the borrower only needs to pay a one-time fee, which is calculated as a percentage of the total assets, ranging from 0.5% to 5%. Or convert LSDC on TENET; users only need to bear a one-time exchange fee ranging from 0.5% to 5%. All of these fees will depend on the conversion activity on the network; if the activity is low, the fees will be cheap, and vice versa, to ensure that the value of LSDC is anchored at $1.

Pledging TENET will receive veTENET, which can participate in project governance, share profits, and receive additional rewards.

Tenet has created a large enough revenue ecosystem to attract investors, which is still the most important factor. If the network activity is slow and no users use TENET tokens as a reward for each new generated block, the network will not be able to develop.

Tenet’s pros and cons

Pros:

-

Supports multiple native tokens from other blockchains.

-

Pledge and obtain tLSDToken tokens as collateral, enabling Mint Stablecoin LSDC to participate in the DeFi market and obtain greater profits.

-

Provides interest-free LSDC loans based on a Mint fee of 0.5% to 5% based on network activity.

-

When conversion activity is high, the fees are also high, and vice versa. This mechanism helps to maintain the price of LSDC.

-

The veToken model using TENET governance tokens is very good, and it can prevent the dumping of Token TENET when veTENET holders can participate in the index and share profits.

Cons:

-

There are smart contract risks and underlying asset liquidation risks when borrowing Stablecoin LSDC.

-

Every new generated block rewards TENET Tokens, leading to inflation.

Predictions for ReStaking

Currently, the largest market in the DeFi industry is Staking, with a total value of approximately $20 billion (TVL). With many blockchain platforms currently under development, the cryptocurrency market is expanding rapidly. As a result, the ReStaking market will have many growth opportunities.

With the contribution of Staking and ReStaking to the expansion of the DeFi market, the underlying blockchain becomes more secure, and investors receive greater passive income. Additionally, the development of these two markets will pave the way for the growth of other markets, such as AMM, Lending, and Farming.

In the current market, ReStaking has many opportunities to grow and become an essential part of DeFi. In addition to increasing profits, ReStake also increases the risk exposure of participants.

Summary

By the end of 2022, approximately six months after the emergence of ReStaking, this market will expand rapidly and become a trend. ReStaking is not a narrative that will disappear quickly, but one of the most important and promising areas of DeFi.

This is because ReStaking helps users not only to earn profits but also to improve the security of the platform, especially by promoting the growth of other areas of the industry and driving market expansion.

However, this also comes with risks, such as asset loss, smart contract risks, property value inflation, and bubble bursts. Therefore, we must be cautious and tolerate the risk of capital loss when participating in this market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 5 noteworthy zkSync ecosystem projects inventory

- Long Push: In-depth Analysis of Pendle, the LSD Genius Project that Grew 10x in Six Months

- Analysis of Asymetrix: An LSD-based Asymmetric Profit Distribution Protocol

- Circle’s 15 potential projects to watch in 2023

- Perform data analysis and comparison for the (3,3) section projects, bribery efficiency ranks as follows: Thena > Velo > Chronos > Pearl.

- New Project Preview | LSDFi: Lucid Finance to Assist Emerging LST Protocol in Gaining Liquidity

- Exploring the Ethereum Layer2 network Fraxchain