Opinion Supporting the US dollar with Bitcoin would restrict the Federal Reserve’s ability to respond to economic crises.

The US dollar supported by Bitcoin could limit the Federal Reserve's crisis response.Author: JAMES BICKERTON, Newsweek; Translator: 松雪, LianGuai

Robert F. Kennedy Jr.’s proposal to support the US dollar with Bitcoin has been criticized by cryptocurrency experts, with one economist pointing out that the plan is an “almost impossible feat” that would limit the Federal Reserve’s ability to respond to economic crises.

Earlier this month, Kennedy made a speech at an event hosted by the “Bridge the Divide Super PAC,” which is associated with prominent Republicans who support Donald Trump. He claimed that supporting the US dollar with hard assets, including Bitcoin, would “restrain inflation and usher in a new era of American financial stability, peace, and prosperity.”

Kennedy is currently running for the Democratic Party’s nomination for the 2024 presidential election, although polls show him far behind President Biden who is seeking re-election. Kennedy is an environmental activist who later became skeptical of vaccines, and he is using his campaign to challenge what he sees as ongoing attacks on free speech and to oppose the Biden administration’s military aid to Ukraine.

- Token Economics 101 How to Create and Accumulate Real Value?

- JPMorgan Chase and the Clash of Bitcoin Adaptability is the Core of Financial Evolution

- Data Consensus Rebuilding the Trust System and Returning Digital Oil to Individuals

When talking about bridging the divide, Kennedy said, “My plan is to start on a very, very small scale, perhaps 1% of the issued national debt would be backed by hard currency, gold, silver, or Bitcoin.”

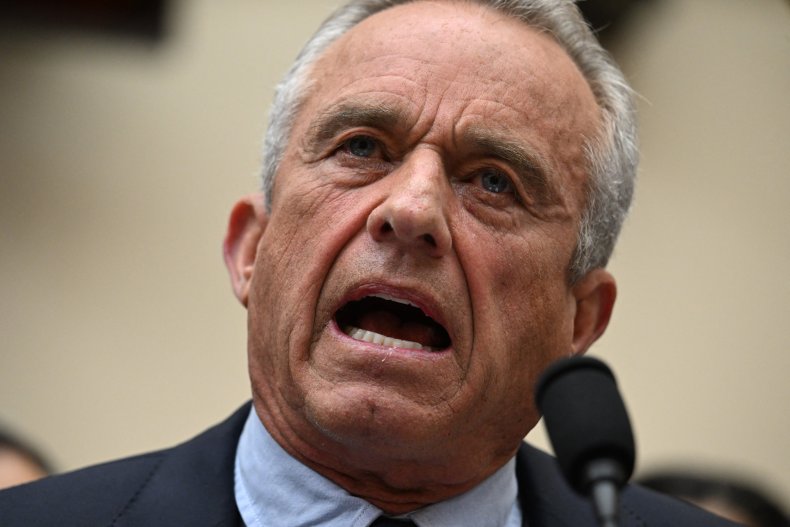

Robert Kennedy Jr. testified at a hearing in Washington, D.C. on July 20, 2023. Kennedy’s proposal to support the US dollar with Bitcoin would limit the Federal Reserve’s ability to respond to financial crises.

Treasury bills are short-term government debt sold by the Department of the Treasury, with the funds raised used to support government expenditures.

Kennedy also pledged to “exempt capital gains tax on the exchange of Bitcoin for dollars,” believing that this would create more job opportunities in the United States and safeguard free speech.

He said, “Non-taxable events are non-reportable, which means the government will have a harder time weaponizing currency against free speech, and as many of you know, that is one of my main objectives.”

Jean-LianGuaiul Lam, a cryptocurrency expert and associate professor at the University of Waterloo in Canada, strongly criticized a policy he called “essentially a return to the gold standard.”

Lam pointed out, “Considering all the issues associated with Bitcoin, such as price volatility, security, and limited flexibility, it is almost impossible for Bitcoin to serve as the currency backing for any country.”

“However, the main and potentially fatal flaw of the gold-bitcoin standard is that it would severely limit the ability of the Federal Reserve to respond to economic downturns and provide necessary monetary stimulus during crises. For example, imagine how the Federal Reserve would have dealt with the 2008-2009 financial crisis or the COVID-19 pandemic under a gold standard (it would have been unable to prevent economic catastrophes).

Lam said, ‘The drawbacks of the gold standard far outweigh any benefits we might gain from it. This issue has been thoroughly debated and resolved. It is not worth further discussion.’

Billy Bambrough, a senior contributor at Forbes who specializes in cryptocurrencies, also expressed concerns, stating that Kennedy’s plan would create ‘a certain level of uncertainty that the market may struggle to cope with.’

Bambrough said, ‘As we’ve seen recently in the UK, short-lived Prime Minister Liz Truss attempted to defy economic realities, and unorthodox or unconventional economic policies can lead to market turmoil and make these positions unsustainable.’

Bambrough pointed out that Kennedy’s campaign team is ‘the first to include the rights to create, buy, sell, and hold digital assets such as Bitcoin on the [presidential] ballot.’

Kennedy described Bitcoin as an exercise and guarantee of civil liberties during his speech at the Bitcoin 2023 conference in May. He said, ‘As president, I will ensure that your right to hold and use Bitcoin is not infringed.’

“

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpreting the RWA track of on-chain real estate Can it revolutionize the traditional trading and leasing market?

- Interview with Uniswap Founder Handing Over Routing Issues to the Market through UniswapX

- Can blockchain revolutionize the traditional real estate transaction and leasing market?

- Tokyo vs Kyoto Japan’s Cryptocurrency Twin Cities

- Reading the Bitcoin ETF 5 futures ETFs with total assets of nearly $1.3 billion. How much does the news of the Bitcoin application affect?

- Analysis of Bitcoin ETFs The total assets of 5 futures ETFs are nearly 1.3 billion US dollars, how much impact does the application news have on Bitcoin?

- Some ‘dirt’ on the SEC Chair