The fourth halving of Bitcoin is imminent, will the cryptocurrency market repeat yesterday’s story?

Bitcoin's fourth halving is approaching. Will the cryptocurrency market go through a similar scenario as yesterday?

Author | Terry

Produced by | Plain Language Blockchain (ID: hellobtc)

- Why has the significant discount on GBTC gradually narrowed recently?

- Exploring the Vietnamese crypto market VC interest is growing, NFT community is rising

- Exploring the Reasons behind the Low Adoption Rate of DeFi in the South Korean Cryptocurrency Market

With the continuous changes in the “atypical bear market”, the narrative of “halving” in the crypto world, which has never faded, is gradually approaching. Currently, there are about 9 months left until the fourth Bitcoin halving, which is expected to be on April 26, 2024, when the block reward will be reduced from 6.25 BTC to 3.125 BTC.

Everything in the past is just a prologue. As one of the most important narratives in the crypto industry, “Bitcoin halving” has always been a remedy to boost market confidence. Now that the bear market is faintly audible and the footsteps of the bull are uncertain, will this halving cycle follow the same rhythm as before?

01. The Historical Cycle of Halving

For the crypto industry, every halving is a grand event, especially the first two halving cycles of Bitcoin, which saw astonishing price increases of tens of times (in the short term, both halvings were followed by short-term declines due to the exhaustion of bullish factors, but after the adjustments were completed, they entered into a long-term uptrend).

However, starting from the third halving in 2020, due to the significant increase in the number of industry practitioners, market attention, and the improvement of supporting infrastructure, Bitcoin is no longer a niche product confined to the geek circle, but has begun to interact with more external factors.

In summary:

Before the first two halvings (2012, from 50 BTC to 25 BTC; 2016, from 25 BTC to 12.5 BTC), geeks in the industry were more concerned about the possibility of Bitcoin as electronic cash;

In the third halving (2020, from 12.5 BTC to 6.25 BTC), the focus on Bitcoin shifted to its role as a payment tool, which also triggered a series of debates (the subsequent BCH fork was almost the top topic in the industry);

In the fourth halving cycle (2024, from 6.25 BTC to 3.125 BTC), Bitcoin has become an alternative asset, and the focus has shifted to traditional institutions and capital deployment.

Therefore, compared to the first two halvings, the third halving of Bitcoin was unprecedentedly heated. At the same time, the overall global political and economic environment during the third halving of Bitcoin also affected its performance:

Under the influence of macro factors, in the two months leading up to the halving on May 11, from March 12th to March 13th, Bitcoin plummeted from $7,600 and first oscillated to $5,500. It then continued to break through support levels, reaching a low of $3,600, evaporating a total market value of $55 billion, and causing over 20 billion RMB worth of forced liquidation on the entire network, achieving a “halving of price” accurately.

However, after the halving in May, DeFi Summer started a new bull market cycle, and Bitcoin skyrocketed to $60,000, nearly 20 times higher than the previous low point before the halving.

Overall, according to the rules of the historical halving cycle, from a traditional perspective, the price of Bitcoin will return to half of the previous bull market price during the halving – that is, by April 2024, the price of Bitcoin may be around $30,000.

It is highly likely that a new bull market cycle will begin after the halving, and although it may be difficult for the current volume to achieve an increase of more than 10 times, surpassing the previous bull market high of $60,000 is still highly anticipated.

02, New Variables: Similarities and Differences

However, at the same time, with Bitcoin having undergone three halvings, the block reward reduced to 6.25, and the number of Bitcoins mined exceeding 19 million, many situations and things have reached a point where they need to be rethought from a new perspective.

Especially in addition to this round of Bitcoin halving, there have been some new variables worth paying attention to in both the industry and Bitcoin itself.

(1) Ethereum’s Transition from PoW to PoS

Firstly, last year Ethereum completed the transition from PoW to PoS. Now, as the two largest cryptocurrencies by market capitalization, Bitcoin and Ethereum have become the leading cryptocurrencies representing PoW and PoS, respectively, bringing their competition into a new era.

After transitioning to PoS, newly minted Ethereum will only be produced through PoS staking. According to current data estimates, after The Merge upgrade, Ethereum is expected to have an annual PoS minting of approximately 660,000 ETH.

However, according to the data from ultrasound.money shown in the above chart, since The Merge, the circulating supply of Ethereum has not increased but has decreased by nearly 300,000 ETH, entering a deflationary era, with the current annualized deflation rate being 0.289%.

This is not only due to the support from the on-chain burning after Ethereum’s London upgrade in 2021, but also because the new issuance of Ethereum under the PoS mechanism is much less than that under the PoW mechanism:

Under the PoW mechanism, nearly 5 million ETH is newly minted each year, which is nearly 8 times the amount under the PoS mechanism (660,000 ETH). If we estimate based on this data, Ethereum will still be in an inflationary state, with an annualized inflation rate of up to 3.26%.

Therefore, the transition of Ethereum from PoW to PoS, combined with the support of on-chain burning, has successfully entered the deflationary era. Compared to the effects of Bitcoin halving, the impact on the supply side is undoubtedly more direct, to a certain extent weakening the attractiveness of Bitcoin halving. This is also one of the biggest variables of this halving compared to the previous ones.

(2) Transaction Fee Revenue

According to the halving rule of Bitcoin, the block reward starts at 50 bitcoins, and the rule is halved every four years. It has been halved three times so far, resulting in 6.25 bitcoins. The next halving will occur in 2024. This process will continue until the year 2140, when Bitcoin will no longer have block rewards;

However, transaction fees will continue to exist. Therefore, with each round of halving, block rewards will gradually decrease and eventually approach zero. In the future, miners’ income will become very single, consisting only of transaction fee rewards.

This year, especially with the prosperity of the Bitcoin ecosystem, especially BRC20, a new wave of “BitcoinFi” has emerged, and the activity of internal transactions in the Bitcoin ecosystem has reached a new peak, thereby boosting the increase in Bitcoin’s transaction fee revenue.

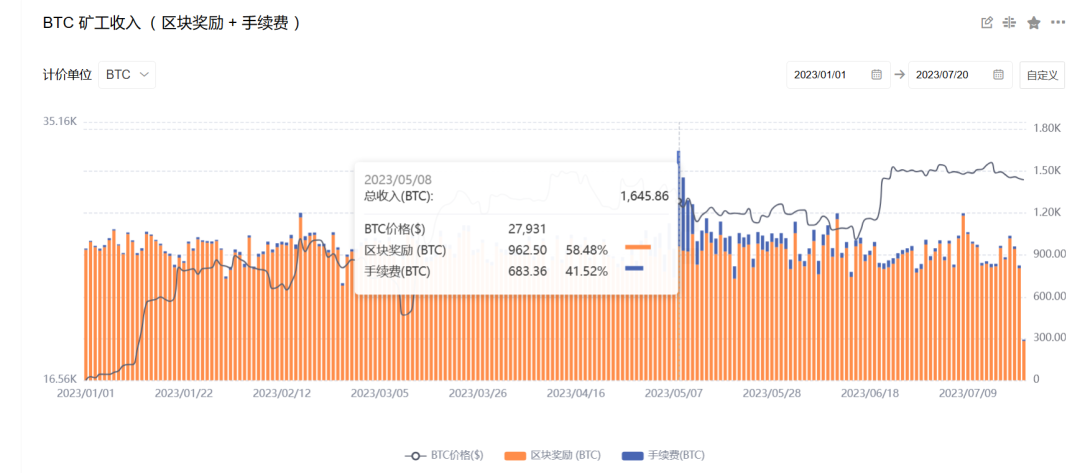

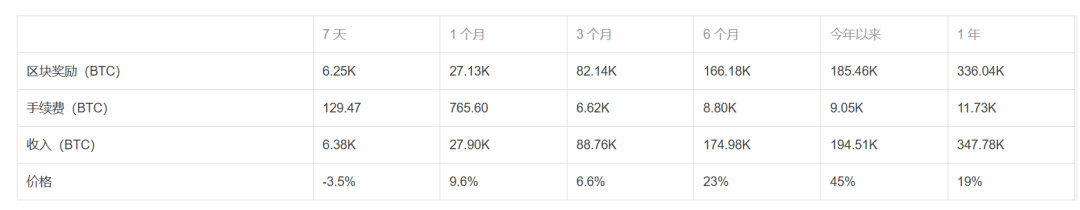

Image source: https://www.oklink.com

On May 8th, the BTC mining fee income reached a nearly 5-year high, reaching 683.36 BTC (about 19.08 million US dollars), accounting for 40% of the miner’s total income that day.

In the past, the historical average data of miner’s fee income was usually only about 2%. However, the average data in the past three months has reached about 8%, setting a new record (although the proportion of recent fee income has fallen back to the level of about 2% before).

Image source: https://www.oklink.com

But as the subsequent block rewards gradually decrease until they approach zero, the importance of transaction fees will become higher and higher, until they eventually become the only source of income.

The BRC20 in the first half of this year can be regarded as a preview. Regardless of its success, with the upcoming Bitcoin halving, the exploration on this path will undoubtedly receive more attention.

03. What is the impact of this halving?

In fact, in addition to the halving of Bitcoin, after Ethereum transitions to PoS, old tokens that adopt the PoW mechanism and start using it this year also face their own “halving” nodes:

Litecoin’s time node is approaching, and it is expected to halve on August 3rd this year-the block reward will be reduced from 12.5 coins to 6.25 coins. Recently, Litecoin’s secondary market performance has also fluctuated widely, but overall it has performed better than most other assets.

BCH is similar to Bitcoin in terms of timing, and it is expected to halve on April 5th, 2024-the block reward will be reduced from 6.25 coins to 3.125 coins. Recently, BCH has also experienced a wave of significant increases.

This also provides plenty of imagination space for the Bitcoin halving in 2024, and the capital in the industry has always liked to collectively gamble on the “halving event.” The overall growth of the industry and Bitcoin will be determined by factors such as the continuously increasing computing power, new hardware, and the upcoming halving of rewards, especially now:

As of the latest mining difficulty adjustment for Bitcoin at block height 798,336, the mining difficulty has been significantly increased by 6.45% to 53.91T, reaching a new historical high and nearly doubling compared to a year ago.

However, against the backdrop of the carbon neutrality issue and the soaring global energy prices this year, the biggest narrative difference between PoS and PoW networks is that PoS networks consume less energy and are “more environmentally friendly.”

Of course, PoW has unique advantages in the face of increasingly tightened regulations – so far, cryptocurrencies based on PoW have been classified as commodities, complying with existing regulatory rules, while PoS coins have regulatory risks of being classified as securities.

04. Summary

Overall, we are now in the middle of a new halving cycle – there is still a window period of more than half a year before the Bitcoin halving event, and there may be a reaction period of one to two years after the halving event.

This may also be the first (or second) time that the majority of practitioners and investors in this round have witnessed and experienced the “halving event” of Bitcoin. The future direction of Bitcoin and this round of the cycle after the halving event is still unknown.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- NYDIG What impact will the forecasted market size of Bitcoin spot ETF have?

- If the Bitcoin spot ETF is approved in the United States, how much capital will it bring to the market?

- Will Financialization Destroy NFTs? An Exploration of the Impact of NFTFi on the Market

- How does Ethereum build ‘brick by brick’ for the metaverse?

- Interpreting the Current Situation of Digital Asset Custody Opportunities and Challenges for Institutional Investors.

- Robert F. Kennedy Jr Will Support the US Dollar with Bitcoin if Elected President

- Interpreting the Current Situation of Digital Asset Custody Opportunities and Challenges for Institutional Investors