Can blockchain revolutionize the traditional real estate transaction and leasing market?

Can blockchain revolutionize real estate transactions and leasing?Author: Jeff@Foresight Ventures

Summary:

-

On-chain real estate can split the asset structure and rights of real estate, and separate property rights, income rights, and usage rights. These three can be traded separately. In particular, on-chain real estate can also be split into multiple layers in terms of time scale.

-

The core of the current development of on-chain real estate projects is how to solve the problem of scene fragmentation in the process of being put on the chain. Platform tokens, DIDs, and on-chain payment platforms have the opportunity to become tools to solve the black box problem.

-

The current compliance architecture has potential risks, and there is a lack of firm rights relationship between the NFT in the hands of buyers and SPV companies.

- Tokyo vs Kyoto Japan’s Cryptocurrency Twin Cities

- Reading the Bitcoin ETF 5 futures ETFs with total assets of nearly $1.3 billion. How much does the news of the Bitcoin application affect?

- Analysis of Bitcoin ETFs The total assets of 5 futures ETFs are nearly 1.3 billion US dollars, how much impact does the application news have on Bitcoin?

-

It is recommended to try bridging uncommon asset categories, such as extremely cheap distressed assets and extremely expensive scarce assets, and bind the rights NFT of fragmented property rights to solve the real trading needs of buyers and sellers.

-

It is recommended to try to segment user circles and refine usage scenarios, for example, serve the rental needs of digital nomads well, and use the native web3 genes of this group to create small and beautiful business models.

In the competition of the RWA track, the core of innovation is the splitting and recombination of asset structures. The total market capacity of the real estate industry reached 11 trillion US dollars in 2022. It is worth paying attention to how to bridge such a large market to the chain and form a new market ecosystem. This article summarizes the on-chain real estate projects on the market, proposes common problems faced by on-chain real estate projects, and puts forward corresponding assumptions.

1. On-chain solution ideas for Korea’s full rental housing problem

The real estate crisis caused by Korea’s full rental housing system fully demonstrates the many problems in the traditional real estate transaction chain. The full rental housing system refers to the system where tenants pay 60-70% of the total value of the house as a deposit to the landlord and can use the house without rent for a fixed period (usually 2 years). Due to the lack of transparent regulatory mechanisms, the deposit used by tenants to offset rent is fully invested by landlords in new properties, and then continues to circulate through the full rental housing system for cashing out. The real estate market is very fragile under high leverage. Once there are problems such as a significant decline in house prices, loan default, and the breakage of the funding chain, it will become precarious. Therefore, many landlords choose to quietly run away when they cannot return the deposit. Since the deposit paid by the tenant can only represent the landlord’s personal debt, they can only receive a small amount of compensation from the debt settlement after the house is auctioned with a lower priority.

Can the problems caused by full rental housing be avoided through on-chain real estate projects? Here are the main market problems and corresponding on-chain solutions.

-

Problems with default of funds such as deposits.

By paying deposits on-chain, tenants can effectively track the flow of funds and debt situation of landlords, and timely alert the situation of “insufficient assets to cover liabilities”. Smart contracts can also specify the unlocking date of funds and automatically return the deposit or guarantee to the payer.

-

Lack of background check platforms for landlords and tenants, especially for tenants who cannot assess the risk of housing mortgages.

If the ownership of the house is put on-chain and an NFT is generated, tenants can clearly trace the mortgage status of the ownership NFT and effectively avoid “high debt” landlords. This reduces unnecessary trouble.

-

If the landlord defaults on debt, the tenant can only wait for compensation with lower debt priority because they do not hold the ownership of the house.

If the ownership NFT is further fragmented on-chain, tenants can receive proportionate ownership NFT when paying the deposit, and return the corresponding NFT upon receiving the deposit. If the landlord defaults and needs to be liquidated, they can also obtain corresponding compensation based on the corresponding ownership NFT.

-

Real estate transaction markets have local limitations.

In the process of default property liquidation and auction, by putting ownership on-chain and minting NFTs, the geographical restrictions of real estate transactions can be effectively reduced, and the range of users participating in transactions can be expanded from local to all on-chain users.

-

Restrictions on bulk transactions in real estate.

Most full rental housing is concentrated in prime locations in Seoul, and the high individual prices deter ordinary investors. By fragmenting the ownership NFT, buyers can only purchase a portion of the fragmented ownership NFT, greatly reducing the investment amount restriction.

2. Target Pain Points and Core Links of On-Chain Real Estate Projects

Referring to the above examples, we have supplemented potential market pain points and issues in the real estate chain and categorized them into three core links for discussion: transaction link, leasing link, and mortgage loan link.

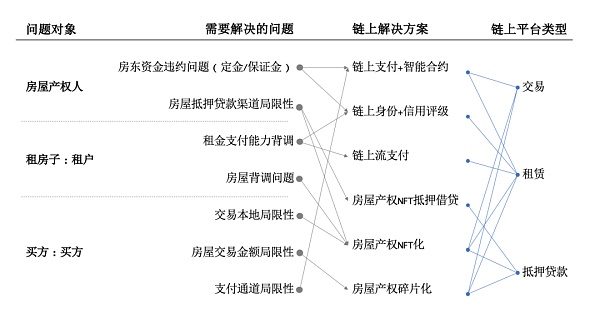

Figure: Summary of Market Pain Points and On-Chain Solutions

In the transaction link of real estate, the buyer’s needs are often given the highest priority. Existing on-chain real estate projects mainly split the property rights and usage rights, recombine the transaction content with the dimension of time, and try to solve potential market problems through on-chain payments, on-chain identities, property rights NFTs, and their fragmentation.

-

Eliminate the limitations of local transactions, and make the housing information more real and reliable through on-chain property background checks.

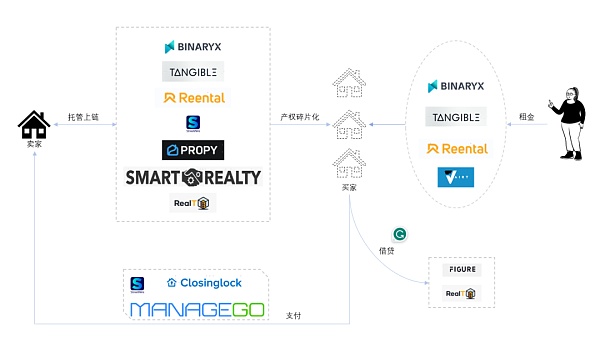

It is not difficult to understand that on-chain platforms provide global investors with a free investment window. Platforms like Tangible package the property rights into the Special Purpose Vehicle (SPV) in the location of the property and mint all property rights certificates, housing information, etc. into property rights NFTs. Global traders can directly purchase the NFTs of the houses through their portal website, which represents ownership of the corresponding property. In this process, Tangible platform advances 10% as a deposit to the seller, and then opens the subscription to the buyer. The buyer decides whether to purchase after reading the property rights and information of the house.

-

Prevent failure to refund assets such as earnest money deposits and ensure fund security through on-chain payments.

By using on-chain payments for house deposits, smart contracts can be set up and time limits can be specified to automatically hold the defaulting party liable for losses. On-chain payments can also increase fund transparency and provide early warning for risks. In the description above, if the subscription is not completed within the agreed period after Tangible advances the deposit for selling the house, the deposit will be automatically refunded to the Tangible platform.

-

Eliminate the limitations of transaction amounts and reduce the entry threshold for purchases.

Users can customize their investment amounts. In order to lower the entry threshold for cross-border property purchases, platforms like RealT split the property rights of houses for a second time, some by fragmenting the property rights of real estate, allowing small-scale investors to voluntarily subscribe to quotas; others by splitting the property rights and rental income of houses, allowing users to only purchase future rental income for a certain number of years. In addition, CityDAO fragments the ownership of land by registering DAO companies, giving buyers not only property rights but also governance rights.

-

Eliminate limitations of payment channels.

The regulatory issues faced by fiat currency transactions also trouble global traders. As a result, platforms like Smart Reality and ManageGo have specially established virtual currency payment channels, which can custody down payments. Based on mutual agreement between the buyer and seller, settlements can even be made directly in virtual currencies. As an intermediary, platforms like Closing lock monitor the security of funds and charge corresponding commissions.

The issues surrounding the leasing process mainly revolve around rent collection and property safety. Currently, leasing platforms in the market have not fully implemented leasing activities on the blockchain. Without exception, the platforms Tangible, BinaryX, and Reental have all adopted a combination of web2 outsourcing companies to ensure that tenants pay rent on time. However, there is more room for exploration in managing property leasing on the blockchain.

-

On the blockchain, both the tenant’s ability to pay rent and the landlord’s property background can be verified.

Through blockchain-based leasing, landlords can observe tenants’ activities on the blockchain to assess their assets and ability to pay, and propose corresponding deposit payment plans. Tenants can also use the property’s blockchain-based ownership information to assess the reliability of the rental property. Currently, StreetWire is working on a series of functions in this area.

-

On the blockchain, deposit payment ensures asset security, and payment platforms make rent payment mandatory.

As mentioned in the previous case of full rental housing in Korea, after deposit payment on the blockchain, tenants’ interests can be protected through fractional ownership. For traditional monthly rental models, blockchain-based payment platforms can use smart contracts to enforce timely rent payment by tenants, and ensure that the deposit is refunded promptly when the rent is due. We have already seen successful cases of timed rent payment on the Sablier platform.

-

Fractional ownership NFTs make rental income from properties divisible and combinable.

Fractional ownership NFTs can distribute the collected rent to each landlord according to the ownership ratio through smart contracts. External adjustment factors can also be introduced to dynamically adjust leasing conditions based on market demand. This way, ownership NFTs become combinable, and users can freely sell “lease contracts” and impose time limits. The leasing platforms Tangible and others mentioned earlier have already developed the functionality to split rental income. In addition to this model, platforms like Vairt are also attempting to bring short-term rentals to the blockchain to deal with property vacancies.

The mortgage loan process for real estate is currently in a market void, with only RealT and FIGURE attempting to provide mortgage lending functions for fractional ownership NFTs. However, due to factors such as the immaturity of the market pricing mechanism and imbalanced supply relationships, it has not yet gained widespread market recognition. In addition, lending platforms aimed at reducing the cost of home buying are also in a market void, and there is currently a lack of Buy Now Pay Later (BNPL) functionality in the market.

III. Regulatory Framework and Asset Security

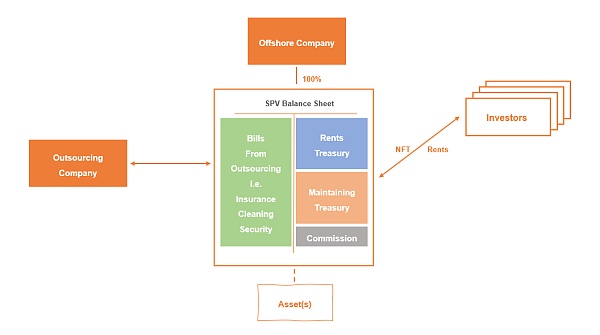

Ensuring the compliance of blockchain-based property rights is the most concerning issue in my research. Currently, almost all blockchain-based real estate projects bypass market regulations by using offshore holding SPVs. However, I believe this method is not entirely safe and effective.

Figure: Diagram of the SPV architecture for on-chain real estate projects

Here, we take Tangible’s compliance solution as an example. The UK properties sold on the Tangible platform are held by independent UK SPVs. The offshore entity of Tangible platform directly holds the shares of each SPV company. The fractional ownership NFTs of the houses are issued and sold to buyers by the SPV entity. To some extent, the security and legality of the house transactions are protected. However, strictly speaking, the fractional ownership NFTs do not directly represent the corresponding SPV shares.Once the parent company or SPV encounters a debt dispute, since the fractional ownership NFTs cannot directly confirm property rights or even correspond to any shares of the offshore company, buyers are highly likely to end up empty-handed. The asset security problem that was originally intended to be solved on the chain is now entirely dependent on the trading platform itself, which indirectly increases additional risks. In addition, if the fractional ownership NFTs are issued by the SPV company, everything will return to the regulatory dispute over whether tokens should be defined as securities.

From this, it can be seen that the only solution to bypass regulation and ensure asset security is to strengthen the supervision of SPV companies. CityDAO has given us a good example in this direction.By registering a DAO-formatted company to protect the interests of each NFT holder. We look forward to seeing how CityDAO performs after breaking through geographical limitations in the future.

So, does the SPV company have the risk of debt disputes? Yes, especially the high risk of default in the rental process of houses.

-

Reserve fund risk: Taking Tangible as an example, the platform deducts a total of 7% of the total value of the properties as vacant reserve and repair reserve funds. If the reserve fund falls below the above ratio, 20% of the rental income will be withheld or the rental payment will be suspended to make up for it. The reserve fund, as a non-on-chain asset, is not transparent in real operation. Since the SPV company has the right to dispose of the reserve fund, it is highly likely to use the reserve fund to pay the deposit for subsequent auctioned houses or even for other purposes. Once the houses cannot be rented out for a long time and the funds from the sale of other properties are not returned in a timely manner, the SPV will face the risk of debt default.

-

Mortgage risk: Since the property rights of the houses are owned by the SPV company, users cannot monitor them in real-time in actual operation, and the SPV company may mortgage the houses and use the loaned funds for other investments, which also increases the risk of debt default.

What other problems have not been solved? What could be the solutions?

In my opinion, the black box problem in the process of being put on the chain is the most crucial issue that needs to be solved. The disconnect between on-chain and off-chain scenarios leads to uncertainty in on-chain transactions and leases. This uncertainty directly leads to the following problems:

-

Scarcity of high-quality assets: Good houses can be sold offline without any problem, but online real estate needs background checks before being put on the chain. This additional step may lead to lower transaction efficiency compared to offline real estate intermediaries. The real estate resources that users can see on the chain are often properties that are difficult to sell offline, or they may incur costs higher than the market level. How to improve the efficiency of putting assets on the chain and continuously supplement the housing supply according to customer demand is also a problem that needs to be addressed.

-

Actual investment returns are much lower than expected returns: When calculating expected investment returns, the platform considers both the appreciation potential of the property value and rental income as expected returns. However, in the actual operation process, due to the outsourcing of property rental and management to external companies, factors such as rental duration and tenant default cannot be controlled. In particular, tenant default within Europe is a difficult problem to handle. If a tenant refuses to pay rent, the landlord can only enforce payment through legal means, a process that can take up to six months. This also means that the landlord will receive zero rental income for half a year.

-

Lack of liquidity for real estate on the chain: When purchasing real estate on the chain, ownership becomes fragmented. When owners want to resell their properties, they can only wait for buyers willing to purchase the equivalent fragmented ownership. Liquidity is relatively restricted, and in some cases, it can only be confined to the chain. Additionally, the market for on-chain real estate mortgage loans is in a vacuum and needs to be filled.

In addition to the black box problem, the business model of on-chain real estate platforms is not native to web3, and platform tokens have little empowerment. The entire ecosystem can only be awkwardly classified as an on-chain web2 platform.

-

Most tokens of on-chain real estate platforms do not have any functional use. We hope to increase the use cases of tokens to enhance user stickiness and stimulate the participation of non-investment users. For example, users who browse the website can also become participants and content contributors to the platform.

-

Over-reliance on outsourcing companies for rentals makes it impossible for users to form a sticky usage of the platform. In the rental process, we can introduce purely on-chain transactions by combining user DIDs and credit accounts to determine the amount of collateral that users need to pledge. At the same time, by integrating smart contract-controlled locks or power switches, we can prevent users from not vacating the property after the lease term expires. The maintenance process can also be incentivized through token rewards to improve user stickiness.

-

The platform overly relies on regional resources. Currently, 90% of on-chain real estate platforms are concentrated in the United States, while the global ranking of real estate transactions in 2022 is the United States, Japan, the United Kingdom, and Germany. The other countries and regions receive little attention, and there are few platforms that can connect to the global transaction market or rental market. I believe that the rental market is a native scenario for web3 users and is worth paying attention to. This will be discussed in detail in the following sections.

4. Open Ideas for On-chain Real Estate Projects

Although there are many problems with on-chain real estate projects, the biggest issue is that they have not effectively addressed the real needs of users. However, we still maintain a positive and optimistic outlook on this track, because there are still many niche scenarios and potential user needs that have not been adequately met.

In the real estate market, high-quality assets often lack liquidity. If we can broaden the category of real estate and then reclassify it, we can obtain more focused categories. We have listed two categories:

-

Extremely high-priced scarce immovable properties.

These are rare immovable properties with extremely high prices, which often deter ordinary people, such as castles, old mansions, wineries, farms, etc. These assets generally have extremely high individual prices and are not used to meet daily living needs. Middle-class investors can only admire them but do not have a good investment window. Moreover, these assets also face long transaction cycles, resulting in unsatisfactory liquidity. On-chain platforms provide a good solution by disassembling the property rights and usufruct of these assets. Take wineries as an example. If the wine production can be split during the winery transaction, the property rights of the winery represent the fixed amount of wine produced each year. After purchasing the property rights NFT, buyers can sell the wine produced each year, forming an innovative trading market. Through on-chain contracts, the property rights and usufruct can be dispersed on the timeline, allowing users to freely combine and trade, forming a non-standardized innovative market. This not only reduces the threshold for investors but also quickly improves the liquidity of these assets.

Figure: Concept of winery property rights and usufruct NFT

-

Extremely cheap distressed assets.

These assets are often acquired and reorganized by specialized acquisition companies. For example, abandoned buildings, dilapidated old houses in need of repair, etc. These assets often have commercial usage expectations after renovation, but similarly, there is no safe window for ordinary investors to enter. On-chain platforms can solve this problem by splitting the property rights NFT and the usufruct NFT, which can lower the investor threshold and provide a reasonable exit path. For example, for a house in need of repair, if it can be planned as a guesthouse or hotel, investors can enjoy the usufruct NFT for accommodation and then sell or use it in the sales market. At the same time, the entire fundraising process is centralized on the blockchain, making it easier for all investors to monitor the flow of funds and reduce improper project expenses.

Currently, existing on-chain real estate platforms do not effectively segment users, and the scenarios are relatively crude. By accurately segmenting target users, the leasing track can be tailored to better meet user needs and increase usage frequency. We have listed two possible scenarios:

-

Digital nomads are a large group within the web3 community. Currently, there are over 35 million digital nomads worldwide, and this number continues to grow. Digital nomads often reside globally and have a strong demand for rental housing. However, due to objective factors, they are unable to sign long-term lease contracts, and short-term rentals often come with a high market premium. I believe that launching an on-chain rental platform for digital nomads would be highly effective. They have a good understanding of the on-chain ecosystem, and most people can trace the source of their assets through on-chain activities, which also facilitates the traceability of landlords. An on-chain rental platform can further lock deposits through on-chain smart contracts, and users can also evaluate landlords’ properties. By tagging tenants and landlords with DID (Decentralized Identifiers) separately, the on-chain reputation can effectively constrain both parties.

Figure: Global distribution of digital nomads

-

Launching community-based real estate projects and creating autonomous communities similar to Anaya and CityDAO through “human mining” and the 2Earn mechanism of WEB3 platforms is also a new direction. Community members control the legal entities through ownership NFTs, benefit from and exercise reasonable autonomy rights through token release on the platform, and all property rights and interests can be sold or even mortgaged through the on-chain platform, forming a new community-based real estate model.

Stay optimistic

Although it may seem premature to discuss on-chain real estate projects at this moment, many issues are difficult to resolve in the short term. However, in the face of such a huge market capacity and real market demand, I am still optimistic. I believe that on-chain real estate projects can create innovative market ecosystems.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Some ‘dirt’ on the SEC Chair

- Bitcoin Lightning Network + Nostr Decentralized Social Payment New Paradigm

- Is CoinDesk selling at a loss with a valuation of $125 million after being in business for ten years?

- The fourth halving of Bitcoin is imminent, will the cryptocurrency market repeat yesterday’s story?

- Why has the significant discount on GBTC gradually narrowed recently?

- Exploring the Vietnamese crypto market VC interest is growing, NFT community is rising

- Exploring the Reasons behind the Low Adoption Rate of DeFi in the South Korean Cryptocurrency Market