Analysis of Bitcoin ETFs The total assets of 5 futures ETFs are nearly 1.3 billion US dollars, how much impact does the application news have on Bitcoin?

Analysis of Bitcoin ETFs The total assets of 5 futures ETFs amount to nearly $1.3 billion. How much impact does the application news have on Bitcoin?Author: Carol, LianGuaiNews

The world’s largest asset management company, BlackRock, submitted an application for a Bitcoin spot ETF to the SEC on June 15. Although the SEC will not respond to the review until September 2 at the earliest (related reading: “LianGuai Infographic | A Quick Look at the Key Time Nodes for the Review of Bitcoin Spot ETF Applications”), considering BlackRock’s global position in the asset management industry, this news is still considered an important signal, indicating that Bitcoin and other cryptocurrencies may be adopted by more institutions. In addition, other well-known institutions that have recently submitted Bitcoin spot ETF applications to the SEC include Fidelity, WisdomTree, VanEck, Invesco Galaxy, and more. With more institutions indicating their intention to enter the market, the market is confident in the arrival of more compliant crypto investment products.

What can institutional entry bring to the crypto market? To this end, LianGuaiNews’ data journalism column LianGuaiData analyzed the trading situation of already listed Bitcoin spot ETFs, futures ETFs, and trust funds, and found:

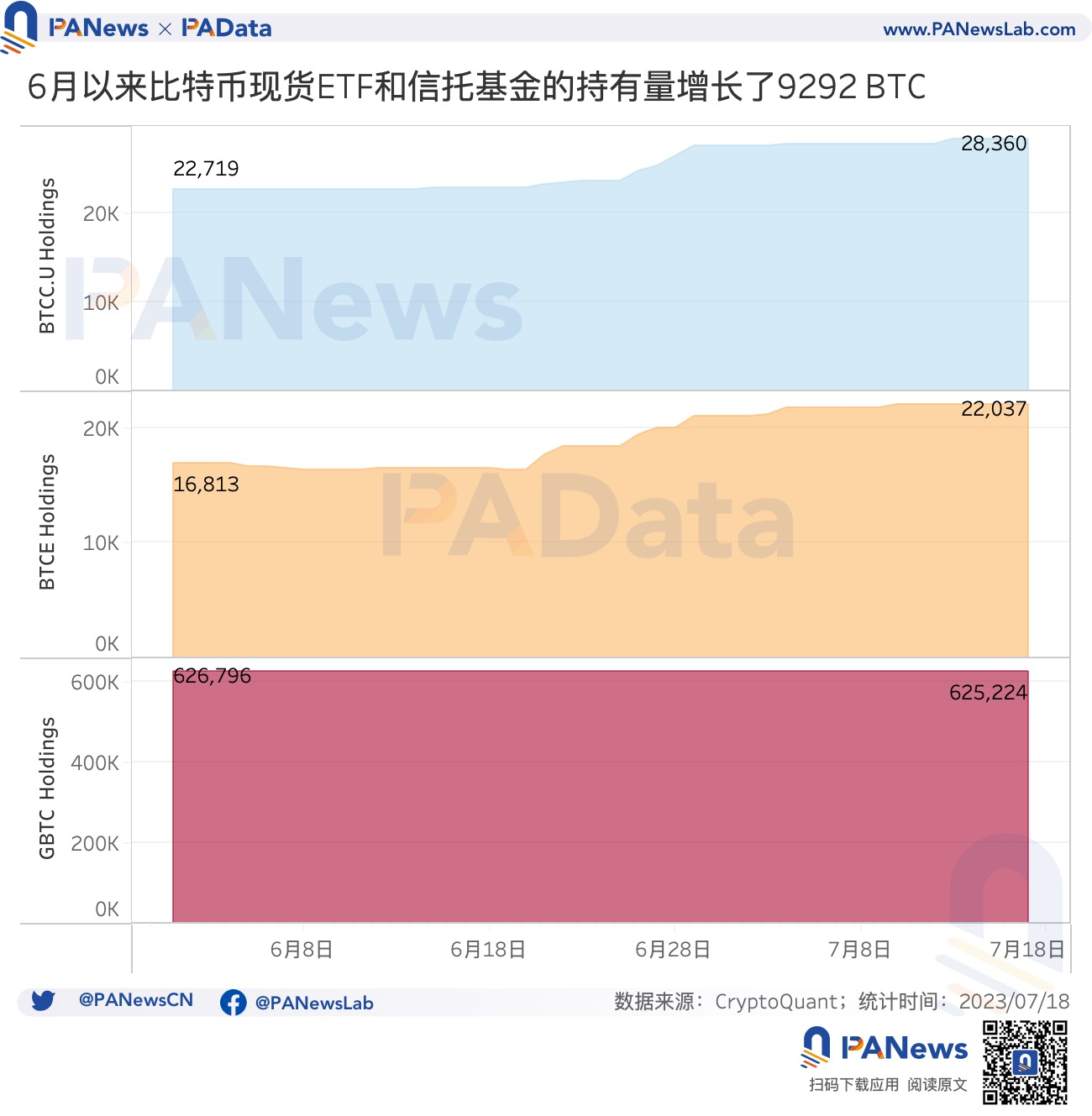

- The total holdings of the funds BTCC.U, BTCE, and GBTC are approximately 675,600 BTC (equivalent to 20.27 billion US dollars). Since June, it has increased by a total of 9,292 BTC, showing a good overall growth trend.

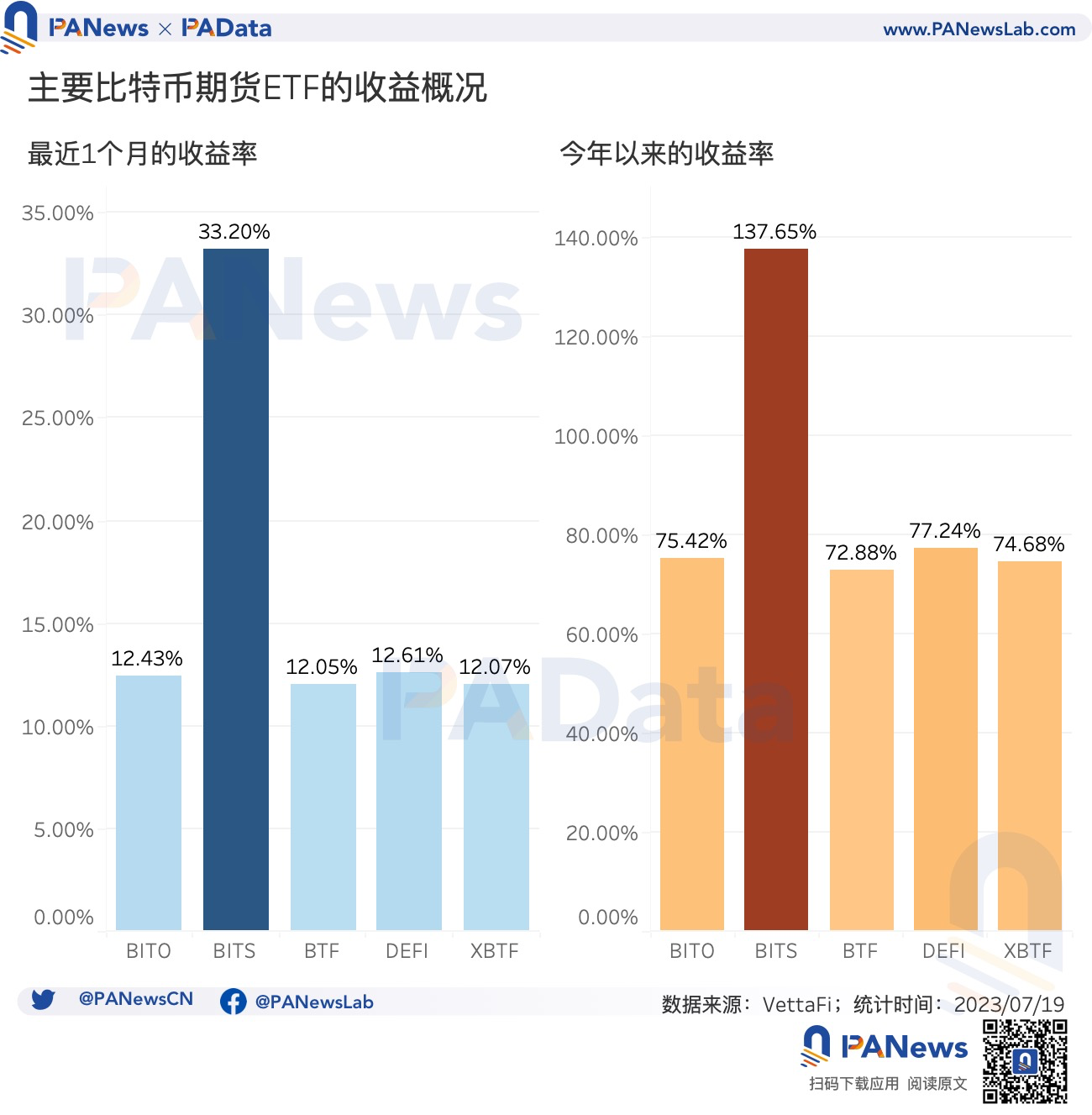

- The total assets managed by the five main Bitcoin futures ETFs BITO, XBTF, BTF, BITS, and DEFI have reached 1.295 billion US dollars. BITO is the only futures ETF that fully allocates CME futures contracts, while other futures ETFs also allocate a certain proportion to other assets such as US Treasury bonds.

- The highest monthly return rate recently is BITS, reaching 33.20%, while the others are around 12%. So far this year, BITS has the highest return rate, reaching 137.65%, while the others are around 74%. The performance is better than spot ETFs and trust funds.

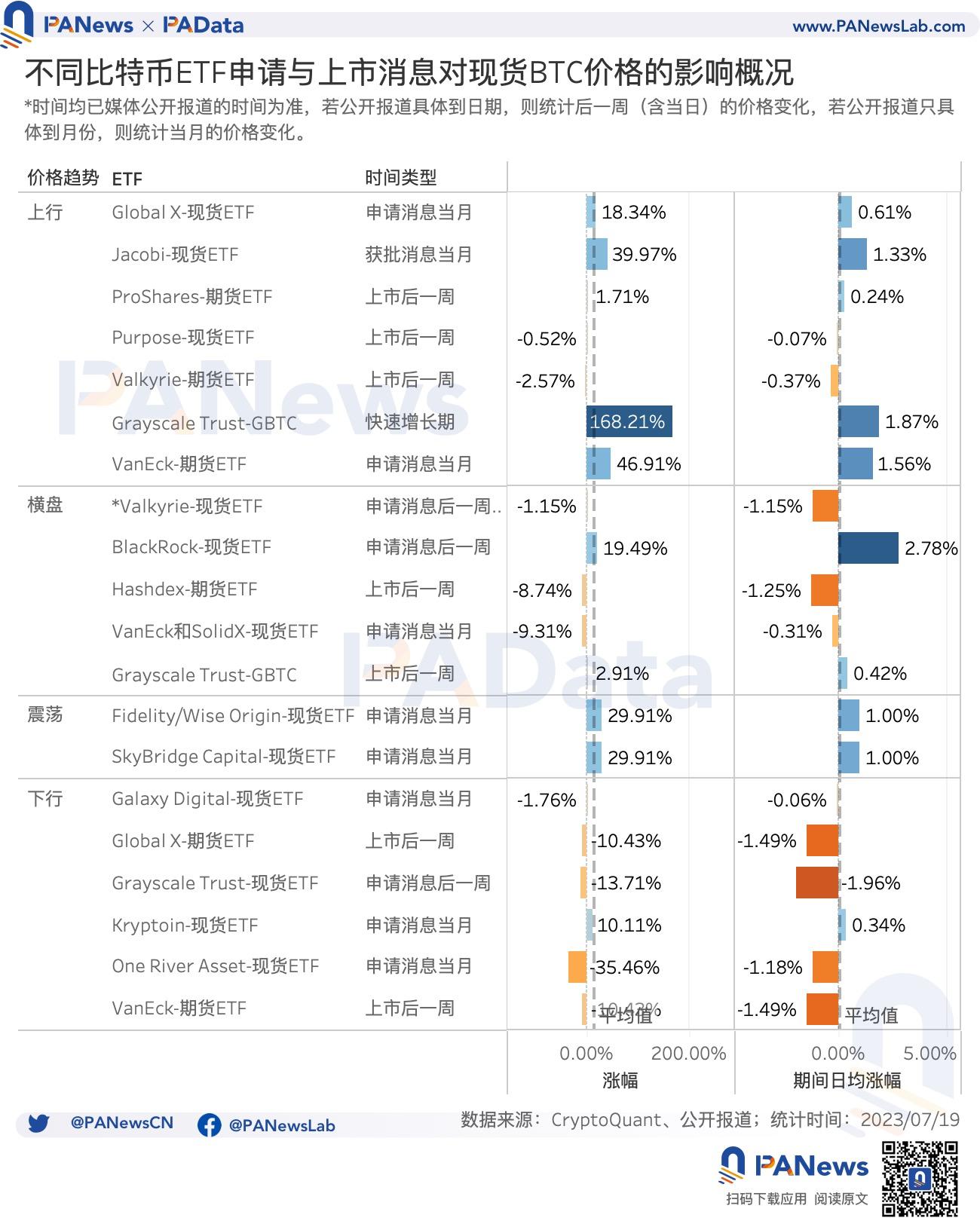

- Within one week after the announcement of BlackRock’s application for a Bitcoin spot ETF, the average daily price of Bitcoin spot rose by 2.78%, which is the largest average daily increase brought by news within the statistical scope. Previously, the highest average daily increase brought by news was also from VanEck’s futures ETF application month, with an average daily increase of 1.56%.

- The impact of institutional ETF application and listing news on the price of Bitcoin spot may come from three aspects: first, the endorsement of the institution itself; second, the type of ETF application, with spot ETF application news bringing a larger increase; third, the price trend of Bitcoin at the time of the news, if the application and listing news occur during an upward trend of Bitcoin, it usually brings a certain degree of price increase, while if it occurs during a downward trend, these news usually cannot reverse the trend.

Bitcoin spot ETF holdings increased by 5,640 BTC, and Grayscale GBTC’s OTC premium rate rebounded

Purpose Investment, a Canadian investment management company, launched the world’s first Bitcoin spot ETF in February 2021. Currently, the official website shows that the ETF includes four trading products: BTCC (purchased in Canadian dollars and hedging against the risk of the US dollar), BTCC.B (purchased in Canadian dollars without hedging against the risk of the US dollar), BTCC.U (purchased in US dollars, allowing investors to hold Bitcoin in US dollars), and BTCC.J (carbon neutral). Investors can purchase these ETFs on the Toronto Stock Exchange, and the shares correspond to physically settled Bitcoins. It is a user-friendly and low-risk method of trading cryptocurrencies. Ordinary US users cannot purchase this ETF. Another product similar to a spot ETF is a closed-end trust fund, which also corresponds to physically settled Bitcoins, such as GBTC issued by Grayscale in the United States, which is purchased by qualified investors. And BTCE issued by ETC Group in Germany. Currently, BTCE can be traded on two exchanges, Deutsche Börse XETRA (a trading venue operated by the Frankfurt Stock Exchange) and SIX Swiss Stock Exchange (Swiss Stock Exchange).

- Some ‘dirt’ on the SEC Chair

- Bitcoin Lightning Network + Nostr Decentralized Social Payment New Paradigm

- Is CoinDesk selling at a loss with a valuation of $125 million after being in business for ten years?

Due to the fact that multiple data service websites only provide the holdings of BTCC.U, here we only partially count the holdings of BTCC.U in the Purpose Spot ETF. Based on the amount of Bitcoin held by BTCC.U, BTCE, and GBTC, as of July 18th, the total holdings of the three funds are approximately 675,600 BTC. According to the recent price of Bitcoin at $30,000, this is equivalent to $20.27 billion. Among them, GBTC has the largest scale with holdings of 625,200 BTC, while the holdings of BTCC.U and BTCE are both around 200,000 BTC. In terms of changes in holdings, since June, the total holdings of the three funds have increased by 9,292 BTC, showing a generally positive growth trend. Among them, only GBTC’s holdings have slightly decreased by 0.25%, while the holdings of BTCC.U and BTCE have increased by 24.83% and 31.07%, respectively.

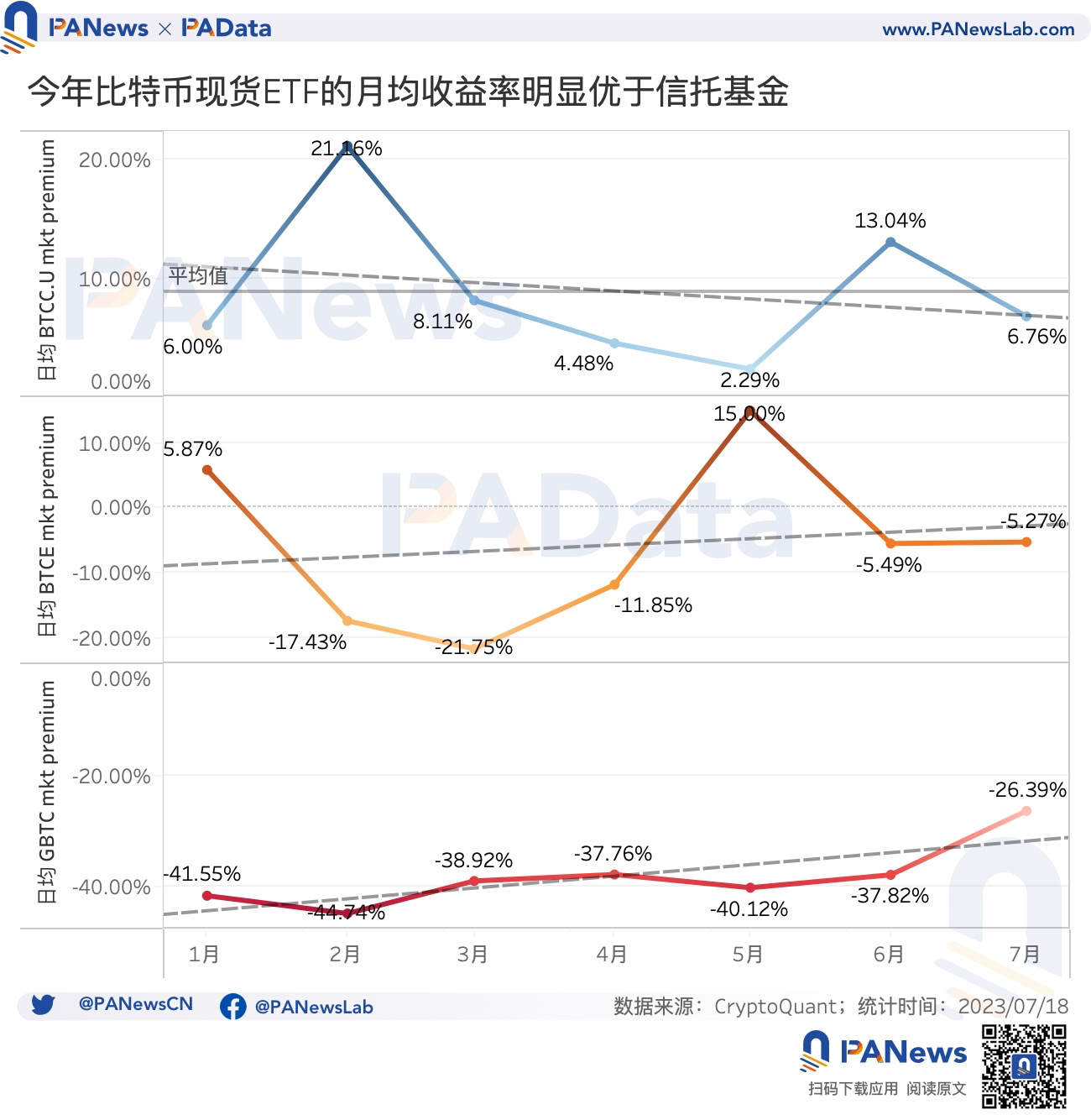

However, trust funds do not have redemption plans and are similar to “paper gold”. Therefore, the price often shows significant discrepancies with its net asset value. On the other hand, spot ETFs allow market makers to provide liquidity, so if there is sufficient liquidity, the price usually does not experience premiums or discounts. These differences are fully reflected in the performance of the three funds’ yields.

As of July 18th, the average monthly yield of BTCC.U is approximately 6.76%, with a yearly average monthly yield of 8.84%, which is significantly better than BTCE and GBTC. The average monthly yield of the latter two this month is -5.27% and -26.39% respectively, and the average monthly yield for the year is -5.85% and -38.18% respectively, indicating a loss. However, the extent of the losses is gradually decreasing.

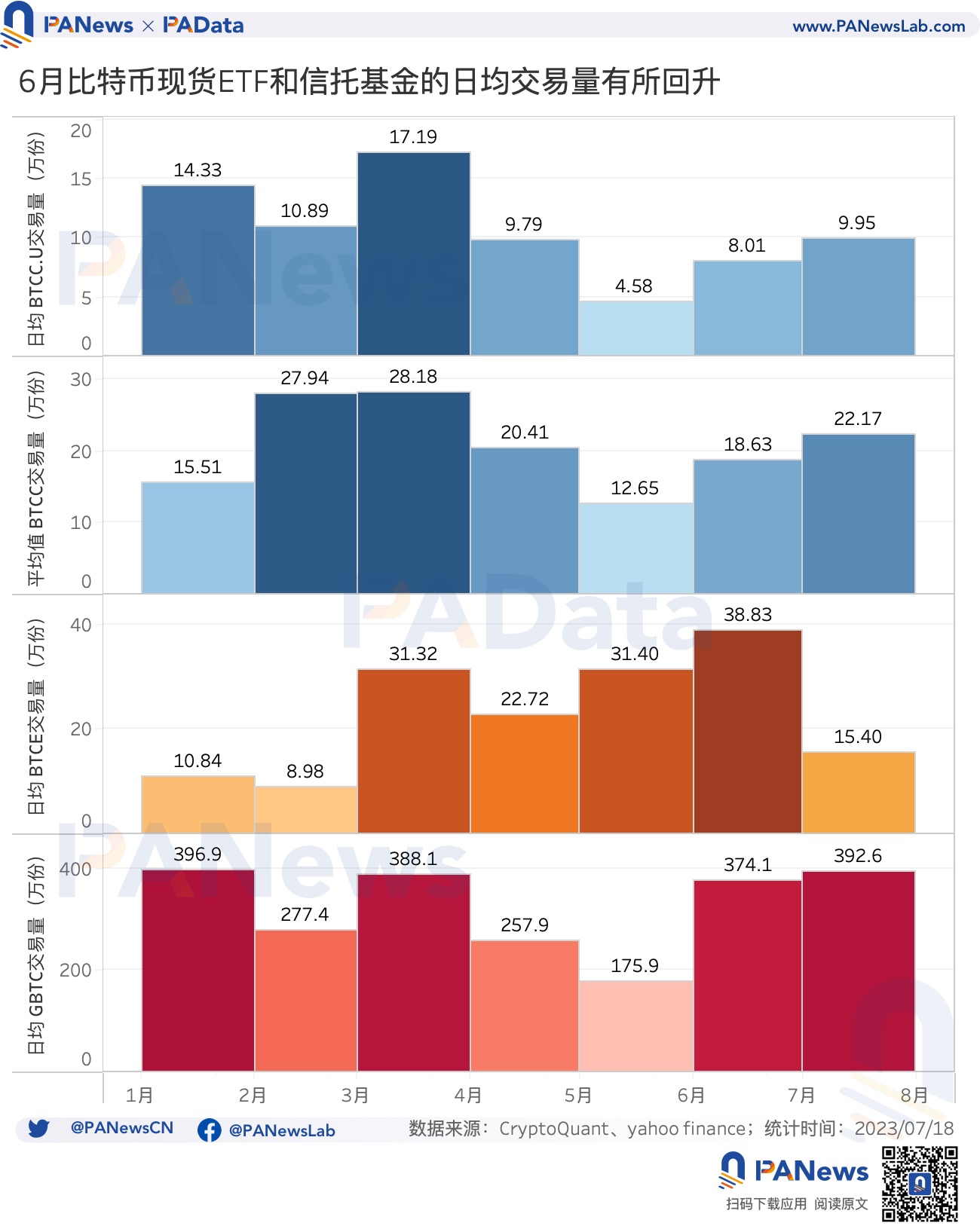

Although BTCC.U has better performance, its trading volume is not the highest. As of July 18th, the average daily trading volume of BTCC.U this month is only 99,500 shares, while the average daily trading volume of BTCC is approximately 221,700 shares. The total is 321,200 shares, higher than the average of 154,000 shares for the same period for BTCE, but lower than the average of 3.926 million shares for GBTC.

However, it is worth noting that with the announcement of more institutional applications in June and the steady rebound in BTC prices, the average daily trading volume of these four funds has increased month-on-month. Among them, the average daily trading volume of BTCC.U increased by 74.89%, BTCC by 47.27%, BTCE by 23.66%, and GBTC by 112.67%. As of this month, the average daily trading volume of BTCC.U, BTCC, and GBTC is still showing a growth trend.

The total assets of the top 5 Bitcoin futures ETFs are nearly $1.3 billion, with a yield of over 70% this year

Although there are currently no Bitcoin spot ETFs listed in the United States, there are already some futures ETFs listed. As of July 18th, the total assets managed by the five major Bitcoin futures ETFs, BITO, XBTF, BTF, BITS, and DEFI, have reached $1.295 billion. Among them, BITO, officially issued by ProShares in October 2021, has the largest scale within the scope of statistics, with total assets reaching $1.199 billion. In addition, the scales of XBTF and BTF issued by VanEck and Valkyrie are also relatively large, with total assets exceeding $30 million and $40 million, respectively.

These Bitcoin futures ETFs typically track the Chicago Mercantile Exchange (CME) Bitcoin futures contracts. Among them, the largest one, BITO, is the only futures ETF that allocates all of its assets to CME futures contracts and implements a “rolling” futures contract strategy. In addition to allocating CME futures contracts, other futures ETFs also allocate a certain proportion of other assets, such as XBTF and BTF allocating US Treasury bonds, BITS allocating other institution-issued blockchain ETFs, and DEFI allocating cash.

Looking at the recent net fund flow situation, BITO has the largest net inflow. In the past month, BITO has had a net inflow of $259 million. BTF and BITS also had a small net inflow in the past month, approximately $1.35 million and $790,000, respectively. If we extend the time period to this year, all five Bitcoin futures ETFs in the observation range have experienced net fund inflows, with BITO still having the highest net inflow of approximately $333 million. XBTF had a net inflow of $6.58 million this year, while the net inflows of other ETFs this year were relatively small.

BITO also has the highest average daily trading volume among these five Bitcoin futures ETFs, at approximately 9.9691 million shares, surpassing the average daily trading volume of GBTC this month by 153.93%. However, the trading volume of other futures ETFs is not high, with BTF at approximately 383,800 shares, XBTF at approximately 17,800 shares, and the remaining two with less than 10,000 shares.

Overall, BITO is far ahead of other Bitcoin futures ETFs in terms of asset size, net fund inflow, and average daily trading volume, but in terms of returns, BITO is not leading.

According to statistics, the highest return in the past month was BITS, reaching 33.20%, while the returns of other ETFs in the observation range were only around 12%. Even if we extend the time period to this year, BITS still has the highest return, reaching 137.65%, while the returns of other ETFs in the observation range are around 74%.

A reasonable speculation is that the returns of futures ETFs are closely related to the allocation of their assets. BITS, which has the highest return, not only allocates Bitcoin futures contracts but also allocates another blockchain ETF, which indicates a broader range of crypto assets, not just Bitcoin. This may bring higher returns for BITS. However, overall, the performance of Bitcoin futures ETFs is much better than that of spot ETFs and trust funds.

The impact of ETF news on BTC prices varies, and recent price increases may be related to on-chain fundamentals

It is undeniable that institutional entry can bring abundant funds to the crypto market, so news about institutional applications and issuances of ETFs can also influence the price of Bitcoin spot. Although the impact of news is not the only reason, it is at least one of the reasons. So, how significant is this impact?

LianGuaiData has compiled data based on public reports, summarizing the changes in the spot price of Bitcoin within a certain period of time after the announcement of some ETF applications and listings. If the specific date can be obtained through cross-validation of the public information, the price changes within one week after the news date will be calculated. Usually, the news about the listing of futures ETFs can be specific to the date. If the specific month can only be obtained after cross-validation of the public information, the price changes within the month of the news will be calculated. Usually, there is a certain degree of ambiguity in the timing of ETF applications. In order to compare on the same scale as much as possible, LianGuaiData calculated the average daily changes in the price of Bitcoin within a certain period of time, with an average of 7 days per week and an average of 30 days per month.

According to statistics, within one week after the announcement of BlackRock’s application for a Bitcoin spot ETF, the price of Bitcoin spot rose by 19.49%, equivalent to a daily average increase of 2.78%, which is the largest daily average increase brought by news in the statistical range. It can be seen that the market has high expectations for the entry of leading institutions.

Secondly, during the rapid growth period of GBTC (October to December 2020), the spot price of Bitcoin rose by 168.21%, equivalent to a daily average increase of 1.87%. However, in the first week after GBTC went public, the spot price of Bitcoin only rose by an average of 0.42% per day.

Other news that has brought higher daily average gains include the month of VanEck’s futures ETF application, with a daily average increase of 1.56% in the spot price of Bitcoin; the month of Jacobi’s spot ETF approval, with a daily average increase of 1.33% in the spot price of Bitcoin; and the month of Fidelity/Wise Origin and SkyBridge Capital’s spot ETF applications, with a daily average increase of 1% in the spot price of Bitcoin. In addition, there are also some news that did not drive up the price of Bitcoin, such as the recent news of Valkyrie’s spot ETF application, which led to a 1.15% decrease in the spot price of Bitcoin on the day it was reported.

In general, the impact of institutional ETF applications and listings on the spot price of Bitcoin may come from three aspects. First, the endorsement of the institution itself. Institutions of larger scale, such as BlackRock, are more capable of stimulating market confidence. Second, the type of ETF application. Spot ETFs face greater regulatory pressure and currently there is no ETF that can be approved and listed in the US. Therefore, the general situation in the past has been that the application news of spot ETFs has brought larger gains. Third, the price trend of Bitcoin at the time of the news. LianGuaiData takes the price of Bitcoin at the time of the news as the midpoint and extends it half a year before and after to observe the price trend of Bitcoin at that time. In this rough observation, it can still be found that if the application and listing news occur during an upward trend of Bitcoin, it usually brings a certain degree of price increase. If it occurs during a downward trend, these news usually cannot reverse the market trend.

Therefore, it is difficult to attribute the recent rise in the price of Bitcoin to one factor alone. In addition to the positive news brought by BlackRock, it is worth noting that the recent increase in the number of on-chain transactions of Bitcoin has also reached a historical high due to the rise of BRC-20 tokens. On July 18th, the number of on-chain transactions of Bitcoin reached 582,500, an increase of 210.83% compared to the 187,400 at the beginning of the year. From the trend perspective, since May, the number of on-chain transactions has mostly been above 400,000, with many exceeding 500,000. The number of on-chain transactions reflects the application situation of Bitcoin intuitively. Generally speaking, an increase in the number of on-chain transactions means an improvement in the fundamental transaction and the price is likely to rise.

The impact of news is complex, whether it is spot or futures, how much scale of funds and confidence the Bitcoin ETF can bring to the market depends on many factors. However, the application and approval of ETFs are closely related to the development of the entire market, and the two should be complementary and interrelated systems. The analysis in this article only aims to review the issued Bitcoin ETFs and observe the impact of news, providing a basis for future analysis. Based on this, LianGuaiData will continue to follow the trading of Bitcoin ETFs.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The fourth halving of Bitcoin is imminent, will the cryptocurrency market repeat yesterday’s story?

- Why has the significant discount on GBTC gradually narrowed recently?

- Exploring the Vietnamese crypto market VC interest is growing, NFT community is rising

- Exploring the Reasons behind the Low Adoption Rate of DeFi in the South Korean Cryptocurrency Market

- NYDIG What impact will the forecasted market size of Bitcoin spot ETF have?

- If the Bitcoin spot ETF is approved in the United States, how much capital will it bring to the market?

- Will Financialization Destroy NFTs? An Exploration of the Impact of NFTFi on the Market