Reading the Bitcoin ETF 5 futures ETFs with total assets of nearly $1.3 billion. How much does the news of the Bitcoin application affect?

Reading the news about the Bitcoin ETF and its impact on the market.Author: Carol, LianGuaiNews

The world’s largest asset management company, BlockRock, submitted an application for a Bitcoin spot ETF to the SEC on June 15th. Although the SEC will not respond to the review until September 2nd at the earliest, considering BlackRock’s global position in the asset management industry, this news is still considered an important signal, indicating that Bitcoin and other cryptocurrencies may be adopted by more institutions. In addition, other well-known institutions that have recently submitted applications for Bitcoin spot ETFs to the SEC include Fidelity, WisdomTree, VanEck, Invesco Galaxy, and more. With more and more institutions expressing their intention to enter the market, the market is confident in the arrival of more compliant cryptocurrency investment products.

What can institutional entry bring to the cryptocurrency market? To answer this question, LianGuaiData, a data journalism column under LianGuaiNews, analyzed the trading situation of listed Bitcoin spot ETFs, futures ETFs, and trust funds, and found:

-

The total holdings of the BTCC.U, BTCE, and GBTC funds are approximately 675,600 BTC (equivalent to $20.27 billion). Since June, they have increased by a total of 9,292 BTC, showing a good overall growth trend.

-

The total assets managed by the five major Bitcoin futures ETFs, BITO, XBTF, BTF, BITS, and DEFI, have reached $1.295 billion. BITO is the only futures ETF that fully allocates CME futures contracts, while other futures ETFs allocate a certain proportion of other assets, such as U.S. government bonds.

-

BITS has the highest return rate in the past month, reaching 33.20%, while others are only around 12%. So far this year, BITS still has the highest return rate, reaching 137.65%, while others are around 74%. The returns are better than spot ETFs and trust funds.

-

Within a week after the announcement of BlackRock’s application for a Bitcoin spot ETF, the daily average price of Bitcoin spot rose by 2.78%, which is the largest daily average increase brought by news within the statistical range. Previously, there was also a relatively high daily average increase brought by news, such as the VanEck futures ETF application month, which increased by an average of 1.56% per day.

-

The impact of institutional ETF application and listing news on the price of Bitcoin spot may come from three aspects. First, the endorsement of the institution itself. Second, the type of ETF application, with spot ETF application news bringing larger price increases. Third, the price trend of Bitcoin when the news occurs. If the application and listing news occur during an upward trend of Bitcoin, it usually brings a certain degree of price increase. If it occurs during a downward trend, these news usually cannot reverse the trend.

Bitcoin spot ETF holdings increased by 5,640 BTC, and the grayscale GBTC over-the-counter premium rate rebounded

Purpose Investments, a Canadian investment management company, launched the world’s first Bitcoin spot ETF in February 2021. The official website currently shows that the ETF includes four trading products: BTCC (purchased in Canadian dollars and hedged against the risk of the US dollar), BTCC.B (purchased in Canadian dollars without hedging the risk of the US dollar), BTCC.U (purchased in US dollars, allowing investors to hold Bitcoin in US dollars), and BTCC.J (carbon neutral). Investors can purchase these ETFs on the Toronto Stock Exchange, and the shares correspond to physical settlement of Bitcoin. It is a user-friendly and low-risk method of trading cryptocurrencies, but ordinary users in the United States cannot purchase this ETF. Another product similar to the spot ETF is a closed-end trust fund, which also corresponds to physical Bitcoin, such as GBTC issued by Grayscale in the United States, which is available for purchase by qualified investors. There is also BTCE issued by ETC Group in Germany, which can currently be traded on two exchanges, Deutsche Börse XETRA (operated by the Frankfurt Stock Exchange) and SIX Swiss Stock Exchange (Swiss Stock Exchange).

Due to the fact that multiple data service websites only provide the holdings of BTCC.U, here we only partially count the holdings of BTCC.U in Purpose Spot ETF. Based on the amount of Bitcoin held by BTCC.U, BTCE, and GBTC, as of July 18th, the total holdings of these three funds are approximately 675,600 BTC. Based on the recent price of Bitcoin at $30,000, this is equivalent to $20.27 billion. Among them, GBTC has the largest scale with holdings of 625,200 BTC, while the holdings of BTCC.U and BTCE are both around 200,000 BTC. In terms of changes in holdings, since June, the total holdings of these three funds have increased by 9,292 BTC, showing a good overall growth trend. Among them, only the holdings of GBTC have slightly decreased by 0.25%, while the holdings of BTCC.U and BTCE have increased by 24.83% and 31.07% respectively.

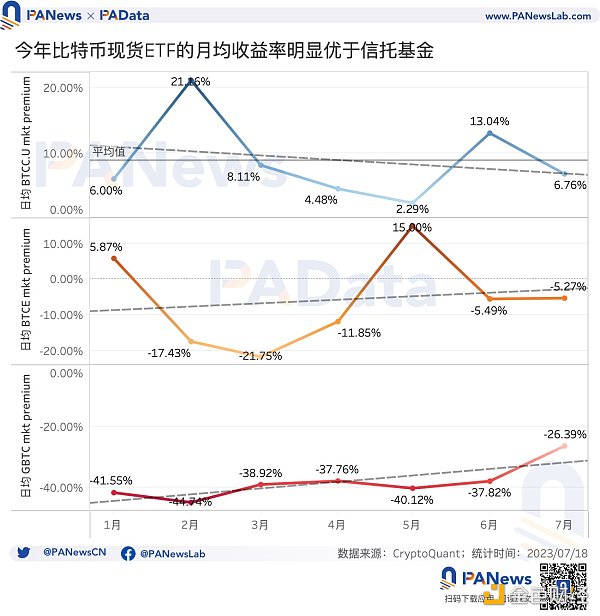

However, trust funds do not have redemption plans, similar to “paper gold,” so the price often exhibits significant differences from its net asset value. However, spot ETFs allow market makers to make markets, and if there is sufficient liquidity, the price usually does not experience premiums or discounts. These differences are fully reflected in the performance of the three funds in terms of returns.

As of July 18th, the average monthly return of BTCC.U is approximately 6.76%, while the average monthly return for this year is about 8.84%, significantly outperforming BTCE and GBTC. The average monthly returns of the latter two funds for this month are -5.27% and -26.39% respectively, and the average monthly returns for this year are -5.85% and -38.18% respectively, all in a loss state, but the magnitude of the losses is decreasing.

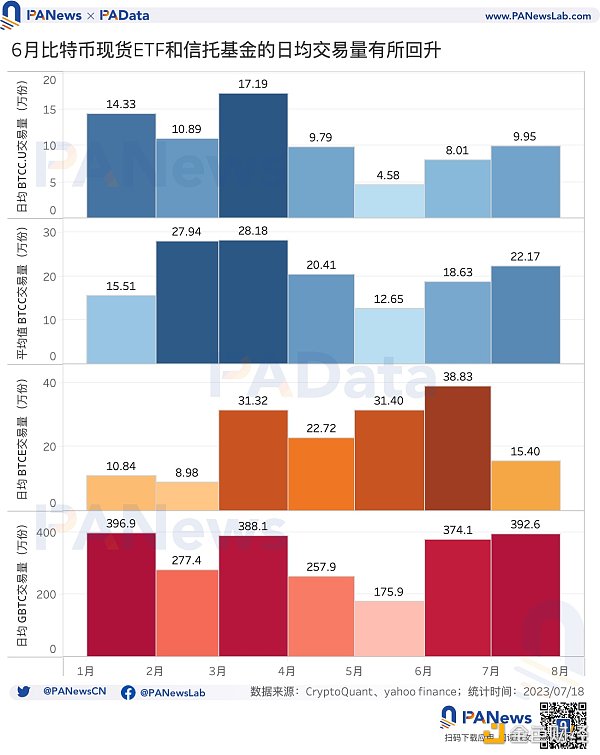

Although BTCC.U has better performance in terms of returns, its trading volume is not the highest. As of July 18th, the average daily trading volume of BTCC.U this month is only 99,500 shares, while the average daily trading volume of BTCC is about 221,700 shares. The combined total is 321,200 shares, higher than the average of 154,000 shares for BTCE during the same period, but lower than the average of 3.926 million shares for GBTC during the same period.

However, it is worth noting that with more institutional application news being released in June and the steady rise in BTC prices, the average daily trading volumes of these four funds have increased month-on-month. Among them, BTCC.U has increased by 74.89%, BTCC has increased by 47.27%, BTCE has increased by 23.66%, and GBTC has increased by 112.67%. As of this month, the average daily trading volumes of BTCC.U, BTCC, and GBTC continue to show growth momentum.

Total assets of the top 5 Bitcoin futures ETFs are nearly $1.3 billion, with returns exceeding 70% this year

Although there are currently no Bitcoin spot ETFs listed in the United States, there are already some futures ETFs listed in the United States. As of July 18th, the total assets managed by the top 5 Bitcoin futures ETFs, including BITO, XBTF, BTF, BITS, and DEFI, have reached $1.295 billion. Among them, BITO, officially launched by ProShares in October 2021, is the largest futures ETF in terms of scale within the scope of statistics, with total assets reaching $1.199 billion. Next, the scale of XBTF and BTF, issued by VanEck and Valkyrie respectively, is also relatively large, with total assets exceeding $30 million and $40 million respectively.

These Bitcoin futures ETFs typically track the underlying assets of the Chicago Mercantile Exchange (CME) Bitcoin futures contracts. Among them, the largest is BITO, which is the only futures ETF that fully allocates CME futures contracts and implements a strategy of “rolling” futures contracts. In addition, other futures ETFs allocate a certain proportion of other assets on the basis of CME futures contracts, such as XBTF and BTF allocate US Treasury bonds, BITS allocate blockchain ETFs issued by other institutions, and DEFI allocate cash.

From the recent net fund flow situation, BITO has the largest net inflow. In the past month, BITO has had a net inflow of $259 million. Next, BTF and BITS also had a small net inflow in the past month, about $1.35 million and $790,000 respectively. If the time period is extended to this year, then all 5 Bitcoin futures ETFs in the observation range have had net inflows of funds, with the highest net inflow still being BITO, about $333 million. Next, XBTF had a net inflow of $6.58 million this year, while the net inflow of other ETFs this year is relatively small.

BITO is also the Bitcoin futures ETF with the highest average daily trading volume among these 5, about 9.9691 million shares, exceeding the average daily trading volume of GBTC this month by 153.93%. However, the trading volumes of other futures ETFs are not high, with BTF at about 383,800 shares, XBTF at about 17,800 shares, and the remaining two are all less than 10,000 shares.

Overall, BITO is far ahead of other Bitcoin futures ETFs in terms of fund size, net inflow of funds, and average daily trading volume, but in terms of returns, BITO is not leading.

According to statistics, the highest return in the past month is BITS, reaching 33.20%, while the returns of other ETFs in the observation range are only about 12%. Even if the time period is extended to this year, the highest return is still BITS, reaching 137.65%, while the returns of other ETFs in the observation range are all around 74%.

A reasonable speculation is that the return of futures ETFs is closely related to their allocation of asset exposures. BITS, which has the highest return, not only allocates Bitcoin futures contracts but also another blockchain ETF, which points to a broader range of crypto assets, not just Bitcoin, which may bring higher returns to BITS. However, overall, the performance of Bitcoin futures ETFs is far better than spot ETFs and trust funds.

The impact of ETF news on BTC prices varies, and the recent rise in BTC prices may still be related to on-chain fundamentals

It is undeniable that institutional entry can bring abundant funds to the crypto market, so news about institutional applications and issuances of ETFs can also drive changes in Bitcoin spot prices. Although the impact of news is not the only reason, it is at least one of the reasons. So how big is this impact?

LianGuaiData has compiled data based on public reports, summarizing the changes in the spot price of Bitcoin within a certain period after the announcement of certain ETF applications and listings. If the specific date can be obtained after cross-validation of public information, the price changes within one week after the date of the news are calculated. Usually, the news about the listing of futures ETFs can be specific to the date. If the specific month can only be obtained after cross-validation of public information, the price changes within the month of the news are calculated. Usually, there is a certain degree of ambiguity in the timing of ETF applications. In order to compare on the same scale as much as possible, LianGuaiData calculates the daily average price changes of Bitcoin within a certain period of time. The weekly average is calculated based on 7 days, and the monthly average is calculated based on 30 days.

According to statistics, within one week after the announcement of BlackRock’s application for a Bitcoin spot ETF, the spot price of Bitcoin rose by 19.49%, equivalent to a daily average increase of 2.78%, which is the largest daily average increase brought by news in the statistical range. It can be seen that the market has high expectations for the entry of institutional leaders.

In addition, during the rapid growth period of GBTC (from October to December 2020), the spot price of Bitcoin rose by 168.21%, equivalent to a daily average increase of 1.87%. However, in the first week after GBTC was listed, the spot price of Bitcoin only increased by an average of 0.42% per day.

Other news-driven daily average increases include the month when VanEck applied for futures ETF, with a daily average increase of 1.56% in the spot price of Bitcoin; the month when Jacobi’s spot ETF was approved, with a daily average increase of 1.33% in the spot price of Bitcoin; the month when Fidelity/Wise Origin and SkyBridge Capital applied for spot ETF, with a daily average increase of 1% in the spot price of Bitcoin. In addition, there are also some news that did not drive an increase in the price of Bitcoin, such as the recent Valkyrie spot ETF application news, which caused the spot price of Bitcoin to fall by 1.15% on the day it was reported.

In summary, the impact of institutional ETF applications and listings on the spot price of Bitcoin may come from three aspects. First, the endorsement of the institution itself. Institutions of such scale as BlackRock can stimulate market confidence. Second, the type of ETF applied for. Spot ETFs face greater regulatory pressures and currently there is no ETF that can be approved and listed in the U.S. Therefore, in the past, it has generally been the case that the application news of spot ETFs has brought greater increases. Third, the price trend of Bitcoin at the time of the news. LianGuaiData takes the price of Bitcoin at the time of the news as the midpoint, extends half a year before and after, and observes the price trend of Bitcoin at that time. Even in this rough observation, it can still be seen that if the application and listing news occurs during an upward trend of Bitcoin, it usually brings a certain degree of price increase; if it occurs during a downward trend, these news usually cannot reverse the market trend.

Therefore, it is difficult to attribute the recent rise in the price of Bitcoin to one factor alone. In addition to the positive news brought by BlackRock, it is worth noting that the recent increase in the number of on-chain transactions of Bitcoin is also reaching a historical high due to the rise of BRC-20 tokens. On July 18th, the number of on-chain transactions of Bitcoin reached 582,500, an increase of 210.83% compared to the beginning of the year when it was 187,400. From the trend perspective, since May, the number of on-chain transactions has been above 400,000 most of the time, and there have been many instances where it exceeded 500,000. The number of on-chain transactions is a direct reflection of the application situation of Bitcoin. Generally speaking, an increase in the number of on-chain transactions indicates an improvement in the basic transaction fundamentals and the price is likely to rise.

The impact of news is complex, whether it is spot or futures, the scale of funds that Bitcoin ETF can bring to the market, as well as the level of confidence, depends on many factors. However, the application and approval of ETFs are closely related to the overall development of the market, and the two should be complementary and interrelated systems. The analysis in this article only hopes to review the issued Bitcoin ETFs and observe the impact of news, providing a basis for future analysis. Based on this, LianGuaiData will continue to pay attention to the trading of Bitcoin ETFs.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is CoinDesk selling at a loss with a valuation of $125 million after being in business for ten years?

- The fourth halving of Bitcoin is imminent, will the cryptocurrency market repeat yesterday’s story?

- Why has the significant discount on GBTC gradually narrowed recently?

- Exploring the Vietnamese crypto market VC interest is growing, NFT community is rising

- Exploring the Reasons behind the Low Adoption Rate of DeFi in the South Korean Cryptocurrency Market

- NYDIG What impact will the forecasted market size of Bitcoin spot ETF have?

- If the Bitcoin spot ETF is approved in the United States, how much capital will it bring to the market?