Twitter Featured | Ethereum into Tether settlement layer! Gas uses a new high, USDT is the biggest hero

Blockchain market analysis platform glassnode:

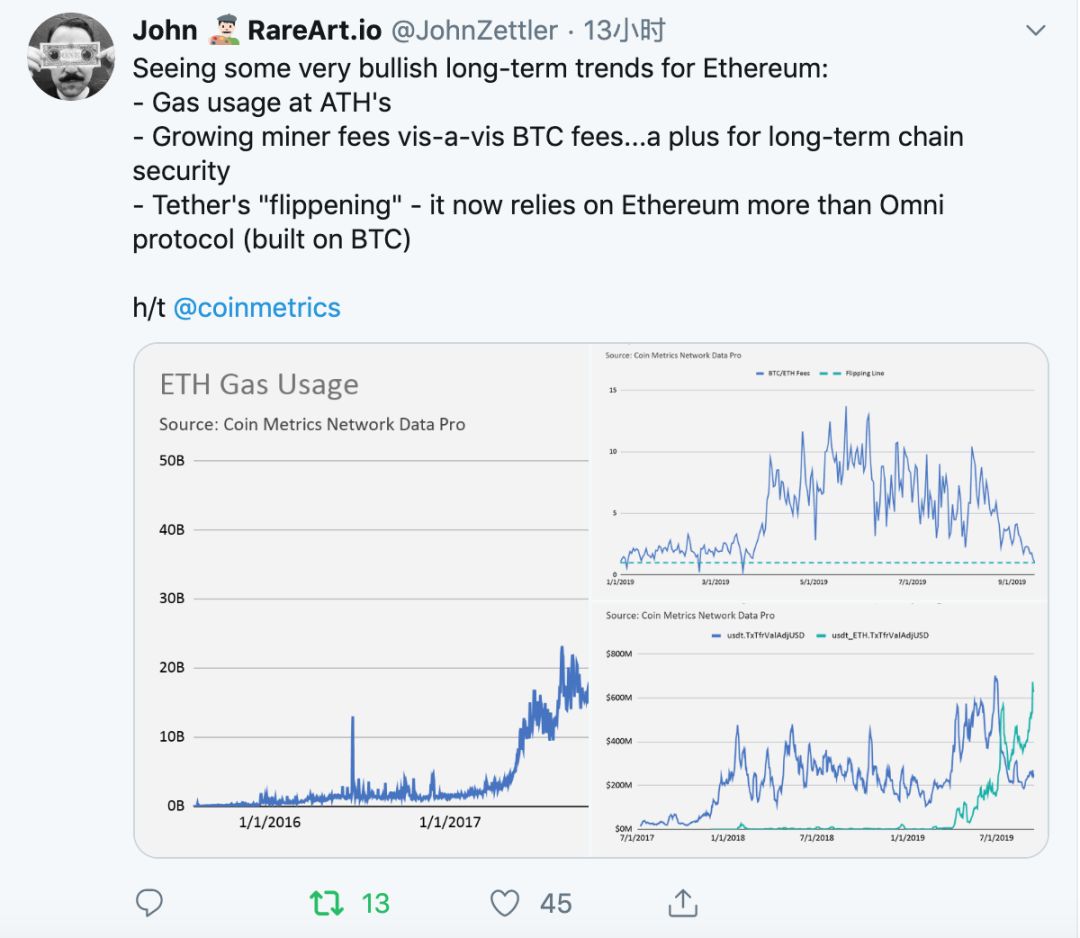

Ethereum Gas uses a new high.

How is Gas used?

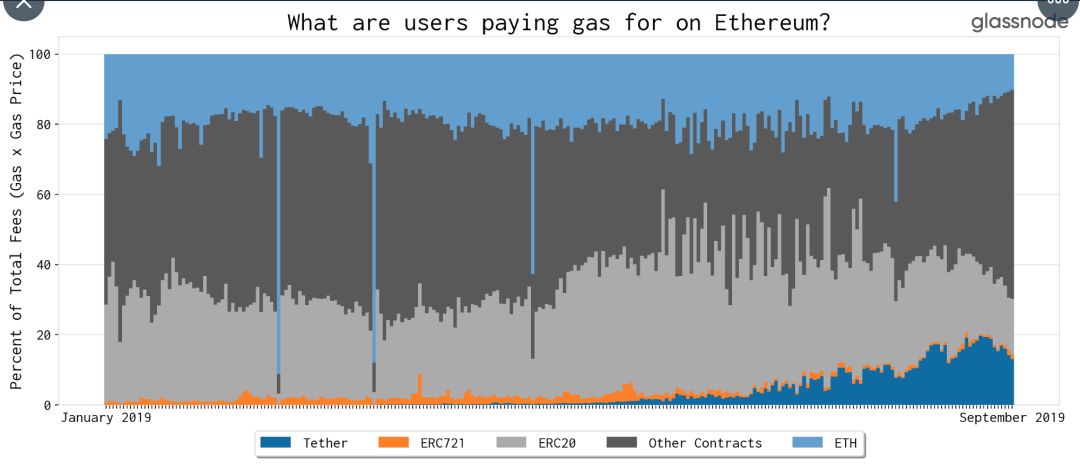

Tether's transfer of USDT (and the use of Gas) has been growing, with recent peaks reaching 20% of all network costs.

- The network is in short supply, the price is “four consecutive yangs”, is the spring of Ethereum coming?

- Wells Fargo wants to launch cryptocurrencies to help its global cross-border payment business

- Viewpoint | Looking at the "new revolution" of financial infrastructure under the digital wave from Libra

However, the Gas used to transfer ETH is less, and most of it is consumed by non-standard contracts (note: Other Contracts in the figure below), which requires more calculations.

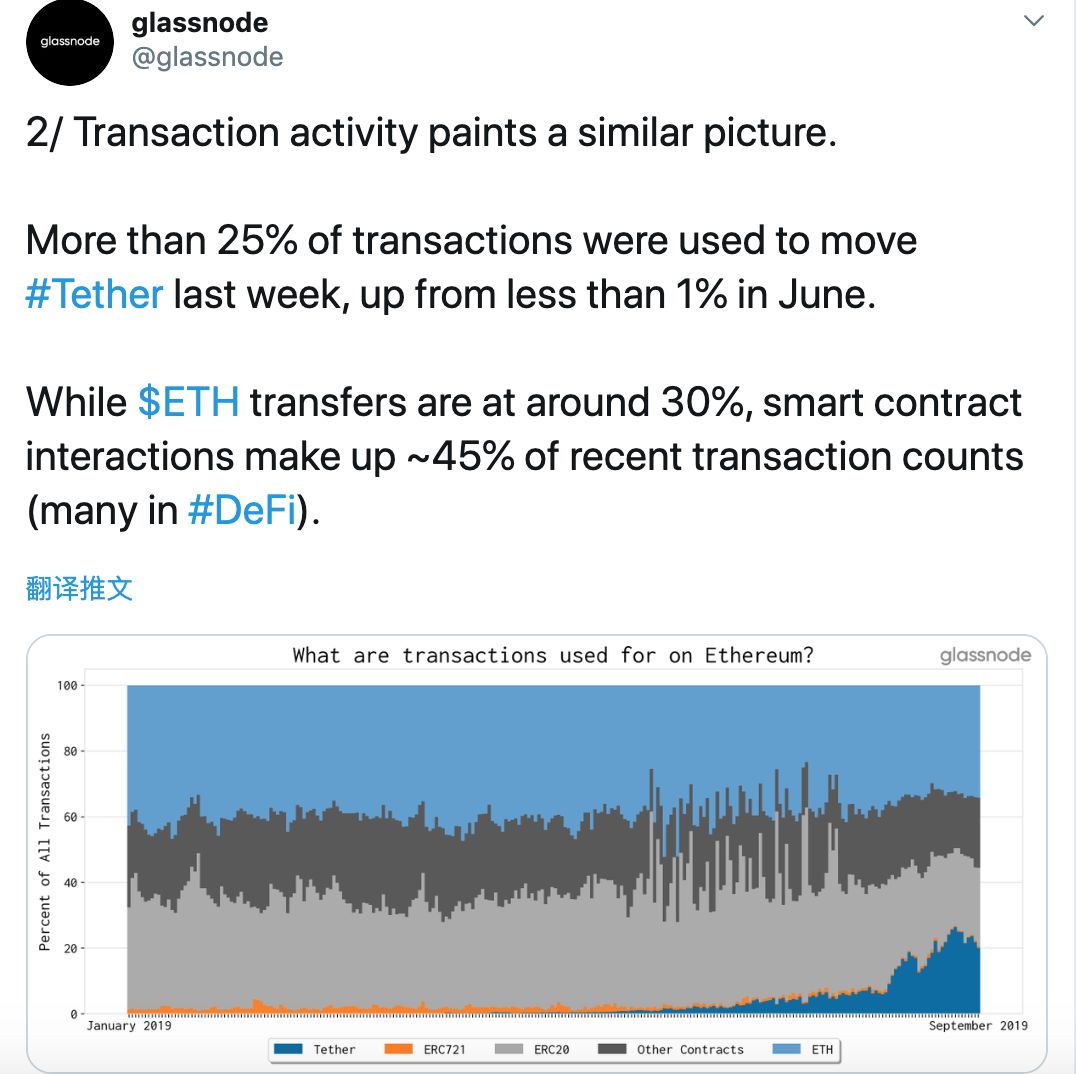

Trading activity is similar.

Last week, more than 25% of transactions were used to transfer Tether, which was less than 1% in June.

ETH's trading ratio is about 30%, and smart contract interactions account for 45% of recent transactions (mainly DeFi).

Chris Burniske, founder of venture capital firm, commented:

The idea that Tether promotes the adoption of Ethereum is not true.

Tether does not account for 20% of the use of Gas in Ethereum.

The use of Ethereum is robust; people now realize that (ETH) is oversold.

Ethhub_io founder Anthony Sassano:

The cost is reversed.

Ethereum's daily transaction costs are about to exceed Bitcoin. As of September 15, Ethereum's daily transaction costs are $182,899, and Bitcoin's daily transaction costs are $185,993.

(Note: The transaction fee compared here, for miners, also need to consider the block reward, Ethereum average 15 seconds out of a block, block reward 2ETH, bitcoin average 10 minutes out of a block, block reward 12.5BTC .)

Ethereum has briefly exceeded the cost of Bitcoin in the past, but now the Ethereum transaction fee is driven by Tether, and Tether's demand is constant.

Eric Conner, Ethereum enthusiast:

Remind that in addition to repairing the inefficient gas market, Ethereum's improvement proposal EIP-1559 will introduce a network fee destruction mechanism.

(Note: EIP-1559 is an Ethereum improvement proposal proposed by Eric. The proposal mainly consists of three parts: one is to increase the gas limit from 8 million to 16 million; the second is to set a basic fee for each block, and then The usage rate of the gas is used to dynamically adjust the handling fee. In addition, the handling fee of the block is not paid to the miners, but is destroyed. Finally, in addition to the basic handling fee of the block, the user can customize the tip to the miner. EIP-1559 is currently only a proposal. Can it be passed, and when it is passed is still unknown.)

Yesterday, the handling fee at Ethereum was 1009 Ethereum. 370,000 Ethereum will be destroyed each year (0.35% of the total supply).

These are the default settings of Ethereum 2.0.

Anthony Sassano commented : "The 10 million ETH pledge makes the issue rate 0.54%.

( Note: In April of this year, V God mentioned in a proposal that when 2.0 pledges more than 10 million Ethanols, the ETS's issuance rate is controlled at 0.54%, and the maximum annualized rate of participation in staking is 5.72%. )

The destruction of 0.35% of the supply each year reduced the actual issuance rate to 0.19%.

Where Ethereum will be used:

– lost

– Slashed's Ethereum (the penalty for the pledge of the evildoer under the Ethereum 2.0 POS mechanism)

– Lock the bin in DeFi

– Payment status rent

Supply limit? The place to go to Ethereum does not require a supply ceiling.

Finally, John, the founder of the Digital Collectibles Platform, made a summary:

I saw some very optimistic long-term trends in Ethereum:

– Gas usage is at a record high

– Compared with the Bitcoin handling fee, the (Eafangfang) miner's handling fee is increasing… This is a plus item for the long-term safety of the chain.

— Tether's flip, which is now more dependent on Ethereum than the Omni protocol.

1. According to Cointelegraph, Japanese social communication giant Line (about 80 million daily) launched its cryptocurrency trading platform, Bitmax, which will initially support transactions in five currencies such as BTC, BCH, ETH, XRP and LTC.

2. According to CoinDesk, VanEck and SolidX canceled the Bitcoin ETF proposal.

It is also a strange thing that the ETF has been postponed. The currency circle has long been used to it. CNBC encrypted channel host Ran NeuNer tweeted "now in 2097, the US Securities and Exchange Commission (SEC) has not yet passed the Bitcoin ETF."

3. According to CoinDesk, US financial giant Wells Fargo (note: one of the four major US banks with total assets of $1.9 trillion) is developing a dollar-linked cryptocurrency WellCoin, which will be in the company’s Run on the first blockchain platform. It is reported that WellCoin will be used first for internal settlement trials.

—— End ——

Turn around every day and see the big coffee point of view, bringing you the freshest and most interesting points. Welcome message, forward!

Author: March only hope

Source: Public No. Wildflowers

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blackstone CEO Su Shimin first talked about Bitcoin: the currency that no one controls is very strange.

- U.S. government agencies’ three-fold increase in blockchain analysis service spending for three years, reaching nearly $10 million

- Babbitt Column | Blockchain: Smart Assets

- Decentralized stable currency monetary policy and fiscal policy governance

- The history of cryptography changes: the enlightenment of the two pits in Germany and the Enigma machine to the mining machine manufacturers

- Viewpoint | Digital currency will open the currency scenario for blockchain technology applications

- How to make a steady profit without losing, become the king of BTC escape?