Viewpoint | Looking at the "new revolution" of financial infrastructure under the digital wave from Libra

On June 18, 2019, Facebook, the world's largest social networking site, published a white paper on the "Libra" digital currency with the mission of building a simple, borderless currency and financial infrastructure for billions of people. This financial infrastructure allows people to “should be as easy, cost-effective, and even safer as texting or sharing photos, regardless of where they live, whatever their work or income, when transferring money globally.”

Libra's financial infrastructure consists of three components that will work together to create a more inclusive financial system:

1. It is based on a secure, scalable and reliable blockchain;

2. It is backed by an asset reserve that gives it intrinsic value;

- Blackstone CEO Su Shimin first talked about Bitcoin: the currency that no one controls is very strange.

- U.S. government agencies’ three-fold increase in blockchain analysis service spending for three years, reaching nearly $10 million

- Babbitt Column | Blockchain: Smart Assets

3. It is governed by the independent Libra Association, whose mission is to promote the development of this financial ecosystem. It corresponds to the information infrastructure of traditional financial technology infrastructure, payment clearing facilities, and regulatory infrastructure, but presents different characteristics.

1 blockchain technology and information infrastructure

(1) Data collection and computing power

Blockchain, also known as distributed ledger, every transaction, all nodes in the system, have to remember the account, the data must be fully calculated and stored, the data storage requirements are very high, and its other The biggest drawback is that scalability is relatively poor. It is difficult to expand the resources, such as CPU and server, to achieve the growth of computing power and achieve an increase in efficiency and performance. However, Libra is based on a secure, scalable and reliable blockchain. It is not a blockchain. It avoids the technical shortcomings of the blockchain. It uses a hybrid architecture, which is a layered, underlying transaction. Centralized processing, the uppermost blockchain.

The Libra blockchain is a single data structure that records transaction history and status over time. This implementation simplifies the workload of applications accessing the blockchain, allowing them to read any data from any point in time and verifying the integrity of the data using a unified framework.

Compared to libra, traditional financial technology data collection generally relies on various accounts, such as financial accounts, social network accounts, e-commerce accounts and other application accounts. The wide application of biometric technologies such as face, fingerprint and iris will further strengthen the relationship between account and identity, so that the account can effectively record the behavior of account owners in different scenarios such as social and consumption, and analyze these behaviors through big data and AI technology. Information, you can make a portrait of the account owner (consumer profiling), and infer the important characteristics of the account owner's preferences, credit and income.

Libra is based on blockchain and does not require users to have a good credit rating or even a credit history. In other words, the platform used by users does not depend on the credit system. Based on this feature, as long as users have libra cryptocurrency assets, they can use these assets to exchange legal currency, even if they are so-called "old Lai" ".

Traditional financial technology cannot do this. In the credit field, the credit report is the main basis for credit evaluation, followed by the data analysis method. The AI classifies the face photos, user preferences, and the probability of default and the probability of distress. In the credit field, it is more needed. There are two aspects to the aspect of attention. First, although some variables contribute to credit assessment, lending accordingly may cause controversy in credit equity. Second, many data analysis methods have not undergone a complete financial cycle test. The power think tank thinks that the existence of the procyclical problem is very likely.

2 Asset reserve and payment clearing infrastructure

(1) Account system

Libra is backed by an asset reserve that gives it intrinsic value. Its payment clearing is represented by the Token paradigm account: Token, smart contracts and consensus algorithms are all within the consensus boundary. Token and smart contracts are inextricably linked, and the consensus algorithm ensures A trust-trust environment within the boundaries of consensus.

As a synthetic currency unit based on a basket of currencies, Libra is a super-sovereign currency like the IMF Special Drawing Rights. However, based on the Token paradigm, Libra does not have a currency creation function. The only way to expand Libra is to increase the French currency reserve. Libra has valuable storage capabilities, but trading media and pricing unit functions will be limited in the early stages of Libra's development.

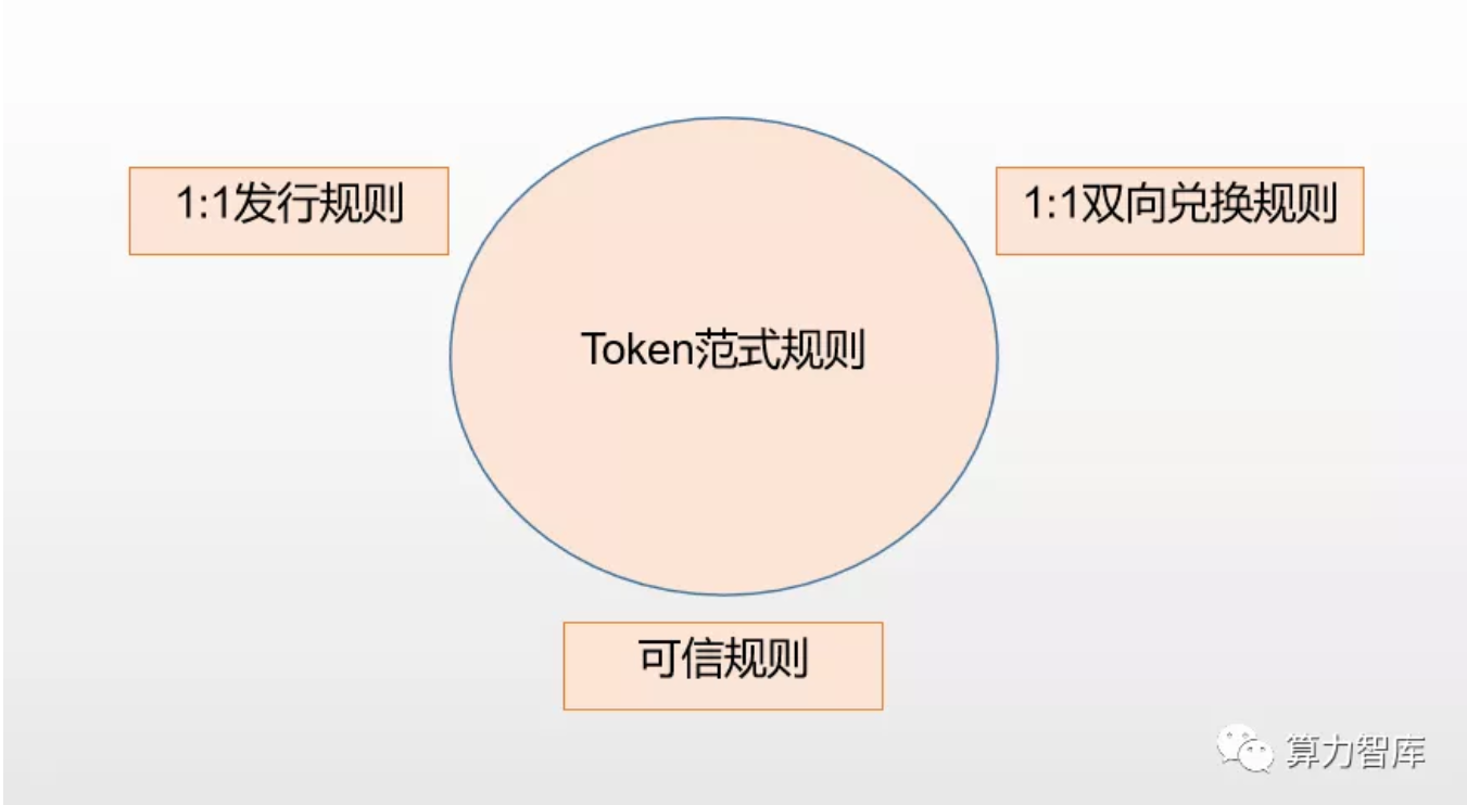

Based on the Token paradigm, Libra can be used to carry financial assets and transactions. The essence is based on laws and regulations. It uses a block of sovereign currency and government bonds as a reserve asset. This process is inseparable from centralized trustees and must follow three rules: 1:1 issue rules, 1:1 two-way exchange rules, and trusted rules. Under the constraints of these three rules, one unit of libra represents the value of one unit of the underlying asset.

Because the blockchain runs on the Internet, Libra's transfer between different addresses within the blockchain is naturally cross-border. This is the basis for Libra's application to cross-border payments. From the perspective of the transaction medium, Libra's largest application. The scenario is cross-border payment or cross-border remittance. Libra has obvious advantages in trading scene performance, openness and privacy protection, but it also brings difficulties in KYC, AML and CFT.

Traditional finance is represented by the account paradigm. Individuals, enterprises and government departments open deposit accounts in commercial banks, and commercial banks open deposit reserve accounts in central banks. The legal currency exists in the liability side of the financial system, and the base currency is the liability of the central bank. Among them, the cash is the central bank's debt to the public, and the deposit reserve is the central bank's liability to commercial banks. Deposits are the liabilities of commercial banks to individuals, businesses and government.

Transfers and remittances involve bank account operations. In addition to adjusting the balances of the deposit accounts of the two parties at the respective bank, the interbank transfers involve settlement between the two banks, and the settlement between commercial banks needs to adjust their deposits at the central bank. The balance of the reserve account, the bank account involved in cross-border payment is more complicated, and it needs to be carried out through the interbank account of the correspondent bank, as well as the currency exchange problem.

(2) Settlement after the transaction

In the post-financial transaction processing, Libra mainly replaces the settlement and account maintenance functions of the central securities registration institution with blockchain technology, establishes and maintains shared and simultaneous books, simplifies the transaction reconciliation process, shortens the custody chain and reduces settlement. Time and risk exposure.

But it also faces challenges:

1. How to realize the payment of coupons and simultaneous settlement?

2. How to ensure the finality of the settlement? Many blockchain systems can only guarantee the finality of settlements in a probabilistic sense because of the possibility of forking.

3. Transaction matching and error management. The untamed nature of the blockchain adds to the difficulty of this.

4. How to ensure the confidentiality of transaction information when multiple parties participate in the verification?

The settlement after traditional financial transactions is mainly composed of three steps: transaction order management, clearing and settlement. The central securities registration agency plays a key role in settlement, and undertakes certification (fair and trustworthy maintenance of records of issued securities) and settlement (will The ownership of the securities is transferred from the seller to the buyer) and the functions of the accounts are maintained (establishing and updating the ownership records of the securities), sometimes taking on functions such as securities custody, asset services, financing, reporting or securities lending.

In post-financial transaction settlement, a transaction involves multiple agencies. Each organization uses its own system to process, send and receive transaction orders, check data, manage errors, etc., and maintain its own transaction records. The data standards used by each organization are not uniform, which incurs significant costs.

3 Libra Association and Regulatory Infrastructure

Libra is regulated by the Libra Association, a regulatory body of diverse independent members, an independent non-profit membership organization based in Geneva, Switzerland. Switzerland has always held a global neutral position and is open to blockchain technology, and the Libra Association is also striving to become a neutral international institution. The Libra Association aims to promote the operation of the Libra blockchain and coordinate the various stakeholders (the network's verifier nodes) to agree on the process of promoting, developing and expanding the network, as well as managing assets.

Traditional financial technology, on the other hand, has reduced the financial activities originally carried out through the balance sheets of financial institutions to a number of institutions, and the market division of labor formed by these institutions is supervised. This poses a great challenge for financial regulation. If financial activities are carried out through the financial institution's balance sheet, it is relatively easy to assess which financial institutions bear the risks and the scale, so as to introduce capital adequacy, liquidity and Regulatory requirements such as leverage ratios to control the risk-taking behavior of these financial institutions. However, in the case of financial activities through the market division of labor, risk taking and transmission will become hidden and complex, and institutional supervision may not work.

In terms of data privacy protection, libra is a licensing chain that requires authorization to join. In a few cases, Calibra does not share account information or financial data with Facebook or any third party without the customer's consent. These individual cases are: prevention of fraud and criminal activity; compliance with laws; payment processing and service providers, but these individual criteria are difficult to define.

In the field of traditional financial technology, data privacy protection is both an institutional issue and a technical issue. The computing think tank organizes the following three representative practices in the world.

First, the establishment of data privacy legislation , taking the General Data Protection Regulations (GDPR), which was implemented in the EU in May 2018, as an example, has the following three main points: 1. The right to delete personal data means that the data subject has the right to request the data controller. Delete their personal data to avoid the transmission of personal data; 2. The right to carry, means that the data subject has the right to request the data from the data controller and decide the purpose; 3. The data subject is voluntary, based on specific purposes and in data control In the case of a balance of status, the data controller is authorized to process personal data, but the authorization is not legally valid and can be withdrawn at any time. Other countries are also increasing their focus on data security. The United States has introduced privacy laws and cybersecurity laws. Singapore has issued a personal information protection law that is increasing the protection of user data.

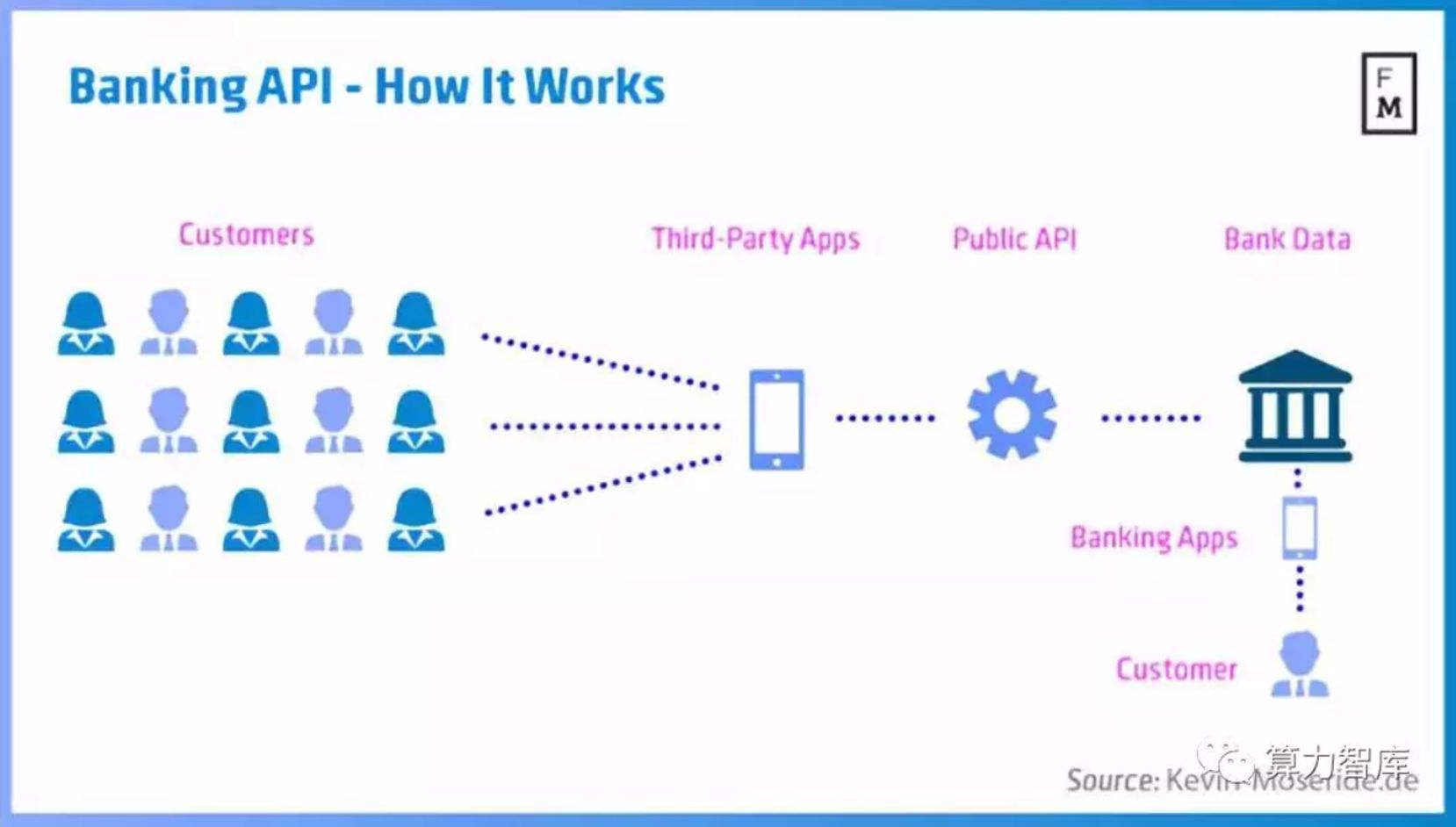

Second, open the banking application interface (API) . Banks open user data to authorized third-party organizations through APIs to facilitate the development and use of user data, and in fact partially realize the portability of user data. Banks define which user data is open and which institutions are open to them. The Hong Kong Monetary Authority announced the implementation progress and future plans for the banking API framework at the end of July this year. Up to now, 20 participating retail banks have provided more than 500 open APIs to facilitate access to a wide range of banking products and services.

Third, cryptography techniques such as verifiable computing, homomorphic encryption, and secure multiparty computing . For complex computational tasks, verifiable calculations produce a short proof. As long as you verify this short proof, you can determine whether the calculation task is executed accurately and does not need to repeat the calculation task. Homomorphic encryption and secure multi-party computing support data validation, making it possible to trade data usage rights without affecting data ownership, thereby building the property base of data transactions.

Libra brought a revolution in financial infrastructure. Under the digital economic tide, the different business models, applications, processes and products of financial technology are essentially based on these infrastructures for economic resource allocation across time and space, cross-border, The digital economy across organizations and across time and space will inevitably have new financial infrastructure to serve, and the new revolution in financial infrastructure will be a major trend in the future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Decentralized stable currency monetary policy and fiscal policy governance

- The history of cryptography changes: the enlightenment of the two pits in Germany and the Enigma machine to the mining machine manufacturers

- Viewpoint | Digital currency will open the currency scenario for blockchain technology applications

- How to make a steady profit without losing, become the king of BTC escape?

- Research Report | Preliminary Study on the Digital Currency of the People's Bank of China: Goals, Positioning, Mechanism and Impact

- QKL123 market analysis | Bitcoin continues to drop, will fall below $ 9,000? (0924)

- Winners such as Tencent, Fidelity and Lotte, Everledger finally won $20 million in Series A financing