The network is in short supply, the price is “four consecutive yangs”, is the spring of Ethereum coming?

OKEx market shows that at 20 o'clock on the evening of September 17, Beijing time, Ethereum price successfully broke through 200 US dollars; as of 9:00 am on the 18th, ETH temporarily reported 212 US dollars, 24H rose 7%.

After a lapse of one month, ETH successfully stood on the $200 mark.

ETH starts to force

ETH starts to force

In the Mavericks market opened in April this year, the ETH price trend was significantly weaker than other mainstream currencies: ETH's highest increase of 170% during the year, while the BTC's highest increase of 270% during the same period, EOS's highest increase of 240% during the year, and LTC's highest increase of 370% during the year. BCH's highest increase of 230% during the year.

- Wells Fargo wants to launch cryptocurrencies to help its global cross-border payment business

- Viewpoint | Looking at the "new revolution" of financial infrastructure under the digital wave from Libra

- Blackstone CEO Su Shimin first talked about Bitcoin: the currency that no one controls is very strange.

The price trend of ETH once made investors exclaimed the wrong car. "So many mainstream currencies have chosen the worst, and they have been cut as a leek when they first entered the market." Investors once told the Odaily Planet Daily.

In the past three weeks, Ethereum prices seem to have a recovery trend.

Encrypt analyst Leo said that from the weekly chart, the price trend of Ethereum in the past three weeks has been “three consecutive yangs”; the price trend in the past four days has been “four consecutive yangs”, leading the mainstream currency. This also shows that the ETH bulls are currently gaining an advantage and the downward trend in prices has been curbed.

(Odaily Planet Daily Note: San Lianyang, stock market terminology, refers to the continuous rise in the market, which is the simplest form of rising market.)

(ETH Price Weekly Chart)

(ETH Price Weekly Chart)

(ETH price daily chart)

(ETH price daily chart)

“Before the $200 was the resistance level of ETH, the situation is now reversed and the resistance level has become a support level.” Leo explained that Ethereum may have a support level of US$200 in the future.

Leo added that if there is a callback on the daily chart and even on the weekly chart, there will be a “4 consecutive +1 yin” pattern, indicating that ETH is about to open the main rising wave, and investors can appropriately increase the position.

"Now the big direction is still bullish, and the callback is only temporary. Be cautious and short, don't add leverage. "

Like Leo, Kong De, chief industry researcher at OKEx, is also optimistic about the future price trend of ETH.

Kong Deyun said: From the daily chart (below), it can be seen that the current k-line has fallen from the bottom up on September 13 and the current 5-day moving average indicates that ETH is entering an upward trend. It will continue; from the MACD brush map, the current MACD index is above the zero line, but the distance is not too far, and the MACD line is currently penetrating the signal line and there is still an upward trend, indicating that the price of ETH will continue to rise. There has not been a trend reversal signal; from the RSI indicator, ETH has not yet entered the overbought condition, so it can continue to be held in the short term.

(ETH price daily chart)

(ETH price daily chart)

In the past few trading days, ETH prices have soared, rising more than 11% on the 7th, leading the mainstream currency.

What puzzles investors is why the ETH price has such a large fluctuation in the near future?

Ethereum observer Yuan Yang believes that ETH has fallen too much compared to BTC, and this price increase is an oversold rebound.

The Odaily Planet Daily found that since the beginning of this year, ETH / BTC has been in a downward trend with a drop of nearly 60%. BCH / BTC, LTC / BTC, etc. have all experienced significant increases, with the highest drop of 50%.

Han Eiji, the initiator of an Ethereum project, believes that the main reason for the recent increase in ETH prices is that the business volume on the Taifang network has increased significantly, resulting in a very congested network, which in turn has increased the cost of miners for transaction packaging.

“Taking decentralized mortgage lending on NEST as an example, in the case of the Ethereum network is not congested, the miners paying a lending contract pays about 0.003 ETH, but now it needs 0.02 ETH, which is directly an order of magnitude. In other words, due to the shortage of network resources in Ethereum, the miners' fees have been greatly increased, which in turn has changed the supply and demand relationship in the ETH market, which has prompted the rise of this round of ETH prices.

Then the question is coming. Where does the huge transaction volume come from?

Han Seiji believes that one of the sources of huge trading volume is Tether. On September 12th, Tether moved the $300 million Omni-based USDT to Ethereum, and the USDT transaction accounted for about 25% of Ethereum's entire network, which also led to a significant increase in Ethereum's online trading volume. At full capacity.

According to data from the data research firm Ethgasstation.info, in the past 30 days, the Tether cost of processing Ethereum transactions has reached $260,000, and Ethernet network utilization has soared to 90%. As Tether takes up more capacity, it leaves less capacity for other developers.

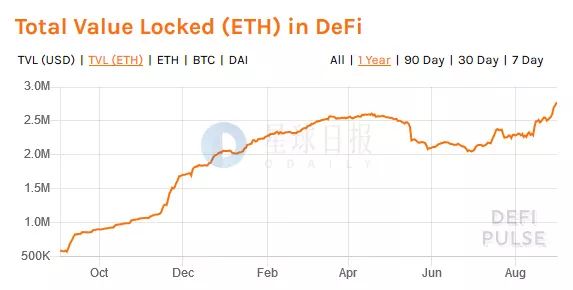

In addition, the second source of huge transaction volume is the booming Detai Ecology, which has led to an increase in the use of smart contracts. “The contract deployment volume including the headed DeFi projects like MakerDao, Compound, etc. has increased significantly in the most recent quarter, taking up more network resources. At present, most of the Ethereum network Gas fee contribution comes from DeFi. Directional products and services, such as decentralized mortgage lending, DEX, stable currency, etc." Han said.

Reports from AMBCrypto show that more than 2.77 million ETHs are currently locked into the DeFi application, the highest level since its inception in October 2018.

Solution: Increase Gas Limit

Solution: Increase Gas Limit

According to Glassnode's data, the 7-day moving average data of the Ethereum Gas daily usage reached about 48.913 billion Gwei on September 13th, the highest value since the Ethereum blockchain was created. At the same time, Ethereum began to appear congested. The phenomenon.

In order to solve the network congestion problem, on September 14, the miners began voting with Spark Pool and F2Pool to increase the Gas Limit, from 8 million to 10 million. On the evening of September 15, V Shenfa said: “Almost exactly 50% of miners are now voting to support the increase of Gas Limit, which for the first time exceeded 8.1 million.”

In order to solve the network congestion problem, on September 14, the miners began voting with Spark Pool and F2Pool to increase the Gas Limit, from 8 million to 10 million. On the evening of September 15, V Shenfa said: “Almost exactly 50% of miners are now voting to support the increase of Gas Limit, which for the first time exceeded 8.1 million.”

The so-called Gas Limit refers to the maximum Gas limit that can be consumed in each block, and does not refer to the Gas limit of a package transaction. The larger the Gas Limit of the block, the more blocks can be packed in a single block, which can directly increase the TPS value of Ethereum.

Many people think that the rise of the Gas limit can push the ETH price up. In fact, the two are relatively independent. "When the highway is widened, can the French currency rise? Obviously not." Kong Deyun said.

However, some respondents are not optimistic about raising Gas Limit.

Han Jianyi believes that increasing the Gaslimit of the block can indeed alleviate the network congestion, but this does not solve the problem fundamentally, because the larger the Gaslimit of the block, the larger the amount of data packed in the block will lead to the area. It takes longer for the block to spread throughout the Ethereum network. If the confirmation time of the miners' package transactions is long, the probability of occurrence of orphan blocks and uncle blocks will increase, which will not only reduce the income of the miners, but also affect the efficient operation of the Ethereum network.

"So, the miners cannot increase the Gas Limit of the block indefinitely. It is necessary to make small dynamic adjustments according to the operation of the Ethereum network to ensure the smooth operation of Ethereum." Han said.

Kong Deyun believes that the real solution to the congestion problem needs to be achieved through Ethereum 2.0. "The most important purpose of Ethereum 2.0 is to achieve state fragmentation. State fragmentation is the ultimate goal of fragmentation technology, and there is no successful precedent in state fragmentation. If Ethereum's state is fragmented, the problem of network congestion will be solved. To solve this problem, it is imperative to realize a more diversified and larger DEFI industry in Ethereum in the future."

Gradually promote ETH2.0

Gradually promote ETH2.0

At the beginning of Ethereum, four stages were set: Frontier, Homestead, Metropolis and Serenity.

At present, Ethereum is in the metropolitan stage, and tranquility is ETH 2.0. Unlike the ETH 1.X phase, ETH 2.0 will have two major changes: one is the transition from PoW (workload proof) to PoS (the proof of equity); the second is the expansion of Ethereum performance.

Despite the problems in Ethereum, core personnel including the co-founders have been running away and the forks have been delayed, but ETH 2.0 has been moving forward.

On September 14th, Jonny Rhea, an engineer at ConseSys development team PegaSys, announced on Twitter that ETH 2.0 multi-client operation has been confirmed. Consistency is now achieved by installing the seven clients of the beacon chain and forming the network. The seven clients are: Prysm from Prysmatic Labs, Artemis from PegaSys, Nimbus from Status, Lighthouse from Sigma Prime, Lodestar from Chainsafe, Trinity from Triniy Team, and Harmony from Ether Camp.

ETH 2.0 is expected to be implemented in 2020-2021, and the various teams developing the Ethereum 2.0 client have completed the trial network composition as a separate client, but running on multiple clients is still in development. The development team is currently gathering in Boston for on-site verification.

In addition to ETH 2.0, the ETH 1.X Istanbul hard fork upgrade as a transitional phase is also carried out step by step. Although the upgrade process was not as smooth as imagined – test network activation was postponed until October 2, the activation of the main network will be postponed until November, but fortunately the problem is not big, after all, it will continue smoothly.

After all, Ethereum has climbed too many pits, and these minor problems have not affected much. The day before the escalation of Constantinople this year, Ethereum discovered vulnerabilities, and despite the final extension of the upgrade, it was carried out according to the established goals.

postscript

postscript

The rebound in ETH prices has also given investors greater confidence.

“Insist on fixed investment, the return will come.” Investors who voted for ETH said that their current fixed ETH yield is about 30%.

“ETH has risen to $1,000, and I sent 100,000 red packets in the group. You can take screenshots,” said an ETH miner.

Text | Qin Xiaofeng

Produced | Odaily Planet Daily (ID: o-daily)

Original article; unauthorized reprinting is strictly prohibited, and violation of the law will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- U.S. government agencies’ three-fold increase in blockchain analysis service spending for three years, reaching nearly $10 million

- Babbitt Column | Blockchain: Smart Assets

- Decentralized stable currency monetary policy and fiscal policy governance

- The history of cryptography changes: the enlightenment of the two pits in Germany and the Enigma machine to the mining machine manufacturers

- Viewpoint | Digital currency will open the currency scenario for blockchain technology applications

- How to make a steady profit without losing, become the king of BTC escape?

- Research Report | Preliminary Study on the Digital Currency of the People's Bank of China: Goals, Positioning, Mechanism and Impact