Overview of Unsecured DeFi Lending Track

Unsecured DeFi Lending OverviewAuthor: Achim Struve, Outlier Ventures; Translator: Blockingxiaozou

1、Introduction

Our recent article “The Open Metaverse Under Attack – Fight Back” introduced many encouraging development paths in the Web3 field, and this article will focus on a hugely promising specific area.

The unsecured personal loan market in the United States alone reached $210 billion in the first quarter of 2023, surpassing the total locked value of decentralized finance (DeFi), which was only $61 billion.

- Ordinals: A New Perspective on Inscription Collections and Interpretation of Generative ERC-721 Standards

- Reviewing the most controversial moments in Moonbirds history

- Settlement Reached in Coinbase Insider Trading Case: What Impact Will This Have on the Industry?

This means that the DeFi field as a whole has huge growth potential, especially in the decentralized lending field. This significant growth potential has prompted us to survey the current leading decentralized unsecured loan protocols.

We will compare these protocols in all aspects, including capital adoption, token valuation, incentive impact, and main marketing methods, in order to paint a clear picture of the absolute and relative market landscape.

2、Overview

The cornerstone of any financial system is the ability to lend and borrow assets. The lender receives a return from idle cash, while the borrower needs quick access to working capital. The DeFi lending market is often over-collateralized, meaning that the borrower must deposit collateral worth more than the loan value. For example, a borrower needs to provide $10,000 of ETH as collateral for a $5,000 USDC loan. Although over-collateralized loans are the norm in DeFi, unsecured loans in the traditional financial sector sometimes have insufficient collateral, or even no collateral. Over-collateralization ensures that in the event of borrower default, the collateral can be sold to compensate the lender. Although over-collateralized loans are safer for creditors, their market expansion is limited by their low capital efficiency. This is where unsecured loan protocols come in to overcome this limitation in DeFi. Unsecured loan protocols can access trusted credit data to estimate the borrower’s risk profile without leaking sensitive information on the blockchain. Oracles combined with zero-knowledge proofs are already being developed to reduce the need for borrowers to disclose their identity to unsecured lending platforms.

However, unsecured loans are an important branch of DeFi, with their higher risk reflected in higher loan annual percentage yields (APY) compared to overcollateralized loan providers such as Aave and Compound. Insufficient or unsecured collateral increases the likelihood of default. Loan settlements and repayments using off-chain assets and contracts may also take a long time. Regarding the security of the lending pool, lenders must rely on pool managers’ due diligence. Lenders may not be able to obtain liquidity when needed, as the amount of liquidity that can be withdrawn from the lending pool depends on the amount of liquidity present in the pool.The following figure is a representative advanced unsecured loan protocol ecosystem using TrueFi as an example. Here, the lender sponsors a lending pool, from which borrowers will access the loan. TRU pledgers can vote on loans, which must also receive portfolio manager approval.Table 1 shows some protocol overviews that offer unsecured loans to institutional borrowers, sorted by total locked value (TVL).Table 1: Protocol OverviewThe FDV MC (fully diluted valuation; MC: market capitalization) of all native tokens of unsecured loan protocols in Table 1 totals $341 million, equivalent to 6.6% of the crypto lending field, 0.7% of the DeFi field, and 0.03% of the total crypto MC. In addition, the total TVL is $384 million, equivalent to 0.6% of the DeFi TVL.These data indicate that the market share of unsecured loan protocols in Table 1 is minimal compared to the entire DeFi and cryptocurrency fields. On the other hand, given the size of the traditional off-chain unsecured loan market, these data also show growth potential. The growth potential becomes more apparent when considering the competitive average loan APY of 8.6%, including all protocol native token rewards.Note that compared to lending to overcollateralized loan protocols (such as Aave), lending to unsecured protocols involves higher risk, so lenders have reason to obtain higher compensation.

4. Tokens Performance Comparison

By comparing the historical valuation developments of the related tokens in Table 1, we can gain insights into their potential future trajectories. However, token valuations measured by FDV MC are affected by various factors such as general market conditions, adoption of individual protocols, and token design itself. Tokens with lower value capture properties may perform poorly, while products – lending platforms – may perform well in TVL and bad debt rates. Therefore, comparisons will be made on multiple levels. An overview of token design and value capture properties can give you a preliminary understanding of the expected correlation between overall protocol adoption and performance. For example, tokens that capture strong value from protocol revenue may better represent general protocol performance than tokens with limited value capture mechanisms. Then, the measurement standards of current important tokens will be compared. The final token performance analysis will focus on historical development.

(1) Token Value Capture

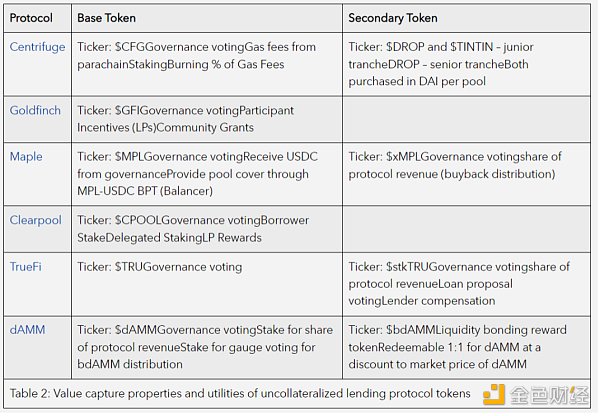

Table 2 summarizes the value capture properties and utilities of the top 6 ranked protocols in Table 1. All tokens provide governance power to both holders and stakers. In addition, Maple, Centrifuge, and TrueFi use staking to exchange for secondary receipt tokens. Receipt tokens are sometimes designed as voting escrow (ve) models or as tools for distributing fee splits to loyal supporters. In the cases of Centrifuge, Maple, TrueFi, Clearpool, and dAMM, fee splits are given directly or achieved through decentralized buybacks. Goldfinch and Clearpool do not have secondary tokens, and instead use their primary tokens directly as protocol incentive tools. All native protocol tokens derive value directly from product usage, or through the aforementioned fee splits, governance, or providing user benefits in staking tokens. This means that we can expect all tokens to have this correlation between protocol adoption and token valuation.

(2) Token Measurement Standards

The following figure shows the relationship between protocol deposits (TVL) and different measurement standards, such as FDV MC, the average APY of lenders, the number of holders, and Twitter followers. These ratios are the percentage of the highest value in the same category.

Deposit / FDV MC ratio indicates the capital adoption status of the protocol relative to the current market valuation. Please note that these indicators only take into account deposits without collateral and pledged deposits.

Deposit / Average A PY ratio is an indicator that represents capital adoption relative to capital incentives.

Deposit / Holder ratio represents the average deposit value per native token holder, which is a benchmark that considers actual user quality from the perspective of capital size.

Deposit / Fan ratio is an indicator of the amount of capital adoption brought by each unit of marketing work. Please note that the number of Twitter fans is not necessarily related to the actual user adoption of the product.

Fan / Holder ratio represents the performance of marketing work compared to the actual user adoption of native tokens.

Data collection work has been carried out since February, but due to the drastic changes in the market, all data points need to be updated. In the previous data collection, there was a huge difference in the ranking of different categories between protocols. Today, we see that Centrifuge is a clear leader in all categories, which is a direct result of its high TVL, which is twice that of Goldfinch, ranked second. Compared with other competitors, their success may be due to their innovative real-world asset (RWA) tokenization and mortgage forms.

(3) Comparison of token market value history

The previous comparisons are all related to recent values. The figure below shows the historical development of FDV MC of different unsecured loan protocol tokens. These values are normalized by ETH FDV MC to achieve a benchmark for the encrypted market. The ordinate is on a logarithmic scale, thereby alleviating the occurrence of high volatility. Given the period from January 1, 2022 to May 19, 2023, the value of all native unsecured tokens relative to ETH has decreased.

5. Summary and Insights

The token design of unsecured loan protocols shows different methods and value accumulation mechanisms, all of which provide governance power through their tokens, but not all protocols provide direct income sharing through collateral. However, all token designs will obtain value in some form from product adoption.

Centrifuge is currently the most successful unsecured loan protocol in terms of FDV valuation and TVL. Although they also face some issues with delinquent loans, their strength lies in their innovative approach to tokenizing real-world assets.

The overall valuation performance of all native unsecured loan tokens has been lower than the crypto market. Too many bad loans occurred during the bear market of 2022, and some loans didn’t even receive a penny of repayment, leading to a decrease in trust in the industry.

As far as overall FDV MC is concerned, unsecured loans are only a relatively small piece of the cake compared to the entire DeFi space (0.7%) and the entire crypto market (0.03%). Considering the huge correlation between unsecured loans and the traditional financial sector, as well as the market’s trend of optimizing capital efficiency, decentralized unsecured loans still show enormous growth and innovative potential. It just needs more time to rebuild trust and innovation, and eventually move towards a brighter future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Cregis Research: Why is an MPC wallet more secure than a regular wallet?

- Nansen CEO: Expansion speed was too fast, costs were too high, and 30% of employees have been laid off.

- After carrying a huge debt and shutting down TradeBlock, the former crypto empire DCG is now struggling for survival with one arm.

- Understanding ERC-6551 in one article: How to change the rules of NFT gaming?

- Revisiting the Legitimacy of Crypto: The Ideological Divide Between Us and Vitalik

- Benefits and Challenges of StarkNet Built-In Functions

- Why is LSDFi considered a transparent narrative?