5 LSD Protocol Considerations to Keep in Mind

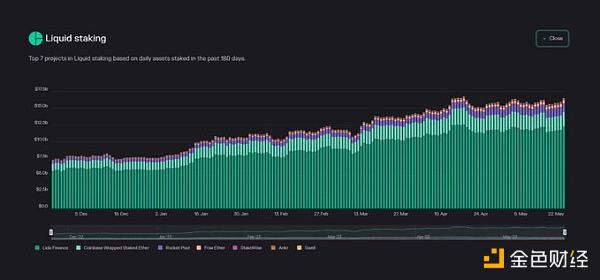

5 Key Points for LSD ProtocolAuthor: Emperor Osmo, Crypto KOL; Translation: Blocking0xxzLiquid Staking is one of the hottest topics in DeFi this year, growing by over $10 billion since the beginning of the year. With the arrival of the LSD liquidity trend, it is just getting started.

This article introduces 5 LSD protocols that can profit from the LSD wave.

The Shapella upgrade is the biggest catalyst for ETH liquidity staking, driving it to $18.06 billion in assets and becoming the largest race in the cryptocurrency field. Since then, innovative projects have surged, hoping to take advantage of this liquidity growth.

- Overview of Unsecured DeFi Lending Track

- Ordinals: A New Perspective on Inscription Collections and Interpretation of Generative ERC-721 Standards

- Reviewing the most controversial moments in Moonbirds history

Unsheth

Token USH. Ush allows users to make their ETH liquid while maximizing the decentralization of validators that provide these services. This means that your ETH can obtain the most favorable interest rates (up to 349%), while funds are distributed everywhere.

The Unsheth team has been building and expanding rapidly. They have already launched on the Ethereum mainnet, BNB chain and Arbitrum, and will soon be fully staked.

The Unsheth team has been building and expanding rapidly. They have already launched on the Ethereum mainnet, BNB chain and Arbitrum, and will soon be fully staked.

Combining expansion with solutions, such as gusher.xyz, which will innovate on the USH token, makes this a very interesting game.

Current market value of USH: $12.7 million

LSDx Finance

Token: LSD. LSD aims to optimize the value of LSD assets by providing liquidity for LSD assets needed for various DeFi applications.

They offer 2 products:

UM, a stablecoin collateralized by surplus ETHx.

ETHx, a basket of various ETH LSD assets.

Their token LSD will be used for governance voting to determine the direction of LSDxfinance development and revenue generation.

50% of the generated revenue will be handed over to the treasury. All revenue received by the treasury will be distributed to veLSD holders.

Current market value of LSD: $772,000

Zero Liquid

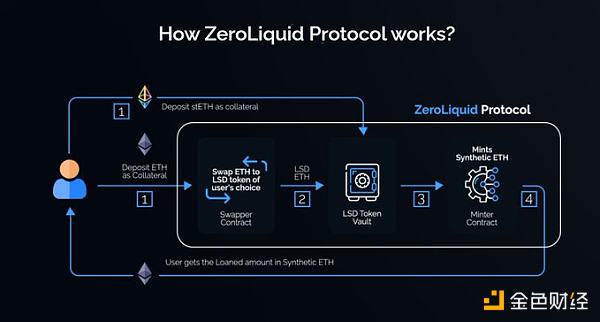

Token: Zero. What if you could use your ETH as liquidity collateral and still get attractive rewards?

This is where Zero Liquid comes in, offering: 1. 0% loan interest; 2. Self-repayment of loans; 3. No liquidation

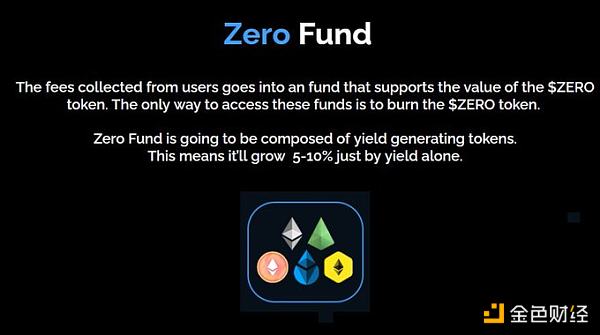

The ZERO token has two use cases: governance and earning protocol fees. When Zero Liquid harvests earnings from the insurance pool, an 8% fee is charged. 55% of the protocol fees will be allocated to stakers, 35% for liquidity incentives, and 10% for the Zero Fund. Current market cap: $3.51 million.

The ZERO token has two use cases: governance and earning protocol fees. When Zero Liquid harvests earnings from the insurance pool, an 8% fee is charged. 55% of the protocol fees will be allocated to stakers, 35% for liquidity incentives, and 10% for the Zero Fund. Current market cap: $3.51 million.

Origin DeFi

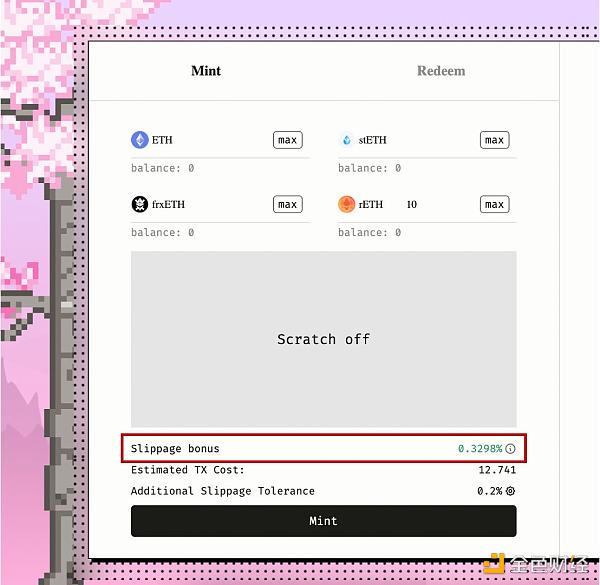

Token: OGV. OETH is a yield aggregator that optimizes returns between liquidity staking derivatives on AMMs and ETH liquidity provision.

Users can deposit ETH, stETH, rETH, or frxETH to receive Origin Ether, which can be used to earn income or mint the fully-backed stablecoin OUSD.

Lybra Finance

Lybra is solving one of the biggest problems in DeFi today, generating returns through liquidity staking of ETH.

With Lybra, users can deposit ETH or stETH to mint eUSD, their over-collateralized stablecoin that earns yield without exposure to volatility.

LBR is the native token of Lybra Finance, used for governance and protocol fee sharing for users minting eUSD. Lybra has been one of the best performing assets since its launch, and their V2 is full of exciting developments.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Settlement Reached in Coinbase Insider Trading Case: What Impact Will This Have on the Industry?

- Cregis Research: Why is an MPC wallet more secure than a regular wallet?

- Nansen CEO: Expansion speed was too fast, costs were too high, and 30% of employees have been laid off.

- After carrying a huge debt and shutting down TradeBlock, the former crypto empire DCG is now struggling for survival with one arm.

- Understanding ERC-6551 in one article: How to change the rules of NFT gaming?

- Revisiting the Legitimacy of Crypto: The Ideological Divide Between Us and Vitalik

- Benefits and Challenges of StarkNet Built-In Functions