Gary Gensler’s Crypto Game: Stealing the Spotlight from Congress to Illuminate the SEC’s Path

Gary Gensler's Crypto Focus: Shining a Light on the SEC's PathAuthor: John Roberts, Fortune Crypto; Translation: bayemon.eth, ChainCatcher

ChainCatcher’s Comment:

Due to the unique decentralized system in the United States, the awkward situation of cryptocurrency regulation in the United States stems from the fact that various regulatory agencies have not yet formed a unified cognitive framework. For many years, institutions such as the SEC, CFTC, and the United States Congress have been fighting for jurisdiction over cryptocurrencies, which has to some extent led to slow legislation and further caused unclear cryptocurrency policies that cannot be relied upon. At present, there is a delicate situation in the United States, that is, the CFTC has limited power in the spot market because it only has regulatory power over the derivatives market, and cannot directly compete with the SEC, whose dissatisfaction and complaints from various parties are growing stronger. Public opinion and various forces are calling for timely intervention by the US Congress and ultimately resolving the issue through legislation.

Therefore, we have recently seen two congressional members submit a bill to impeach SEC Chairman Gary Gensler, and Coinbase and other US-based cryptocurrency institutions publicly call for reliance only on Congress or case law to achieve regulatory clarity. However, some lawyers have analyzed that even if people hope that the country will quickly establish regulatory regulations, this process may take longer than SEC’s more definitive action.

- Understanding the Distributed AI Computing Network Gensyn

- Office of the New York Attorney General Provides Tether-Related Documents in Response to CoinDesk

- How should investors hedge their risks during the “storm” of encryption?

Fortune today published an article about SEC Chairman Gary Gensler’s manipulation of the media in an attempt to cover up congressional actions in the cryptocurrency field, and combed through the timeline. The article is interesting, and we may be able to glimpse some of the regulatory trends in the United States from it.

Gary Gensler is a master of playing the media. Last October, the SEC chairman released a video on a Monday morning announcing that the SEC would fine Kim Kardashian for promoting a certain cryptocurrency because it played a subtle role. Although this seemingly insignificant event occurred in June 2021, due to the mixed effect of celebrity scandals and release time, it almost drowned Gensler and the SEC in the overwhelming news reports.

The cryptocurrency industry has long been dissatisfied with this “trick” and believes that Gensler should focus on creating a regulatory framework for digital assets. But recently, because Gensler has shifted people’s attention away from the congressional cryptocurrency legislation proposal through his influence on media issues, the world’s spotlight has instead been focused on the SEC where he is located.

In early June, the House Agriculture Committee held a hearing called “The Future of Digital Assets” to determine the gap between current regulatory schemes and actual situations. However, on the morning of the hearing, the SEC suddenly challenged Coinbase with a lawsuit, just a few hours after the agency filed a lawsuit against the industry’s largest exchange, Binance. The result is unquestionable, as both the hearing and the media reported on the SEC’s lawsuit, and the so-called improvement of regulatory schemes has long been forgotten.

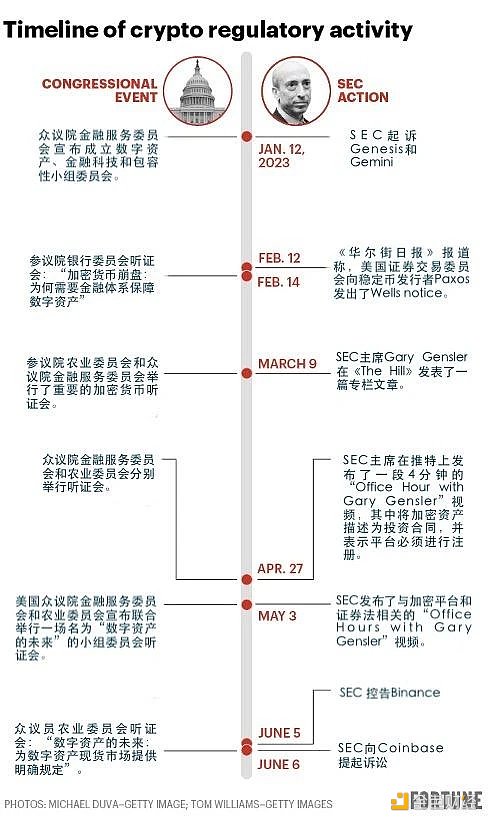

The timing of the SEC lawsuit may be a coincidence, but it is consistent with the agency’s pattern of releasing announcements related to cryptocurrencies at previous hearings. As shown in the following figure, Fortune magazine discovered six such examples in 2023 alone.

Note*: The picture has been compiled by ChainCatcher

Although several lawsuits coincided with hearing events are “coincidences” of the SEC, it is obvious that the SEC has other means to keep itself firmly in the center of the spotlight. For example, the SEC has twice released videos with Gary Gensler as the focus and cryptocurrency as the main topic on the same day as legislative hearings, entitled “Office Hours with Gary Gensler”.

In an interview with Fortune magazine, executives in the cryptocurrency industry expressed great anger at these strategies. A high-ranking executive who didn’t want to be named for fear of retaliation from Gensler complained to Fortune magazine that the SEC chairman tried to interfere with Congress’s normal agenda through his actions and accused him of trying to obstruct legislative efforts. However, there is currently no clear evidence or regulations to judge Gensler’s behavior inappropriate.

Jonathan Adler is a professor at Case Western Reserve University and an expert in administrative law research. He pointed out that agency heads like Gensler are political appointees, and their actions are in line with this identity.

Adler believes that agency heads like Gensler typically have their own policy agendas to advance, which mainly articulate the goals the agency wants to achieve and the efforts made for them. For many years, only a few agency heads, especially the late chairman of the Federal Trade Commission (FTC), Michael Pertschuk, have been able to publicly respond to public questioning of their regulatory fairness. However, Adler said thatalthough the cryptocurrency industry may be unhappy with Gensler’s attempts to hinder legislative progress, Gensler’s behavior has not crossed the line.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Uniswap v4: What’s Next for the Top DEX?

- Evening Reading | USDT Faces Serious Selling Pressure: Are Market Makers Exiting?

- Is USDT facing severe selling pressure due to market makers exiting?

- How can the development path centered around application chains avoid the pitfalls of Polkadot and Cosmos?

- How can we participate in interactions now that the re-collateralization agreement EigenLayer has officially launched on the mainnet?

- How can Prisma, who calls themselves “LST Endgame,” create a growth flywheel?

- Interpreting the Maverick Protocol DeFi Protocol