Winning projects from hackathons hosted by Delphi Labs and Cosmos ecosystem

Winning projects from Delphi Labs and Cosmos ecosystem hackathons.Author: Delphi Labs

Translation: Felix, BlockingNews

Delphi Digital’s incubation department, Delphi Labs, partnered with Osmosis, Injective, and Neutron to hold the Delphi Labs Cosmos Hackathon. More than 250 participants submitted a total of 60 works. This article will give you a glimpse of the top three winning projects based on the Osmosis, Injective, and Neutron ecosystems, respectively.

Osmosis Ecosystem

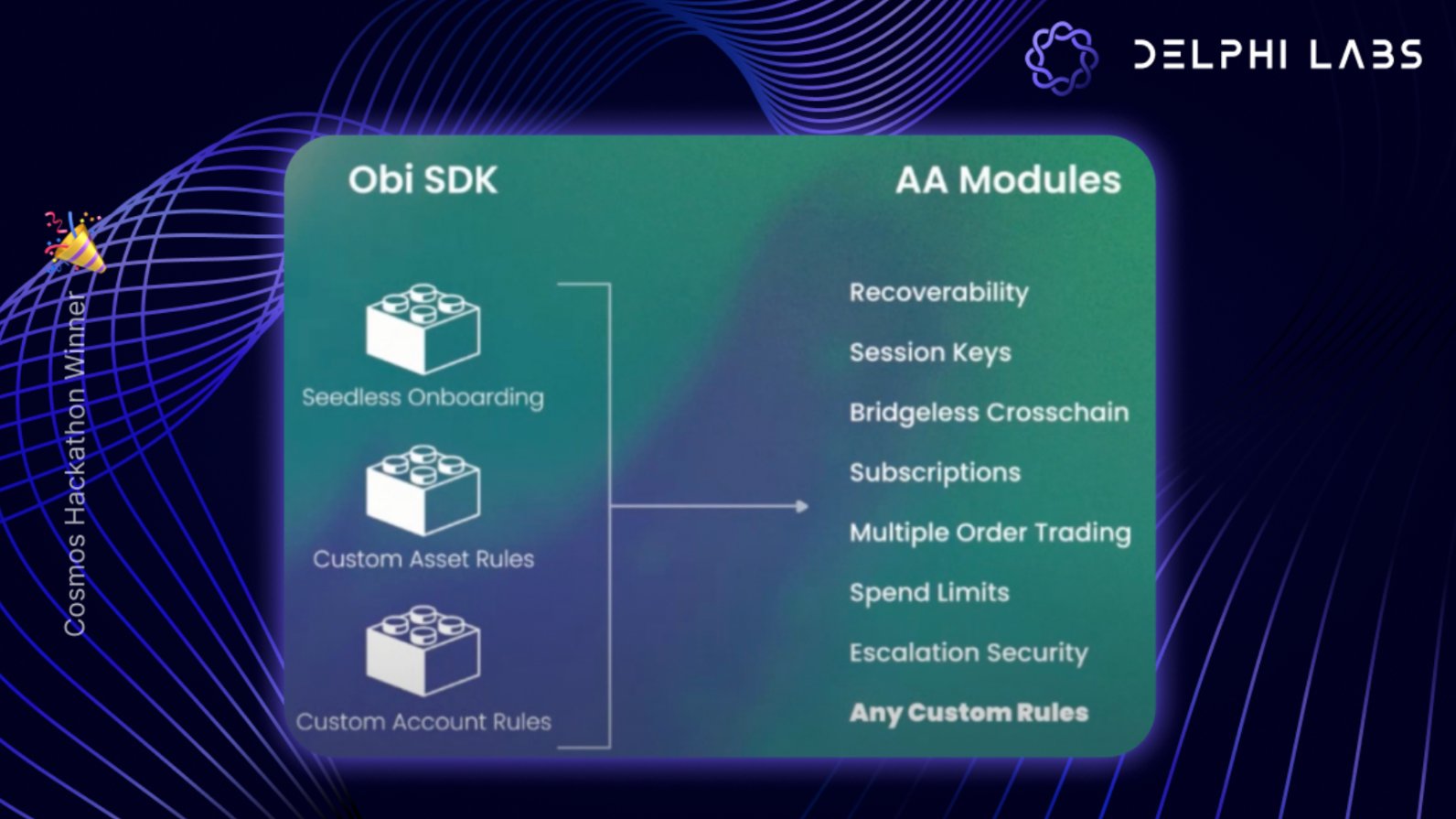

First Place: @Obi_Money_

For cryptocurrencies to enter traditional fields and become mainstream, significant improvements are needed in users’ wallet experience. Obi provides an excellent user experience for Osmosis’ new generation of users. Features include mnemonic-free login, recoverable assets, and account abstraction modules, such as session keys and spending limits.

- Inventory of 6 encryption projects joined in NVIDIA Inception program

- Will the introduction of “staking mining” on BRC-20S mark the beginning of Bitcoin DeFi summer?

- Hidden Gems in the Crypto World: A Review of Web3 Gaming Projects

Second Place: @Aegis_finance

Aegis Finance is bringing privacy attributes to Osmosis. By supporting multi-asset shielded pools, users can perform privacy transactions, LP, staking, and more without any mixing. Although building is challenging, Delphi Labs believes that privacy will eventually become a necessary attribute in the process of encrypted user transactions.

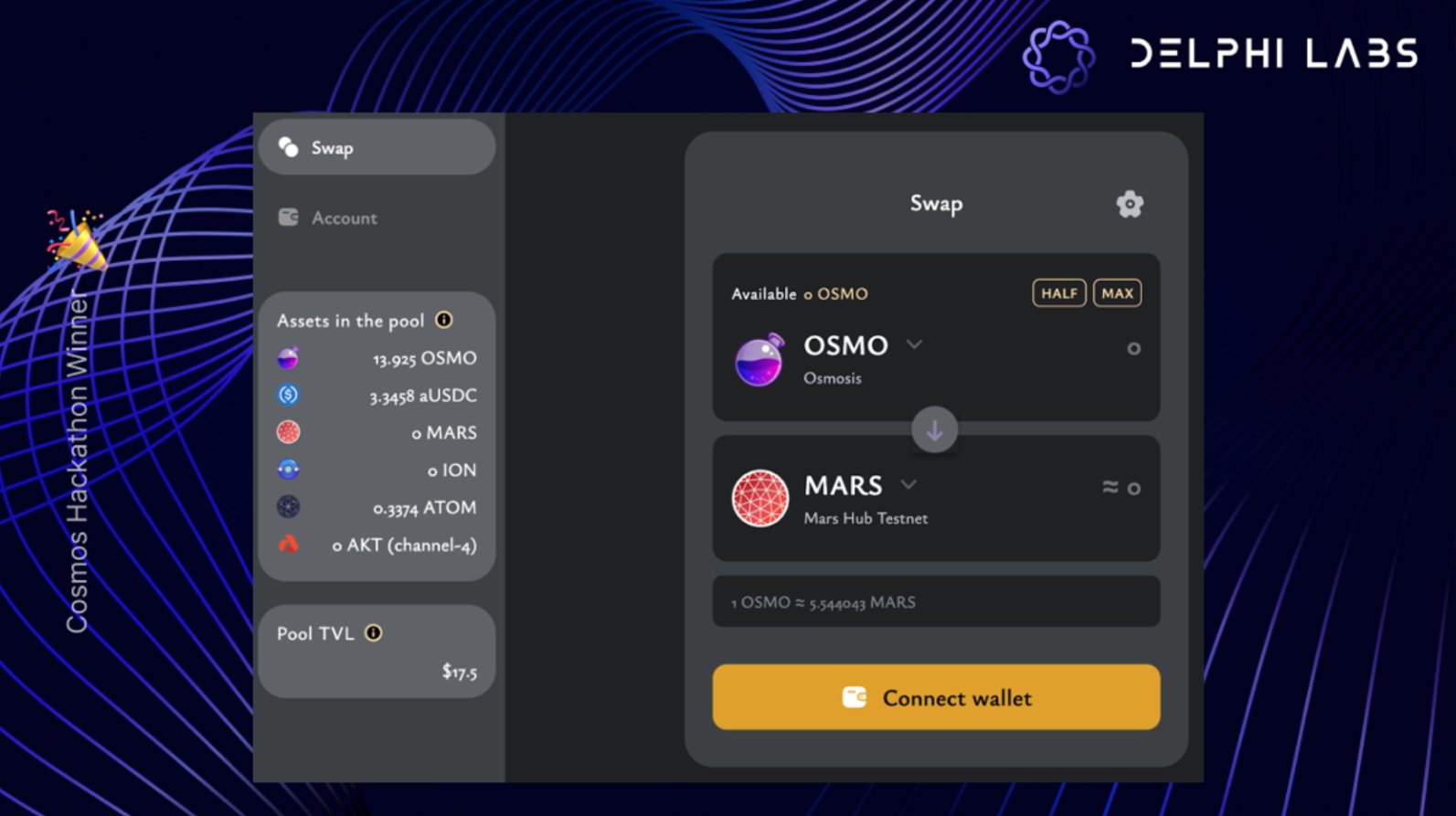

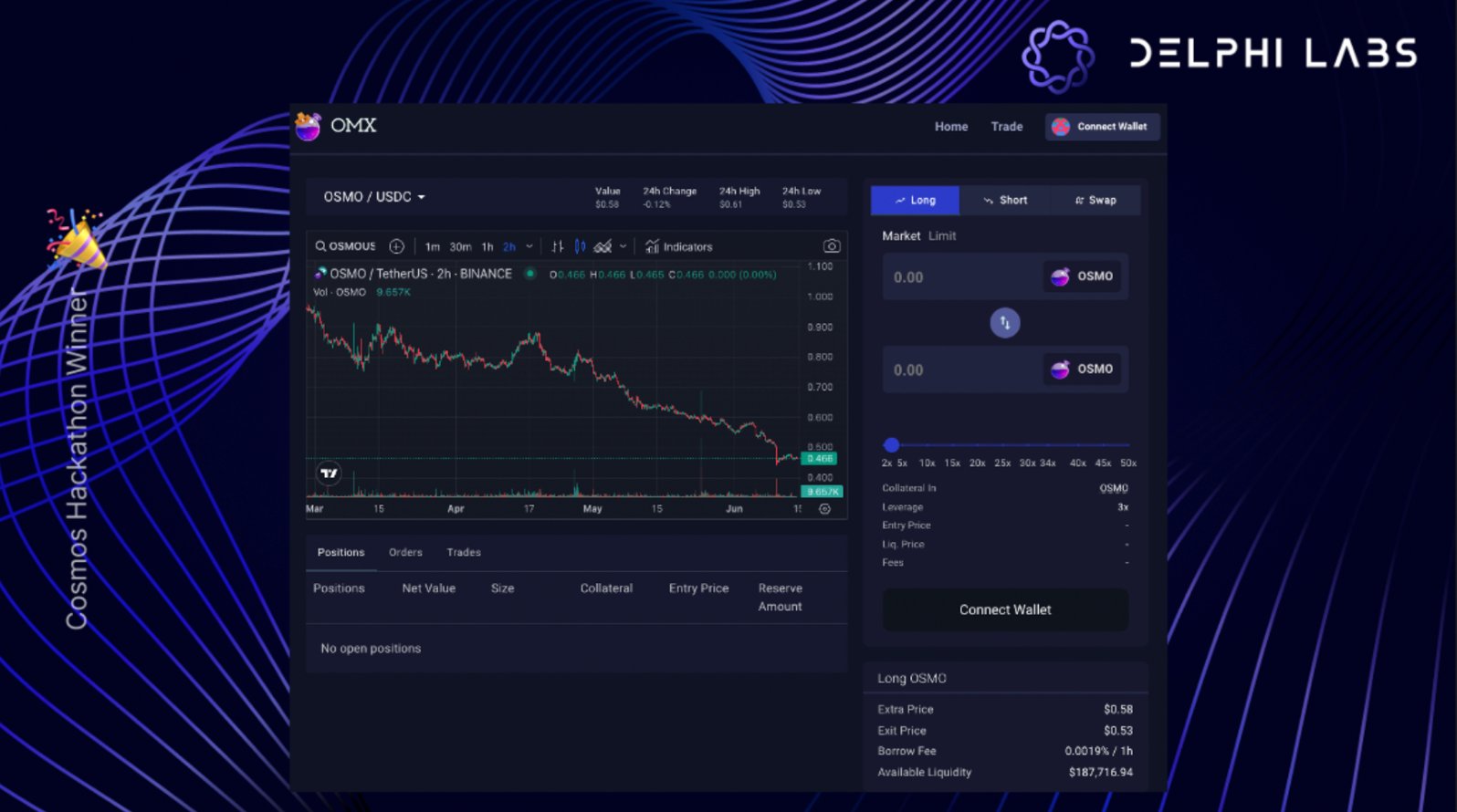

Third Place: @OmxApp

The perpetual contract trading project OMX aims to enhance Osmosis DeFi and bring a set of DeFi products to LP tokens, including derivatives, leverage, hedging against impermanent loss, and volatility trading.

Injective

In the past few months, Injective has experienced explosive growth in TVL, projects, and ecosystem events. The three winning projects in the Injective ecosystem are:

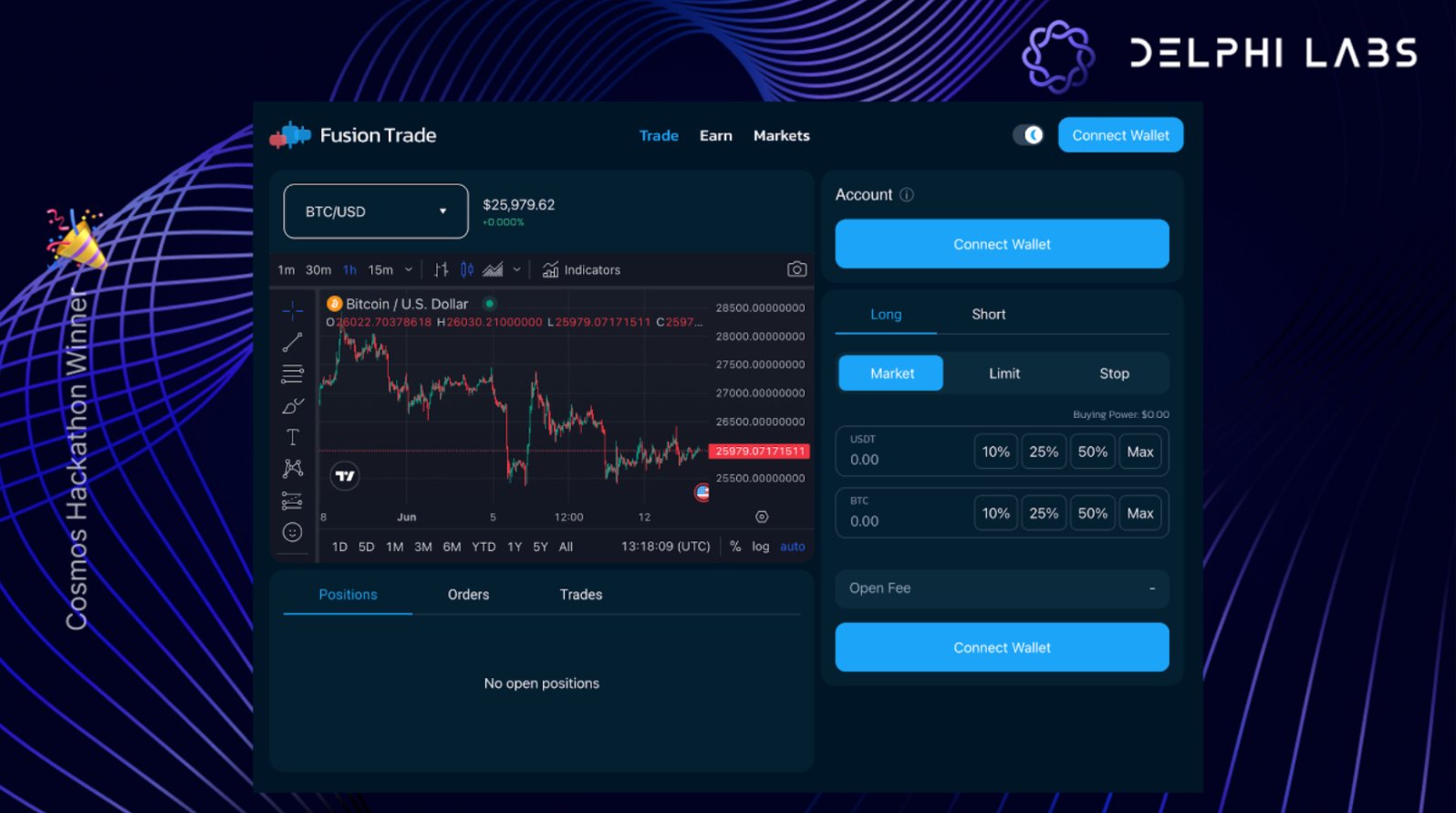

First Place: @FusionTradeDEX

Although order books and automated market makers have performed well in Cosmos, Oracle-based solutions have not. Fusion Trade is a cross-margin, Oracle-based perpetual contract DEX.

With Injective’s speed and unique features, Fusion Trade aims to be the best perpetual contract DEX on the Cosmos chain.

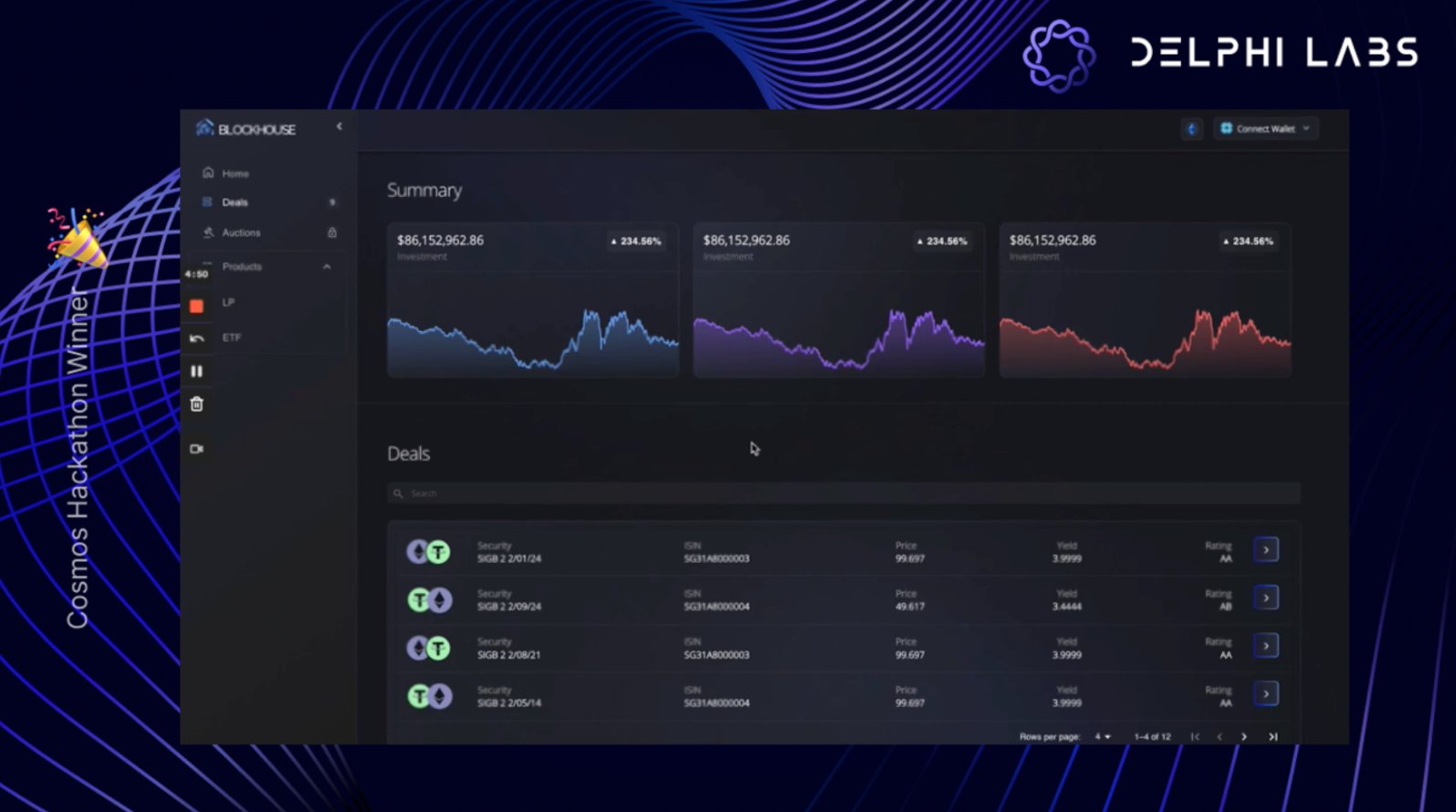

Second place: @blockhouse_cap

Blockhouse aims to accelerate the process of putting all assets on-chain and bring the next generation of institutional users to Cosmos through credit tokenization and hybrid AMM primitives.

Institutions can use Blockhouse for bond trading, with the advantages of pre-trade transparency, automatic execution, real-time settlement, and low trading costs.

Third place: @WardWallet

As the industry integrates into traditional fields, smart contract wallets will become an important window for improving user experience. Ward, a smart contract wallet soon to be launched on Injective, is expected to unlock some killer features, including social recovery, key rotation, and offline signing.

Neutron Ecosystem

Neutron’s mainnet has just launched and has attracted a series of development activities. As a general, permissionless blockchain, there are a variety of projects based on the Neutron ecosystem. Here are the top 3:

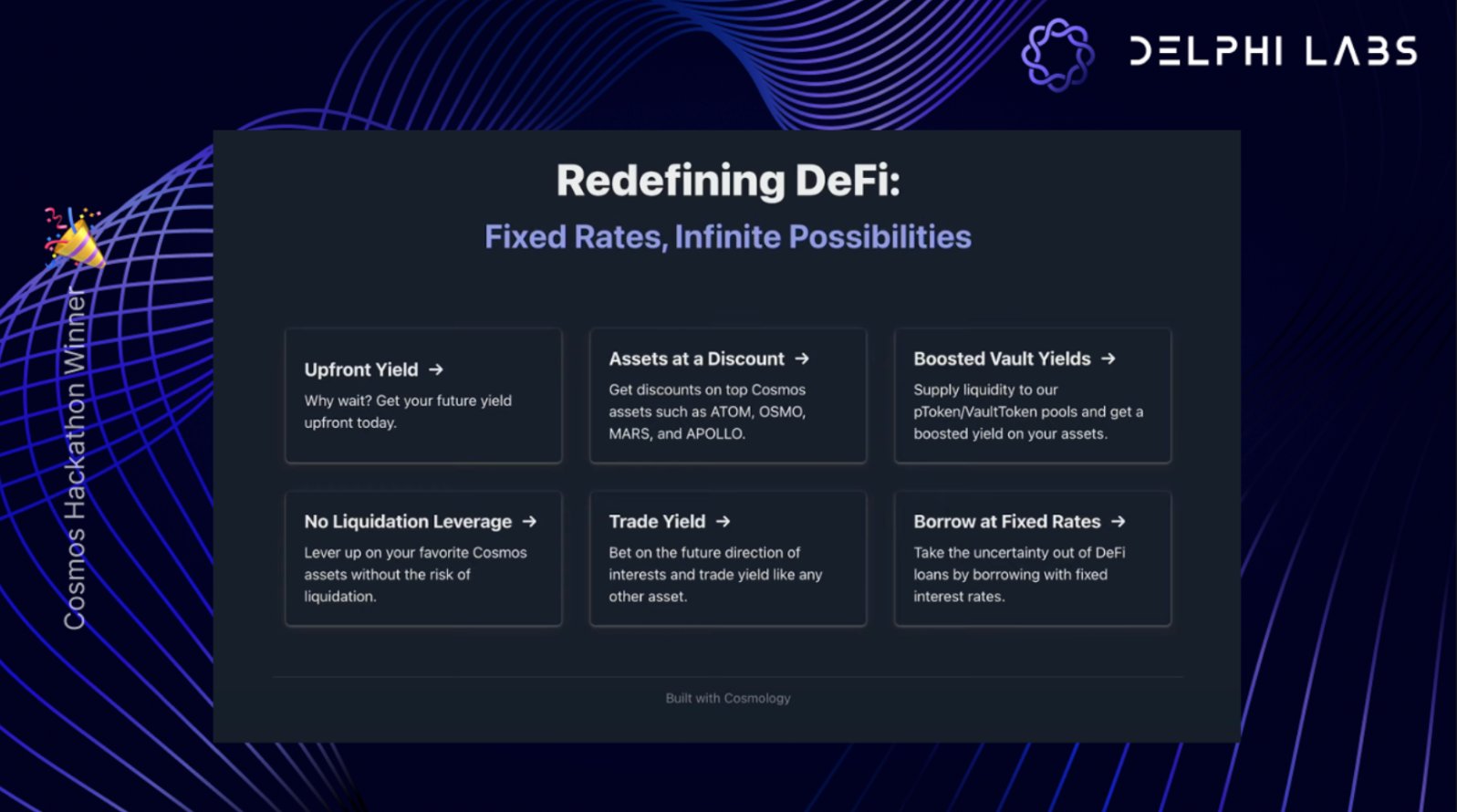

First place: @fission_finance

The Fission Finance protocol splits yield tokens into principal and yield tokens, allowing yield trading, unleveraged borrowing, and fixed-rate lending.

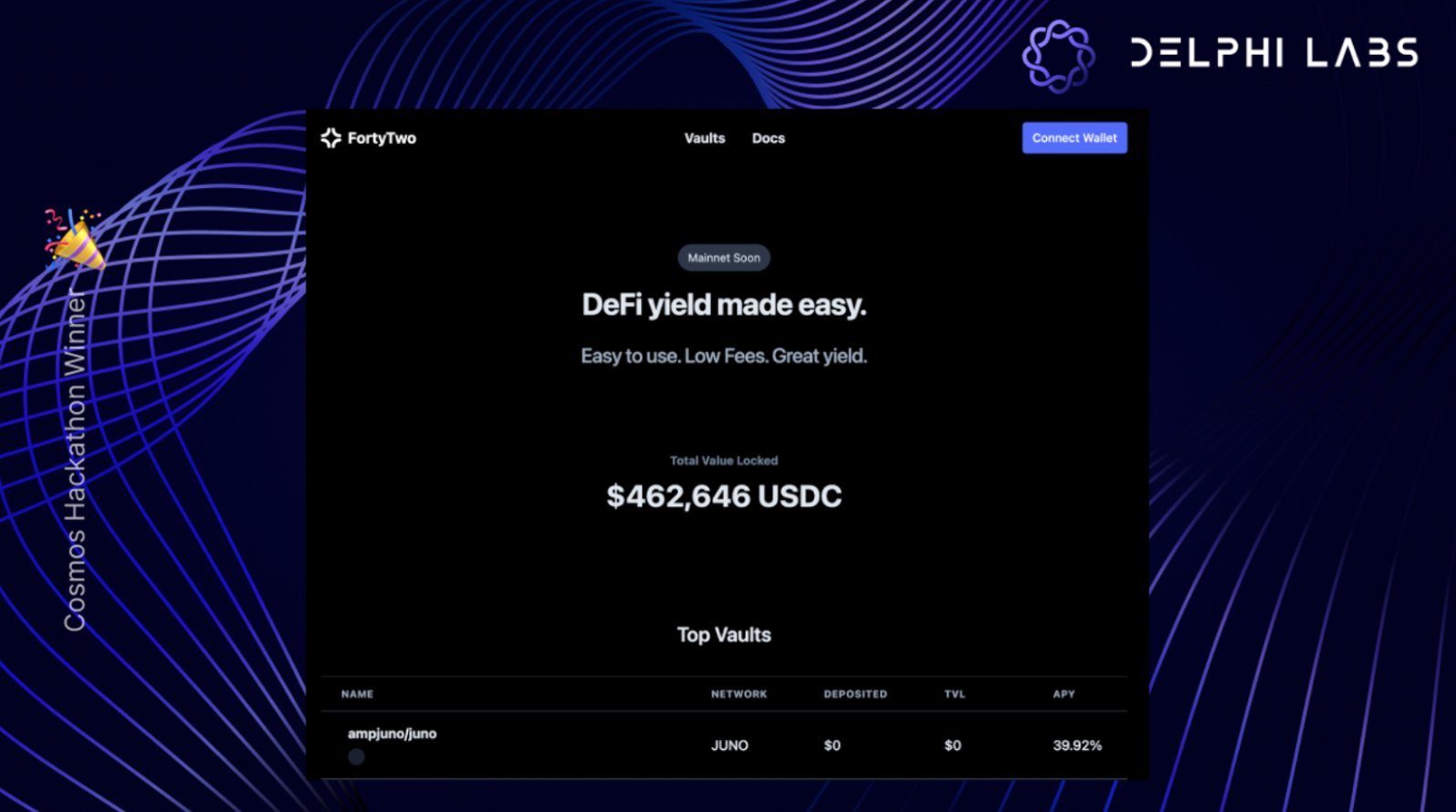

Second place: @FortyTwo_money

FortyTwo aims to change the Cosmos experience by integrating the entire ecosystem’s frontend. Users will be able to easily view their entire Cosmos product portfolio and interact with on-chain applications through a streamlined UI.

FortyTwo’s initial product will also enable automatic compounding mining and DEX aggregation on Astroport and Neutron.

Third place: @StarScopeCosmos

Starscope ensures users no longer miss important on-chain events. Starscope’s notification system can push key alerts, including unlocked LP tokens, new governance proposals, liquidations, and more.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Creator project of FVM, which is the latest addition to the FVM mainnet

- Hidden gems in the encrypted world: A list of Web3 gaming projects

- Following Crypto VC, let’s take stock of 8 well-known VC investments: gensyn, Taiko…

- 20 Potential Projects Worth Paying Attention To

- How to prepare for a bear market in encryption? A summary of 20 “potential stocks” worth paying attention to.

- Analysis of LSDfi Leader Lybra Finance: Project Characteristics and Potential Risks

- Analysis of Binance’s Launchpool Project Maverick: How does MAV AMM improve capital efficiency?