Will the introduction of “staking mining” on BRC-20S mark the beginning of Bitcoin DeFi summer?

Will staking mining on BRC-20S start Bitcoin DeFi summer?BRC-20S (BRC-20 Staking) is an extended version of the BRC-20 protocol proposed by OKX, designed to introduce a staking mechanism for BRC-20 tokens or Bitcoin to the Bitcoin network.

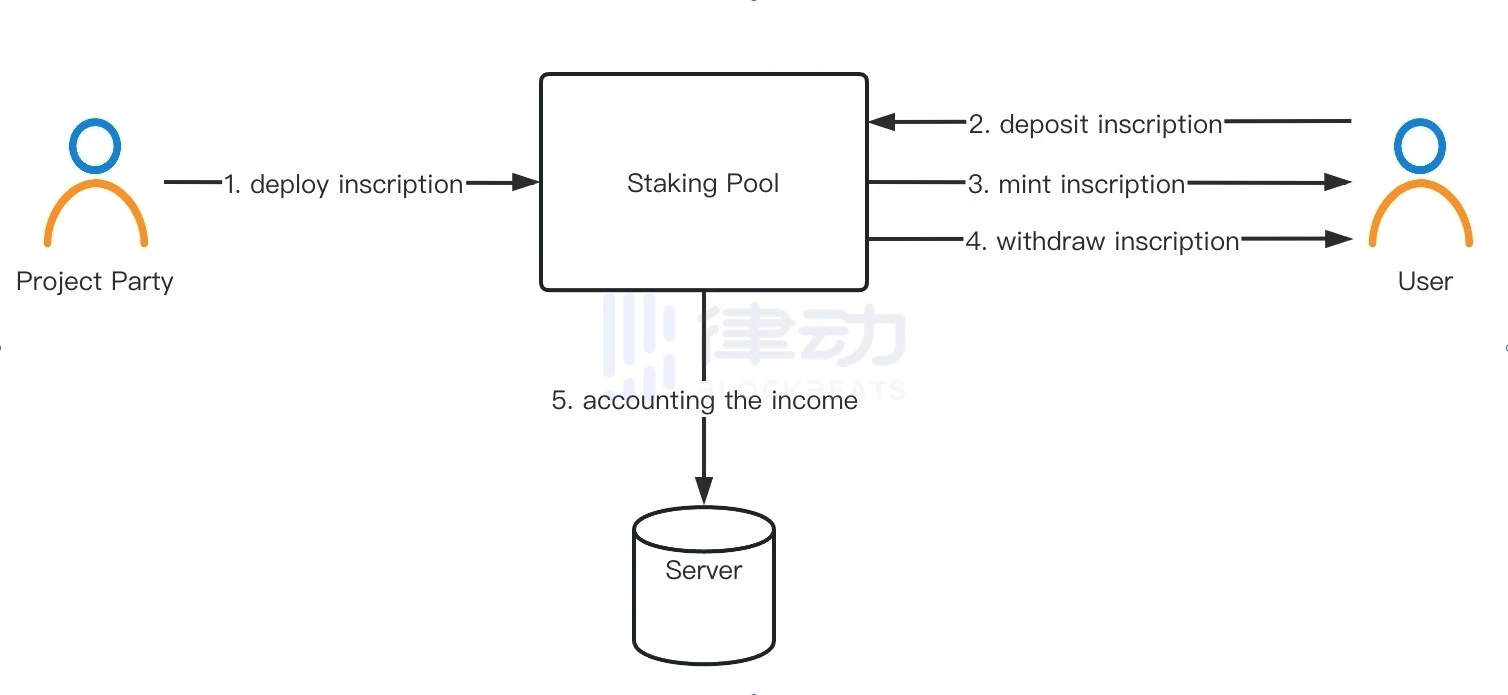

With BRC-20S, users can stake their own BRC-20 tokens or Bitcoin and receive corresponding BRC-20S tokens as a reward. Like BRC-20, the calculation of staking rewards will also be achieved through an index. OKX will provide an open-source interface for profit calculation, and any user’s staking income will be calculated consistently in the backend and open-source tools, ensuring the consistency of all calculations.

BRC-20S Interaction Process

Currently, the deployment of BRC-20S still awaits the perfection of OKX’s index and related infrastructure such as the BRC-20S token trading market. But we can imagine what new changes BRC-20S may bring to the market.

- Hidden Gems in the Crypto World: A Review of Web3 Gaming Projects

- Creator project of FVM, which is the latest addition to the FVM mainnet

- Hidden gems in the encrypted world: A list of Web3 gaming projects

New BRC Token Issuance Method

Currently, the issuance of BRC-20 tokens has gradually evolved from the original publication of the ticker (token name) for everyone to engrave and has been completed through the mature BRC-20 token issuance tool, Luminex. The principle of completion through Luminex is that when the project party deploys BRC-20 tokens, the number of single engraved tokens that can be engraved is set to the same as the total amount. All tokens are first engraved in their own hands, and users pay gas through Luminex, and finally, the tokens are distributed. With Luminex, the whitelist system has been well applied to the issuance of BRC-20 tokens, providing assistance to the cold start of projects.

With BRC-20S supporting direct staking of Bitcoin to “mine” BRC-20S token rewards, it is likely to once again trigger a new change in the BRC token issuance model. In the future, new projects may directly complete initial token distribution by staking Bitcoin, and a “Bitcoin staking mining” trend may be set off. At the same time, BRC-20S also supports staking BRC-20 tokens to “mine” BRC-20S token rewards, which will expand the gameplay of BRC-20 tokens. Will BRC-20 token leader $ORDI become a “golden shovel”?

“Mother Token” and “Child Token”

In the Ethereum ecosystem, the “dual-token model” has been seen frequently. BRC-20S has technically cleared the obstacles to implementing the “dual-token model” on the Bitcoin network. The next question is, how can we play?

For this, I envision an adaptation scenario based on the “Dual Token Model.” The recent new concept of “recursive inscriptions” is essentially a mutual reference between Bitcoin chain inscriptions resources. If a studio that generates art appears and trains a AI model with all existing inscriptions on the chain as daily material to produce a generated art work and auction it, then the BRC-20 Token can act as the “mother token” to play a governance role, such as deciding the theme of each period of art work generation (which inscriptions to keep or remove as training materials, etc.), deciding which art work to put on the shelf for each period, external cooperation decisions for the studio, and so on. At the same time, the “child tokens” obtained by pledging this “mother token” can be used as payment tokens for claiming this art work.

The “Dual Token Model” has many other adaptation scenarios, such as GameFi, SocialFi, etc. Combined with “recursive inscriptions,” there will be more interesting applications on the Bitcoin network.

Prospects: Pledging Small Pictures

Since BRC-20S has already realized the pledging of BRC-20 Tokens, is it possible to directly pledge small pictures?

For example, by adding two keywords to the protocol, one specifying the name of the NFT series, and the other specifying the set of valid inscription numbers for the series (such as Inscription #10000, Inscription #10001, etc.), it is possible to confirm whether the deposited inscription is valid through off-chain indexing, calculate the staking reward for the holding address of the valid deposited inscription, thus achieving the pledging of small pictures.

Conclusion

The support of pledging function in BRC-20S on the Bitcoin network broadens the imagination space of BRC-20 Tokens and is expected to bring better positive effects on the liquidity of Bitcoin and BRC-20 Tokens. It’s hard not to love the Ordinals ecosystem that has been developing.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Following Crypto VC, let’s take stock of 8 well-known VC investments: gensyn, Taiko…

- 20 Potential Projects Worth Paying Attention To

- How to prepare for a bear market in encryption? A summary of 20 “potential stocks” worth paying attention to.

- Analysis of LSDfi Leader Lybra Finance: Project Characteristics and Potential Risks

- Analysis of Binance’s Launchpool Project Maverick: How does MAV AMM improve capital efficiency?

- Listing 7 zkSync ecosystem projects worth paying attention to: Sat.is, SyncSwap, Velocore…

- Will Recursive Markings Trigger the Next Wave of BTC Ecology?