20 Potential Projects Worth Paying Attention To

20 Promising Projects to WatchAuthor: slappjakke.eth, Crypto KOL; Compilation: Felix, BlockingNews

The market is in decline, and copy trading (CT) has failed. It’s time to start accumulating quality projects slowly. This article is a list of the top 20 projects worth paying attention to, compiled by Crypto KOL slappjakke.eth.

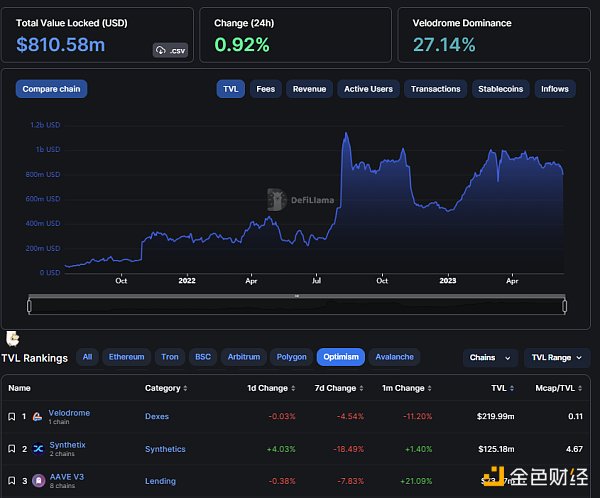

VELO

Velodrome is the first successful ve(3,3) DEX and the only one that dominates TVL on a chain. It is the main liquidity center of Optimism. It is about to switch fees with V2 to achieve centralized liquidity. In the future, it will airdrop the token AERO to the veVELO lockers on Base.

- How to prepare for a bear market in encryption? A summary of 20 “potential stocks” worth paying attention to.

- Analysis of LSDfi Leader Lybra Finance: Project Characteristics and Potential Risks

- Analysis of Binance’s Launchpool Project Maverick: How does MAV AMM improve capital efficiency?

ARB

Arbitrum is a leader in Layer 2 and has established an impressive ecosystem. Arbitrum has strong user stickiness, and innovative projects are more willing to launch on Arbitrum than on Etherscan.

STG

Stargate Finance is a flagship project based on LayerZero technology, connecting cross-chain bridges and DEXs for all chains. As more and more chains are adopted, Stargate will be in a leading position, and the entire chain narrative will become larger and larger.

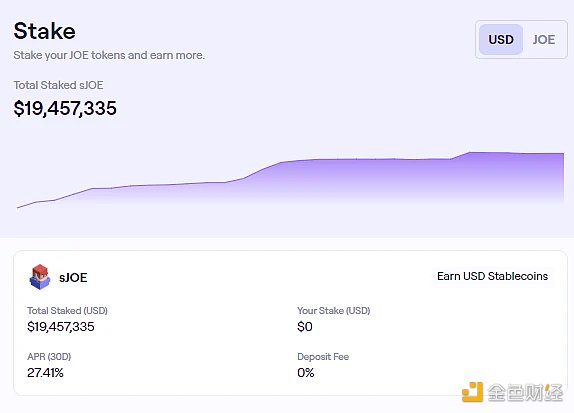

JOE

The Liquidity Book of Trader Joe is an innovative centralized liquidity DEX that recently released Auto Pools (automatic rebalancing and fee compounding). Joe has the advantages of high fees for LPs, profit sharing for stakers (APR is 27%), and low emissions.

FXS

Frax Finance has been continuously building and delivering during the bear market. With its innovative frxETH, it quietly occupied a large share of the LSD market. The currently launched products include:

-

frxETH (liquidity pledge product)

-

FraxFerry (cross-chain bridge)

-

FraxLend (lending platform)

Coming soon:

-

frxETH v2

-

Frax v3

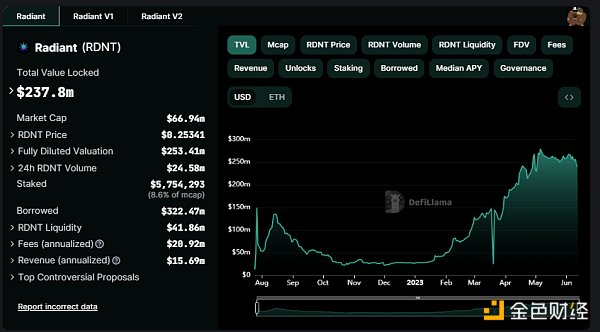

RDNT

RDNT Capital is a full-chain lending protocol based on LayerZero technology, which has been deployed on Arbitrum and Binance Smart Chain and will soon be launched on more chains. With innovative token economics, RDNT achieved dynamic liquidity and TVL growth during the bear market.

PENDLE

Pendle has made interest rate swaps more diverse by splitting the principal token PT and the yield token YT, and this innovative protocol has swept the LSD market share. Even during the bear market, Pendle’s TVL remained on the rise and had a higher market share than Equilibria.

GMX

GMX is a derivative DEX protocol with increasing trading volume and fee revenue, and has started a true revenue narrative through their GLP token, with innovative and first-class token economics.

Although GMX’s fee revenue has recently declined and token prices have been impacted, its V2 version supporting synthetic assets is coming soon.

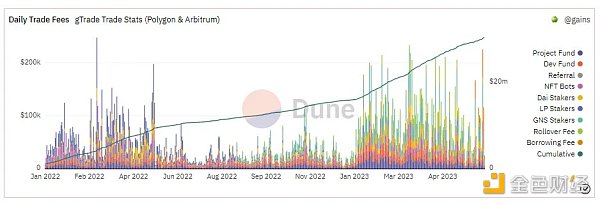

GNS

Gains Network is a decentralized derivative trading platform that offers up to 100x leverage, forex trading, and more. After launching on Arbitrum, Gains Network’s fee revenue increased significantly.

LYRA

lyra Finance is an on-chain option trading protocol based on AMM, allowing users to buy/sell call or put options for ETH, BTC, ARB, and OP. Hedging LP Vaults ensures safer LPs and lower tail risk.

After deploying on Arbitrum, lyra Finance dominated on-chain option trading volume.

THE

Thena is the leader of ve(3,3) on BNBchain, with centralized liquidity already implemented in functionality and perpetual trading with ALPHA coming soon. All fees go to veTHE lockers.

Thena team delivers products quickly and has an intensive roadmap with many upcoming products.

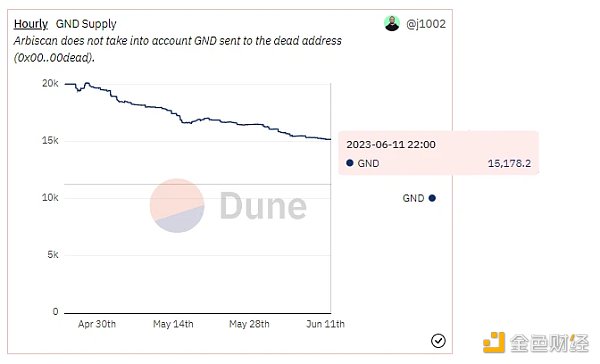

GND

GND Protocol is creating a high-deflation yield stablecoin gmUSD and a uniswap v3 CL farm.

With buybacks, OTC buybacks, and xGND lockups, GND supply is decreasing and has fallen by 25% in 2 months.

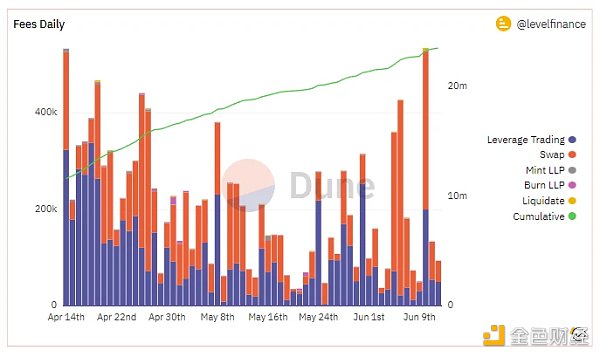

LVL

Level Finance is a perp dex that uses innovative risk management systems. It has recently been charging huge fees (note that some say all fees are for farming incentives) and plans to deploy the product on Arbitrum soon.

rDPX

dopex_io is a decentralized options protocol that has two tokens, $DPX and $rDPX.

rDPX V2 is currently under development, which will introduce the synthetic asset dpxETH, which is minted by burning $rDPX (creating deflationary pressure). dopex_io is a Gigabrain team (people who have a deep understanding of the crypto industry), has ample DAO funding, and has excellent meme genes.

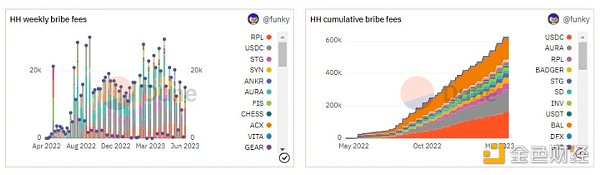

BTRFLY

RedactedCartel, a liquidity bribery market operator, is building products on the Curve, Convex, Frax, Balancer, and Aura ecosystems and is a powerful builder with a large DAO treasury and high-quality products.

Products include:

-

Hidden Hand (bribery market)

-

Pirex (automatic mixing)

Upcoming:

-

Dinero (stablecoin)

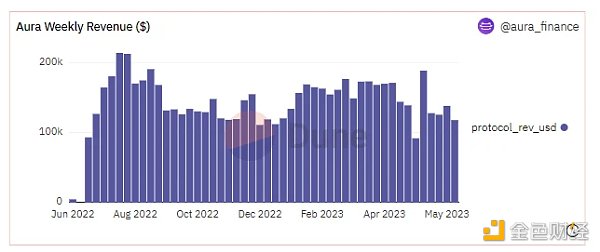

AURA

Aura Finance is a yield aggregator, meta-governance platform, and bribery market for the Balancer ecosystem, controlling 31% of veBAL and about to be released on Arbitrum.

STX

Stacks is creating an L2 smart contract layer for Bitcoin. Stacks is to Bitcoin what Arbitrum and Optimism are to Ethereum.

Stacks has introduced a new consensus mechanism: the Proof of Transfer (PoX) consensus mechanism. However, the confirmation time of the current version of Stacks is very slow, but the Nakamoto Release plan aims to fix this problem.

BIT (MNT)

Mantle is launching a modular Layer 2 rollup on Ethereum with $3 billion Mantle DAO support and multiple grants and incentives to attract builders and users.

The last two projects have high risks, so pay attention to your own risk management.

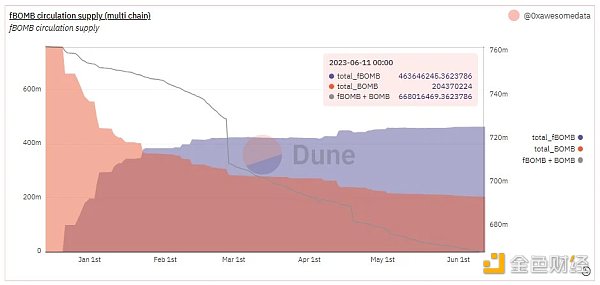

fbomb

fBomb Opera is an inflationary farming token with over 20 farms and flywheels on various ve(3, 3)s, with DAO bribes and veNFT accumulation. fBomb Opera always maintains 100% APR and can follow the market well.

At the same time, fBomb Opera’s burning rate is stable, and over 10% of its supply has been burned in the past 6 months.

UNIBOT

Team Unibot has created a Telegram bot that allows users to paste contract addresses to trade in TG chats.

However, for security reasons, users are advised to use a new wallet. To date, Team Unibot’s trading volume has exceeded $10 million.

-

Sniper bot

-

Copy whale transactions

In addition, Team Unibot’s migration and staking, as well as fee sharing, will be launched soon.

It should be noted that although slappjakke.eth has made the above recommendations, some of these projects may not survive in a bear market. Especially when investing in a risky period, as we are currently in a bear market, prices may continue to fall. DYOR.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Listing 7 zkSync ecosystem projects worth paying attention to: Sat.is, SyncSwap, Velocore…

- Will Recursive Markings Trigger the Next Wave of BTC Ecology?

- a16z will open an office in London and plans to launch a blockchain accelerator project.

- Preview of a New Project | Rodeo, a Leveraged DeFi Mining Project: Could it Become the Leveraged Center of the Arbitrum Ecosystem?

- Quick Look at Token Unlocking Status of Mainstream Projects in June

- Inventory of Catalysts Coming to the Cryptocurrency Industry: GMX V2, Camelot Upgrade, Lybra Finance V2…

- Introducing Ark: a privacy-focused alternative Bitcoin scaling solution