When the industrial financing reform is going on, how does encryption finance bring a new style to Hollywood movies?

Today, traditional finance is being integrated into an unprecedented financial innovation, especially in industrial financing. Many companies are trying to replace traditional financing methods with new financing models. The film is such an industry. Due to the emergence of blockchain technology, the industry is currently experiencing a quiet "funding revolution."

If asset securitization is seen as a thing of the past and the present, then asset compliance certification represented by digital securities is a future matter. In the new financing model, the certification is based on the traditional investment and financing model, which further enhances asset liquidity and transaction flexibility compared to equity investment. In theory, anything can be clarified, and this trend is becoming a reality.

Daywalker Film Fund and growing demand for certification

- Babbitt Column | From Central Bank to Digital Currency Exchange: A Typical Case of Banking Sinking

- Chainalysis Asia Pacific cryptocurrency trend development report (October 2019)

- Privacy Backtracking and Investment: Oligarchs are significant and future value can be expected

Wesley Snipes is a famous Hollywood film actor, director and producer. The "Blade Warrior" series starring the film has won more than $400 million in box office worldwide. This time he hopes to use the opportunity of asset certification to jointly launch a fully regulated digital securities issuance program with the Liechtenstein Encrypted Assets Exchange (LCX) to raise $25 million for the film.

The funds raised will form a film fund called Daywalker to invest in films and TV shows produced by Wesley Snipes and its production company Maandi House Studios, and allow global investors to hold a share of the fund's products. Through the digital securities issued by the Daywalker Film Fund, investors will not only receive a portion of the fund's product profits, but will also be able to enjoy a range of value-added services and benefits from actual movies to games, merchandise and intellectual property, such as movie premieres. Invitation. The Daywalker Film Fund's profits will be reinvested in the fund to increase its long-term value.

In the movie space, Wesley Snipes is not the first to pass the film product, and the blockchain company tZERO, a US retail giant's overstock.com, is the first to propose this concept. In July of this year, the company announced that it would pass the biography of Atari: Fistful of Quarters, the founder of game publisher Atari Nolan Bushnell. tZERO plans to work with the film's producer to design a digital security called "Bushnell" and said it will take a portion of the globally adjusted total movie revenue as a return on investment, including Some other interests.

It is clear that the demand for citation in the film industry is growing rapidly. More importantly, most people believe that the film industry is in desperate need of new liquidity tools. The traditional financing method makes the investment sources of the film diverse. From hedge funds to individual investment, the form of return on investment is usually the partial ownership of the film products.

In the more than a decade of portfolio theory began to apply to film investment, a large amount of social capital swarmed. In 2004, Wall Street's private equity funds and hedge funds joined the film investment army as a film investment fund. The common nature of high-risk and high-yield made the third-party equity financing a popular method and became an important economic pillar of Hollywood. In 1995, third-party equity financing accounted for 35% of the major film companies' film products and was used by industry giants such as Fox, Miramax and Paramount.

While this type of financing is often used to reduce risk, the financial risks of the film industry are particularly prevalent. Because the film industry can only make effective valuations before the demand is evaluated, and most of the demand cannot be estimated, the investment can only be seen when the film is released. In Hollywood, usually the movie has not yet officially started, and the budget of more than 50% has been recovered in advance to reach this standard before it can be turned on. To this end, investors have a very cautious investment attitude towards film products. Especially in recent years, the rise of the Internet and its impact on the traditional distribution model of the film industry have intensified this situation.

The demand for new capital flows in the independent film industry is particularly evident. In the field of independent films, it is difficult for emerging filmmakers to find the right funds. For example, some independent filmmakers face numerous obstacles. Netflix and streaming services can take a huge share of the traditional movie market with lower financial risk and distribution costs. In general, investing in an independent project can have three options: self-financing, crowdfunding, and government subsidies through charitable organizations.

Crowdfunding VS The rise of universalization

The rise of crowdfunding has led many filmmakers to find a new financing path. GoFundMe, Kickstarter and other platforms firmly control the field of crowdfunding financing. These platforms either return equity to investors or use lower incentives (such as obtaining in advance). Product) Returns to investors. However, crowdfunding is not without its shortcomings. Although various crowdfunding platforms are overwhelmed by a large number of financing requests, this freshness seems to be fading.

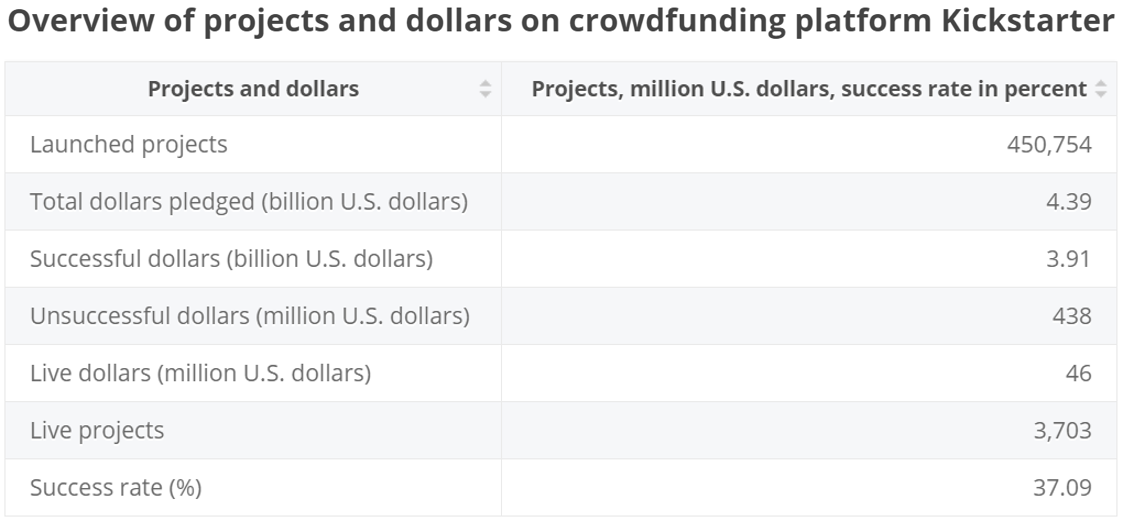

According to the Kickstarter website, only 37% of its film and video projects have been successfully funded since the site's inception, and this success rate has fallen by 6% since 2015. Crowdfunding can be a good choice compared to traditional financing, especially as it allows some startups or small projects to start. However, this is also a difficult task, and underestimating this will cause huge losses.

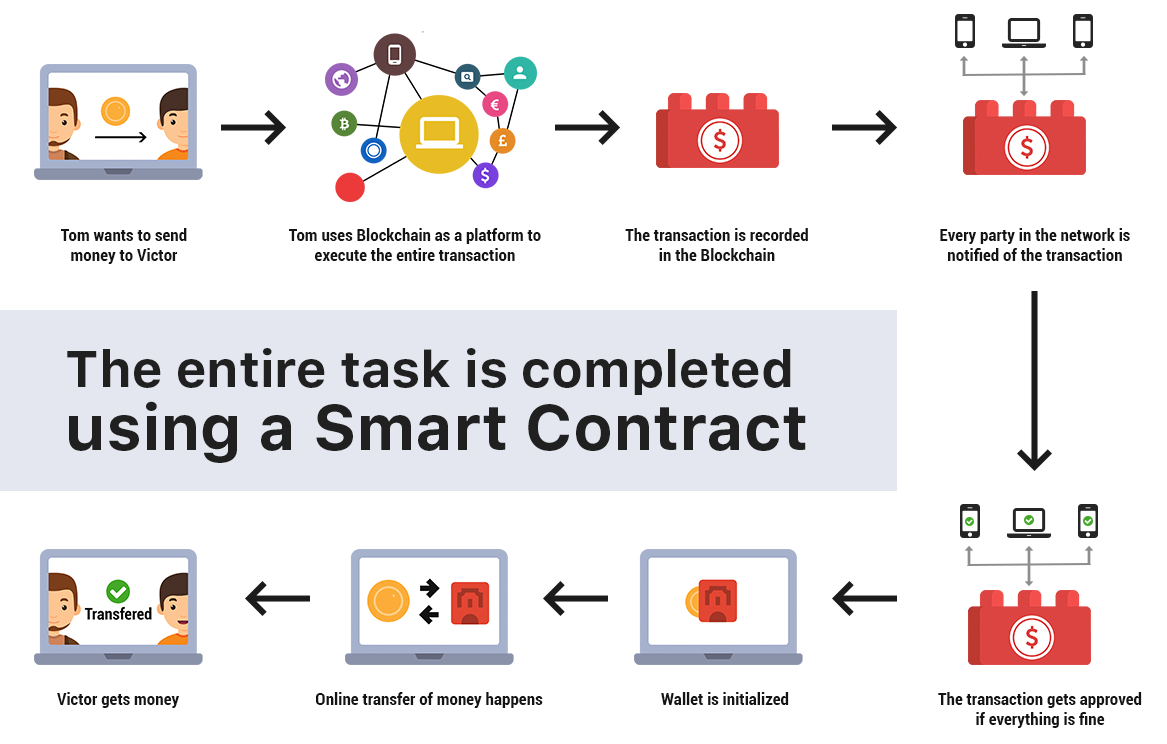

Today, crowdfunding is becoming a new and inefficient form of financing that requires a lot of time and effort to plan financing separately. Just as crowdfunding seeks to go beyond traditional financing methods, today's certification is also preparing to go beyond crowdfunding. Although there is a similarity between Citation and Crowdfunding, the blockchain has elevated the concept of Citation to a whole new level. From the perspective of the entire value chain, crowdfunding is just a front-end activity where users can purchase future products or services, but the entire backend must be managed manually. Blockchain technology not only realizes front-end automation, but also turns the entire back-end into digital. Smart contracts are executed according to rules. The actual products can be digital assets, such as digital securities.

Some of the main features of Citation come from the convenience provided by the underlying technology, and the blockchain builds a verifiable financing framework that can be easily implemented. Smart contracts provide investors with a complete set of automation solutions that automate the cost-intensive compliance work, complex issuance, interest distribution and other processes. In addition, CIS has spread the investment risk to almost everyone who has access to the Internet and a variety of investment products.

In this way, not only filmmakers can profit from it, but investors can also benefit from the risk management of traditional film financing because they can invest in a series of film combinations rather than investing in a movie like Wesley Snipes. The biggest advantage of CIS is that it provides investors with immediate liquidity so they can buy or sell a pass at any time.

It is undeniable that universalization has opened a new door for mass film financing, and it has great potential to create a more democratic and transparent financing ecosystem. As a powerful new financing tool, Licensing can connect with audiences in the early stages of film production and turn them into fans or users.

Of course, like all things, there are drawbacks to the pass. For example, the general risks associated with the film industry still exist: if a movie fails, investors' profits will fall. In addition, if there is a lack of middlemen, the disadvantages are sometimes more obvious than the advantages. Smart contracts replace lawyers who used to be responsible for drafting agreements, defining customer and investor rights, determining return on investment, and ensuring that the due diligence needs of regulators are met. All of this will be transferred to the issuer of the certificate, and the certificate itself has compliance risks, and may even discourage some investors. In addition, jurisdictional restrictions may block some investors because of compliance requirements.

Although there is no small obstacle in the development process, it still cannot be blocked from being widely adopted. According to Inwara Analytical, STOs increased by 130% in the first quarter of 2019 alone. Currently, the film industry only produces films that decision makers consider to be profitable. They rely on market research, past successes, or just investment intuition. Through the liberalization of the film industry, viewers will gain greater voice and ultimately decide what film to make. With the continuation of the growth momentum, the opportunities brought by the certification will no longer be limited to the film industry. The entire entertainment industry, Hollywood film companies and movie fans will change. Finers will pay more and more attention to this new financing method. And provide new investment options for venture capital and angel investors. It seems that the film industry is very likely to be just one of many industries that are about to be subverted.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Libra responds to G7 full text: Improving opportunities for cross-border payments

- The cryptocurrency developer 108 will (1): the craftsmen who hide behind the code

- The four operations of the correct investment in the encryption market: how to minimize losses to make a profit?

- New Balance's latest sneakers are coming soon, plus the blockchain hidden gameplay do you know?

- Deputy Governor of the Bank of France: Encrypted assets have the potential to replace the traditional banking system, stabilizing the currency or will have a systemic impact

- If Solana succeeds, does it mean that all the shards are scams?

- Telegram insists that Gram is not a security, former SEC legal counsel: this is just a struggle