3-Minute Introduction to UniswapX How Powerful is the Next-Generation DEX Liquidity Aggregator?

3-Minute Introduction to UniswapX The Power of Next-Generation DEX Liquidity AggregatorAuthor: Hayden Adams, Founder of Uniswap

Translation: Babywhale, Foresight News

Since the launch of the first version of the Uniswap protocol in 2018, on-chain transactions have experienced explosive growth, with millions of users, hundreds of use cases, and $1.5 trillion in trading volume on Uniswap alone.

In order to develop on-chain transactions and improve self-custody trading, we are pleased to announce the launch of a new permissionless, open-source (GPL), Dutch auction-based protocol for trading across AMMs and other liquidity sources.

- LianGuai Daily | Lens Protocol releases its V2 version; Binance has integrated BTC Lightning Network

- In-depth analysis of dYdX, the leader in on-chain derivatives How big is the imagination space of DYDX from DEX to Layer1?

- Q2 2023 Investment and Financing Report Total investment amount decreases quarter-on-quarter, with the United States taking the lead.

Today, we are launching a test version of this protocol on the Uniswap Labs interface, which is compatible with the Ethereum mainnet and will be expanded to other chains and Uniswap Wallet in the future. You can view the code here and read the full whitepaper here.

Over time, UniswapX will improve the trading experience in various ways:

- Obtain better prices through aggregated liquidity sources

- Gas-free transactions

- Prevent MEV

- No fees for failed transactions

- In the coming months, UniswapX will expand to gas-free cross-chain transactions

Further Aggregation

On-chain routing is an increasingly important and complex problem. The innovation of on-chain transactions has led to explosive growth in liquidity pools. New fee tiers, new L2 solutions, and more on-chain protocols will disperse liquidity. We expect to build thousands of custom pool designs on Uniswap v4, making routing more challenging. However, as liquidity sources grow, providing competitive prices requires manual integration and a significant amount of ongoing maintenance and work.

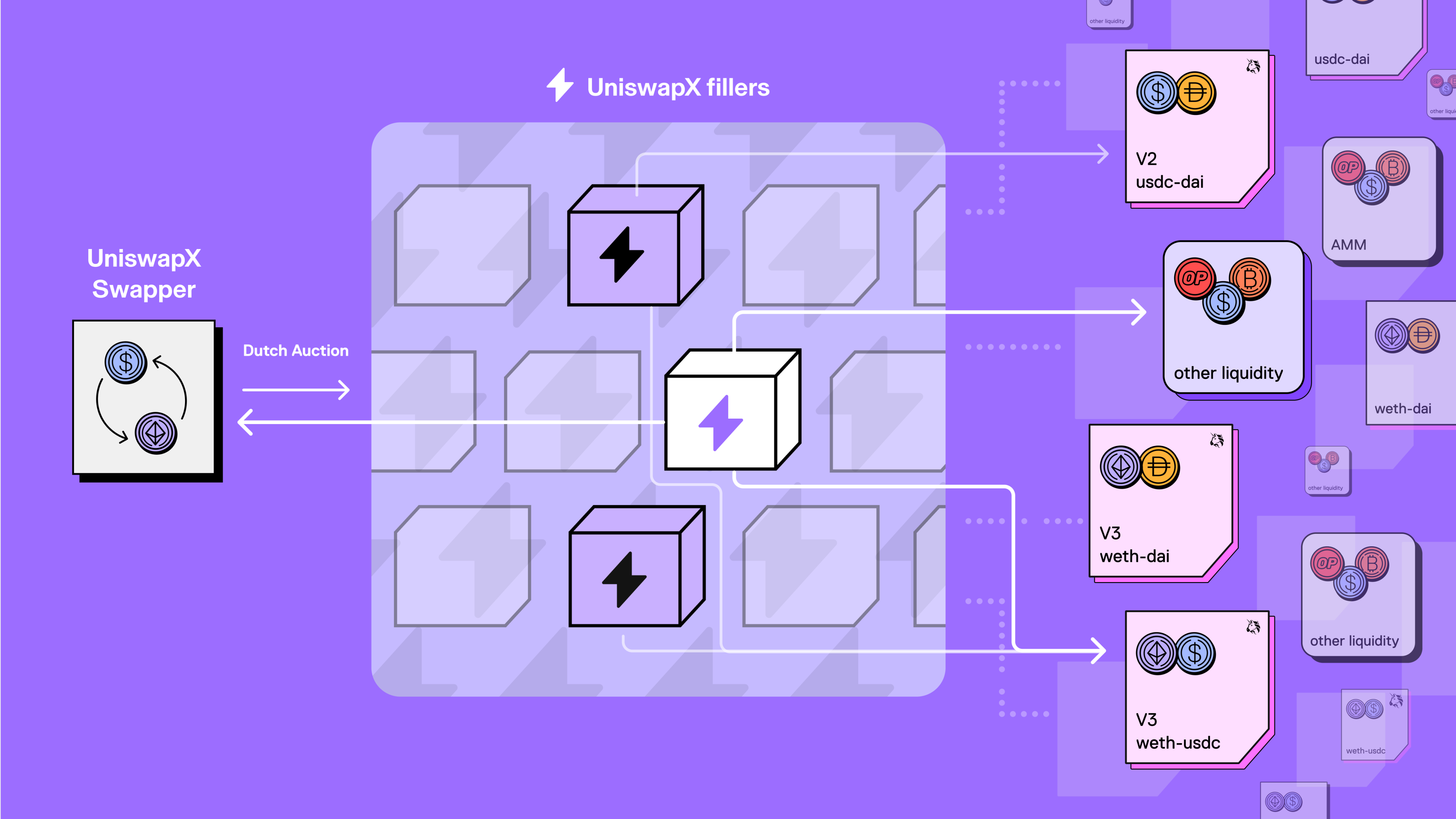

UniswapX aims to solve this problem by outsourcing routing complexity to an open network of third parties, who then compete to fill trades using on-chain liquidity such as AMM pools or personal assets.

With UniswapX, traders will be able to use the Uniswap interface without worrying about getting the best price and transactions will always be recorded and settled on-chain transparently. All orders are supported by the Uniswap smart order router, which forces third parties to compete with Uniswap v1, v2, v3, and future v4.

Gas-free Transactions: No fees for failed transactions

With UniswapX, traders sign a unique off-chain order that is then submitted on-chain by a third party who pays the gas on behalf of the trader. Because traders do not need to pay gas, they do not need the native tokens of the chain (e.g. ETH, MATIC) to trade or pay any fees for failed transactions. The third party includes the gas cost in the transaction price but can compete for the best price and reduce transaction costs by executing multiple orders in batches.

In certain cases, users may still need to pay gas fees, such as for the initial token authorization of Permit2. Additionally, gas fees are required for token wrapping during sale.

MEV Protection

MEV is one of the biggest issues faced by on-chain transactions today, resulting in even worse execution prices for traders.

With UniswapX, the MEV that was originally obtained through arbitrage trading will be returned to traders with better prices. UniswapX also helps users avoid more explicit forms of MEV extraction: orders executed using third-party private assets cannot be “sandwich attacked”, and third parties are incentivized to use private transaction relays when routing orders to on-chain liquidity pools.

Next Step: Cross-Chain Version of UniswapX

Later this year, we will launch a cross-chain version of UniswapX that combines trading and cross-chain functionality into a single operation. With cross-chain UniswapX, traders will be able to trade between chains in a matter of seconds. Traders can also choose the assets they wish to receive on the target chain. For more detailed information on the design and advantages of cross-chain UniswapX, please refer to the whitepaper.

Launching UniswapX on the Uniswap Labs Interface

UniswapX brings the concepts and patterns of DeFi and digital markets into a new system, with its security, self-regulation, and community principles making Uniswap the most trusted brand in the DeFi space.

UniswapX is an immutable smart contract with no permissions. No one, including Uniswap Labs, can modify or pause the contract. The earliest third-party “filler” is ready to ensure the appropriate auction starting price and fast order execution, and we expect the “filler” network to expand rapidly with user adoption.

In line with our commitment to security, ABDK has extensively tested and audited the code and offers bug bounties. Traders always maintain ownership of their funds, and their original assets will only be transferred out of their accounts once the orders are executed and the target assets are received.

Like the Uniswap protocol, UniswapX includes a protocol fee switch that can only be activated by Uniswap governance (Uniswap Labs does not participate in this process).

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DigiFT Research Report: Two Paths for MakerDAO to Implement RWA – Offline Trust and On-Chain RWA

- Q2 2023 Polkadot Research Report: Revenue Decline by 32% Quarter-on-Quarter

- Binance Research Report: 88% of institutional-grade users are optimistic about the long-term development of cryptocurrency assets.

- Consensys: Global Cryptocurrency and Web3 Survey

- LD Weekly Report: ETH Staking Rate Rises to 19.43%, Layer2 TVL Total Locked Amount Reaches $9.68 Billion USD

- Decoding Chainalysis research report: How retail traders, veterans, and institutions contribute value to exchanges?

- Unrest and Consequences of Centralized Communities: Reddit Protests in Progress