In-depth analysis of dYdX, the leader in on-chain derivatives How big is the imagination space of DYDX from DEX to Layer1?

Analyzing dYdX, the leading on-chain derivatives platform Exploring the vast potential of DYDX from DEX to Layer1.Author: HotairballoonCN

1. Project Introduction

1. What is dYdX?

dYdX is the world’s first decentralized cryptocurrency derivatives trading platform. The platform aims to establish more open, transparent, and secure financial products through decentralized technology.

On the dYdX platform, it mainly supports margin (leverage) trading and derivatives (perpetual contracts) trading, with leverage of up to 20 times.

- Q2 2023 Investment and Financing Report Total investment amount decreases quarter-on-quarter, with the United States taking the lead.

- DigiFT Research Report: Two Paths for MakerDAO to Implement RWA – Offline Trust and On-Chain RWA

- Q2 2023 Polkadot Research Report: Revenue Decline by 32% Quarter-on-Quarter

2. Product Architecture

1) Main Trading Mode

As we all know, AMM (Automated Market Maker) is one of the cornerstone protocols of DeFi. In the AMM mode, the counterparty is the liquidity pool, and the liquidity pool provides real-time quotes, which is equivalent to human-machine trading. There is no need to wait for the platform’s matching of trades, so transactions can be completed quickly. This is also the advantage of the AMM mode.

Classic DeFi projects such as Uniswap (DEX), PancakeSwap, and GMX (derivatives) all adopt the AMM mode.

However, dYdX goes against the trend and does not adopt the AMM mode. Instead, it adopts the order book mode that centralized exchanges (CEX) have been using.

On the dYdX platform, users can not only place market orders and limit orders, but also have 5 types of stop-loss modes. In addition, users can set the expiration time of orders.

In dYdX’s view, the order book mode is more in line with the needs of professional traders and also meets the needs of more cryptocurrency traders. After all, in the current cryptocurrency trading, centralized exchanges (CEX) account for more than 95% of the market share.

Compared with DeFi platforms that use the AMM mode (passive trading), it is obvious that traders on the dYdX platform have more autonomy. Users can customize their trading strategies based on their needs, such as leverage ratio, order type, stop-loss type, and order expiration, to meet their own trading needs.

2) Underlying Technology Architecture

dYdX (currently version V3) is built on the Starkware network, one of the four giants in the Ethereum L2 track, as a DeFi derivatives trading platform.

With the high scalability and low transaction fees of Starkware, as well as dYdX’s smooth off-chain order book and on-chain settlement mode, users’ trading experience on the dYdX platform is almost comparable to that of centralized exchanges (CEX).

In the upcoming dYdX V4 version, it will migrate to the Cosmos network. dYdX will create its own independent L1 blockchain called dYdX Chain based on the Cosmos SDK and CometBFT PoS consensus protocol, with a completely decentralized off-chain order book and matching engine.

As a custom L1 blockchain on Cosmos, dYdX Chain will have more autonomy, such as running nodes and adjusting the platform’s fee structure, in order to provide users with a better trading experience.

3. Development History

dYdX was founded in July 2017, and its founder Antonio Juliano worked as an engineer at Coinbase from 2015 to 2016. At that time, the first generation of decentralized exchanges (0x, Kyber) had appeared, but dYdX mainly focused on margin trading and derivatives trading.

In Antonio Juliano’s view, this seemed logical. Because margin trading (led by Bitfinex) had already started to rise in the field of cryptocurrencies, he believed that the financial market would undergo the evolution of “spot-margins-derivatives” over time.

And cryptocurrencies seemed to be no different, going through the process of evolving from spot trading to margin trading (leverage) and then to derivatives (contracts, etc.).

dYdX’s first product Expo was built on top of the V1 margin protocol, which was a simple trading application for buying leveraged tokens. At its peak, Expo had a daily trading volume of about $50.

Then, in 2019, the second version of the dYdX margin trading protocol, codenamed “Solo,” was launched. This version was more powerful and addressed some of the issues with the original protocol. It quickly increased the platform’s trading volume to about $1 million per day.

Then dYdX started building its own order book system.

dYdX initially built on Ethereum L1, but the DeFi boom increased gas costs by 100-1000 times, and the congestion of the Ethereum network severely affected the user’s trading experience.

Then, in April 2021, dYdX migrated to the more scalable Ethereum L2 Starkware platform. Both in terms of scalability (TPS) and gas fees, Starkware’s advantages were very obvious. Shortly after the launch of L2, dYdX’s trading volume soared to about $30 million per day, about 5 times the previous level.

- dYdX Foundation issued DYDX tokens

In the summer of 2021, the independent Swiss foundation dYdX Foundation was established, and in August 2021, it released DYDX, the token of the dYdX protocol. After the token was launched, the trading volume on the dYdX platform soared.

In June 2022, dYdX announced that its v4 version would be launched as an independent blockchain based on Cosmos SDK and Tendermint consensus.

dYdX V4 testnet was officially launched on July 6th.

4. Financing Situation

According to public information, as of now, dYdX has completed at least 4 rounds of financing:

In December 2017, it raised $2 million in seed funding, with participation from Andreessen Horowitz (a16z), Polychain Capital, 1confirmation, Kindred Ventures, Caffeinated Capital, Abstract Ventures, and many other investment institutions.

In October 2018, it raised $10 million in Series A financing, with investments from Andreessen Horowitz (a16z), Bain Capital Ventures, Abstract Ventures, Craft Ventures, Polychain Capital, Fred Ehrsam (former Coinbase partner), and Brian Armstrong (Coinbase CEO), among others.

In January 2021, it raised $10 million in Series B financing, led by Three Arrows Capital and deFiance Capital, with participation from new investors Wintermute, Hashed, GSR, SCP, Scalar Capital, SLianGuairtan Group, RockTree Capital, as well as existing investors a16z, Polychain Capital, Kindred Ventures, 1confirmation, Elad Gil, and Fred Ehrsam.

In June 2021, it raised $65 million in Series C financing, led by LianGuairadigm, with participation from liquidity provider QCP Capital, CMS Holdings, CMT Digital, Finlink Capital, Sixtant, Menai Financial Group, MGNR, Kronos Research, and investment firms HashKey, Electric Capital, Delphi Digital, and StarkWare.

A total of $87 million was raised in four rounds of financing, with investment from well-known institutions such as LianGuairadigm, Polychain Capital, Andreessen Horowitz (A16Z), Three Arrows Capital, and one of the largest liquidity providers on dydx, Wintermute, among others. The project has strong financial support.

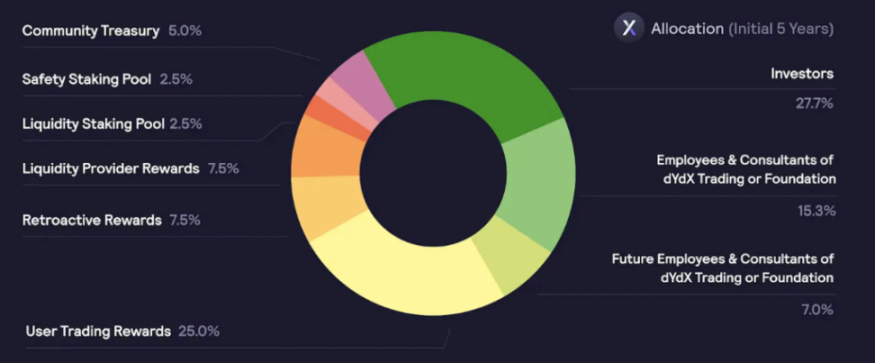

According to its token distribution plan, 27.73% of the tokens, or 277 million tokens, are owned by investors, with an average cost of $0.31 per DYDX token.

Considering the difference in valuation between rounds, the cost of the $65 million investment in the last round may be higher than $0.31 per token. The market attention received by dydx is partly due to its strong financial backing, which also contributes to its current leading position in the industry.

5. Fundamental Influence

dYdX is the world’s first decentralized cryptocurrency derivatives trading platform.

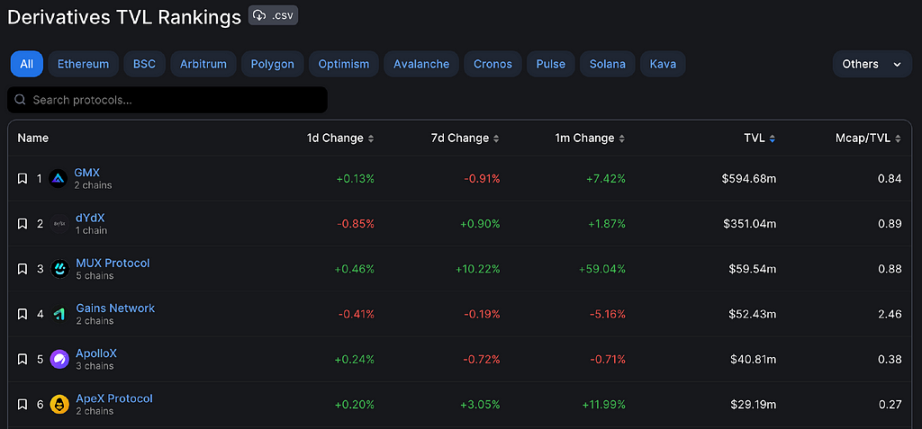

According to data from defillama, dYdX’s TVL in the DeFi derivatives track reached $350 million, second only to GMX.

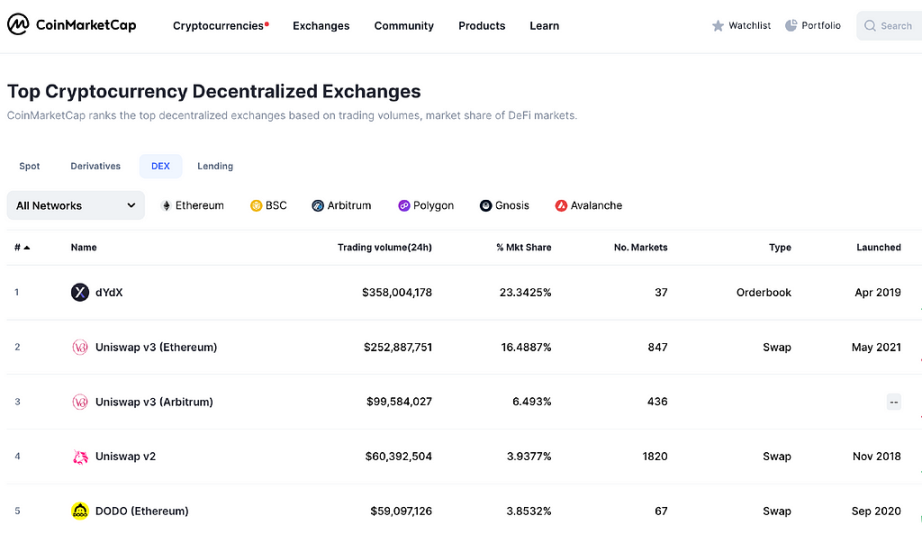

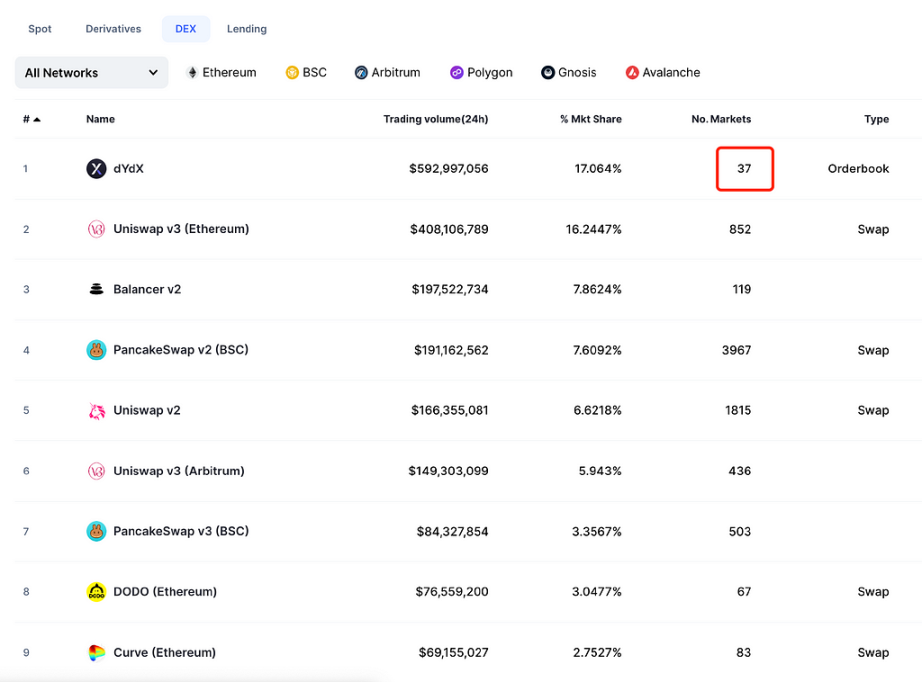

According to data from CoinMarketCap, in the DEX track, dYdX ranks first in trading volume in the past 24 hours, with a market share of 23.3%, surpassing UniswapV3.

Furthermore, dYdX currently only supports 37 trading pairs, much lower than the number of trading pairs listed on other DEX trading platforms.

2. DYDX Token

1. Token Distribution

The total supply of DYDX tokens is 1 billion, distributed over five years starting from August 3, 2021.

1) 50.00% of the supply will be allocated to the community, including:

- 25.00% as transaction rewards;

- 7.50% for mining rewards;

- 7.50% allocated to liquidity providers;

- 5.00% will go into the community treasury;

- 2.50% will be specifically used for users who pledge USDC to the liquidity staking pool;

- 2.50% will be specifically used for users who pledge DYDX to the security staking pool.

The remaining 50%:

2) 27.73% will be reserved for past investors.

3) 15.27% will be allocated to founders, employees, advisors, and consultants.

4) 7.00% will be reserved for future employees and advisors of dYdX.

After 5 years, the maximum annual inflation rate will be 2.00% to support the platform’s development.

2. Token Utility

DYDX tokens have the following three main uses:

1. Governance and Voting

As a governance token, DYDX tokens have the function of voting and participating in governance.

2. Fee Discounts

As tokens of the trading platform, DYDX tokens, like Binance Coin (BNB), allow holders to receive fee discounts based on their current holdings.

3. Staking

Stakers will receive DYDX tokens based on their share of total USDC staked in the pool. If a staker wants to withdraw USDC in the next period, they must request to unstake the USDC at least 14 days before the end of the current period. If the staker does not request a withdrawal, their staked USDC will be transferred to the next period.

3. Latest Developments and Future Possibilities

1. dYdX Chain

In the dYdX community, the current focus is on dYdX V4.

In the current version of dYdX, most components have been decentralized, but the order book and matching engine are still centralized components.

dYdX aims to achieve full decentralization, where the decentralization of the least decentralized component represents the decentralization of the entire system. This means that every component of V4 needs to be decentralized while maintaining high performance.

The V4 version aims to decentralize the order book and matching engine, eliminating the use of centralized components and achieving full decentralization of the dYdX platform.

To achieve this decentralization goal, dYdX is creating its own L1 blockchain on Cosmos, called dYdXChain.

Compared to previous versions, V4 is an independent L1 blockchain. It is a customized L1 blockchain on Cosmos according to its own needs. It is superior to dYdX V3 on L2 Starkware in terms of scalability and gas transaction fees. It will also receive more technical support from Cosmos.

In fact, the main reason why dYdX migrated from Ethereum to Cosmos is to improve the user trading experience.

dYdX founder Antonio once stated on Twitter:

“If there is a better technology to build dYdX, we will use it,” “I don’t care at all which chain dYdX is built on, I only care about bringing the best product experience to users.”

Implicitly, he believes that building a Cosmos application chain is the best solution to improve the user experience for dYdX at present.

TobbyKitty, co-founder of StarkNet, also stated that the biggest reason for migrating to Cosmos is to allow dYdX Token to run verification nodes on the new chain and lock the protocol value, which is not possible on L2.

In the future dYdX chain, users will use DYDX tokens instead of ETH to pay transaction fees.

Currently, DYDX is equivalent to a mining coin. Although the dYdX protocol has developed quite well, it operates on the Ethereum ecosystem, and the gas fees for transactions are paid in ETH.

And the transaction income generated on the dYdX platform ultimately belongs to the project party.

The DYDX token lacks a rich application scenario. Therefore, the rapid development of the dYdX platform has not significantly promoted the price increase of the DYDX token.

In fact, DYDX encounters the same problem as UNI. Although the platform has developed quite well, the performance of the platform token is relatively average.

However, after dYdX migrates to Cosmos as an L1 blockchain with greater autonomy, the DYDX token will become the underlying foundational token for the development of the entire dYdX Chain ecosystem, and the value of the token will be deeply tied to the platform’s development.

The token staked to build nodes is DYDX, and the gas consumed in transactions is also paid in DYDX tokens. The better the development of the dYdX Chain, the more DYDX tokens will be consumed.

Moreover, after the full decentralization of the V4 version, control will be taken away from dYdX Trading Inc. by the community. Therefore, the community can propose that more of the platform’s income flow into the hands of DYDX token holders, instead of flowing into the platform as in the V4 version.

In this way, the DYDX token can capture more value from the development of the dYdX protocol.

If V3 is just an application chain on the Ethereum L2, then V4 (dYdX Chain) is an independent L1 blockchain with more operational space.

2. Trading Volume of Derivatives

In traditional financial markets, the trading volume of derivatives is much higher than that of spot.

However, in the cryptocurrency market, the current trading volume of derivatives is not much higher than that of spot, so there is still a lot of room for development in the derivative trading volume of the cryptocurrency market.

Moreover, compared to Binance’s derivative trading volume, dYdX’s derivative trading volume is only 2% of Binance’s. As a leading decentralized derivative trading platform, dYdX still has a lot of room for overall trading volume growth.

3. PoS Staking Locked Tokens

After transitioning to PoS consensus, dYdX will operate its own nodes, and running PoS nodes requires staking a certain amount of DYDX tokens. The higher the staking rate of DYDX tokens, the more secure the dYdX Chain network will be.

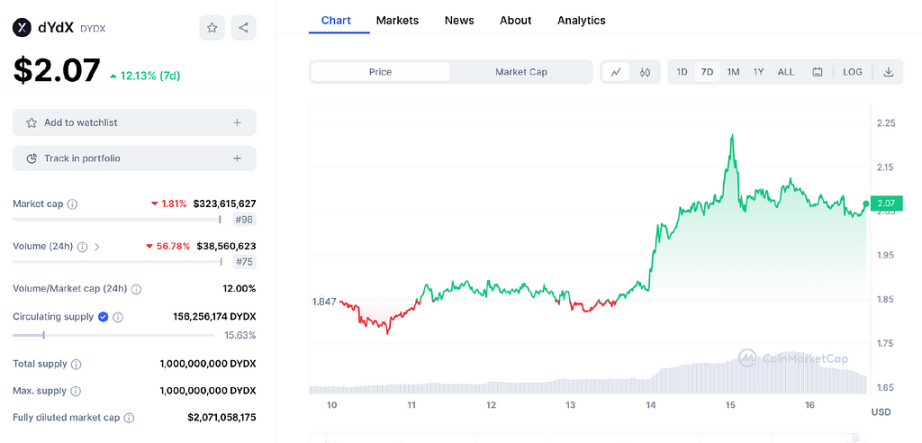

Even some PoS blockchains have staking rates of over 50%. It is well known that the current circulating supply of DYDX tokens is only 15.63%, and there will still be a significant amount of unlocked tokens in the future.

Staking PoS nodes will to some extent dilute the impact of unlocked selling pressure on DYDX tokens. In addition, the consumption of DYDX tokens in dYdX Chain and the linear unlocking of DYDX tokens in batches, so overall, the impact of unlocked selling pressure on DYDX tokens will not be significant.

4. Number of Listed Tokens on dYdX

Currently, dYdX platform only supports trading of 37 tokens, which is very few compared to other DEX platforms.

Although the number of listed tokens on dYdX is lower than other DEX platforms, the platform’s trading volume is higher than others.

Therefore, with the continuous development of dYdX and the launch of V4 version, the community can vote to list more tokens, and there is still a lot of room for the platform’s trading volume.

5. Resistance to Regulation

After the collapse of the FTX platform, the trading volume of DEX platforms has shown significant growth. For dYdX, the platform’s trading volume and DYDX token price have performed well.

The reason for this is that the dYdX platform has a certain degree of resistance to regulation. In the future V4 version, dYdX will be completely decentralized, and dYdX Trading Inc. (the platform operator) will no longer operate any centralized components. The platform’s decisions on which tokens to list, how to allocate protocol revenue, and the future direction of the platform will all be decided by community voting.

dYdX Chain’s 100% decentralized operation will avoid unnecessary regulatory issues.

The dYdX team is an ambitious team. The team mentioned in their blog that one of dYdX’s core values is to think ten times bigger. dYdX should focus on what it can achieve, rather than protecting what has been built so far. The goal of dYdX is to make it one of the largest exchanges in the cryptocurrency field.

4. Competitive Comparison

In the decentralized derivatives track, the most noteworthy projects are GMX and dYdX. Let’s compare these two projects.

Firstly, they adopt different models.

dYdX adopts the order book model, where users (or market makers) act as counterparties to each other, and the platform operates the orders of both buyers and sellers.

On the other hand, GMX adopts the AMM (Automatic Market Maker) model, where users and the asset pool act as counterparties to each other.

Now let’s analyze them from the aspects of liquidity, price discovery mechanism, and funding rate.

1. Liquidity

Liquidity in a cryptocurrency exchange refers to the quantity of cryptocurrencies available for buying and selling on the exchange and the stability of their prices.

dYdX introduces market makers to provide liquidity and pursue matching efficiency, but it cannot avoid slippage. Transactions are not executed at stable prices, and when the trading volume is large, the slippage is even higher.

On the other hand, GMX platform adopts a zero-slippage mechanism. The counterparty is the asset pool, and the prices are provided by oracles. Transactions can be quickly completed, and because there is no slippage, traders can buy and sell at relatively stable prices. Even when the trading volume is large, the zero-slippage mechanism of its oracles ensures price stability.

For example, if 1000 ETH is traded on the dYdX platform, the price will certainly increase (such as a 10% increase), and the trader has to bear a higher slippage. However, if 1000 ETH is traded on the GMX platform, the price remains stable because the price is provided by oracles in the asset pool and there is zero slippage.

In this sense, GMX has better liquidity.

However, as more CEX derivatives users migrate to the chain in the future, the number of DEX derivatives users and trading volume will increase significantly. Theoretically, the liquidity ceiling of dYdX is higher than that of GMX.

Because dYdX adopts the order book model, there is no need to consider how to maximize the profitability of LP (Liquidity Providers) in order to incentivize more LPs to provide liquidity. As long as there is a match between buyers and sellers in the market, there is liquidity.

On the other hand, GMX adopts the AMM model, where users and the asset pool bet against each other, and there is no matching of buy and sell orders between users. The liquidity of the platform depends on the liquidity providers, and the platform needs to consider the profitability of LPs in order to incentivize more LPs to provide liquidity.

2. Price Discovery Mechanism

The price discovery mechanism determines whether an exchange has the power to set prices.

The order book has the power to set prices and is less likely to experience significant OI deviations. This is because the order book is a peer-to-peer system where long and short positions need to be matched 1:1 between users. Most positions can be offset, and any remaining imbalances will result in price fluctuations, similar to the mechanism used by centralized exchanges.

On the other hand, oracle machines do not have the power to set prices and do not affect the price. They can only passively receive price feeds from oracles, and the party receiving the price can only digest the price changes themselves. This may lead to oracle attacks. For example, GMX was attacked in September 2022 due to zero slippage.

Because GMX uses a zero slippage mechanism, zero slippage means that attackers always have unlimited liquidity and low attack costs.

For example, if a user goes long on AVAX with a volume of 1 billion USD on the GMX platform, according to common sense, such a high trading volume would definitely drive up the price of AVAX. However, GMX uses a zero slippage mechanism, so it opens positions based on the price provided by the oracle.

But this volume of trading will definitely drive up the price of AVAX tokens on other trading platforms. Assuming it rises by 20%, the oracle will then feed back the latest AVAX price (which has already risen by 20%) to the GMX platform, allowing users to close positions based on the latest price that has risen by 20%.

On the GMX platform, because oracle price feeds are used and there is a zero slippage mechanism, if the future trading volume on the platform is huge but the source of price information still comes from external sources, it is easy to be vulnerable to price attacks.

Regardless of the trading volume, there will be no slippage on the GMX platform. When large transactions occur, there will be differences and delays between the prices on external platforms and the prices quoted on the GMX platform, which attackers can exploit.

However, for the dYdX platform, it does not use an oracle price feed mechanism, and prices can reflect the fair market price. This model gives dYdX an advantage when competing with CEX.

3. Funding Rate

The fee collection mechanism of dYdX is the same as that of centralized exchanges (CEX).

But on the GMX platform, both long and short positions can be understood as borrowing risk assets or stablecoins from the GLP pool to establish positions. Both long and short positions on GMX have been paying funding fees and do not receive funding fees.

In other words, on the GMX platform, the long and short positions cannot be balanced. Once a strong one-sided market occurs, resulting in significant OI deviations, the GLP pool may bear significant profits or losses.

For example, in a bull market, most people choose to go long. If you go short on the GMX platform, not only will you not receive funding fees, but you will also have to pay borrowing fees. Therefore, traders will not choose to go short on GMX, which leads to an imbalance of long and short positions on the GMX platform.

However, in the dYdX platform, it adopts a strategy consistent with centralized exchanges, which can balance the long and short sides well.

4. Value Capture Capability

Obviously, GMX has a stronger value capture capability. 30% of the platform fees are given to GMX stakers, and the remaining 70% is given to GLP stakers. GMX gives 100% of the platform fees to token stakers. The better the platform develops, the higher the returns for token holders, which means that the value of GMX tokens is deeply tied to the platform’s development, which is the main reason for the rise in GMX price.

However, the value of DYDX tokens is not deeply tied to the development of the dYdX platform. The platform token has not captured much value from the development of dYdX. Although dYdX has developed quite well, the price performance of DYDX tokens is very average.

From the above comparison between dYdX and GMX, we can see that both sides have their own advantages.

GMX’s value capture capability and decentralization level surpass the dYdX platform.

However, whether GMX’s “burning money” approach of returning 100% of platform fees to token holders is truly sustainable remains to be seen.

On the other hand, dYdX’s decentralization level and the value capture capability of the platform token will be addressed in the future dYdX V4 version.

dYdX V4 claims to achieve complete decentralization, mainly reflected in the order book and matching engine. The platform will no longer operate any centralized components of the protocol, which means that the community will have more control over the development of dYdX. For example, they can vote to tilt the distribution of protocol revenue towards platform token holders and give DYDX more use cases, which will increase the value capture capability of DYDX.

Therefore, although GMX tokens currently have a better price performance, in the long run, it is obvious that DYDX has greater room for imagination.

5. Market Value Prediction

Currently, the price of GMX is around $2, with a market value of just over $200 million, ranking around 100th, while GMX’s market value ranks around 80th.

By observing the historical candlestick chart of DYDX tokens, it can be found that the highest increase in DYDX was after the token was issued and mining was launched, with the price rising to over $27. Later, due to the platform not giving DYDX more use cases, DYDX has always lacked sufficient use cases. Although dYdX has developed quite well, the price of DYDX has been in a long-term downturn.

The current price of DYDX is far from the highest price, with a decline of over 93%. It is basically in a low position for a long time, and can even be said to be oversold.

However, after the launch of version 4, these issues will be resolved, and the community will allocate more platform revenue to DYDX holders through voting.

Of course, one significant problem facing DYDX token is the large unlock selling pressure. However, after the launch of version 4, token staking is likely to absorb the unlock selling pressure.

In addition, the trading volume of decentralized derivatives is currently low. With the arrival of global regulatory policies, more trading will shift to decentralized trading platforms, providing significant development potential for decentralized derivatives in the future.

Based on the above predictions, in the future bullish market, DYDX’s market value is highly likely to enter the top 30-50, and it is possible to even reach the top 30. The price of the DYDX token is conservatively estimated to have an increase of 5-10 times, or even higher.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Binance Research Report: 88% of institutional-grade users are optimistic about the long-term development of cryptocurrency assets.

- Consensys: Global Cryptocurrency and Web3 Survey

- LD Weekly Report: ETH Staking Rate Rises to 19.43%, Layer2 TVL Total Locked Amount Reaches $9.68 Billion USD

- Decoding Chainalysis research report: How retail traders, veterans, and institutions contribute value to exchanges?

- Unrest and Consequences of Centralized Communities: Reddit Protests in Progress

- Game Article: Key Points in Designing Economic Systems

- Huang Licheng sues online detective ZachXBT for defamation