LianGuai Daily | LianGuai Launches Cryptocurrency to USD Exchange Service; MakerDAO Protocol RWA Total Assets Reach $2.613 Billion

LianGuai Daily | LianGuai launches crypto to USD exchange service; MakerDAO protocol RWA assets reach $2.613B.Today’s News Highlights:

Court documents reveal: FTX has approximately $7 billion in assets, including $3.4 billion in cryptocurrencies

LianGuaiyLianGuail launches cryptocurrency to USD exchange service

Cryptocurrency exchange Luno to prohibit some UK customers from investing in cryptocurrencies starting from October 6

- Cryptocurrency Track Weekly Report [2023/09/11] ETH Staking Rate Rises, Layer2 TVL Declines

- In-Depth Analysis of Coinbase’s Proposal for Flatcoin How to Design an Inflation-Adjusted Stablecoin?

- Why should MakerDAO choose Cosmos instead of Solana?

BANANA goes to zero just over an hour after launch, project team will deploy a new contract and promise to compensate victims

Coinbase Prime launches Web3 wallet for institutional and corporate clients

Digital asset platform Fireblocks launches non-custodial wallet service

Bitget launches $100 million EmpowerX fund to support ecosystem development

MakerDAO adds another $100 million in RWA assets, bringing the total RWA assets of the protocol to $2.613 billion

Regulatory News

Chairman of the U.S. SEC: Cryptocurrency industry generally does not comply with securities laws, many cryptocurrencies fall under the SEC’s jurisdiction

According to The Block, Gary Gensler, Chairman of the U.S. Securities and Exchange Commission (SEC), will testify at a hearing of the U.S. Senate Banking Committee on Tuesday morning. He still believes that cryptocurrencies must comply with the same laws as other securities such as stocks, and many cryptocurrencies fall under the SEC’s jurisdiction. In his prepared testimony released on Monday, he stated, “Given the industry’s widespread non-compliance with securities laws, it is not surprising that we see many problems in the market. This reminds us of the situation before the implementation of the federal securities laws in the 1920s. Therefore, we have taken a series of enforcement actions, some of which have reached settlements and some of which have been litigated.”

NFT

Milady Founder: Milady developer seizes code repository and misappropriates $1 million from Bonkler treasury

Charlotte Fang, founder of Milady, stated on X platform that a Milady developer misappropriated approximately $1 million from the official Milady project’s Bonkler treasury. The developer also seized the code repository and demanded the team surrender more funds and NFT reserves. Currently, the X accounts of miladymaker and remilionaire are under the control of this developer.

Charlotte Fang stated that the relevant members have been locked out and their responsibilities will be pursued to the fullest extent of the law. The minting of Bonkler NFTs has temporarily been suspended, and the Bonkler community treasury, contracts, and NFTs are secure. Other series of NFTs under Milady’s parent company, Remilia, have not been affected.

Data shows that the floor price of Milady Maker series NFTs has dropped to 2.9 ETH, with a 24-hour decline of 12.68%.

Project Updates

Court documents reveal: FTX has approximately $7 billion in assets, including $3.4 billion in cryptocurrencies

Court documents show that the bankrupt FTX has organized approximately $7 billion in assets, including $1.16 billion in solana (SOL) tokens and $560 million in bitcoin (BTC). The documents state that in addition to the $1.1 billion held on November 11, the company has also received $1.5 billion in cash and holds cryptocurrencies valued at $3.4 billion as of August 31. Additionally, there are over 1,300 lesser-known tokens with a value of hundreds of millions of dollars, some of which have lower liquidity, such as MAPS and serum (SRM). The presentation also details the $2.2 billion in cash, cryptocurrencies, equity, and real estate received by other executives such as Bankman-Fried and Nishad Singh, Zixiao “Gary” Wang, and Caroline Ellison in the months leading up to the bankruptcy. The documents also report 38 apartments, penthouses, and other properties in the Bahamas, estimated to be worth around $200 million.

Regarding customer claims: As of August 24th, a total of 36,075 customer claims have been submitted, with a total amount of 16 billion US dollars.

Later on, it was reported that FTX has contacted more than 75 bidders since May to assess the possibility of restarting the exchange.

LianGuaiyLianGuail launches cryptocurrency to USD exchange service

According to The Block, LianGuaiyLianGuail has launched a new cryptocurrency to USD exchange service. Previously, the company had launched a service that allows customers to purchase cryptocurrencies. In a statement, LianGuaiyLianGuail stated that US cryptocurrency wallet users can directly exchange their cryptocurrencies for USD and have it added to their LianGuaiyLianGuail balance, which can then be used for shopping or transferred to their bank accounts. This service is supported on wallets, dApps, NFT markets, and MetaMask.

Coinbase Cloud integrates Kiln, a staking platform for native ETH below 32 ETH

Coinbase Cloud has integrated Kiln’s on-chain staking protocol, which allows for native ETH staking below the 32 ETH limit. This integration will enable Coinbase wallet users to directly deposit smaller amounts of ETH from their cryptocurrency wallets.

Last year, the staking platform Kiln completed a 17 million euro financing round, with participation from Kraken and ConsenSys, among others.

Cryptocurrency exchange Luno will prohibit some UK customers from investing in cryptocurrencies starting from October 6th

According to CoinDesk, Nick Taylor, the Head of Public Policy at cryptocurrency exchange Luno, stated in a statement that the company plans to prohibit some UK customers from investing in cryptocurrencies. An email from a Luno customer shows that they will not be able to buy or trade cryptocurrencies starting from October 6th. Taylor stated that the Financial Conduct Authority (FCA) has implemented new regulations on cryptocurrency companies. Therefore, all compliant cryptocurrency companies with UK customers are making adjustments to their platforms to comply with the new regulations. Affected Luno customers can still sell cryptocurrencies and make withdrawals. Previous reports indicate that the FCA will implement stricter regulations on cryptocurrency advertisers starting from October 8th, including banning investment incentives such as “referral bonuses” or “new joiner bonuses,” and prohibiting the combination of incentive measures like cryptocurrency airdrops with guiding users to invest. Luno is not the only company that has temporarily suspended some UK operations. LianGuaiyLianGuail previously announced the suspension of cryptocurrency purchasing services in the UK starting from October 1st, with plans to resume in early next year.

BANANA goes to zero within an hour after launch, project team will deploy a new contract and promise to compensate affected users

Telegram Bot project Banana Gun stated on the X platform that there is a vulnerability in the Banana Gun contract that cannot be resolved through hotfix. Despite undergoing two audits, there still exists a vulnerability in the contract related to taxes, which allows people to sell their tokens while there are remaining tax tokens in their wallets. The first step is to sell the treasury wallet to drain the LP (now locked), so that we can reuse it for the new contract. Secondly, we will restart and provide airdrops as soon as possible.

Banana Gun subsequently stated in another announcement: “We are reviewing the new contract and will not launch until everything is confirmed to be normal. Next steps: 1. Before taking any action, a snapshot will be taken (18115275), and all holders, LPs, and presale participants will receive an airdrop of their tokens, even if they sell them later; 2. We will also restore the LP pool; 3. For all transactions, we have analyzed the profit and loss of all traders before 22:30 local time. If they purchased more than they sold, they will be compensated in full ETH.”

In addition, data shows that the Banana Gun token BANANA went to zero shortly after trading opened for 1.5 hours, with a brief surge to a high of $8.5.

Later today, an anonymous programmer known as MisterChoc claimed to have discovered the vulnerability described by Banana Gun in a few seconds using OpenAI’s chatbot ChatGPT.

Coinbase Prime launches Web3 wallet for institutions and corporate clients

According to the official blog, Coinbase announced that its institutional brokerage platform Coinbase Prime has launched an institutional-grade Web3 wallet. Institutional and corporate clients can utilize the MPC technology of this non-custodial wallet to store any tokens from supported networks (including assets not yet offered on Prime Custody), instantly access funds, directly interact with dApps and smart contracts, trade large volumes of assets using decentralized liquidity, vote in DAO governance, lend assets or equity, directly access DeFi, buy/sell/mint/manage NFT collections, and manage Web3 social accounts.

Vitalik: Joined Farcaster, a recoverable Ethereum address for accounts compromised due to SIM card hijacking

According to screenshots shared by SlowMist’s Chief Information Security Officer 23pds on the X platform, Vitalik Buterin stated that he has taken back his T-mobile account and confirmed that his previous account was compromised due to a SIM card hijacking attack. Vitalik stated that the phone number should be completely removed from the X platform (Twitter). He mentioned that he may have used the phone number for registration when signing up for Twitter Blue, and he previously saw the advice “phone numbers are not secure, do not use them for authentication,” but he did not realize this before. Vitalik stated that he is glad to have joined the decentralized social protocol Farcaster, and account recovery can be controlled through an Ethereum address.

Previously, Vitalik’s X account was compromised after hackers posted phishing links, leading to a theft of $691,000.

Digital asset platform Fireblocks launches non-custodial wallet service

According to CoinDesk, digital asset platform Fireblocks has launched a non-custodial wallet service to allow end consumers using companies like Revolut and Nubank to have full control over their assets. Fireblocks currently provides services to major companies such as BNY Mellon, BNP LianGuairibas, Flipkart, eToro, Revolut, NuBank, and Wisdom Tree.

Michael Shaulov, CEO of Fireblocks, stated that this move fundamentally frees fintech companies from acting as custodians for end users, making it easier for these end users to access cryptocurrency products such as decentralized finance (DeFi) and other Web3 applications.

Bitget launches $100 million EmpowerX Fund to support ecosystem development

Gracy Chen, Managing Director of Bitget, announced the launch of the $100 million EmpowerX Fund at the Bitget EmpowerX event in Singapore. The fund will seek to invest in regional exchanges, data analysis companies, media organizations, and other entities. Chen stated, “With the tightening of regulations and the rapid development of Layer 2 and DeFi technologies, the CEX field is constantly evolving, and we expect to see more investments, mergers, and acquisitions in the coming months.”

The Bitget EmpowerX Fund aims to expand Bitget’s business scope and create a comprehensive ecosystem that includes dimensions such as trading, investment, research, DeFi, and media. Through more targeted and strategic investments, the fund will assist Bitget in expanding its ecosystem more comprehensively. A spokesperson for Bitget stated that the size of the fund may increase based on market conditions and future business strategies. The $100 million comes from Bitget’s strategic reserves, which are separate from the company’s core budget, and has been allocated to the fund for investment purposes.

The target selection for the FTX 2.0 bidding will take place on October 16th, and the relaunch plan will be confirmed in Q2 of next year.

According to the FTX creditor @sunil_trades, as shared on the X platform, after the deadline for FTX 2.0 bidding on September 24th, the target selection for the mock bidding will take place on October 16th, and the plan solicitation will take place in Q1 or Q2 of 2024, with the plan being confirmed in Q2 of 2024.

It is reported that mock bidding refers to the initial open bidding proposed by the buyer selected by the company under bankruptcy protection. This can attract more potential buyers to propose competitive acquisition prices.

Sony and Astar developer to establish a joint venture blockchain subsidiary to develop Sony Chain as a benchmark.

According to CoinDesk JaLianGuain, Sony’s wholly-owned subsidiary, Sony Network Communications, has signed an agreement with Startale Labs, a development company of Astar Network, to establish a joint venture subsidiary, “Sony Network Communications Labs Pte. Ltd.,” in mid-September. The new company will focus on the research and development of blockchain technology.

Startale Labs CEO Sohta Watanabe stated that the new joint venture subsidiary will advance the development of Sony Chain, which has the potential to surpass Base, the Layer2 network previously released by Coinbase.

Arthur Hayes: If the Fed chooses to cut interest rates, Bitcoin will quickly rise to $70,000

Arthur Hayes, founder of BitMEX, stated in a blog post that if the Fed continues to raise interest rates, real interest rates will become even more negative and may remain in this condition in the foreseeable future. The reason Bitcoin has not reached $70,000 is that people are more focused on the nominal Fed interest rate and have not compared it to the high nominal GDP growth in the United States.

Hayes believes that the primary task of the Fed is to protect banks and other financial institutions from bankruptcy, and the rot of bonds could lead to the collapse of the entire financial sector. Therefore, the only option for the Fed is to cut interest rates to restore the health of the banking system and propel Bitcoin quickly towards $70,000. The reason Bitcoin has such a positive convex relationship with Fed policy is that the high debt-to-GDP ratio has caused the collapse of traditional economic relationships. It is similar to raising the temperature of water to 100 degrees Celsius, it remains liquid until suddenly boiling and turning into gas. In extreme cases, things become nonlinear and can potentially bifurcate.

Although Hayes believes that the Federal Reserve may be forced to lower interest rates to near zero and restart quantitative easing, he believes that even if this is not the case, Bitcoin can still rise significantly.

The block data on the zkSync Era block explorer has been restored, and the previous issue may be due to a browser malfunction.

The block data on the zkSync Era block explorer has now been restored, and the latest block on the zkSync Era network is #208622.

The previous data of the browser was stuck at block #208455 at 14:14. After investigation, the batch of blocks #208456 was mined at 14:14, and block #208457 was mined at 14:15, with a block time interval of about 1 minute. Therefore, the data is not updating or it is a browser data malfunction.

The Mantle community has passed the proposal “Allocating $238 million to promote ecosystem development.”

According to the snapshot page, the Mantle community (formerly BitDAO) has voted 100% in favor of proposal MIP-26, which uses the Mantle Treasury to promote network applications. The proposal suggests providing up to $160 million in liquidity support for applications, up to $60 million in seed liquidity for RWA-backed stablecoins, and up to approximately $18 million in liquidity support for third-party cross-chain bridges. A total of $238 million will be allocated.

The Ethereum client Geth has released version 1.13, which provides a new database model for storing Ethereum states.

According to the Ethereum official blog, Go Ethereum has released Ethereum client Geth version 1.13. Go Ethereum states that this version, which has been developed for 6 years, provides a new database model for storing Ethereum states that is faster than previous solutions and has proper pruning implementation. This model supports correct and comprehensive dynamic pruning of historical states, which means that there is no need to take nodes offline again for resynchronization or manual pruning.

Ankr and Tencent Cloud jointly launch Tencent Cloud blockchain RPC service for developers.

LayerZero partners with Google Cloud, and Google Cloud will serve as the default oracle for LayerZero.

Binance Futures platform encountered technical issues, and subsequently, the issues with USDT-margin futures were resolved.

Funding News

Gaming startup LianGuaihdo Labs completes $1,500,000 Series A funding round led by a16z.

According to Decrypt, gaming startup LianGuaihdo Labs has completed a $1.5 million Series A funding round led by Andreessen Horowitz (a16z). LianGuaihdo has not formally announced other Series A investors, but Crunchbase mentions the participation of companies such as BoxGroup, Long Journey Ventures, PearVC, and 2 Punks Capital in this funding round.

It is reported that LianGuaihdo Labs is a game development company based in New York, founded in 2021. The company’s core goal is to create unique game experiences that allow players to deeply engage and continuously influence the game world using generative artificial intelligence (AI) technology. Halcyon Zero is the anime-style action role-playing game developed by the company, and LianGuaihdo Labs plans to use AI technology to introduce new game modes for Halcyon Zero. According to a tweet by a16z general partner Jon Lai, LianGuaihdo is “opening up creator tools for players to make their own animated games and enhance game features through AI/programmatic generation.”

Mountain Protocol launches interest-bearing stablecoin USDM and announces seed funding

Mountain Protocol has announced the launch of a compliant and yield-bearing stablecoin called USDM. The token is fully backed by short-term US Treasury bonds and differs from other stablecoins by providing daily rewards to users through a mechanism known as “base interest”, currently set at an annual rate of 5%. Mountain Protocol obtained a license from the Bermuda Monetary Authority on July 27th to become a digital asset issuer. However, USDM is not available to US customers and the asset is also not registered as a security in the United States.

Mountain Protocol also announced seed funding led by Nic Carter of Castle Island Ventures, with participation from Coinbase Ventures, New Form Capital, Daedalus Angels, and others. Martin Carrica, Co-founder and CEO of Mountain Protocol, stated that the funding amount for this round is confidential due to regulatory requirements. It is worth noting that the CEO of Coinbase previously mentioned Mountain Protocol as one of the top 10 innovative projects he is optimistic about.

Web3 game studio GamePhilos completes $8 million seed funding, led by Animoca Ventures

According to Businesswire, GamePhilos Studio, the development studio behind the Web3 strategy game Age of Dino, has completed an $8 million seed funding round. The round was led by Xterio, Animoca Ventures, SevenX Ventures, and Chain Hill Capital, with participation from Hashkey Capital, Sanctor Capital, Game7, Bas1s, GSR Markets, GSG Ventures, and others.

The funds raised in this round will be used to develop the mobile/PC strategy game Age of Dino, which will be built on the Xterio platform and will deploy opBNB and integrate NFTs, among other features. Xterio platform will provide technical support and software development tools for Age of Dino. The game is planned to be released on selected countries/regions for mobile devices in early next year.

Important Data

CoinShares: Net outflow of $59.3 million from digital asset investment products last week

According to the CoinShares weekly report, there was a net outflow of $59.3 million from digital asset investment products last week, marking the fourth consecutive week of net outflows, with a total of $294 million outflow over the four weeks. Bitcoin investment products saw a net outflow of $68.9 million, while Ethereum investment products had a net outflow of $4.8 million. It is worth mentioning that investment products shorting Bitcoin had a net inflow of $15.2 million, the largest weekly net inflow since March this year.

Data: Trading firms like Jump Trading transferred a large amount of Bitcoin, Ethereum, and ARB to exchanges on Monday

On-chain data shows that on Monday, as the market sell-off intensified, trading firms such as Jump Trading, Wintermute, and Abraxas Capital transferred a large amount of Bitcoin, Ethereum, and ARB to crypto exchanges. Blockchain analytics company Arkham Intelligence tweeted that asset management firm Abraxas Capital transferred 14,130 ETH, worth about $22.5 million, to Bitfinex in two transactions. Primary market maker Jump Trading sent nearly 236 BTC, worth $5.9 million, in a single transaction to Binance. In addition, according to Lookonchain monitoring, another major market maker Wintermute deposited over $3.3 million worth of ARB into Binance in the past 8 hours.

Vitalik’s related addresses once again transferred 2,000 ETH to an address starting with 0x5567 early in the morning.

According to Lookonchain monitoring, Vitalik Buterin’s related address once again transferred 2000 ETH to the address starting with 0x5567 in the early morning today, worth about $3.12 million.

It is reported that in the past month, Vitalik’s related address has accumulated 2700 ETH transferred to Bitstamp through the address starting with 0x5567, worth about $4.77 million.

MakerDAO has once again increased its RWA assets by $100 million, with a total RWA asset value of $2.613 billion.

According to data from makerburn.com, MakerDAO has increased its RWA assets by $100 million in the past 24 hours. Among them, $50 million of RWA assets were added through BlockTower Andromeda, mainly invested in short-term US government bonds with an annual interest rate of 4.5%. Another $50 million of RWA assets were added through Monetalis Clydesdale, with an annual interest rate of 4%. In addition, the current total RWA assets of the protocol have reached $2.613 billion.

The LianGuaiNews APP Points Mall is officially launched

Hardcore prizes for free redemption: imKeyPro hardware wallet, First Class Cabin research report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections. First come, first served, experience now!

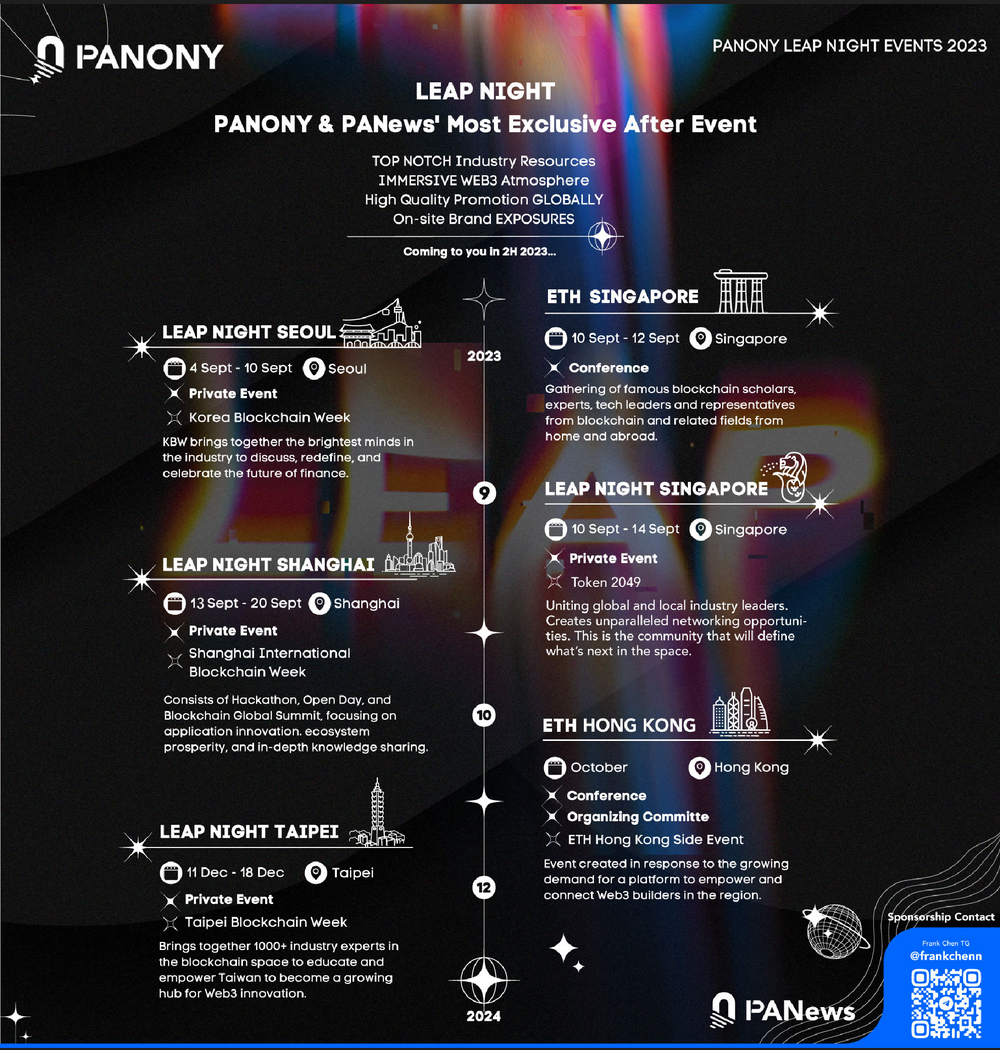

LianGuaiNews launches the global LEAP tour!

Korea, Singapore, Shanghai, Taipei, multiple locations from September to December, witnessing a new chapter in globalization!

📥Activities are being jointly organized in multiple locations, welcome to communicate!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- An Instrument for Observation, Decision-making, and Trading – Friend Tech Tools.

- Interpreting Arweave Atomic Assets and Its Ecosystem A New NFT Paradigm Paving the Way for Creators’ Migration

- Dark version of Friend.tech? A quick look at nofriend.tech, a social platform that converts friendship into rewards.

- What are the legal risks of NFT digital collectibles playing lottery?

- The Wonderful Use of Tokens in the Web3 Gaming Sector Incentivizing Community Engagement and Enhancing Network Effects

- TaxDAO Writes to the U.S. Senate Finance Committee Addressing the 9 Key Issues of Digital Asset Taxation

- Connext has made another mistake? Learn about the Connext airdrop claim incident in one article.