Analysis of Binance’s New Coin Investment Returns: The Exclusive Curse of Top 1

Binance's Top 1 Coin: An Analysis of Investment ReturnsAuthor: 0xLoki

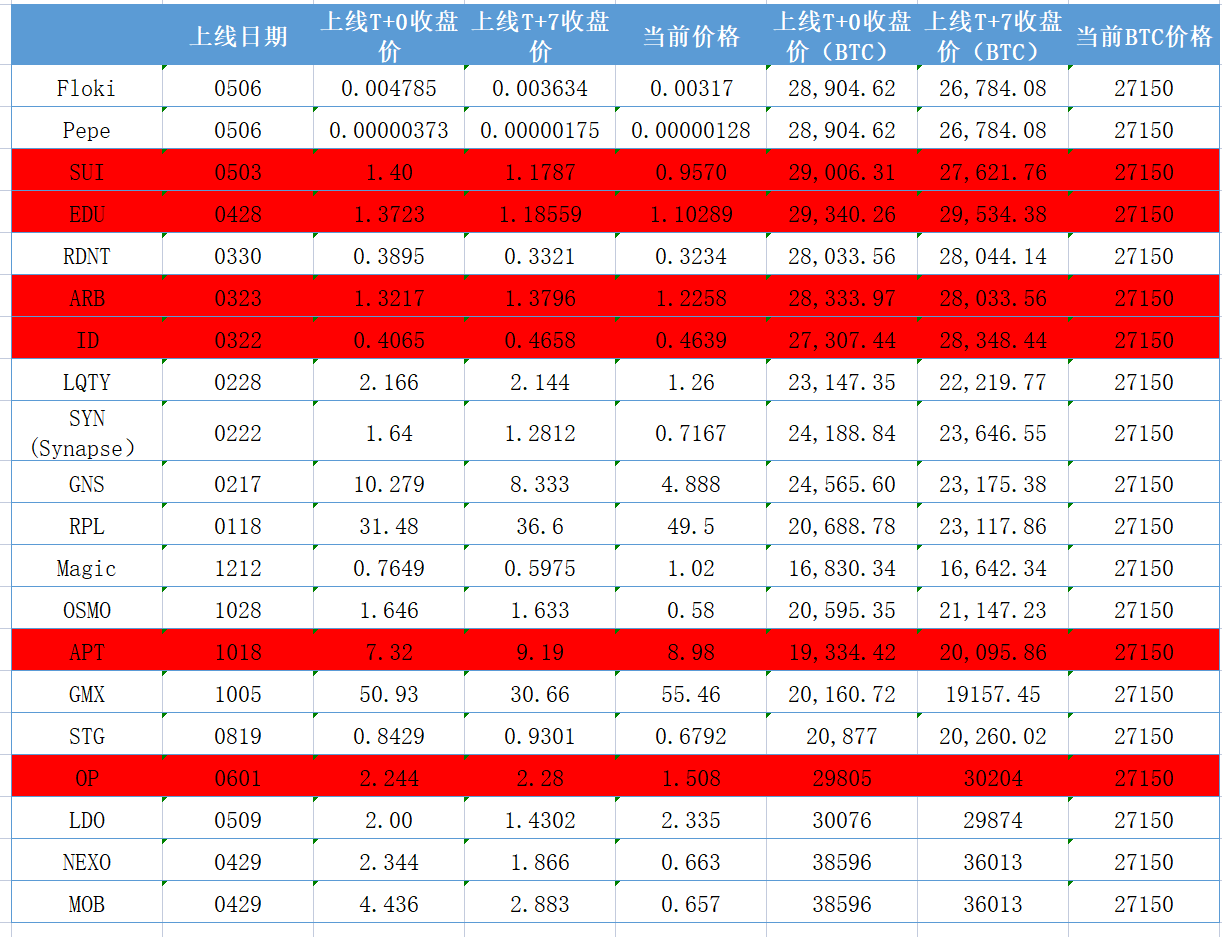

According to the Binance Listing announcement, Binance has launched a total of 20 spot-traded tokens during the 13-month period from April 29, 2022, to June 4, 2023, including 6 new coins (on other exchanges for no more than 3 months) and 14 old coins (on at least 1 other exchange for more than 3 months).

Based on this data, we can calculate three rates of return:

- Foresight Ventures: Rational View of Decentralized Computing Power Network

- How can Google’s StyleDrop compete with the AI drawing tool Midjourney?

- LD Capital: Analysis on Customized DEX Mechanism for L2 Top-tier Liquidity

1) Rate of return from listing (closing price) to present

2) Rate of return from listing (closing price) to 7 days after listing (closing price)

3) Rate of return from 7 days after listing (closing price) to present

The average holding rate of return for the 20 projects to date is -22.3%, while the average holding rate of return for BTC during the same period is 7.9%, significantly worse than BTC. Only ID, RPL, and LDO have returns that exceed those of BTC, while the remaining 17 have underperformed BTC over the same period, with RPL having the highest return rate (26% ahead) and OSMO having the lowest (96.6% behind).

Considering the listing effect of Binance, the listing day may be a local high, so we use T+7 as the base date for calculation. The average rate of return of the 20 projects is -11.3%, the number of projects that outperform BTC increases to 6, showing significant improvement, but it still lags behind the average rate of return of BTC (9.4%).

This data shows that the “listing effect” to some extent pulls down the holding rate of return of new coins on Binance. Even if a user buys in from T+7 days, there is still a higher probability of loss.

Next, we try to be a short-term speculator, buying at the closing price on the day of listing on Binance and selling 7 days later. Unfortunately, we can only achieve a return rate of -11.8%, worse than BTC’s -1.6%. Among the 20 purchases, only 5 can be profitable, 6 can outperform BTC, and most of the rest will lose to BTC and suffer losses.

Where is the problem? The first thing we can be sure of is that the 14 old coins launched on Binance are all good fundamentals and have been market-tested, and they also cover popular tracks such as L2 and Shanghai upgrade, objectively speaking, they do belong to the [high-quality coins]. Under the circumstances that the project fundamentals or Binance’s screening project standards are not problematic, there are mainly three more possible reasons:

(1) The timing of the launch is too late

This reason is more obvious in popular topics (such as MEME, ETHMerge concepts), Binance launched Floki and Pepe in May 2023, by which time Floki and Pepe were already listed on almost all exchanges; the listing time of LQTY, OSMO, and RPL was also slightly late. This lag also reflects to some extent Binance’s insufficient attention to industry hotspots, especially bottom-up hotspots.

(2) Binance’s liquidity advantage becomes a dumping destination

According to Tokeninsight’s statistical data, Binance’s spot trading volume in 2022 accounted for 58.98% of the entire market, which is 6.44 times that of the second-ranked OKX. Binance has the largest number of users and the largest trading volume. Listing on Binance means more attention from investors, but this liquidity advantage can also become a dumping destination for projects, including both volume and price.

(3) The listing effect has overdrafted the growth space

This issue has been discussed before. In the first seven days of listing on Binance, the 20 tokens averaged a return rate of -11.3%, which significantly reduced users’ investment returns. If we exclude the 6 new coins, the average return rate of the remaining 14 coins is -18.1%, which is even more significant.

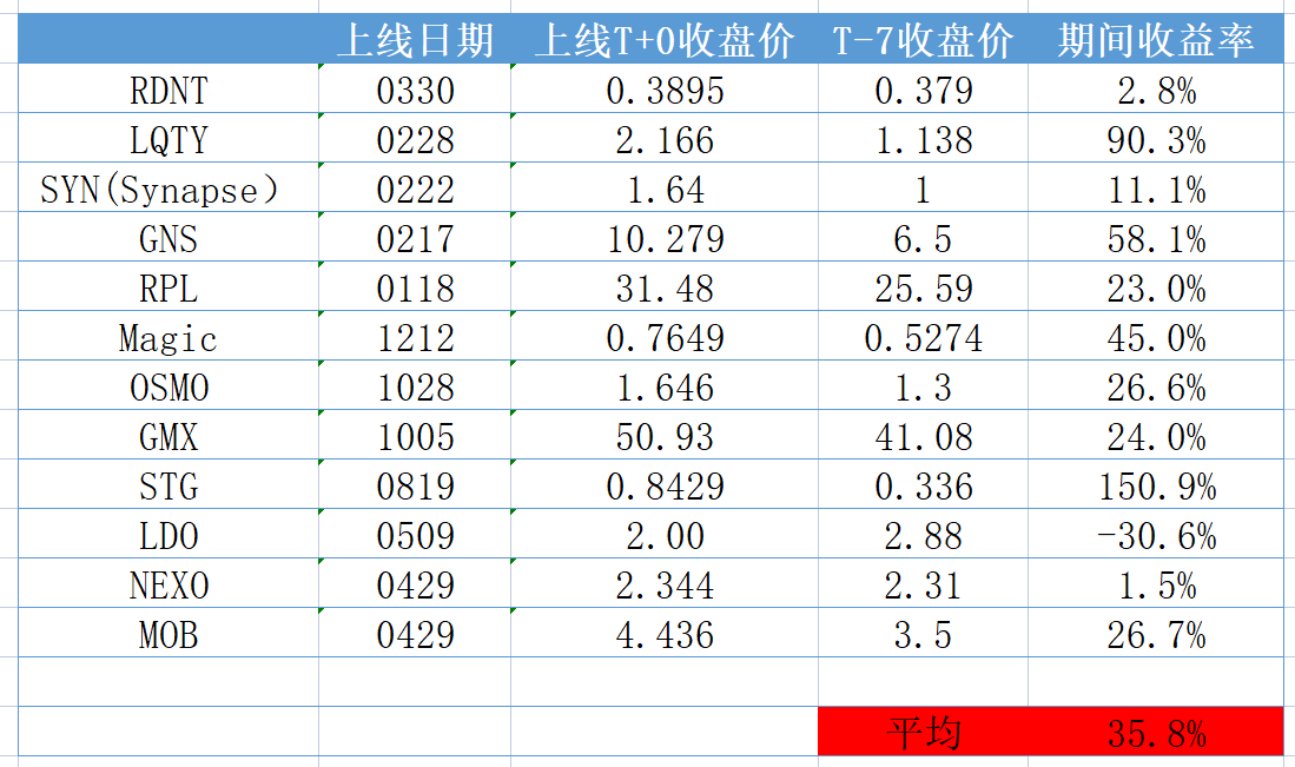

On this basis, let’s look forward, because the “listing effect” not only affects the increase after listing, but more gains have been achieved before listing. We selected 14 old coins and calculated the rate of return from the day of Binance’s listing to the 7 days before Binance’s listing (here we excluded 2 MEMEs and 6 new coins, because they will distort the data, and the listing decision of MEME is mostly driven by market heat rather than fundamentals):

It can be seen that the “listing effect” of Binance is very obvious, except for LDO, the remaining 13 new coins of Binance all have significant increases, with an average increase of 35.8% (during the LDO listing period, BTC prices fell from 39K to 29K), 35.8% can still achieve a return of 13.5% even after deducting the current yield of -22.3% since listing.

After the above analysis, we can find that the “listing effect” has overdrafted the growth space, which is the main reason why new coins listed on Binance did not perform well, and this also explains the difference in feelings between Binance and users:

From the perspective of Binance, a reasonable process was followed to select tokens with good fundamentals for listing. If the listing decision happened before the listing or when Binance made the listing decision, buying the token could still earn returns above the market average, even if the market cycle was extended.

From the perspective of users, I bought a new coin listed on Binance and lost X. The reason for this problem is the “listing effect”. The 35% increase has consumed the potential increase space that the token should have had, which is a kind of irrational investment or overinvestment. So the problem is simple, starting line lost by 35%, how can Binance’s new coins achieve excess returns?

In fact, the “listing effect” of overinvestment, late listing time (because it needs to be more cautious), and the advantage of liquidity being a dumping destination are unique to Binance. In addition to these, there are also widespread controversies such as IEOs, layoffs (or personnel optimization), and Labs, but no one cares whether the Rank 10 executives have girlfriends, and no one cares whether the Rank 50 exchange is laying off employees today. These are all exclusive curses for the industry Top1.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Deciphering the new regulations from the Monetary Authority of Singapore: Will cryptocurrency firms face stricter supervision?

- Is this the darkest moment for the NFT leader? Multidimensional interpretation of Yuga Labs’ performance in May

- Integration of Crypto and AI: Four Key Intersection Points

- SharkTeam: On-Chain Data Analysis of RWA Raceway

- LD Capital: Analysis of L2 Head Liquidity Customization DEX Mechanism of Trader Joe, Izumi, and Maverick

- Aave community initiates a temperature check proposal to integrate MakerDAO’s DSR into Aave V3 Ethereum pool.

- Everything you need to know about LSD Summer