Analysis Why will the bull market start as early as next year from the perspective of the halving period?

Analysis Why will the bull market start early next year due to the halving period?Author: Jakub Dziadkowiec, BeinCrypto

Translation: Felix, LianGuaiNews

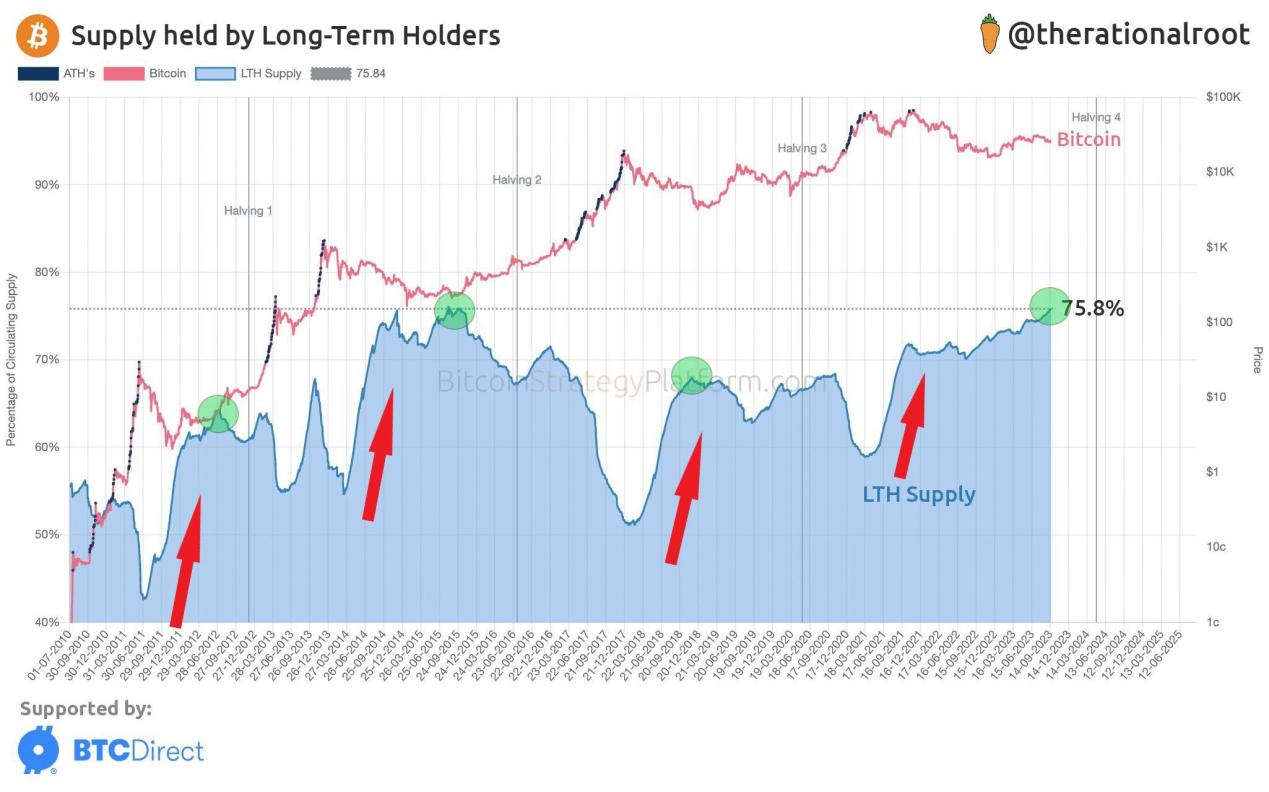

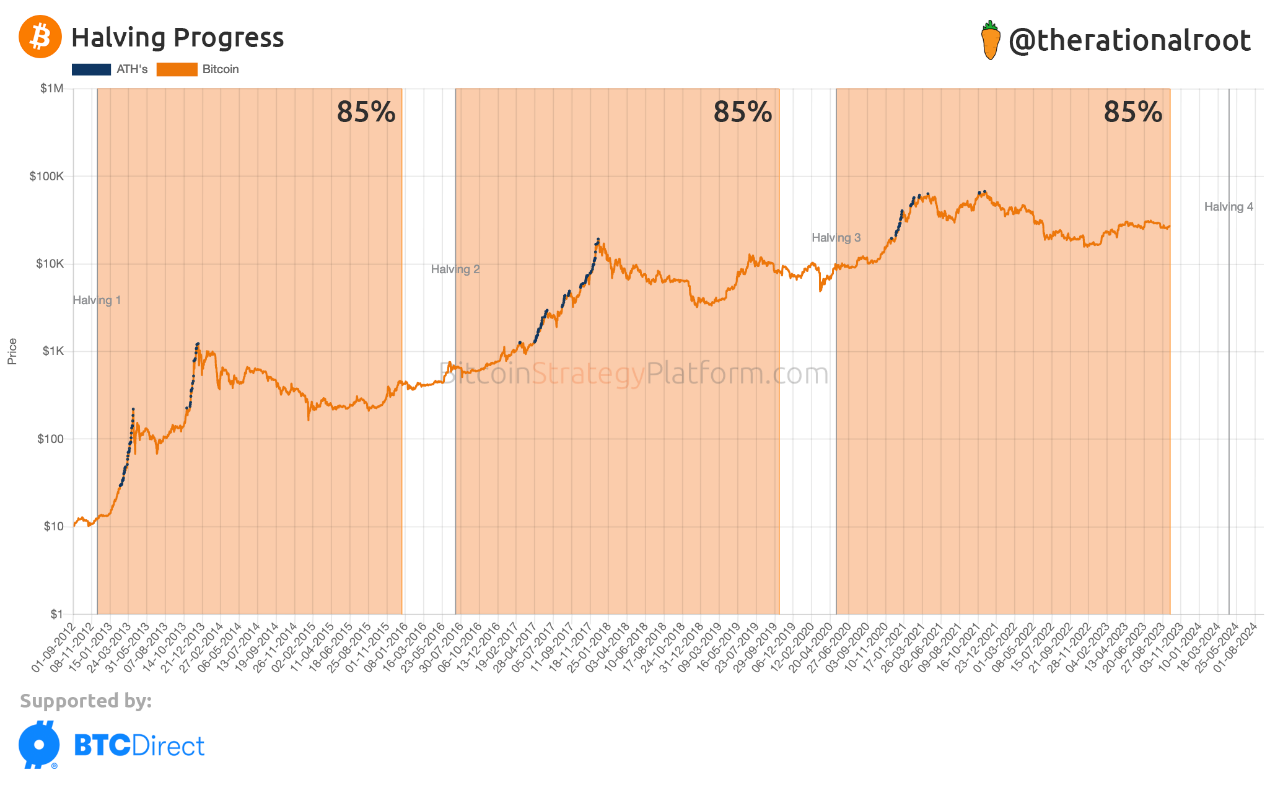

According to the latest data, 85% of the time has passed since the halving in May 2020 to the next halving. At the same time, the supply held by long-term holders (LTH) is close to its all-time high (ATH). In previous cycles, this has been a signal near the macro bottom, followed by the early stages of a new cycle.

Supply Held by LTH Approaching ATH

- Wu’s Selection Zhu Su of Three Arrows suddenly arrested, Binance exits Russia, Mixin hacked for 200 million, MicroStrategy continues to buy BTC, and Top 10 news.

- Hong Kong Securities and Futures Commission discloses regulatory list, which crypto company has the highest risk?

- Ethereum transactions decrease, Layer 2 dominating the market in-depth analysis of on-chain activities and trends

Historically, the amount of Bitcoin held by long-term holders has been an indicator of the health of the crypto market. Historically, this indicator has shown a negative correlation with the long-term price trend of Bitcoin.

Long-term holders hold their assets during market bottoms (HODL). Additionally, the increase in holdings by long-term holders occurs during bear markets (red arrows). This is when large investors see Bitcoin prices plummet and are unwilling to sell. They hold onto their tokens because they believe that the crypto market will rebound in the future, making their investments profitable.

In contrast, during the collapse of a bull market, the situation is reversed. The surge in Bitcoin prices leads long-term holders to become more willing to sell and secure their profits. Historically, in each bull market cycle, the Bitcoin holdings of long-term holders decrease during this period. These tokens are then transferred to short-term holders (STH), who enter the market later with the desire for quick profits.

Cryptocurrency analyst @therationalroot posted a chart on X platform showing the amount of Bitcoin held by long-term holders. He also overlaid the occurrences of each Bitcoin halving on his chart (see above). In his chart, one first notices the fact that currently, the percentage of Bitcoin held by long-term holders is approaching its ATH of around 76% of the circulating supply. The ATH record was set at the end of 2015, when Bitcoin prices finished the accumulation phase before the second halving.

One can then observe that each time this indicator reaches its peak a few months before a Bitcoin halving (green circles), the amount of Bitcoin held by long-term holders gradually declines and consolidates until a few months after the next halving. A sharp decline in this indicator occurs around 6 months after the halving, signaling the start of a full-blown bull market for cryptocurrencies.

85% of the time has passed since the previous halving

The analyst mentioned above also posted another chart showing the progress in the percentage of Bitcoin halving (see below). The chart compares the time periods between the historical halvings of the first three cycles.

According to @therationalroot, the Bitcoin halving has already completed 85% of its progress. In the remaining 15% of the time, the price of Bitcoin tends to consolidate. This is because, similar to the bull markets of 2016 and 2020, the price of Bitcoin tends to consolidate during this period.

Different from the previous two cycles, Bitcoin experienced a sideways trend with an upward tendency. On the other hand, in the last cycle, the Black Swan caused by COVID-19 gave investors an additional opportunity. They could buy at a low price before the planned halving.

If history repeats itself, in the long run, the crypto market may face a sideways trend for about a year. The Bitcoin halving scheduled for mid-April 2024 may not immediately affect the price of Bitcoin. Its impact may not be evident until the last quarter of 2024 and throughout 2025.

This prediction is consistent with the trend seen in the long-term holders’ position chart. The indicator is currently approaching ATH (All-Time High). It will take about a year to reverse the trend. When long-term holders start selling after the Bitcoin halving, it will be one of the first signals for the start of a cryptocurrency bull market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Q3 Eight major hotspots review Ripple, L2, PYUSD

- 2024 Bitcoin Price Prediction Insights from Major Banks and Hedge Funds

- A record of the closure of a rural bank Is encryption beginning to ‘butcher’ the banking industry?

- Interview with Lily Liu, Chair of Solana Foundation Entering the Asia-Pacific market at the right time, Solana may have new moves by the end of the year

- Account abstraction implementation, the on-chain ecosystem will shift towards the buyer’s market.

- A Review of Eight Hot Events in the Cryptocurrency Market in Q3

- Variant联创 Li Jin The main obstacle to the mainstream adoption of cryptocurrencies is the issue of product-market fit.