Building to collapse? Another South Korean cryptocurrency company suspends withdrawals

Another South Korean crypto firm suspends withdrawals due to possible collapse.Author: Karen, Foresight News

Following Haru Invest’s suspension of platform deposits and withdrawals, Delio announced yesterday that it is temporarily suspending withdrawals due to increased market volatility. Amid concerns from users about Delio depositing client funds into Haru Invest, many are worried about the possibility of panic and a chain run risk.

Yesterday afternoon, Haru Invest stated that its operator, B&S Holdings, had provided fraudulent management reports containing false information, and has filed criminal and civil suits against B&S Holdings. According to News1, B&S Holdings is a Korean company that has used FTX.

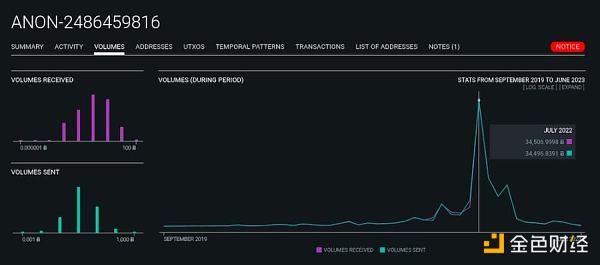

Additionally, @ErgoBTC tweeted that “Haru Invest’s BTC balance has never been particularly high, and the highest trading volume was in the summer of 2022. Haru Invest’s two fund transactions with FTX were the largest outflow transactions from its Bitcoin address.”

- June 2023 FOMC Meeting Notes: Rates Can Go Higher

- Deep Dive into Uniswap V4: A “Masterpiece” of Decentralized Exchange

- Analysis of Sui’s ecological data and token release status

However, in response to the FTX issue in November of last year, Haru Invest stated that “we detected the risk before the FTX risk spread and withdrew all assets managed on FTX without any loss. We were not affected by the FTX and FTT price drops and only redistributed assets to exchanges that have reserve proof or guidelines for reserve proof.”

It is unclear whether Haru Invest’s response to the FTX issue is true, or whether Haru Invest and its operator, B&S Holdings, were affected by FTX and only recently responded.

So what happened with Delio and Haru Invest these past few days? Who are the companies behind them? What services do they provide? What business dealings do they have? How do regulatory officials view this event? This article will take a closer look.

Who is Haru Invest?

Haru Invest is headquartered in Singapore, but has mainly operated in South Korea, providing products or services such as Earn products (flexible savings and fixed deposits), cryptocurrency asset exchanges, and using certain trading strategies to generate returns on user deposits. Haru Invest claims to provide more than 10% annualized returns for deposits such as Bitcoin through trading strategies such as arbitrage.

Haru Invest was established in 2019 by its parent company, Block Crafters (a digital asset investment institution). In 2020, Block Crafters completed a strategic round of financing, with investors including Chun Yang-Hyun, executive chairman of Web3 Avatar and digital company Cocone Corporation, and former president of LINE JaBlockingn, as well as DTN Investment and T Investment. In September 2022, Haru Invest completed a $4 million strategic financing round at a valuation of $284 million, with Chun Yang-Hyun as the lead investor.

According to the Haru Invest official website, Haru Invest currently has over 80,000 members in more than 140 countries/regions, with a total trading volume of over $2.27 billion and less than $1 billion in managed assets.

Who is Delio?

Delio was founded in 2018 and is a cryptocurrency financial company. It has already completed a virtual asset business declaration in accordance with the Korean “Special Financial Law” in 2022 and has also obtained a US currency service business (MSB) license. According to the official website, Delio provides services such as deposits (earn income from deposited assets), loans, collateral, and exchanges, and also provides asset custody services for enterprises, institutions, and large accounts. The Delio official website stated that its asset custody service can provide an annual return of up to 12%.

It is worth mentioning that in early June 2022, according to Edaily, Delio signed an asset supply contract worth about $600 million with BlockFi and Three Arrows Capital. Delio will obtain $600 million worth of Bitcoin, ETH, and USDT assets from the two companies, and Delio plans to use this collateral to expand the current loan services and increase loan amounts. In addition, Delio is also discussing ways to cooperate with BlockFi on cryptocurrency financial business.

Unfortunately, in the same month, Three Arrows Capital suffered serious losses under market sales and was ordered to liquidate by a court in the British Virgin Islands (BVI) in mid-June. After that, it filed for bankruptcy. Affected by this, BlockFi, which provided loans of approximately $1 billion to Three Arrows Capital, was also affected by the FTX collapse shock and applied for bankruptcy in November last year. Of course, it is currently unclear what progress has been made in the handling of Delio’s contract with BlockFi and Three Arrows Capital after signing the contract.

According to the official website, Delio’s current total value utilized is 41,740 BTC (approximately $1.084 billion), 118,033 ETH ($206 million) and nearly $6.45 million in altcoins.

What happened?

June 13

-

Haru Invest announced that due to recent issues with a service partner, it is further investigating the matter and seeking emergency plans to correct the situation. To protect the assets of custodial users, deposits and withdrawals are suspended.

-

According to Yonhap News Agency, Haru Invest’s office space is suspected to be closed, and social media accounts such as Instagram and LinkedIn have been canceled.

-

Several Korean exchanges, including Upbit, restrict withdrawals to Haru Invest.

-

Haru Invest tweeted that “The Haru Invest office is still running, and the so-called ‘Rug Pull controversy’ mentioned in some articles is completely untrue. Haru Invest is working hard to investigate and respond to related work, and will also do its best to protect investors.”

-

Haru Invest explained and updated the suspension of deposit and withdrawal services, saying, “We recently discovered through internal checks that a consignment operator provided suspected false information. To protect investors, it is necessary to immediately suspend transactions. At present, we are conducting a factual investigation of the involved operator and planning to take necessary measures.”

-

Delio said that the suspension of deposit and withdrawal services by Haru Invest has nothing to do with the company.

June 14th

-

Delio announced that all employees will work from home starting from June 15th (Delio stated that all employees will work from home before the end of June).

-

Delio announced that it will temporarily change the operating method of the customer center, that is, the customer service center will only provide email and chat channels from June 15th to June 30th, and cancel the phone communication channel.

-

Delio announced that it will suspend withdrawals from 18:30 local time today. Delio stated that this was due to the increase in market volatility after Haru Invest suspended deposits and withdrawals.

-

Subsequently, multiple Korean cryptocurrency exchanges stated that they will limit the withdrawal of assets to Delio.

-

Haru Invest issued another announcement stating that “its entrusted operator B&S Holdings (formerly known as Aventus) fraudulently provided management reports containing false information, thereby deceiving the company and users’ judgments, so we decided to take legal action immediately. In addition, Haru Invest has filed a criminal lawsuit against B&S Holdings today and plans to file a civil lawsuit.”

However, Foresight News has not yet found any information related to B&S Holdings. According to News1, B&S Holdings is a Korean company. According to its website, it used the bankrupt exchange FTX in November last year. Currently, BNS Holdings is deleting the information listed on the homepage in real time. In a Korean Telegram group, a user said that B&S Holdings’ website is suspected to be http://bangnsong.com/, and the information on the website has been deleted.

Haru Invest and Delio have business contacts

Regarding the relationship between Haru Invest and Delio, although Delio clarified on June 13th that Haru Invest’s suspension of deposits and withdrawals has nothing to do with the company. However, in the context of external continuous questioning of Delio’s deposit of customer funds into Haru Invest, Delio’s representative responded to Block Media that “Delio has business contacts with Haru Invest, but it is inconvenient to disclose the specific amount. The suspension of withdrawals is because Delio’s withdrawal requests surged after the Haru Invest incident. There are multiple wallets within the company, and transferring funds between wallets is common.”

After Delio suspended withdrawals, according to Bloomingbit, the Korean financial regulatory agency stated that due to more misappropriation and breach of trust issues, it will cooperate with the financial regulatory agency to discuss countermeasures. A person in charge of the financial intelligence department of the Korean Financial Services Commission stated that “Delio has indeed completed the virtual asset service provider (VASP) declaration. However, after investigation, we found that the main problem seems to be embezzlement and malfeasance. The focus of the FIU investigation is money laundering and suspicious transactions.”

According to officials from FIU, “If that is the case, we will eventually have to cooperate with investigative authorities to understand the situation regarding criminal penalties. We will discuss together how to deal with this issue. Rumors also suggest that the Delio incident is related to Haru Invest, which has not been reported, but there is currently no confirmed information, so we are still observing. The transaction between Delio and unreported Haru Invest itself is not a problem, but more importantly, whether Haru Invest has committed any illegal acts. If this also involves embezzlement and fraud, not just money laundering, then an investigation should be conducted together with the investigative agency.”

Many users are worried that there may be panic and a risk of a chain run. According to Edaily, currently, about 300 domestic users gather in a chat room initiated by victims related to Haru Invest to discuss countermeasures. On June 14th, when Edaily visited Haru Invest Korea and Block Crafters in Gangnam-gu, Seoul, there was no one in the office. A visiting victim said, “I have about 20 million won in there, but I feel like I can’t get it back.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Exploring ERC-4626: Tokenized Vault Standard

- The Best Use of Cryptocurrency: Is Combining It with AI the Way Out?

- What do you think about the upcoming MEME token launch by Memeland? Are you excited or worried?

- Foresight Ventures: How to profit from shorting in the imitation coin market

- Why has Ledger Recover reached a dead end?

- Overview of the LSDfi Protocol Swell: How to Participate and Evaluate?

- What did the US CFTC’s victory in the world’s first DAO case release?