June 2023 FOMC Meeting Notes: Rates Can Go Higher

June 2023 FOMC Meeting: Rates Can IncreaseAbstract

-

The Fed maintained its interest rate at 5%-5.25%.

-

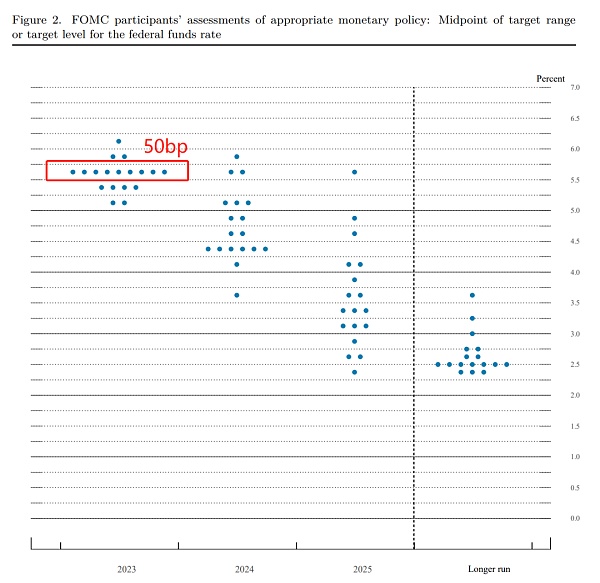

The dot plot showed that Fed officials’ rate expectations have moved up slightly, implying that there will be another 50bp rate hike in the second half of this year, slightly exceeding market expectations.

-

The Fed has become more optimistic about economic data and inflation forecasts, and seems very confident in the soft landing of the US economy.

-

Powell insisted on defending the Fed’s 2% inflation target and made the famous statement “Whatever it takes”. Unfortunately, the dot plot did not reflect officials’ confidence in achieving the inflation target.

-

Powell believes that this meeting should not be defined as a “pause in rate hikes”, and his statement is more inclined to slow down the pace of tightening and practice “Higher for Longer”.

-

Powell takes a cautious attitude towards inflation, which is in contrast to market expectations after the release of inflation data. Powell seems very concerned about the resilience of core inflation, while market participants seem to believe that the narrative of inflation has turned the page.

-

The US dollar index and long-term US bond yields rose, and US stocks fluctuated.

Statement

The text of this statement is almost unchanged from that of May, with only minor changes in rhetoric.

Dot Plot and Economic Forecast

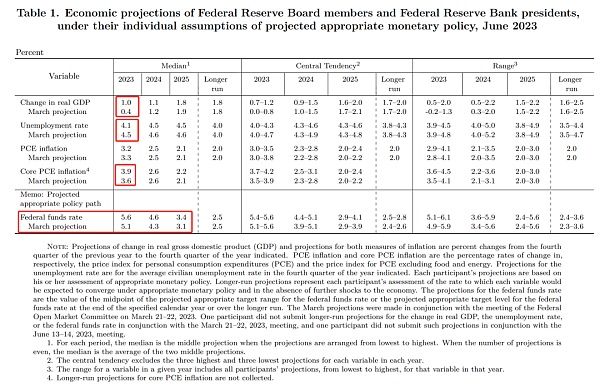

Raised this year’s GDP growth forecast, 0.4% to 1.0%

Lowered this year’s unemployment rate forecast, 4.5% to 4.1%

Raised this year’s core PCE inflation forecast, 3.6% to 3.9%

Overall, the Fed is confident in the soft landing, and at the same time, the Fed believes that the current anti-inflation process may fluctuate.

Raised the level of terminal interest rates, most officials expect interest rates to be at the level of 5.5%-5.75% by the end of this year, 50bp higher than the current level .

Raised the level of terminal interest rates, most officials expect interest rates to be at the level of 5.5%-5.75% by the end of this year, 50bp higher than the current level .

Key Points of the Press Conference

Q1. At a time when the housing market is rebounding and financial conditions are beginning to ease, what makes you confident that pausing the rate hike will not backfire?

There are three main parameters for the rate hike cycle: speed, amplitude, and duration. 15 months ago, the Fed’s primary concern was how to quickly raise interest rates. After raising rates by 75 basis points last year, we reduced the rate hike amplitude to 50 basis points and will further reduce it to 25 basis points at three meetings this year.

At present, as terminal rates approach, the main problem facing the Fed is determining how much more rates need to be raised. The Fed should moderate rate hikes, and the pause in rate hikes at this meeting reflects this process. The rate hike pace and terminal rate are separate variables, and slowing the pace is unrelated to the level of the terminal rate .

Finally, I need to emphasize that the FOMC committee adheres to a wait-and-see approach. We made no decision on future monetary policy, particularly the July meeting, at today’s meeting.

Follow up: Was there no discussion of the policy position for July at this meeting?

This issue did come up during the meeting, but we didn’t make any decisions on it . In addition, the July interest rate meeting will be broadcast live by the Fed .

Q2. The SEP dot matrix graph has shifted upwards overall, the labor market is stronger, the GDP growth rate forecast has doubled, and demand will not cool down quickly. In your soft landing narrative, where does the disinflation come from?

First of all, the data is higher than expected, but if we compare it with the SEP in March, the forecast is not too far off: GDP growth is up, unemployment is down, and inflation is up, all of which means more policy tightening is needed. The terminal interest rate predicted by the dot matrix is consistent with the market’s expected interest rate before the banking event in March. In other words, we’re back to the situation in March .

As for where disinflation comes from, I think the narrative is still the same. In terms of commodity inflation, the supply side has improved but has not yet returned to its original level; in terms of housing inflation, new rental prices are lower, and the data’s downward move is only a temporary issue. Most of the disinflation this year and next year will come from this sub-item, but the disinflation rate may be slower than expected. Lastly, core service inflation accounts for more than half of core PCE, and there are currently no clear signs of disinflation. Labor costs are the greatest cost in this sub-item, and there is some evidence that the labor market is cooling, but we need this situation to continue. In conclusion, although inflation has entered a downward channel, the process of disinflation is long and arduous .

Q3. What is the value of pausing rate hikes? Why not stick to the idea of enduring short-term pain and continuing to raise rates?

By slowing the pace of rate hikes, the Fed can incorporate more data and information into its decision-making and wait for the economy to fully absorb and reflect the effects of monetary policy and banking events that have led to credit tightening. If we look at the pace of rate hikes and terminal rates separately, I think it makes sense to pause rate hikes.

Follow-up: Which reports will the committee rely on to make policy decisions, including the June employment market and CPI reports, ECI, and senior loan officer survey, which will be released before the July meeting?

If we add these data releases before this meeting, we will be able to see the complete three months, a whole quarter of data, which will allow us to draw more conclusions than just looking at six weeks of data. We will consider the risks and financial conditions in making decisions.

Q4. Since March, what factors have deepened your understanding of economic resilience and inflation stickiness, leading to the revision of the SEP? Is it possible for the terminal rate to be higher than 5.6%?

First, the SEP revision is based on data. Second, the SEP dot plot is based on the individual assessments of FOMC voters on the economic path, and I do not know whether it will be lowered or raised in the future. The terminal rate will be driven by data, and I have nothing to say about it right now.

Q5. At the end of May, you said that you thought risks were getting closer to balance. Has your view on risk management changed? What interest rate level is considered “restrictive”?

As we approach the terminal rate, the risks of doing less and doing more naturally become more balanced. But I and my Fed colleagues believe that inflation risks are still trending upward: although overall inflation has declined, core inflation has not made much progress since last year, and the latter is a better indicator of predicting the direction of inflation. We want to see reliable evidence that inflation has peaked and fallen. In addition, since financial conditions tightened last year, we have gone through a year of rate hikes, and there is reason to believe that monetary policy has begun to take effect. This is also why we want to slow the pace of rate hikes and make judgments after seeing more data.

Q6. What indicators would you look at to determine when the lagging effects of monetary policy begin to affect the economy?

First, financial conditions have already begun to tighten before actual rate hikes. If the 2-year Treasury yield is used as an intermediate value for policy direction, this indicator has risen from 20bp to about 200bp at the start of the rate hike. Due to news media, the effect of monetary policy is now faster than in the newspaper era. Secondly, interest-sensitive expenditures, such as housing and durable goods, have quickly felt the impact of rate hikes, but monetary policy transmission to broader demand and expenditure as well as asset prices requires more time. Various studies have diverse predictions for the timing of delays, and there is no consensus in the industry. We can only make judgments based on the current economic situation. This is also why we need to slow down the rate hike. With a little more time, we won’t overcorrect.

Follow up: How is the current credit tightening situation? How to distinguish the impact of monetary policy from the impact of credit tightening?

It is too early to assess the degree of credit tightening. If credit tightening exceeds expectations, we will incorporate it into interest rate decisions.

Q7. Currently, the downtrend in inflation for the three departments has already taken place. Why is the dot plot so hawkish?

In the past two and a half years, the financial sector and the Fed have repeatedly predicted inflation downturns, all of which have been wrong. The core PCE inflation rate has not made significant progress in the past six months and is still hovering above 4.5%, without a real downward trend. Therefore, our policy decision today both slows down the pace of rate hikes and indicates a stance of continuing to hike rates this year.

Follow up: Research by the San Francisco Fed shows that wages are not necessarily the key driver of inflation, but you still mentioned wage inflation today. How do you view this relationship?

I will not comment on specific research, but overall, inflation in 21 mainly comes from strong commodity demand and supply chain disruptions, and the importance of wage inflation rises in 22 or 23, especially in non-housing core service sectors. We need to bring wage inflation back to the level consistent with 2% inflation. We have seen a widespread decline in wages, but it takes time. My view is consistent with Bernanke’s latest research.

Q8. Would you take action if you saw the same labor market and inflation levels in July or September?

I don’t answer hypothetical questions. You can see the thoughts of Fed officials at the July meeting.

Follow up: Will inflation fall?

See SEP for details.

Q9. Are we approaching a reserve shortage? Will reserve conditions be affected by Treasury issuance? Is the RRP rate considered for a cut to relieve bank pressure?

We have been very concerned about this issue for several months. The Treasury Department publicly stated its borrowing plan, and the Treasury Secretary’s comments yesterday indicated that the Treasury had extensive consultations with market participants to avoid market confusion. At the Fed, we will closely monitor market conditions during the TGA recharge period. During this period, both the RRP and reserve levels are expected to decline, but the flow situation is currently unknown. As the reserve level is still high, we do not believe there will be a reserve shortage issue in the short term or within the year .

Follow up: Will the RRP rate be cut?

There is no evidence that the RRP has caused deposit outflows, and the RRP balance has been shrinking recently. Adjusting the RRP rate is only one of the tools that the Fed can call on at any time. There are other tools to solve monetary market problems, so the Fed is not considering adjusting the RRP rate in the short term .

Q10. How will the recent rebound in the housing market be taken into account?

Due to last year’s rate hike, the housing market is currently bottoming out and fluctuating, but it is recovering. We will continue to monitor the housing market and expect that low-level rents will gradually be reflected in housing inflation. I don’t think housing inflation will rebound quickly .

Follow up: Will the rebound in the housing market lead to further interest rate hikes?

Housing is part of the consideration of interest rate decisions, and we will make decisions from a holistic perspective.

Q11. The CBO predicts that the scale of national debt will reach 52 trillion dollars in 23 years, and the fiscal deficit will reach 2.8 trillion dollars within 10 years. Will the Fed discuss fiscal issues with the legislature?

Given the Fed’s policy independence, it is not appropriate to discuss fiscal issues with the legislature.

Follow up: Will the Fed provide monetary financing for government bonds?

Absolutely not.

Q12. Compared to March, has the probability of a soft landing increased?

The path to a soft landing is possible. However, as shown in the SEP dot plot, the FOMC unanimously believes that it is necessary to lower inflation to the target level of 2% and will spare no effort to do so (“whatever it takes”). This is our plan. Price stability is in the interest of today’s workers, families, and businesses, benefiting generations to come, and is the foundation of the economy as well as our top priority.

Follow up: The SEP shows that inflation will remain high next year, but the dot plot predicts that the federal funds rate will be lower than it is now. Is this contradictory to your “whatever it takes” approach to lowering inflation?

Due to high uncertainty, I will not give too much weight to next year’s forecast. However, they indicate that if the inflation rate falls, nominal interest rates must also fall to keep real interest rates unchanged. In other words, when inflation really drops significantly, rate cuts are certainly appropriate. Of course, I’m talking about a few years from now. As we all know, no one on the committee voted to cut interest rates this year. I also believe that it is not at all likely to be appropriate to cut rates this year. Inflation has not really fallen, nor has it had much impact on current rate hikes. We have to keep working hard.

Q13. The black unemployment rate rebounded in May. Does this fit the Fed’s mission to promote maximum employment?

We recognize that there are long-term differences in unemployment rates among different groups, but at the same time, all current unemployment rates, including the black unemployment rate, are still at historically low levels. This is a very tight labor market.

Q14. Federal Reserve Board Governor Warsh mentioned that he has not seen a slowdown in rental rates reflected in housing inflation, and the final degree of slowdown may also be lower than expected. How do you view this?

Indeed, rental inflation accounts for one-third of the CPI and half of the PCE, and is an important component of inflation indicators. Therefore, we need rental rates to bottom out and maintain low growth. However, core inflation over the past six months or year has shown that the deflationary process has not met expectations, and the SEP predicts that the core PCE inflation rate will reach 3.9% this year.

Follow up: What is the view on recent salary inflation?

We have seen some progress, and major wage inflation indicators have gradually fallen from the very high levels seen a year ago. We hope this process will continue.

Q15. Regarding salary inflation, has the committee mentioned recent strike issues such as Hollywood and the Automotive Workers’ Union?

The labor market is one of our core topics and is also part of the Fed’s dual mandate. However, many labor market issues are structural and cannot be resolved by Fed action, so while we are monitoring the developments of these events, we are not participating in discussions related to strikes.

Q16. What is the view on financial systemic risks, including commercial real estate and risks related to non-bank financial institutions?

Regarding commercial real estate, there are a large number of commercial real estate-related assets in the banking system, with a large proportion concentrated in small banks. We expect these banks to incur losses, and banks with concentrated holdings may suffer even greater losses. We are currently monitoring this issue, but commercial real estate risks are more likely to persist in the long term rather than erupt in the short term .

Regarding the non-bank financial sector, there are many ongoing government efforts to address issues related to the national debt market and non-bank finance. However, the Fed’s jurisdiction only includes banks and bank holding companies, which is also where our focus lies. We will also continue to monitor developments in this area. If credit tightening or other financial risks erupt and have an impact on the economy, we will include them in our interest rate decision considerations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Best Use of Cryptocurrency: Is Combining It with AI the Way Out?

- What do you think about the upcoming MEME token launch by Memeland? Are you excited or worried?

- Foresight Ventures: How to profit from shorting in the imitation coin market

- Why has Ledger Recover reached a dead end?

- Overview of the LSDfi Protocol Swell: How to Participate and Evaluate?

- What did the US CFTC’s victory in the world’s first DAO case release?

- Hinman Memo Unsealed: SEC Official Expresses Concern Over “Ethereum is Not a Security” Declaration