Arkham Product Performance, Financing Status, and Investor Expectations

Arkham Product Performance, Financing, and Investor ExpectationsAuthor: Belinda Zhou, Web3angel&enabler/Project Encourager Source: Twitter, @ciaobelindazhou

Arkham is a project aimed at creating an on-chain intelligence trading platform, primarily providing on-chain analysis, token analysis, visualized data, a detective intelligence information trading market, Interl to earn, and AI-driven engine Ultra services, aimed at helping on-chain experts achieve monetization. Here is my analysis of Arkham:

1. Marketing: Arkham adopts a grounded promotion style, knowing where the target user group is and actively cooperating with KOLs in the Asian region. They have collaborated with @Dahuzi_eth, @shirleyusy, and @liangfenxiaodao, demonstrating their understanding of the audience.

- Will NOVA be the next Pepe? Analysis from the perspective of trading techniques.

- Analyzing the new token governance system: Utilizing Balancer weighted pools to achieve deep liquidity and reduce impermanent loss.

- How can Opside collaborate to build the ZK ecosystem as the era of multiple Rollups approaches?

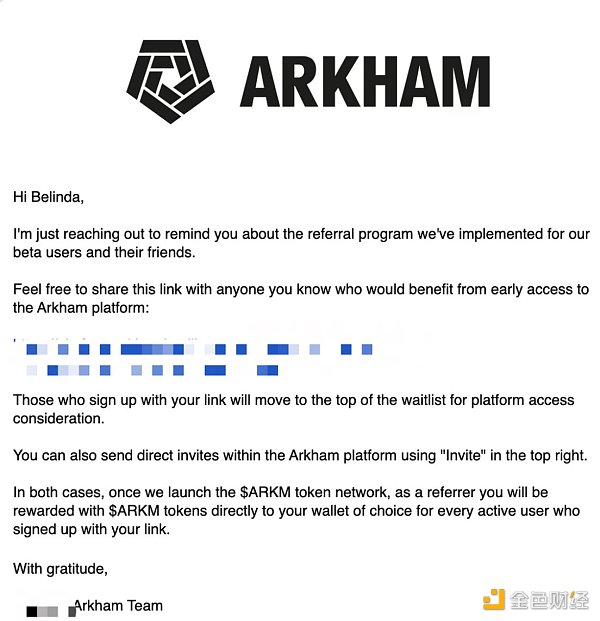

2. Transparent Communication: Arkham conducted beta testing before launching and mentioned the token $arkm in its April recommendation plan. They launched Arkham Intel Exchange in July. They focus on practical actions rather than empty propaganda.

3. Investment Endorsement: Arkham successfully raised $12 million and attracted investors such as the founders of OpenAI and Blockinglantir, Coinbase, and DCG. The endorsement of these investors made Arkham perform well in the Binance launchBlockingd. Founder Miguel previously founded the Reserve Protocol, whose investors include Peter Thiel, Sam Altman, and the Coinbase series.

4. Product Performance: Arkham provides services such as address analysis, token analysis, visualized data, detective intelligence information trading market, and AI-driven engine Ultra, and users generally give positive feedback on their user experience. However, a previous arkham alert error caused a 6% drop in the price of Bitcoin, which needs to be taken seriously to avoid negative effects on the ARKM token price.

5.1 Price speculation: Arkham has undergone two rounds of equity financing, which accounts for 20% of the total supply of ARKM tokens, with a valuation of $150 million. The lock-up method used this time is the typical Binance launchBlockingd lock-up method: 1-year cliff, 3-year release. Investors include market makers such as Wintermute and GSR, which means there may be many opportunities in the token market. However, the actual role of ARKM tokens currently seems somewhat pale and needs further observation.

There is an estimate that the value of $HOOK is 500 million, and the price range of $ARKM may be between 10-20 times, which is $0.5-1. It should be noted that Binance Launchpad usually provides financing opportunities for project parties, so the profitability of investors depends mainly on the timing of their entry into the market. This is a simple analysis, so please correct any errors in the information. Thank you!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- YugaLabs CEO: Our biggest risk is deviating from our mission, not regulation

- With the advent of the Rollup era, how can Opside collaborate to build the ZK ecosystem?

- Crash and Reshape: Drawing Lessons from the History of the Gaming Industry to Look Ahead at the Future of NFTs

- Pendle v2 Overview: Driving Pendle to Become a Key Part of DeFi Infrastructure

- ERC4337: Trigger Transactions Autonomously Without Relying on External EOA Accounts

- Encryption startup Arkham has been conducting months-long doxxing campaigns against its users

- Exploring the current development status of LSD stablecoins field