Viewpoint | BITKRAFT Ventures: How Can Blockchain Games Attract Users?

BITKRAFT Ventures on Blockchain Game User AcquisitionOriginal author: BITKRAFT Ventures

Translation: Zen, BlockingNews

TL;DR

While the rise of Web3 and blockchain technology has created numerous opportunities for game design, game development, and digital asset ownership, the fundamental problem to solve for user acquisition (UA) remains unchanged: maximize player lifetime value (LTV) while minimizing customer acquisition costs (CAC).

- Evening Read | Cosmos’ Threat to Traditional Blockchain

- Ethereum EIP Review: How Does the Ethereum Community Conduct Open Governance?

- Exploring Interoperability of Modular Blockchain: What Are the Solutions?

However, the ability to accurately measure this relationship has changed, and in the decentralized world, both sides of the equation are becoming increasingly blurry:

- CAC is often measured in traditional games as cost per install (CPI), which is much harder to accurately calculate. Many Web3 games are currently web-based, which means there is no installation required.

- The “value” in Web3 games is harder to quantify than in traditional games, and LTV payback periods may have significant differences from standard benchmarks.

- Identifying players can be challenging, with players potentially owning multiple wallets, and game data-associated wallet addresses may actually be bots rather than human. Using wallet addresses rather than specific users as a reference point for LTV and CAC is risky and difficult to predict accurately.

Traditional marketing methods have not been very effective in Web3 games, and at least for the moment, this approach is challenging and underdeveloped. This puts Web3 games at a significant disadvantage compared to web2 games. Even if strong Web3 games are prepared to invest heavily in performance marketing, macro headwinds make such strategies prohibitively expensive and largely unsuitable for early-stage venture capital, especially since many of these companies are still developing their first game.

However, opportunities still exist for savvy operators who can combine thoughtful data analysis with novel crypto-native marketing strategies. By focusing on three critical areas (community, partnerships, and Web3-native growth), founders can promote user acquisition in an economically efficient and Web3-friendly manner.

While measuring LTV and CAC in Web3 is difficult, game companies should still prepare for performance marketing to once again become the dominant strategy. Blockchain game companies can take several steps now to prepare for the future.

Introduction

The introduction of blockchain technology to the gaming industry has caused many founders and industry practitioners to re-examine old ways of doing business. Almost every aspect of the “traditional” gaming industry – from design, development, and distribution, and everything in between – is being dissected and rebuilt to best meet the needs of new games, users, and studios emerging around the nascent Web3 gaming ecosystem.

User Acquisition (UA) is no exception and, in some ways, lags behind other sectors of the gaming industry in adapting to Web3. So far, much of the development and investment activity around blockchain gaming has focused on Pre-Seed, Seed, and Series A venture funding. At this stage, most companies are still developing their first game and are not yet ready to expand to a large user base through traditional performance marketing.

Blockdata reports that, by 2022, 60% of blockchain gaming transactions will still be in the early stages, with an additional 17% entering Series A. Given that developing a game worth scaling takes time, Web3 gaming user acquisition has received little attention until now. In this article, BITKRAFT will outline the challenges associated with Web3 gaming user acquisition, provide practical advice for companies in this space, and highlight areas of opportunity for investment, user acquisition, and internal development.

Throughout the article, BITKRAFT will refer to the terms “User Acquisition” or “UA” as Brand Marketing (essentially more qualitative) and Performance Marketing (usually more quantitative). In the context of traditional gaming, especially mobile gaming, UA typically only involves performance marketing functions. However, performance marketing is not suitable for most Web3 game operations, at least not yet, and blockchain games still need to acquire users through other less precise means.

Basic Challenges of UA

Fundamentally, the effectiveness of user acquisition can always be traced back to the same basic relationship: player lifetime value (LTV) vs. user acquisition cost (CAC). As long as the player’s lifetime value exceeds the cost of acquiring that player, profitability will shift and UA efforts will be considered successful.

Of course, in practice, it’s not that simple.

For example, players may play the game for weeks or months before deciding to spend money. The cost per install (CPI) – the most commonly used CAC metric in games – will fluctuate over time depending on the platform, market conditions, genre, and many other factors. In addition, operating the game and keeping players within the ecosystem also requires ongoing costs.

Regardless, the fundamental strategy of maximizing LTV while minimizing CAC applies to all gaming businesses in both traditional and Web3 domains. This relationship has not changed.

However, as we are about to discuss, there are some key assumptions behind this truth in the Web3 environment that no longer hold, forcing savvy operators to seek new solutions.

Key Assumptions

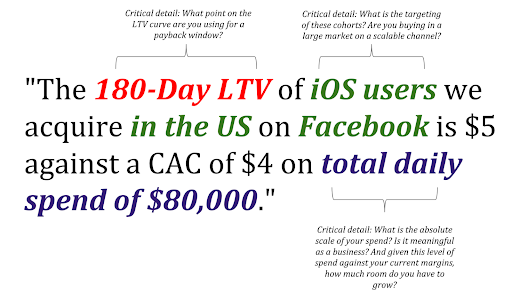

Founders with marketing or user acquisition experience in the traditional gaming arena should be familiar with the following:

This highly specific approach makes traditional user acquisition more science than art. Marketers and user experience practitioners can input the above information into a spreadsheet and predict the LTV and CAC relationship over time, allowing for a quick assessment of the commercial viability of a particular game business.

However, to acquire users so precisely, we must first understand them.

In the traditional gaming environment, users are relatively easy to identify-they are independent users installed on specific devices. In the example above, we know that they play games on iOS, live in the United States, and have been exposed to some Meta Audience Network (Meta advertising business) content.

Although there may be some error, such as multiple users sharing the same device or one user playing games on multiple devices, we can still associate a specific device with a series of behaviors observed in the game and attribute that user to the channel through which they reached our game.

In the world of Web3, we can no longer make such straightforward assumptions.

Although all games distributed through traditional means such as mobile app stores, PC publishing platforms, and console networks can theoretically benefit from the data pipelines frequently used by UA professionals, mixed factors such as wallet ownership and platform policies make this process less straightforward.

Wallet Ownership:

As Web3 games require encrypted wallet connections to take advantage of the benefits provided by blockchain integration, game companies need to be able to directly attribute wallets to players. However, considering that a user may have multiple wallets, this may be challenging.

Additionally, the contents of any given wallet may change over time – NFTs and other tokens may come and go, asset values may fluctuate, and some assets may not even belong to the wallet holder at all (such as in the case of scholar or rented NFTs). This makes it difficult to accurately estimate LTV based solely on wallet contents.

Wallets also obscure the identity of the user, making it harder to effectively target advertising to them. In fact, these wallets may not even be operated by humans at all, but rather by bots or AI. Wallets controlled by bots may even have negative LTVs, as bots are a common means of maximizing value extraction in Web3 games.

Platform Strategies:

Most traditional game distribution platforms are hesitant to allow blockchain integration or the use of NFTs. At the time of writing, any NFT sales on iOS or Android devices must be completed through in-app purchases, with Apple and Google taking a 30% revenue share. Platform owners also impose restrictions on using NFTs to unlock content, effectively limiting their use cases.

Console manufacturers have sent mixed signals on blockchain gaming: they have issued cautious statements to the public while quietly exploring the space through investments and R&D. On the PC side, Valve has issued a complete ban on NFT and blockchain games, while its competitor Epic Games Store has expressed welcome and already offers some blockchain games.

All of this uncertainty, coupled with a lack of mature backend publishing infrastructure to support Web3 integrations, has led many Web3 founders to focus their projects on browser-based experiences, and crypto wallet integrations have skyrocketed. Browser-based games don’t require installation or downloading, which renders standard game CAC per install cost metrics useless. Even if a wallet can be attributed to a specific acquisition channel, players can easily connect and disconnect wallets at will. If a player connects a wallet but doesn’t make any transactions, can a company really say that that player has been “acquired”?

To sum it up:

- If we can’t accurately measure LTV…

- We cannot reliably measure CAC…

- …can we really optimize user acquisition?

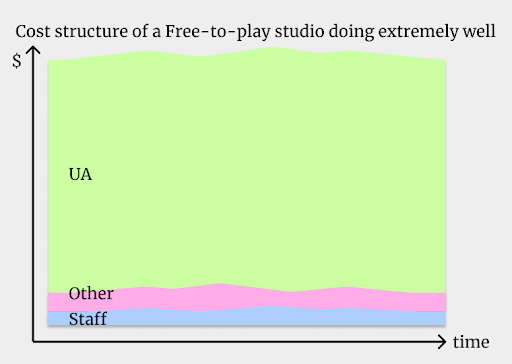

It’s important to consider that even in the best case, user acquisition is difficult. With changes in Apple’s ATT policy, user targeting has become more challenging, and changes in global privacy regulations make the issue even more complex. Even if done well, the cost of user acquisition is still very high (especially in free games):

Even if a Web3 game is ready to expand to a wider audience (i.e. non-crypto native users), it will operate in an unfair competitive environment with non-Web3 games, which do not face challenges such as user login, installation attribution, LTV tracking, or platform policies, and have years of UA data to use for prediction purposes.

Therefore, traditional performance marketing is largely unwelcome, unless it is the most highly developed and well-funded Web3 projects, and/or those with minimal integration with Web3.

From the perspective of the traditional gaming industry, this seems like a challenging environment for startups. However, Web3 has also shown itself to have unique user acquisition opportunities that can be leveraged by companies of all sizes—we will explore this topic further in the next section.

Practical UA advice for founders

In the absence of reliable LTV and CAC metrics, Web3 founders should prioritize low-cost, crypto-native solutions for user acquisition. Fortunately, there are many options available for savvy marketers who understand Web3 users and are willing to step outside of traditional gaming methods.

Utilize player communities

Given the bottom-up nature of Web3 game development, starting from your game’s current community is a constructive and cost-effective starting point. Because early community members can be incentivized through adjustments to the crypto economy, they can be analogized to the “golden group” of traditional games. These early adopters will become your game’s greatest advocates and biggest consumers.

As early contributors to your game’s ecosystem, your genesis series token holders, and even speculators looking for the “next big thing,” community members have a vested interest in raising the profile of your project and attracting new users to your game. While economic incentives or money-making potential may be the primary motivators for some of these players, many others may enjoy the opportunity to participate in community-driven development. Low-cost community-building efforts, such as art contests, game story writing, and friend referral programs, are effective tools for strengthening community member power. When combined with the endowment effect brought by Web3-native initiatives (free NFT minting, token distributions, permissionless listing, etc.), players can feel a greater sense of ownership over the game ecosystem they inhabit.

Encouraging these “co-owners” to play an active role in promoting the game could be a powerful growth strategy and may be cheaper than hiring dedicated full-time staff to do the same thing.

Content creators are particularly valuable in this regard because they can generate buzz around your game through the social media channels (such as Telegram, YouTube, Twitch, and TikTok) that Web3 gamers frequently use. By partnering with content creators, you can tap into their followers and leverage their expertise to showcase your game to a wider audience. Another way to leverage community members is to enlist their help in finding and procuring potential partnerships with other Web3 communities. Most people active in the Web3 gaming community aren’t limited to just one Discord server. Instead, they likely participate in multiple games, PFP projects, DeFi protocols, DAOs, and so on. Allowing the community to identify other projects or communities with shared values or overlapping audiences can quickly and cost-effectively provide your team with a set of “warm leads” that could ultimately result in valuable partnerships.

Partnerships + Collaboration

According to DappRadar, as of the end of May this year, there were just over 1 million unique active wallets. Given the relatively small potential market of current Web3 gamers, another economically effective way to acquire users is to partner with like-minded communities that have already overcome the challenges of Web3 onboarding.

Partnering with other organizations can bring many benefits to your project:

- Increased game traffic through new networks.

- Valuable data on overlapping or adjacent audiences.

- Cross-promotion of marketing content, NFT drops, whitelist promotions, and more.

- Lowered cost and risk of acquiring new users, as these partner communities are already primed for Web3 content.

Given the prevalence of scams and hype in the space, partnerships can also be seen as a more organic way of promoting products to Web3 audiences who are often skeptical of traditional advertising forms. There are many choices for building partnerships and collaborations. One common early example is partnering with guilds. Guilds can help with asset allocation and utilization, provide liquidity, execute marketing plans, organize esports tournaments, create content, and more. These would be good places to start a conversation, even if it’s just to explore the possibility space.

There are also other collaboration opportunities in the platform and infrastructure provider space. There are countless blockchain, technology solutions, distribution and aggregation platforms, markets, automated market makers, and countless other entities that are raising overall awareness of Web3, particularly those with a vested interest in participating in Web3 games. Partnering with these organizations can increase the visibility of the game and potential additional utilities.

For example, partnering with markets such as Magic Eden or OpenSea could bring an increase in trading volume, while transactions with second-tier providers such as Polygon or Immutable could open up to other game developers or those interested in building a presence in Web3. There may even be opportunities to collaborate with other companies to save development time and resources on wallet integration or advertising functionality that is beneficial for acquiring and attracting users.

Finally, one area of growth in recent years has been game and IP partnerships. This type of transaction takes on a new format in Web3, where interoperability allows game assets to have multiple uses across projects. A recent prominent example of this is the partnership between Limit Break and Castaways, which is ubiquitous in traditional games. Collaborating with other games or IP not only brings a new audience, but also demonstrates that the studio can confidently handle future IP integrations.

Of course, the challenge for all of the above options is identifying the right partnerships for the project. The key to this work is a deep understanding of wallet data – a topic that BITKRAFT will explore in more detail in the later planning and scaling sections.

Web3-native growth

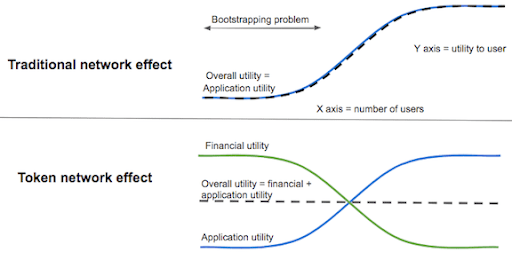

Perhaps the most interesting user acquisition opportunity and space in blockchain games is to use Web3-native features to drive growth. These methods are uniquely implemented by blockchain technology, so there are almost no precedents in the gaming world.

The most common method in this category is to use airdrops and token issuance as a means of incentivizing user participation in the project.

Airdrops or free token distributions are used to attract new users, allowing developers to send tokens to target wallet address lists without permission. While this may seem like a relatively inexpensive marketing form at first glance (the token sender only needs to pay the transaction cost), its effectiveness is debatable. In multiple tests by Web3 marketing company Raleon, less than 1% of game-related airdrops were viewed by recipients, leading to clickthrough rates of less than 0.05%.

Intuitively, this makes sense – receiving an airdrop is like receiving unsolicited spam mail that you can’t delete. As such, airdrop strategies should be approached with caution, with the aim of maintaining stickiness among existing players rather than acquiring new ones. If airdrops are used as rewards (such as for community contributions, completion rewards, etc.), then they can attract existing players, re-engage lapsed players, and potentially bring in additional word-of-mouth users. However, consideration must be given to the potential value of the tokens being distributed. If the tokens have liquidity and meaningful value on the open market, then the execution cost of airdrops suddenly becomes more expensive as a large portion of the token supply moves out of your project.

A specific type of airdrop strategy commonly used in DeFi is called a “vampire attack,” where new projects incentivize conversions by airdropping valuable tokens, thus siphoning users away from established projects. This has also entered the Web3 gaming space: horse racing game MetaDerby airdropped free NFTs and $100 in-game tokens to players of competing horse racing games Zed Run and Pegaxy.

Another strategy for acquiring users found only in Web3 is leveraging token issuance, including the often-maligned “X-to-Earn” systems. While discussion of token economics is beyond the scope of this article, it can be said with certainty that incentivizing users with tokens that have potential value is an effective way to generate short-term attention, though it may only be effective in the short term. Even this temporary growth may begin to experience diminishing returns as players become savvier, and customers generally become more cautious about avoiding scams and unsustainable economics.

However, token issuance need not be limited to profit plans. Games may utilize token rewards as a means of maintaining player engagement, incentivizing deeper gameplay, or granting means of governance voting – for example, distributing tokens when players win a competitive match or achieve certain in-game milestones. These will be determined by smart contracts and require careful pre-planning by game teams to avoid creating unsustainable game economies, but can serve as powerful retention mechanisms.

Planning Scale

While most Web3 gaming organizations might not be ready for large-scale effect marketing, it is important to keep an eye on the future and be prepared to adjust strategies as the industry matures and new opportunities arise. Many steps can be taken today to better prepare for tomorrow’s user-driven growth, while also providing direct benefits to other marketing efforts within the organization.

First, before spending money on UA, it is worth taking the time to thoroughly check the organization’s data readiness:

- Is telemetry enabled for the game’s onboarding process so that you can measure progress, monitor churn, track conversions, and trigger feedback events?

- Is the game’s funnel (a visual representation of the customer journey describing the sales process from awareness to action) recorded? Can you track players from social media to Discord to your game?

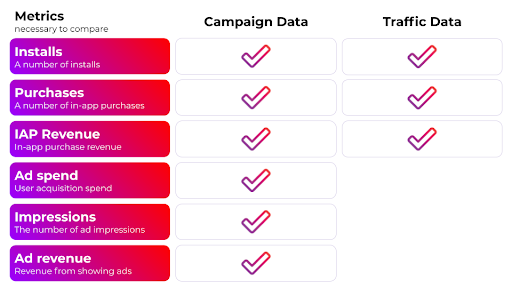

- Can paid activity data be differentiated from organic traffic data?

Next, understanding the unique data associated with Web3 wallets will be helpful. While wallets present their own set of challenges, as mentioned above, they also offer interesting information that was previously unavailable in other traditional gaming scenarios. Here are some examples of unique metric types available in Web3:

- Analysts can view the assets in a given wallet and track their individual and cumulative value.

- Wallet transactions can be parsed to examine total transaction volume, transaction frequency, and average transaction value.

- Wallet buying power can also be analyzed, as well as the share of transactions or total value flow in/out of a given project or set of smart contracts.

- Analysts can even track wallet interactions to visualize the network of connections to other games, dApps, and other Web3-native experiences.

Finally, and perhaps most importantly, it is worth noting that no user acquisition strategy, no matter how clever, can fix a game with underlying flaws. Developers must work hard to create engaging, memorable, and fun experiences before investing heavily in user acquisition. This is not a problem that can be solved by money alone.

Opportunity Areas

As Web3 user acquisition is a nascent area, the company has an opportunity to address UA challenges and overcome the challenges associated with accurately measuring Web3 gameplay performance.

As mentioned earlier, accurately understanding UA capabilities in Web3 games is difficult. Market participants in the AdTech space are sure to try to fill this gap, but traditional game attribution platforms currently lack the ability to incorporate price fluctuations in cryptocurrencies into their platforms. This may present an opportunity for crypto-native companies to quickly ship and stand out in competition.

Similarly, companies operating in the Web3 identity space are also well-positioned to use the opportunity to improve access to reliable, actionable user acquisition data by aggregating different data sources in a way that benefits both players and developers. Given its technical complexity, high transaction volume, and wide range of devices used (PCs, game consoles, mobile devices, web browsers, etc.), gaming is an excellent testbed for such technology. Successful implementation in the gaming space can be replicated more broadly in the media and entertainment space, even if not entirely duplicative of other industries.

With the help of zero-knowledge proofs, a company that allows players to exercise better control and privacy over their data while also connecting them to the gaming industry’s UA sector to seek new ways to reach them may have an opportunity to compete with existing ad tech companies like ironSource and AppLovin. The company would also be a key acquisition candidate for any AAA game publisher looking to venture into Web3.

By allowing users to display a “game work proof,” players’ needs to showcase their identity can also be addressed, perhaps through technical means such as POAP or soul-binding tokens. Players with more impressive achievements can use these achievements to gain better incentives in the game ecosystem where they may be needed. These achievements may relate to in-game achievements, but can also be easily linked to ecosystem building contributions, such as inviting friends, writing blog posts, or participating in game testing. Players will have the incentive to participate, and game enterprises will have more actionable information to target those valuable players. In fact, this may look like casino loyalty rewards, employee discount programs, or Starbucks’ “Stars” system.

Another potential opportunity is a “CRM (customer relationship management) for developers”. As more and more gaming projects launch in Web3, the demand for builders and contributors from the cryptonative community to join these bottom-up ecosystems will grow. These builders will come from different backgrounds, fulfilling various needs (software engineers, social media marketers, forum moderators, player support, etc.) and will increasingly be used as growth partners for Web3 gaming projects. For game publishers, associations, or marketing companies looking to serve the growing audience of game developers, building a strong, high-value contributor CRM could be an excellent business opportunity. Such an enterprise could be likened to a human resources company specializing in Web3 gaming projects. Besides the opportunities listed above, there may be more. Fundamentally, providing, storing, and distributing clean, actionable, and compliant data to stakeholders in the Web3 gaming space is always valuable, and this value will only grow as more users join Web3 in the future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can AI Trigger the Fifth Technological Revolution? (Part 2)

- Comprehensive Explanation of the Shoal Framework: How to Reduce Bullshark Latency on Aptos?

- Financing Weekly Report | 18 public financing events; Gensyn, a blockchain-based AI computing protocol, completes $43 million in Series A financing, led by a16z.

- Blockchain Capital: Looking Ahead to the “Consumer Era” of Cryptocurrencies

- AI in the Web3 Era: Exploring the Infinite Potential of Blockchain and Artificial Intelligence

- Analysis of Lybra Finance, the LSDfi leader: How stable is it? What are the risks of “layer 2 nesting”?

- Long article by V God: What are some non-financial use cases of blockchain?