Inventory of 9 Chain Data Tools Outside of Arkham That Have Not Yet Been Released

Blockchain technology has led to the emergence of various chain data analysis tools. While Arkham is a well-known tool, there are others that have not yet been released. Here are nine examples: 1. Chainstack - a multi-cloud and multi-protocol blockchain platform for building, deploying, and managing decentralized applications. 2. Alethio - a blockchain analytics platform for Ethereum that provides real-time data insights. 3. ChainGuardian - a blockchain security and monitoring platform that detects and prevents security breaches. 4. Blockseer - a blockchain analytics platform for Bitcoin and Bitcoin Cash that analyzes transactions and addresses. 5. Amberdata - a blockchain analytics and monitoring platform that provides real-time data insights into Ethereum and other networks. 6. Zabo - a blockchain data aggregation platform that offers a unified API to interact with various blockchain networks. 7. Dune Analytics - a blockchain data analysis platform that provides various data analysis tools for Ethereum. 8. Amberdata API - a blockchain data API that provides real-time data insights into Ethereum and other networks. 9. Blocknative - a blockchain data platform that offers real-time data insights and analysis tools for Ethereum and other networks.It wasn’t until Binance launched its 32nd Launchpool project, the crypto data analysis platform Arkham (ARKM), that people realized that even temporary issuance of a coin by a data tool could become mainstream, and even users who did not have a wallet address could have the chance to receive airdrops by registering with their email.

With this in mind, what are some other commonly used tools that have yet to issue coins?

Messari

On August 5, 2021, the crypto analysis platform Messari announced the completion of a $21 million Series A financing round, led by Point 72 Ventures, with participation from Coinbase Ventures, Uncork Capital, Underscore VC, Alameda Capital, Blockchain Ventures, CMS Holdings, Gemini Frontier Fund, and others.

On September 21, 2022, Messari announced the completion of a $35 million Series B financing round, led by Brevan Howard Digital, with participation from Morgan Creek Digital, FTX Ventures, Point 72 Ventures, Kraken Ventures, Uncork Capital, Underscore VC, Galaxy, and Coinbase Ventures.

- Evening Reading | RWA Track: Progress of Top 10 Projects

- List of 15 projects worth keeping an eye on: Thena, Stargate, Pendle…

- Overview of RWA Tracks: Progress of Top 10 Headline Projects and 20 Early Stage Projects

Messari is a crypto analysis platform and research institution dedicated to providing comprehensive and transparent information on crypto assets. It is committed to providing users with accurate, timely, and reliable data on crypto assets, as well as in-depth research and insights into the crypto market.

Messari maintains a wide-ranging crypto asset database that includes detailed information on various cryptocurrencies, tokens, and blockchain projects. Users can access this data and receive real-time updates on market capitalization, supply, trading volume, price, and other key metrics. It uses various methods to verify the accuracy and reliability of the data, including collaboration with project teams, integration with API data sources, and analysis of on-chain data.

Messari’s team also publishes research reports and insights on various crypto asset markets. These reports provide in-depth analysis of project fundamentals, industry trends, and market trends, helping users better understand and evaluate crypto asset investment opportunities. In addition, it offers some advanced tools and services designed specifically for institutional investors and professional traders. These tools include data APIs, real-time quotes and exchange data, and data subscription and custom solutions.

Messari hopes to help investors, regulators, and the public understand this revolutionary new asset class and build data tools to drive wise decisions and investments. It believes that cryptocurrencies will democratize information acquisition, break down data silos, and ultimately provide tools for everyone to build wealth.

Nansen

The blockchain analysis platform Nansen announced in October 2020 that it had raised $1.2 million in seed funding, led by Mechanism Capital and Skyfall Ventures, with participation from Robot Ventures, Fabric Ventures, SBlockingrq, Volt Capital, CTF Capital, and Blockrock Capital.

On June 29, 2021, Nansen completed a $12 million funding round led by a16z, with participation from Skyfall Ventures, Coinbase Ventures, imToken Ventures, Mechanism Capital, and QCP Capital.

On December 16, 2021, Nansen completed a $75 million funding round led by venture capital firm Accel, with participation from Andreessen Horowitz, Tiger Global, and others. The funds raised in this round will be used to expand the functionality of its blockchain analysis platform to help users protect their crypto assets.

Nansen focuses on providing in-depth insights and data analysis on the Ethereum network. Its goal is to help users better understand and interpret activity and trends within the Ethereum ecosystem in order to make more informed decisions.

As a blockchain data analytics platform based on Ethereum, Nansen uses a large amount of data resources and advanced algorithms to track, analyze, and visualize information such as addresses, transactions, and smart contracts. It provides rich and accurate data to help users gain a deeper understanding of the background of various blockchain interactions and activities.

One of Nansen’s main features is its powerful address identification ability. By analyzing information such as an address’s historical transaction records, participation in projects, and interaction patterns, Nansen is able to identify and classify addresses and provide users with insights into the detailed background and behavioral patterns of addresses. This capability is helpful for researching market trends, making investment decisions, and assessing risks.

In addition, Nansen also provides rich statistical data and insights. It can display the distribution of token holders, identify the activities of large volume traders, track project activity, and provide other key data about the Ethereum ecosystem. These data and insights are displayed through interactive tools and charts, allowing users to more intuitively understand and analyze the data.

Dune (formerly Dune Analytics)

The blockchain data analytics platform Dune completed a $2 million seed funding round on September 23, 2020, led by Dragonfly Capital, with participation from Multicoin Capital, Coinbase Ventures, Alameda Research, Coingecko, and other institutions, as well as angel investors such as AAVE founder Stani Kulechov and Uniswap’s Matteo Leibowitz.

On August 12, 2021, Dune completed an $8 million Series A financing round led by Union Square Ventures, with Redpoint Ventures, Dragonfly Capital, and Multicoin Capital also participating.

On February 2, 2022, Dune completed a $69.42 million Series B financing round, with a valuation of $1 billion, officially joining the unicorn club. The lead investor of this round was Coatue, and investors included Multicoin Capital and Dragonfly Capital, among other organizations that had previously invested in the company.

Dune was founded in 2018 and launched in Oslo, Norway by Fredrik Haga and Mats Olsen in 2019. It is called the “Nansen for the people” and is also a blockchain data analysis platform and research tool that can be used to query, extract, and visualize massive amounts of Ethereum data. It is a web-based platform that queries Ethereum data from a pre-populated database using simple SQL (Structured Query Language) queries, avoiding the need for each script to individually traverse data and redundant transactions. Users no longer need to write a dedicated script to extract almost any information on the blockchain and can simply query the database.

Essentially, all unprocessed blockchain data is recorded in a collection in a SQL database, which allows all users to easily query. Features such as “data search queries,” “write new query requirements,” “create visualization charts and statistics,” and more can be used for free. Users can use powerful visualization tools to turn query results into charts and graphs, making it easier to understand and display data. At the same time, users can create their own dashboards and queries and share them with other users. This allows users to collaborate on analysis and share insights in the community.

0x scope

0x Scope is a Web3 knowledge graph protocol. On September 22, 2022, 0x Scope announced the completion of a $3 million seed round of financing, led by Huobi co-founder Du Jun and accelerator and venture capital fund ABCDE, Hash Global and Liang Xinjun. Bonfire Union, a venture capital firm under Mask Network, and Bodl Ventures, an early-stage venture capital firm founded by Liu Feng, the former editor-in-chief of Chain News, also participated.

0x Scope provides an innovative solution for exploring data from both Web2 and Web3 in a single product. This converts the Web3’s decentralized data into an organized knowledge graph, and based on the new data layer created by 0x Scope, a large number of data applications can be developed. Watchers is the first 0x Scope-supported product, which enables users to access enhanced due diligence, powerful address clustering tools, transaction monitoring, real-time event alerts, and financial risk controls.

Glassnode

Glassnode is a blockchain data and intelligence platform that offers the most comprehensive on-chain and financial indicator library. Glassnode provides investors with the tools they need to navigate this emerging blockchain industry and helps users make informed decisions in an overly emotional and irrational market. Glassnode’s data and insights are trusted by leading global investors, hedge funds, banks, asset managers, and crypto companies.

Offering the most comprehensive on-chain and crypto financial indicator library in the industry, easily accessible through a unified API. Focus on the most liquid assets and sustainable networks in the industry: Bitcoin and Ethereum, and their token ecosystems. The platform and charting suite remove the abstraction of crypto data, making it easy to navigate, explore, and analyze industry data metrics with user-friendly tools and easy-to-understand visualizations.

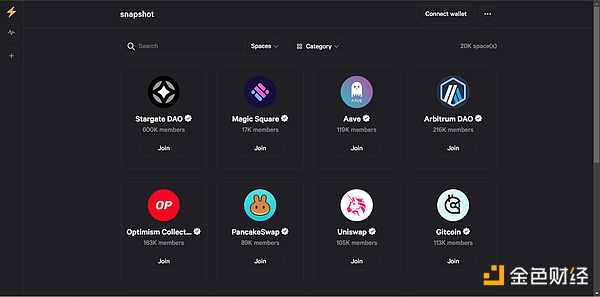

Snapshot

Snapshot Labs, a decentralized autonomous organization (DAO) governance solution provider, announced the completion of a $4 million financing round in November 2021. The round was led by 1kx, with participation from Coinbase Ventures, StarkWare, MetaCartel, Gnosis, and Scalar. The funds raised in this round of financing will be used to further optimize existing DAO governance solutions.

As perhaps the most well-known platform for on-chain governance voting across various project chains, tens of thousands of addresses have initiated many meaningless votes on Snapshot, as previously compiled by BlockBeats in “DeepDAO Research: Who is Cheating with Votes on Snapshot?”

First, when Optimism Network (now renamed OP Mainnet) airdropped, it distributed 423.03 OP airdrops to the 82,239 active DAO governance participant addresses in the Ethereum ecosystem. Second, German crypto venture capital firm 1kx, which is also the lead investor in Safe (formerly Gnosis Safe) $100 million strategic financing, has also participated in multiple rounds of zkSync financing, while Safe has issued tokens but has not yet opened circulation, and zkSync is the “high airdrop expectation” project that hunters must interact with at present.

Furthermore, Snapshot has also published an article explaining its next vision for decentralized sequencers. The answer to how to “decentralize” is yet to be revealed.

Zerion

Zerion, a Web3 wallet tool, completed an $8.2 million Series A financing round in July 2021, led by Mosaic Ventures, with participation from Placeholder, Digital Currency Group, Lightspeed Venture Partners, and Blockchain.com Ventures.

In October 2022, Zerion completed a $12.3 million Series B funding round. The round was led by Wintermute Ventures, with participation from Mosaic, Coinbase Ventures, Alchemy, and Placeholder, among others. The funding will be used to further develop its wallet product, enhance data analytics capabilities, and bring more intuitive display interfaces to users.

Currently, Zerion supports tracking services for wallet addresses on 11 blockchain networks. In addition, its app offers non-custodial wallet functionality, allowing users to import seed phrases or generate wallets and conduct cross-chain and exchange transactions through the app.

It is worth noting that Zerion has launched a brand genesis NFT and a user-exclusive “Zerion DNA” NFT series, and announced the merger of two NFTs and the creation of a premium membership program this year. DNA will become a core part of the Zerion wallet experience.

Debank

Debank can be said to be in the same field as Zerion. In December 2021, one-stop DeFi wallet DeBank completed a $25 million equity financing round with a valuation of $200 million. Sequoia China led the round, with participation from Dragonfly, Hash Global, Youbi, Coinbase Venture, Crypto.com, Circle, and Ledger.

Compared to Nansen’s depth in data analysis and Zerion’s focus on wallet integration, Debank seems to have gone further in account socialization. In January 2022, Debank launched its Web3 social platform and Web 3 ID function, allowing users to follow whale trading dynamics, NFT market trends, track Mirror article updates, and track real-time on-chain activities of Web3 friends through the platform.

In October 2022, DeBank launched the Web3 native communication application DeBank Hi. Users can log in to the application via a wallet address and engage in Web3-form community interaction. Based on this, DeBank has also launched a Twitter-like social platform Stream, where mainstream Web3 project parties can interact with users through the platform. The social applications DeBank Hi and Stream, which are extended from the user’s Web 3 ID, also have a tipping function, which is implemented based on the DeBank Layer 2 and the project party had hinted at the possibility of “DeBank Chain” earlier. With the continuous improvement of social functions, DeBank Chain and “DeBank Coin” may be implemented simultaneously.

DefiLlama

DefiLlama is one of the authoritative websites for DeFi project data analysis. In addition, the platform provides DeFi yield aggregation information, project token unlocking information, stablecoin issuance data, Ethereum liquidity pledging and other information analysis services. Recently, DefiLlama also launched the ChatGPT-4 plugin, which allows users to query Web3 project operating data directly through Chinese dialogue.

Among the many tools and projects that have not yet issued tokens, DefiLlama may be one of the closest. In March of this year, 0x LLam 4, a co-founder of DefiLlama, announced that the project would issue tokens. However, this “declaration” was immediately opposed by other members of the team, led by 0x ngmi, who believed that fundamentally, the token had no value because DefiLlama is not a protocol and the token cannot legally become a form of equity. In the end, the team decided to temporarily shelve the controversy and the token issuance was put on hold.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What projects has dao5, founded by a former Polychain partner, invested in, as part of their plan to co-build a venture capital DAO with the founder?

- 4 Potential Decentralized Physical Infrastructure Network (DePin) Projects: Hivemapper, Render, Helium, and IoTeX

- A Quick Look at Q2 Cryptocurrency Venture Capital Overview, What Projects is Bankless Paying Attention to?

- Has on-chain intelligence become a “human flesh search”? Binance’s new IEO project Arkham receives negative feedback.

- Understanding Binance’s Launchpool Project Arkham and What is Intel-to-Earn?

- Share potential investment opportunities and niche projects worth paying attention to: Flashstake, Protectorate Protocol, aori…

- TOKI and Noble will collaborate with Mitsubishi UFJ Trust and Banking on the Progmat project to bring stablecoins into Cosmos.