The difficult times for NFT: Multiple projects shut down, lending platforms face chain liquidation and bad debts amidst the general market downturn.

NFTs face tough times with project closures, lending platform liquidations, and bad debts during a market downturn.Author: Nancy, BlockingNews

The NFT market is entering its darkest hour. On the one hand, as the overall market enters a downturn, NFT also faces a “shutdown tide”, with several NFT projects announcing closures one after another. On the other hand, Azuki’s new work crash triggered a significant drop in blue-chip NFTs, and lending platforms faced a “big test” as the risk of bad debts led to a run on the platform.

Under the bear market, the NFT market is entering a “shutdown tide”

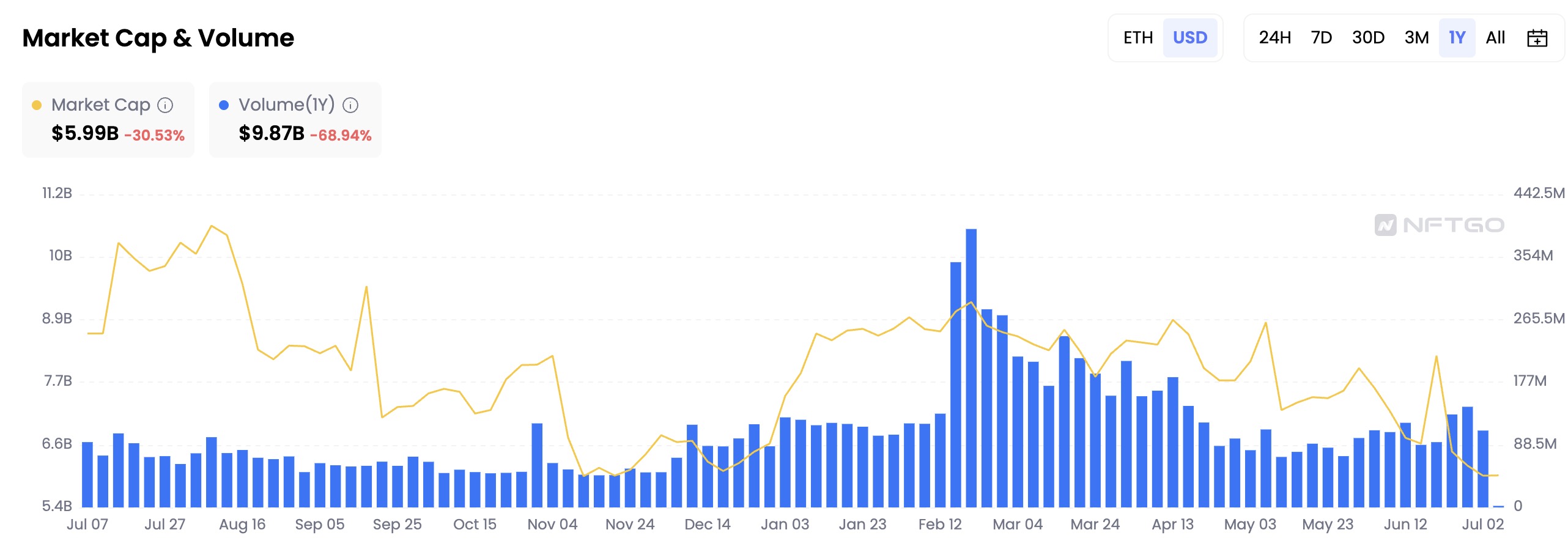

The NFT ecosystem has greatly shrunk and is facing a significant contraction. According to NFTGO data as of July 6, the total NFT market value (only on Ethereum) reached $5.95 billion, a decrease of more than 30.5% in the past year; the total transaction volume was $9.87 billion, a decrease of more than 68.9%; and the number of traders exceeded 1.418 million, a decrease of 17.5%. From the data, the large-scale shrinkage of market value has also caused NFT popularity and funds to continue to drain away.

- A Summary of a Cryptocurrency Project Attempting Hybrid Rollup

- Blur V2 is now online, with updates including a 50% reduction in Gas fees and bidding based on Trait.

- Quickly browse 15 popular GameFi projects on the blockchain in one article

In the NFT market, where the head effect is significant, bear market pressure has undoubtedly intensified the trend of “wolves are more and meat is less”, and bankruptcy has become a high-frequency word in the current NFT field. In recent months, including Cardinal, Rentable, Tessera, Abacus, FormFunction, Mint Square, and NFT Trader have all announced closures, involving NFTfi, trading markets, and infrastructure.

Although these NFT projects have received millions or even tens of millions of dollars in financing, such as Tessera, which has received $20 million in financing from Blockingradigm, and Formfunction, which has received $4.7 million in financing from Variant Fund, they have been forced to close due to macroeconomic downturns, poor business models, difficult profitability, malicious attacks, and other reasons.

For example, Tessera founder Andy Chorlian once tweeted that the team spent a long time carefully analyzing possible market conditions, company structure, and financial situations, and believed that this was the best choice for the team and investors, and said, “When we really delve into Escher’s economic model, we find that the profit targets we need to reach (compared with the time and resource costs of expanding there) do not make good business sense.”

Cardinal once wrote, “Since we started building 18 months ago, we have made every effort to cope with this extremely difficult macroeconomic environment, and it is still difficult to find products that are suitable for the market. The reality is that the members of our team are eager to explore other pursuits. Although we have seen some practical uses of our staking, leasing, and identity products, we still feel that they are trapped in the context of maximizing cryptocurrencies. We had hoped that other industries around the world would begin to adopt blockchain technology on a larger scale, but so far this still feels very distant.”

Platform Provides “Backstop” for Bad Debts, Azuki and BAYC Series Becomes Clearing “Heavyweight”

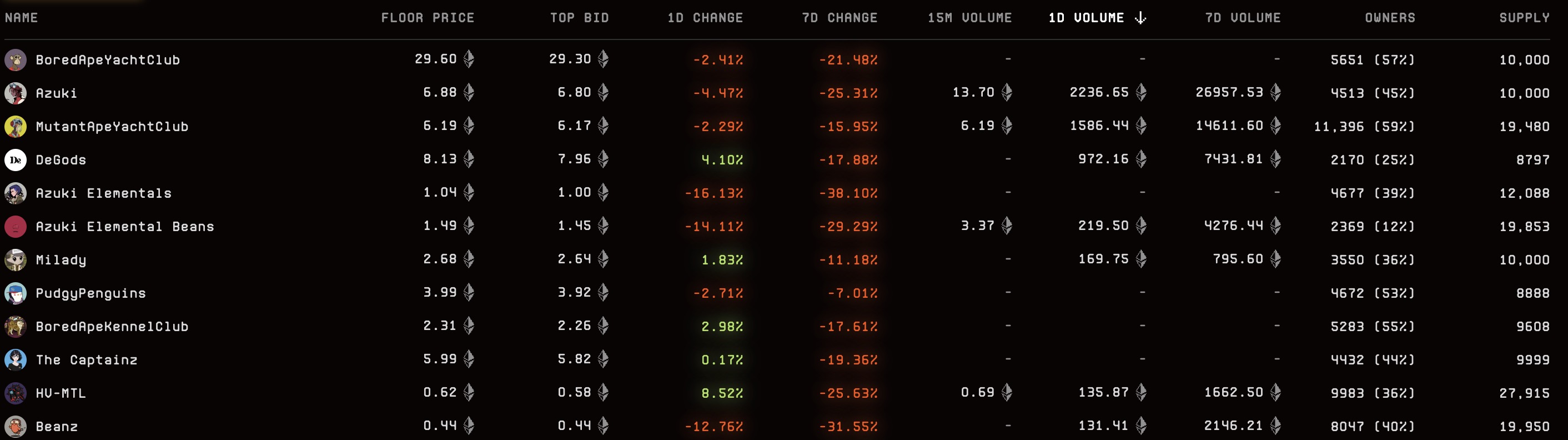

Recently, as a representative of blue-chip projects, Azuki’s unsatisfactory performance undoubtedly dealt a heavy blow to NFTs’ confidence. According to NFTGO data, the blue-chip project index has fallen by about 11.2% in the past 7 days. According to Blur market data, popular projects such as BAYC, Azuki, MAYC, DeGods, Milady, Pudgy Penguins, and others have all seen double-digit drops in the past week, especially the Azuki series.

In the general downturn, a large number of blue-chip NFTs have been caught in a clearing spiral, and due to insufficient market liquidity, many mainstream lending platforms have experienced varying degrees of bad debts, and funds have panicked and fled. However, most lending platform officials have stated that they can cover the range of bad debts.

BendDAO

BendDAO is an NFT mortgage lending agreement in the form of a point-to-pool, which adopts the clearing mechanism of ordinary auctions. According to BendDAO data, as of July 6, the platform has incurred a floating loss of 12.8 ETH in bad debts, mainly from 8 Azuki debts that were higher than the floor price. At the same time, according to DeFiLlama data, as of July 6, BendDAO Lending TVL reached 32.2 million U.S. dollars, with a recent 7-day decline of over 69.6%.

Therefore, the BendDAO community initiated a proposal to “use treasury funds to participate in protocol NFT auctions”, intending to use its DAO treasury to participate in protocol NFT auctions to enhance user confidence and help maintain market stability. Currently, the proposal has obtained a high vote of 97.11%. As of July 6, BendDAO’s treasury contains assets such as 52 ETH and 327,000 USDT, which are sufficient to cover potential floating losses.

BlockingrasBlockingce

BlockingraSBlockingce is also a point-to-pool NFT lending agreement, which adopts the clearing mechanism of hybrid Dutch auctions. Recently, BlockingrasBlockingce announced the suspension of Azuki loan clearing services, stating that this is to give users more time to supplement liquidity, repay loans, and improve health, and that BlockingraSBlockingce has sufficient reserve funds to cope with sudden situations. The current bad debt is about US$100,000, and the BlockingraSBlockingce reserve fund can fully cover it. According to the BlockingrasBlockingce website, there are currently 13 NFTs in a suspended clearing state on the platform, all of which are from Azuki.

According to DeFiLlama data, as of July 6, the TVL of BlockingraSBlockingce Lending reached 55.55 million US dollars, a decrease of more than 19.8% in the past 7 days.

Blend

Blend is a peer-to-peer lending model. As the largest lending platform, Blend includes projects such as BAYC, Azuki, MAYC, Otherdeeed, and Beanz, all of which have bad debts. Among them, Beanz (29), Remilio (18), and BAYC (12) are more obvious. According to DeFiLlama data, as of July 6, Blur Lending TVL was US$24.85 million, a decrease of more than 43.2% in the past 7 days.

Currently, Blur’s bad debt level is the most obvious, and Azuki and BAYC series NFT liquidation have the most in recent price declines.

In short, under the liquidity crisis, the current NFT market is facing a new round of pressure tests and survival tests.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Evening Must-Read | A Quick Look at 15 Popular GameFi Projects on the Blockchain

- Share 3 projects that received funding during the bear market and identify potential winners.

- ZK and AI-driven new project: Noya, how to maximize liquidity mining profits?

- Decentralized Ethereum staking protocol ssv.network announces mainnet launch plan, expected to achieve permissionless full operation in Q4 of this year.

- BlockingncakeSwap V3 has been officially deployed to the Polygon zkEVM mainnet.

- SBlockingrtan Labs: Review of 5 notable projects from ETHGlobal Waterloo Hackathon

- IDO & IEO: Inventory of 8 popular projects to be launched in July