Has on-chain intelligence become a “human flesh search”? Binance’s new IEO project Arkham receives negative feedback.

Is on-chain intelligence now a "human flesh search"? Binance's new IEO, Arkham, receives criticism.Author: BlockingBitpushNews Mary Liu

Cryptographic data company Arkham Intelligence announced on Monday its first on-chain intelligence exchange, Arkham Intel Exchange, aimed at “deanonymizing blockchain,” and Binance will conduct a public token sale for its new token, ARKM.

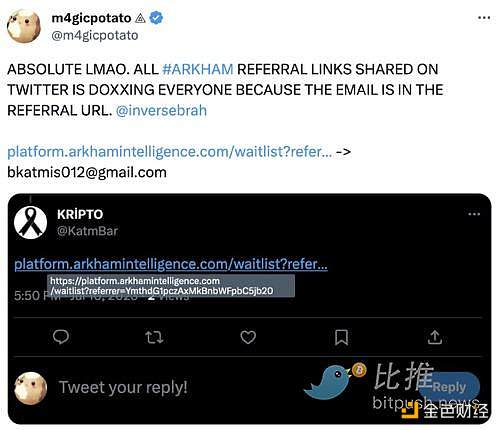

However, the community is not buying it. Arkham generally promotes its service through user referral codes, and users quickly discovered that they could obtain additional data from Arkham’s referral links by inserting the information into a Base64 decoder to obtain the referrer’s full email address, causing outrage in the privacy-focused crypto community.

Arkham had previously stated in its promotional tweet, “We believe that deanonymization is the fate of the cryptocurrency market, and the intelligent technology built by Arkham will be the foundation of self-regulation for the cryptocurrency economy.”

- Understanding Binance’s Launchpool Project Arkham and What is Intel-to-Earn?

- Share potential investment opportunities and niche projects worth paying attention to: Flashstake, Protectorate Protocol, aori…

- TOKI and Noble will collaborate with Mitsubishi UFJ Trust and Banking on the Progmat project to bring stablecoins into Cosmos.

“Human flesh search” tool?

The problem originated with the way Arkham set up its network link referral program. Users of the Arkham wallet tracking dashboard can invite others to join the platform by sharing a unique referral URL. These URLs appear to be composed of random, jumbled characters. But netizens have found that they are actually quite easy to crack.

Contributor to anonymous blockchain Beam m4gicpotato exposed the issue on Twitter on Monday, accusing the company of allowing users to “manually search for personal information without their knowledge,” which quickly sparked a heated discussion. M4gicpotato’s signature claims to be a privacy advocate who has been working in the crypto field since 2017.

m4gicpotato said on Telegram, “As a staunch privacy advocate, I believe these tools invade users’ privacy.”

He said he began researching Arkham after Binance announced it would hold a public sale for ARKM, which is described as an intel-to-earn token, with Intel being short for intelligence.

m4gicpotato said, “I was very surprised when Binance and (CEO Changpeng Zhao) chose to support Arkham, especially shortly after Beam and other privacy coins were delisted globally by the EU.”

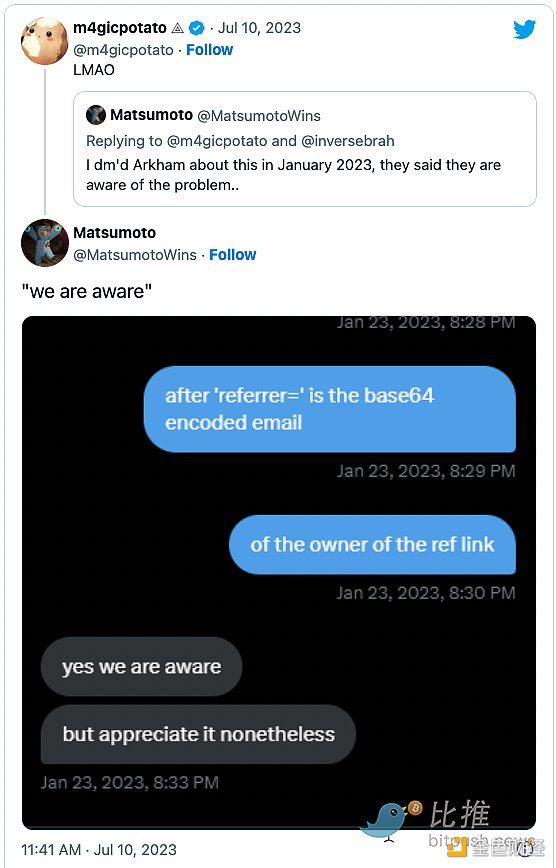

m4gicpotato added that the decision to encode user emails in Base64 “just adds another layer of suspicion.”

Another user, Matsumoto, shared private messages with Arkham in January, and the company seems to have acknowledged the issue several months ago but has not taken any action to address it since then.

In December of last year, Arkham’s Twitter account shared the recommended code for a private beta. The URL of the code contained the Base64 version of the CEO’s email address.

The email address is critical information for hackers and can be used for phishing attacks and may be used to crack previously anonymous encrypted users.

Some users even started generating fake referral links and posting them on Twitter, such as [email protected] and [email protected], as a way to mock Arkham.

It is currently unclear how many users will be affected by this setting. In theory, any user who generates and shares referral links may be exposing their email.

Privacy and Decentralization Concerns

Arkham operates as a blockchain analysis platform, providing data on real-world entities and individuals who participate in on-chain crypto market activities. A core feature of the platform is “intel bounties,” where blockchain analysts can offer paid services to help customers identify the name or address of any cryptocurrency wallet owner.

According to Arkham, users will be able to anonymously post and accept bounties for information on blockchain transactions. After a bounty is paid, any entity that paid the bounty will have exclusive access to the data for 90 days. Arkham says that once the initial exclusivity period is over, it will release the data to the public.

Arkham says its new platform will bridge the gap between analysts and traders, investors, journalists, researchers, and protocols, with available information including detailed evaluations of wallet content and address investment performance.

Last year, cryptocurrency hack attacks and exploits resulted in record-breaking losses, with billions of dollars worth of digital assets stolen from cross-chain bridges, decentralized finance (DeFi) protocols, and exchanges. Arkham aims to combat the spread of cryptocurrency hackers through incentivized on-chain research, but some privacy advocates have raised concerns.

Many cryptocurrency enthusiasts believe that this brings economic benefits to mining personal and private information, a practice that could be dangerous if abused. Additionally, the Arkham Foundation’s responsibility for approving auctions and bounties is highly centralized, which is also a problem.

Mark Zeller, founder of Aave-Chan, commented in a tweet that he was “very disappointed in the ecosystem’s spirit of selling junk coins,” and this idea is a “huge net negative impact.”

Some users also describe the company’s Intel Exchange as a “purposeful disclosure” or “disclosure as a service” plan.

Arkham has raised over $10 million through two rounds of equity financing, with the latest round of equity financing totaling $150 million, and transactions on the Arkham Intel Exchange will be completed through the ARKM token.

According to an announcement by Binance, the initial token sale will begin tomorrow and will be conducted through Binance LaunchBlockingd for six days. 5% of the token supply will be allocated to the token sale, 20% will be allocated to core contributors, 17.5% will be allocated to investors, and 17.2% will be allocated to the foundation treasury. The Arkham Intel Exchange will go live on July 18th after the first sale of ARKM tokens.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The difficult times for NFT: Multiple projects shut down, lending platforms face chain liquidation and bad debts amidst the general market downturn.

- A Summary of a Cryptocurrency Project Attempting Hybrid Rollup

- Blur V2 is now online, with updates including a 50% reduction in Gas fees and bidding based on Trait.

- Quickly browse 15 popular GameFi projects on the blockchain in one article

- Evening Must-Read | A Quick Look at 15 Popular GameFi Projects on the Blockchain

- Share 3 projects that received funding during the bear market and identify potential winners.

- ZK and AI-driven new project: Noya, how to maximize liquidity mining profits?