Overview of RWA Tracks: Progress of Top 10 Headline Projects and 20 Early Stage Projects

Overview of RWA Tracks: Top 10 Headline Projects and 20 Early Stage Projects' Progress.The original author: flowie, ChainCatcher

Although RWA has always been criticized for old stories cutting new rounds, since the beginning of the year, RWA has continued to have institutions entering the market to “add bricks and tiles” to it, and the rising trend of RWA concept tokens has indeed brought some highlights to the sluggish cryptocurrency market.

At the beginning of the year, big institutions such as Binance, Goldman Sachs, Hamilton Lane, and Siemens entered the market successively and intensified the layout of some on-chain US debt protocols, which attracted attention to RWA. Behind the concentrated flow of on-chain bonds, a key driving factor is that the low-yielding DeFi in the bear market cannot meet the income needs of encrypted users. Under the continuous interest rate hike of the Federal Reserve, on-chain US bonds do provide a new income solution for encrypted users.

After a few months, under the regulatory crackdown by the US SEC, the entry of TradFi institutions such as BlackRock’s application for a bitcoin spot ETF, and other encrypted narratives, RWA may have exploded again due to compliance contexts, and there have been a series of recent events in the RWA field that have attracted attention:

- What projects has dao5, founded by a former Polychain partner, invested in, as part of their plan to co-build a venture capital DAO with the founder?

- 4 Potential Decentralized Physical Infrastructure Network (DePin) Projects: Hivemapper, Render, Helium, and IoTeX

- A Quick Look at Q2 Cryptocurrency Venture Capital Overview, What Projects is Bankless Paying Attention to?

-

Compound founder established a new company “Superstate” to seek tokenization of US bonds on Ethereum;

-

Maker buys $700 million in US bonds and raises the short-term US bond investment limit to $1.28 billion;

-

More noteworthy is the entry of the national team: CCB International issued 200 million digital notes through UBS for the Hong Kong market. This is the first product of its kind to comply with Hong Kong and Swiss law and tokenize on the Ethereum blockchain;

-

The attitude of the Hong Kong Securities and Futures Commission (SFC) towards RWA assets has also changed. Elizabeth Wong, head of the financial technology group, said in an interview with Eliptic that SFC will soon launch an update. Securities tokens or RWAs will not be defined as complex products and will have the opportunity to be opened to retail investors. RWAs will be regulated by underlying assets.

-

In addition, Sun Yuchen, who never misses any hotspots, is of course not idle. On July 4th, the TRON ecology announced the launch of the RWA stable pledge product stUSDT, allowing users to pledge USDT to obtain RWA rewards.

After several months of brewing at the beginning of the year, the consecutive assists of the old DeFi protocol and the national team entering the game made the response of the RWA secondary market strong, and tokens such as MRK and COMP rose sharply.

At the same time, compared with the first half of the year, the crypto community’s questioning of RWA seems to have eased, and there are also such feelings: many Crypto natives are disdainful of RWA, just like their attitude towards DeFi Summer in 2020, but the result is that they missed an innovation.

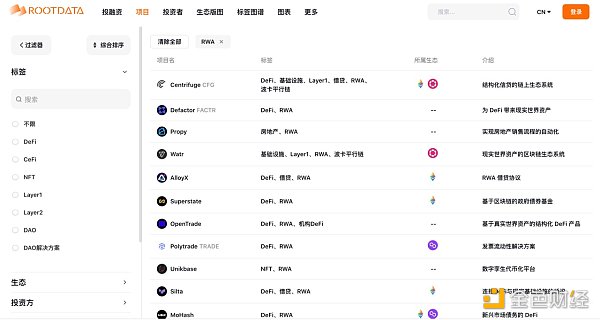

As the RWA concept definition is very broad, the actual development of this field feels very vague. This article mainly focuses on the RWA section of the cryptocurrency data platform RootData, sorts out the specific top projects under the RWA concept and some early projects that have some highlights in financing or mode, and provides an overview of the development of the RWA track.

Latest developments in the top RWA representative projects

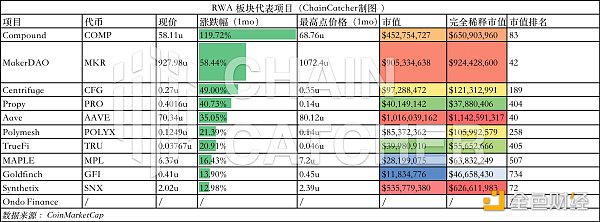

According to the data compiled by CoinMarketCap, the total market value of RWA concept tokens currently exceeds US$2 billion.

In addition to some old DeFi projects, the overall RWA project is relatively early. We first sort out the projects that are relatively top in different sub-sectors, and understand their actual progress or plans on RWA planning in the past six months. Overall, the top 10 RWA concept tokens with higher market value have risen over the past month, with Compound having the highest increase, exceeding 100%.

On-chain US bonds

1. MakerDAO (MKR)

The stablecoin DAI, which is pegged to the US dollar issued by MakerDAO, is currently one of the most common use cases for RWA. MakerDAO is also an early DeFi protocol that has incorporated RWA into its strategic planning, and in 2020 passed a proposal to use RWA as collateral in the form of tokenized real estate, invoices, and accounts receivable to expand the issuance of DAI.

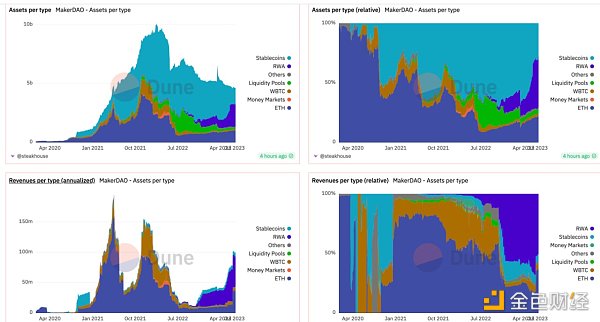

MakerDAO has established multiple RWA vaults, most of which are collateralized by US bonds. This year, in the overall downturn of DeFi, MakerDAO has continued to increase its layout of RWA, especially in the investment of US bonds.

MakerDAO’s RWA vaults, sourced from Dune Analytics (@SebVentures) and Binance Research:

In April, MakerDAO approved a real-world asset (RWA) vault for Coinbase custody services and transferred up to $500 million in USDC stablecoin, with Coinbase’s custody department paying 2.6% annual interest on deposits.

In June, MakerDAO purchased and invested in US Treasurys through RWA vaults. First, MakerDAO passed a governance vote to add BlockTower Andromeda (RWA 015) as a new type of real-world asset (RWA) vault managed by asset management firm BlockTower Capital, which will invest up to $1.28 billion in short-term US Treasurys, funded by Maker’s over-collateralized stablecoin DAI. Maker will pay BlockTower Capital a 0.15% arrangement fee.

Shortly thereafter, MakerDAO purchased $700 million in US Treasurys through digital asset manager Monetalis Clydesdale Vault. Combined with the $500 million in bonds purchased by MakerDAO in October 2022, its total bond holdings now exceed $1.2 billion.

By more effectively allocating assets on the balance sheet to Treasurys and investment-grade bonds, as well as increasing fees charged to DAI borrowers, MakerDAO has seen significant revenue growth. According to Defilama data, MakerDAO’s profits reached $8.32 million in June, up from $5.48 million in May and over $3 million before April. With rising revenue and profits, MakerDAO announced in June that the DAI savings rate would be increased from 1% to 3.49%, more than triple the previous rate.

According to Dune panel data analyzed by @SebVentures, MakerDAO’s RWA assets have gradually expanded, accounting for 45% of its total assets, far exceeding the 26% share of its stablecoin assets, and contributing more than 52% of MakerDAO’s revenue.

2. Compound (COMP)

Compared to MakerDAO, which has been focusing on RWA, Compound’s sudden announcement of the establishment of a new company, Superstate, which focuses on on-chain bonds, quickly ignited the market.

It is reported that Superstate’s fund will invest in “ultra-short-term government securities,” including US Treasurys, government agency securities, and other government-supported tools. Superstate announced that it has completed its seed funding round, with the specific amount of funding yet to be disclosed. The funding round was participated in by BlockingraFi Capital, 1kx, Cumberland, CoinFund, and Distributed Global. However, Superstate is still in the application stage.

3. Aave (AAVE)

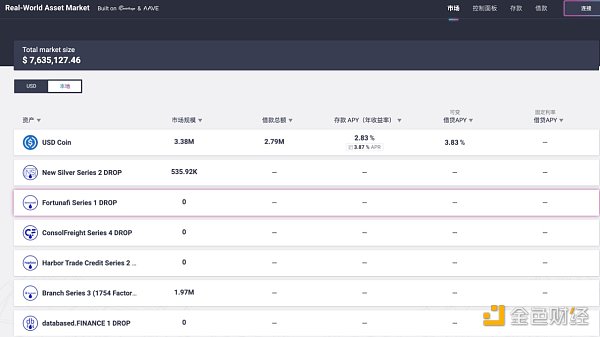

Aave followed MakerDAO in announcing the launch of RWA market in 2021, which also allows collateralized borrowing and lending of real assets. Like MakerDAO, Aave uses Centrifuge as an RWA provider. Its RWA market allows Aave depositors to earn income on real-world collateral, while Centrifuge asset initiators can borrow funds from Aave. Currently, the Aave RWA market is worth about $7.635 million, and only one USDC market can provide storage and borrowing APY, while other markets no longer provide it.

In February of this year, Aave’s native stablecoin GHO launched a testnet. GHO is an over-collateralized stablecoin supported by multiple cryptocurrencies. Subsequently, the lending protocol Centrifuge proposed to introduce RWA into Aave and use it as collateral for the native stablecoin GHO.

In June, the Aave community launched an ARFC proposal to “Go Live on the Native Stablecoin GHO”. If the proposal is passed, GHO will operate on the Ethereum mainnet, and Aave V 3 users on Ethereum will be able to use collateral to mint GHO, and the DAO treasury will receive 100% of the interest on GHO lending as additional income.

With MakerDAO and Compound continuing to push for RWA, Aave is also rumored to be stepping up its efforts in this area.

4. Ondo Finance

Ondo Finance was founded in 2021, and its team members have rich backgrounds in various institutions and DeFi protocols, such as Goldman Sachs, Fortress, Bridgewater, and MakerDAO. Ondo Finance has raised $34 million in investment, with investors including Blockingntera Capital, Coinbase Ventures, Tiger Global, Wintermute, and other well-known institutions.

Earlier this year, Ondo Finance launched a tokenized fund that allows stablecoin holders to invest in bonds and US Treasuries. Ondo Finance currently supports four investment funds – US money market funds (OMMF), US Treasuries (OUSG), short-term bonds (OSTB), and high-yield bonds (OHYG), and marks these investment funds as RWAs (called “fund tokens”). After completing the KYC/AML process, users can trade fund tokens and use them in licensed DeFi protocols.

Ondo Finance team has also developed the decentralized lending protocol Flux Finance, which invests exclusively in BlackRock’s iShares Short Treasury Bond ETF (SHV). The protocol offers various tokens for lending, such as USDC, DAI, USDT, and FRAX, with OUSG being the only collateral asset. OUSG holders who have gone through KYC can deposit into Flux Finance for lending, while lenders can provide stablecoins to earn returns. Earlier this year, Flux Finance went live on the Ethereum mainnet.

According to Dune panel data analysis, the existing market capitalization of bond tokens exceeds 200 million US dollars, of which Ondo (OUSG) has nearly 50% market share, and its market value has exceeded 130 million US dollars. The current Flux Finance TVL has also exceeded 40 million US dollars.

Lending

5. Centrifuge (CFG)

Founded in Centrifuge is one of the earliest DeFi protocols involved in RWA and also a technical provider behind top protocols such as MakerDAO and Aave. Currently, Centrifuge has a total of 17 RWA asset pools.

According to the latest semi-annual report released by Centrifuge, the 220 million US dollars RWA treasury BlockTower deployed by MakerDAO has brought tremendous growth to Centrifuge, helping its TVL rise to 210 million US dollars.

In addition, another major development is that Centrifuge has launched Centrifuge Prime, a service and technology suite that helps DeFi protocols support RWA. Centrifuge Prime includes a compliant legal framework established specifically for DAOs and DeFi protocols, a complex tokenization and issuance platform, decentralized and objective credit risk and financial reporting, and diversified asset categories and issuers, solving many issues related to KYC and legal recourse. It is worth mentioning that, with the popularity of RWA, Centrifuge will hold an RWA-themed summit in New York on September 19, which can be worth following.

However, there are also some bad debt issues in Centrifuge’s RWA asset pool. According to data from the blockchain credit analysis platform rwa.xyz, about 5.8 million US dollars of unpaid loans are in two of Centrifuge’s lending pools, including consumer loans, invoices, and transaction receivables.

The most embarrassing lending pool on Centrifuge is the one that provides funds to 1754 Factory to purchase short-term capital point debt bonds and provides small loans to French customers using Bling Financial’s application. 16 active loans worth about 5.1 million US dollars in the lending pool have exceeded the repayment deadline, and some of the loans have repayment times exceeding 150 days. In addition, there are four loans worth 3.3 million US dollars in the REIF pool that provide funds for commercial real estate mortgages, and the payments are overdue.

6. Goldfinch (GFI)

Goldfinch, created by former Coinbase employees, has received large-scale financing from well-known institutions due to its innovative model, despite entering the game later than Centrifuge. According to RootData, Goldfinch has completed 3 rounds of financing, raising a total of $37 million, with participation from 16z, SV Angel, Alliance DAO, Balaji Srinivasan, Ryan Selkis, and others.

Goldfinch primarily provides loans to debt funds and fintech companies, offering USDC credit limits to borrowers and supporting their conversion to fiat currency. The Goldfinch model is similar to traditional banking in that it has a decentralized auditor, credit provider, and credit analyst pool. The auditor who audits the borrower for Goldfinch must have pledged governance tokens GFI. Goldfinch can offer high returns because of its low collateral threshold, allowing its borrowers to pay interest rates of 10-12%, and there have been no bad debt situations so far.

Earlier this year, Goldfinch announced a pilot project that would only use on-chain cash flow to obtain credit on Goldfinch. Additionally, Goldfinch has launched a new trading structure: redeemable loans. This product allows investors to choose to withdraw their investment before the loan’s final maturity date. For the first transaction, the call payment period will be set at every 3 months, requiring 60 days of notice in advance, but these parameters are customizable in the product’s smart contract.

Goldfinch also announced a $2 million transaction with fintech company Fazz Financial, which can offer users a fixed annual interest rate of 13% USDC, supports 90-day redeemable loans, and provides 60-day advance notice. It is worth noting that this alternative asset category is not affected by fluctuations in cryptocurrency or stock markets, and its returns come from real-world economic activities. This issuance will not be registered under the U.S. Securities Act of 1933 or any securities regulatory agency in any state or other jurisdiction of the United States, and users participating in this issuance are limited to qualified investors in the United States and non-U.S. persons who have completed the qualified investor certification through Blockingrallel Markets.

7. MAPLE (MPL)

Compared to privately secured credit agreements with assets, Maple offers high-activity loans in bull markets due to its unsecured nature. Unlike Goldfinch, which uses users as auditors, Maple employs professional credit auditors to strictly audit borrowers’ credit. However, with no collateral under the unsecured model, Maple has experienced $52 million in bad debt due to the defaults of Three Arrows Capital, FTX, and others, and is controversial for its lack of centralization due to the KYC requirement for borrowing. Recently, Maple has expanded to a model of lending with real assets as collateral to reduce risk.

Maple Finance announced the launch of a U.S. Treasury bond pool in April, causing its token, $MPL, to rise more than 20%. According to Maple Finance’s latest report on the first half of 2023 and progress in the second half, the company reduced concentration and default risk through new loan products in the first half of this year. 1) Open-term loans will allow users to withdraw loans at any time and manage the concentration risk and liquidity required for processing withdrawals more effectively. 2) Active collateral management allows users to request that the value of collateral be maintained above a specific threshold and reduce capital losses in the event of default. 3) Reducing the amount of refinancing capital allows for refinancing in the event of a borrower’s credit rating decline, reducing capital losses in the event of default and more effectively managing concentration risk.

8. TrueFi (TRU)

TrueFi is a decentralized, unsecured credit protocol driven by on-chain credit ratings. Since its launch in November 2020, TrueFi has lent over $1.7 billion to more than 30 borrowers and paid over $40 million in interest to protocol participants. Borrowers include leading cryptocurrency institutions, as well as fintech companies, credit funds, and traditional financial companies.

TrueFi has raised over $30 million to date, with participation from 16z Crypto, BlockTower Capital, Foundation Capital, Distributed Global, ZhenFund, GGV Capital, Jump Trading, DHVC, and others.

Synthetic assets

9. Synthetix (SNX)

Synthetix is a decentralized synthetic asset protocol that allows users to mint synthetic assets (sUSD) by pledging SNX. It supports not only synthetic stablecoins but also tracks prices of forex, stocks, commodities, and other assets with synthetic assets.

In March of this year, Synthetix completed a $20 million financing round with DWF Labs and announced that DWF Labs will provide liquidity and market-making services for SNX. In addition, Synthetix has released version 3, which adds more types of collateral assets, is compatible with EVM, supports cross-chain deployment, and optimizes developer tools.

Layer 1 for security tokens

10. Polymesh (POLYX)

Polymesh is an institutional-grade blockchain built for regulated assets such as security tokens. In April, Binance announced that it would be a node operator for Polymesh, causing POLYX to surge over 10%.

Chain-based Real Estate Investment Platform

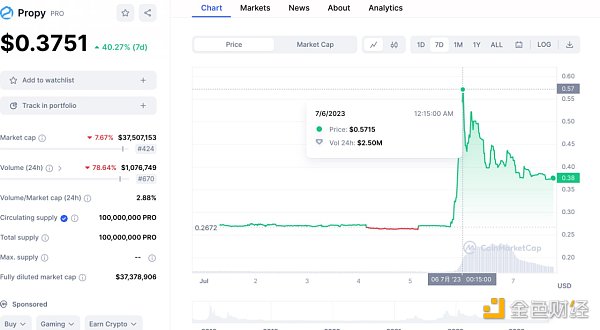

11. Propy (PRO)

Propy is a blockchain-based real estate platform that supports buying and selling homes using cryptocurrencies and buying and selling homes in NFT form.

On July 6th, Propy also announced the integration of AI to improve real estate transaction efficiency. Under the dual hotspots of RWA+AI, the Propy token PRO rose more than 200% from $0.268 to $0.571.

II. A Summary of 20 Early Projects in the Seven Sub-Sectors of RWA

According to RootData, a cryptocurrency data platform, there are nearly 60 projects in the RWA sector, with a focus on innovative projects in the fields of on-chain bonds, credit, and real estate. In addition to some of the more developed projects mentioned earlier, we have selected early-stage projects in the RWA sector that are worth knowing based on their investment and financing situation, partners, and market attention.

It is worth mentioning that many RWA projects received investment from well-known investors in 2020 and 2021, but their overall development has been slow. The main narrative is still about investing cryptocurrency funds in real-world assets such as real estate and bonds, and lenders can borrow using real-world assets as collateral.

Chain-based Bond Investment Platform

1. MoHash

MoHash provides investors with income products backed by real-world debt assets. In June 2022, MoHash raised $6 million in funding from investors led by Sequoia Capital, Jump Crypto, Coinbase Ventures, Coinswitch, Balaji Srinivasan, LedgerPrime, and hash Ventures. MoHash has recently been testing a pure on-chain asset special options trading platform BBZ in addition to its experiments in bonds.

2. OpenEden

OpenEden is an on-chain US Treasury bond protocol that allows users to invest in US Treasury securities through its native stablecoin TBILL to obtain an expected annualized return of 5.3%. The protocol allows users to hold US government bonds without being subject to US trading time restrictions, and TBILL can be redeemed at any time. Currently, the TVL of TBILL has reached 12.96 million US dollars.

3. KUMA Protocol (MIMO)

KUMA Protocol is a project that was established this year, which provides interest-bearing tokens backed by bonds for investors to obtain returns. The KUMA protocol comes from the work of two different organizations: Mimo Labs and the newly established Kuma DAO. Mimo Capital AG uses NFT technology to tokenize bonds, and the KUMA protocol is a decentralized entity managed by MIMO token holders, which uses these bond tokens to issue KUMA interest-bearing tokens.

Lending Platforms

4. Defactor (FACTR)

Defactor is an investment and financing platform that connects traditional finance and DeFi, and provides loans to small and medium-sized enterprises in traditional finance. Although Defactor is an early-stage project, it is worth mentioning that Defactor was supported by Huawei and DogBlockingtch Labs in the “Huawei International Scaling Plan” held in Ireland. In early this year, Huawei’s official Twitter also recommended Defactor, and the governance token FACTR of Defactor responded with a significant increase, with a maximum increase of about 800%. In the past seven days, FACTR has also risen more than 30% under the narrative of RWA.

5. AlloyX

AlloyX is a decentralized credit protocol. The borrower provides funds to the vault in the form of USDC, and the vault aggregates the assets of the stored tokens, which are then allocated and operated according to the preset parameters of the vault. By depositing USDC, users receive insurance tokens based on floating exchange rates and earn income.

Users can build and customize investment strategies based on their own preferences for income, risk, and liquidity. AlloyX aggregates investments in almost all credit and US Treasury protocols, including Credix, Goldfinch, Centrifuge, Flux Finance, and Backed Finance, among others.

On June 29th, AlloyX completed a $2 million pre-seed round of funding and announced the launch of its mainnet. Investors include Hack VC Circle Ventures, DCG, and others. OpenTrade provides on-chain supply chain finance products for Web 3 enterprises, and Circle is a partner of OpenTrade, allowing Web 3 enterprises to provide financing to small and medium-sized enterprises through USDC assets and obtain investment returns. OpenTrade just completed a $1.5 million financing round in May, with participation from Sino Global Capital, Kronos Research, Kyber Ventures, Polygon Ventures, Outlier Ventures, and Circle Ventures. Clearpool is a decentralized credit protocol, and whitelisted institutions can borrow unsecured liquidity from a decentralized lending network. In 2021, Clearpool raised $3 million in seed funding, with participation from HashKey Capital, Sequoia India, Sino Global Capital, Wintermute, Huobi Ventures, and others. The founder of Clearpool also founded Hex Trust, an institutional-grade digital asset custody service provider that has raised nearly $100 million in financing from well-known institutions. Like OpenTrade, Polytrade helps Web 3 institutional investors invest stable coins in small and medium-sized enterprises to obtain returns. Currently, deposits on the Polytrade platform have exceeded $110 million. Polytrade has raised $5 million in two rounds of financing, with participation from Polygon Ventures, LD Capital, Shima Capital, Matrix Partners, and others. NAOS Finance is a decentralized lending protocol that allows Web 3 users to lend to traditional industry enterprises and earn fixed-rate returns. In 2021, NAOS Finance completed a $5.1 million private placement round of financing, with participation from as many as 30 investors, including CMS Holdings, HashKey Capital, OKX Ventures, Spartan Group, Alliance DAO, Collider Ventures, A&T Capital, Hash Global, Hot DAO, Richard Ma, Liang Xinjun, SNZ Holding, Mr. Block, Crypto.com Capital, Coinbase Ventures, and others. However, it was learned from NAOS Finance’s official Twitter account that NAOS Finance’s finance was affected by FTX’s explosion. After the V2 version was launched around the end of last year, it failed to go live, and the fund pool data on the official website cannot be displayed, and TVL is also displayed as zero, but its token has risen more than 10% in the past 7 days.

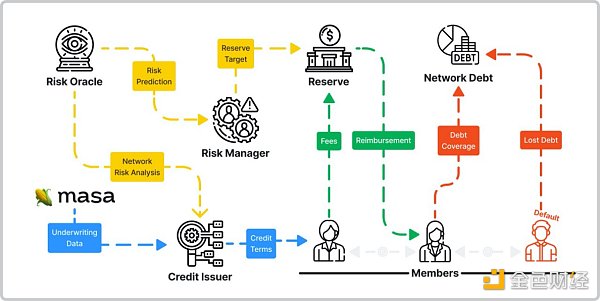

10. ReSource Finance (SOURCE)

ReSource is a decentralized commercial credit protocol that uses products and services as collateral. The platform automatically creates a novel credit system to rate creditors in order to select the best companies to expand credit limits. ReSource uses various data oracles to create credit scores by providing data on a variety of factors, including FICO credit scores, bank statements, accounting software APIs, and market reviews. ReSource completed a $1.7 million seed round of financing in 2021, with participation from NGC Ventures, BlockRock Capital, Flori Ventures, and others.

11. Credefi (CREDI)

Credefi is a credit protocol that provides encrypted loans for traditional small and medium-sized enterprises in the European Union, with the creditor needing to lease physical assets in the real economy as collateral. At the end of 2021, Credefi completed a $1.8 million seed round of financing.

12. Opulous (OPUL)

Opoulous provides music copyright NFTs and DeFi loans for musicians, attracting investment from fans. Opulous has completed two rounds of financing, with a seed round of $1.5 million, and investors including the Algorand Foundation and Kosmos Ventures.

On-Chain Real Estate Trading Platform

13. Blockingrcl

Blockingrcl is a real estate derivative protocol that allows Web 3 users to go long or short on global real estate markets with their own cryptocurrencies. Blockingrcl launched its mainnet in January of this year and had previously raised more than $12 million in two rounds of financing, with investors including Dragonfly, Solana Ventures, Hack VC, Shima Capital, Solana Ventures, Slow Ventures, and Coinbase Ventures.

14. Intelly (INTL)

Intelly is a fractional NFT (F-NFT) real estate investment platform. Investors will be able to use Intelly’s INTL tokens to purchase fractional ownership in real estate assets on the platform. In addition to direct wallet linkage investment, Intelly also allows users to pledge cryptocurrency in their Binance accounts to earn returns. There are multiple pledge cycles to choose from, including 1 day, 1 week, 1 month, 90 days, 180 days, and 365 days.

Additionally, Intelly is about to launch the real estate trading market Intelly Exchange, where real estate owners can create and publish real estate F-NFTs related to the project for investors to invest in and receive returns in stablecoin form. The INTL token has risen 38% in the past month.

15. CitaDAO (KNIGHT)

CitaDAO is an on-chain real estate investment platform where investors can subscribe to a portion of their real estate tokens (Real Estate Tokens) at an agreed price through a real estate project that issued IRO (Introducing Real Estate On-chain). If you miss the IRO, you can also directly purchase their real estate tokens with USDC to earn returns. After purchasing real estate tokens, investors can also choose to stake them in the liquidity pool to provide liquidity and earn rewards in the form of CitaDAO token KNIGHT.

On-chain carbon credit trading market

16. KlimaDAO (KLIMA)

KlimaDAO is a voluntary carbon credit trading market that has issued the algorithmic currency KLIMA token backed by carbon, with each KLIMA token pegged to 1 BCT (Basic Carbon Ton) token. Users can stake KLIMA in Klima DAO to generate income. At the same time, KlimaDAO pushes up the price of carbon credits in the VCM (Voluntary Carbon Market) by buying and hoarding as many credits as possible from the market and locking them in its treasury to encourage emission reduction. To date, KlimaDAO’s trading volume has exceeded $4 billion.

It is reported that Klima DAO is a forked project of the stablecoin protocol Olympus DAO, and it has accumulated more than $110 million in treasury assets within less than a month after its launch at the end of 2021, making it a popular Web 3 project in the carbon credit market. Last year, Polygon also announced that it would purchase $400,000 worth of traceable carbon credits through KlimaDAO’s on-chain carbon market Klima Infinity.

Infrastructure

17. Realio Network (xRIO)

Realio Network is a Layer 1 that focuses on the issuance and management of digital native real-world assets (RWA) and has received token investments from Algorand.

It is worth mentioning that in the face of continuous regulatory crackdowns on the cryptocurrency market by the US government this year, the founder of Realio Network wrote a post in June condemning the US government’s unfriendliness towards cryptocurrency, stating that since founding the company in 2018, the core focus has been on compliance, as investing in real-world assets, whether on or off the blockchain, usually requires compliance with securities laws. However, the US government’s inaction has made the road to compliance difficult, and ultimately he decided to leave the US market.

18、 Boson Protocol (BOSON)

Boson is a public commercial infrastructure that can tokenize, transfer, and trade any physical item as a redeemable NFT. Boson has raised over $10 million in funding, with investors including Animoca Brands and FBG Capital.

Collectibles investment platform

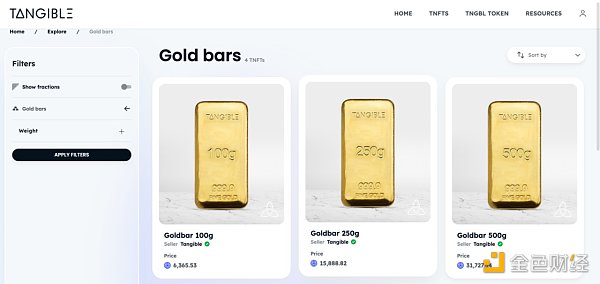

19、 Tangible (TNGBL)

Tangible is an NFT investment platform that allows users to invest in real-world physical assets such as gold, wine, and watches. On Tangible, users can purchase physical goods from global suppliers using Tangible’s stablecoin USDR, and upon successful payment, a TNFT (“Tangible Non-Fungible Token”) is minted as proof of purchase. The physical items are sent to one of Tangible’s secure and insured storage facilities, while the TNFT is sent to the buyer’s wallet. Users can also sell goods on Tangible’s NFT marketplace supported by physical items.

It’s worth noting that Tangible’s stablecoin USDR mainly generates revenue from excess collateralized stablecoins that use tokenized real estate as collateral, and holding this stablecoin can generate revenue. Currently, Tangible’s TVL has reached $51.18 million, and the token has risen more than 40% in the past month.

Synthetic assets

20、 Horizon Protocol (HZN)

Horizon Protocol is a synthetic asset platform on the BNB chain, and the synthetic assets on Horizon Protocol are called “zAssets”. It can track the price changes and risk-return status of traditional assets such as stocks or stocks, commodities such as gold and oil, currencies such as dollars or euros, and cryptocurrencies such as Bitcoin. Users can pledge their HZN to mint synthetic assets zAssets and earn interest.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Has on-chain intelligence become a “human flesh search”? Binance’s new IEO project Arkham receives negative feedback.

- Understanding Binance’s Launchpool Project Arkham and What is Intel-to-Earn?

- Share potential investment opportunities and niche projects worth paying attention to: Flashstake, Protectorate Protocol, aori…

- TOKI and Noble will collaborate with Mitsubishi UFJ Trust and Banking on the Progmat project to bring stablecoins into Cosmos.

- The difficult times for NFT: Multiple projects shut down, lending platforms face chain liquidation and bad debts amidst the general market downturn.

- A Summary of a Cryptocurrency Project Attempting Hybrid Rollup

- Blur V2 is now online, with updates including a 50% reduction in Gas fees and bidding based on Trait.